Enlarge image

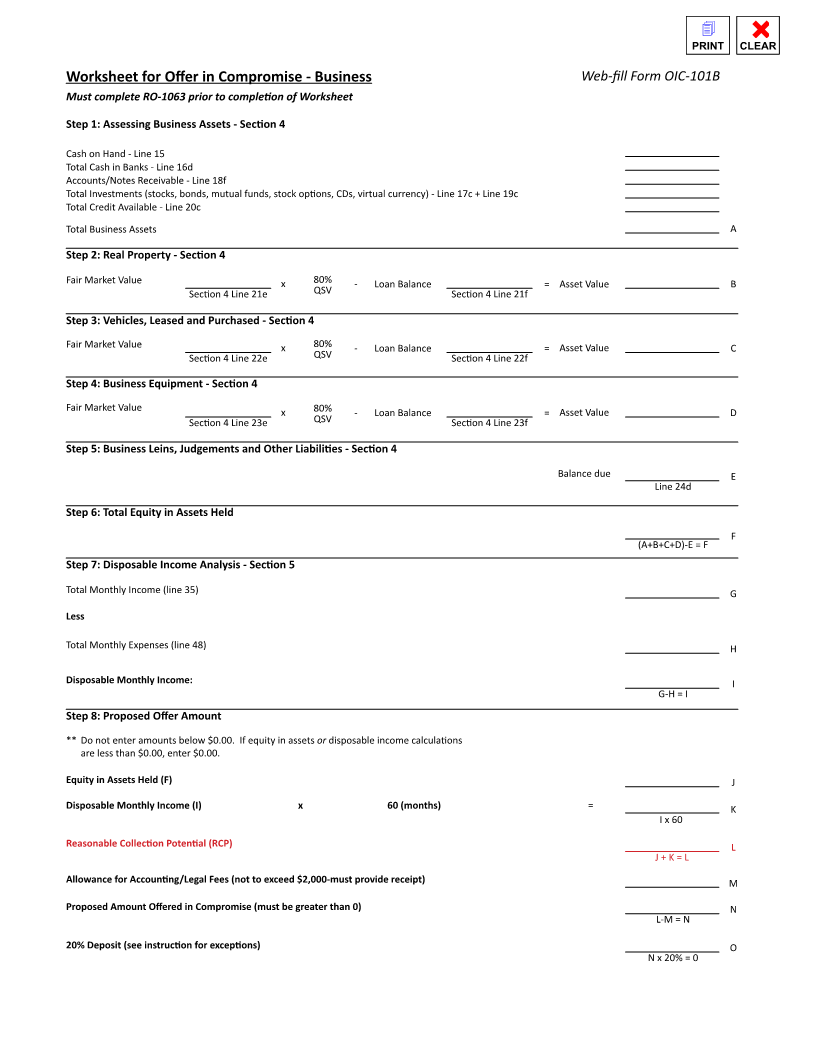

4 6 PRINT CLEAR Worksheet for Offer in Compromise - Business Web-fill Form OIC-101B Must complete RO-1063 prior to completion of Worksheet Step 1: Assessing Business Assets - Section 4 Cash on Hand - Line 15 Total Cash in Banks - Line 16d Accounts/Notes Receivable - Line 18f Total Investments (stocks, bonds, mutual funds, stock options, CDs, virtual currency) - Line 17c + Line 19c Total Credit Available - Line 20c Total Business Assets A Step 2: Real Property - Section 4 Fair Market Value x 80% - Loan Balance = Asset Value B Section 4 Line 21e QSV Section 4 Line 21f Step 3: Vehicles, Leased and Purchased - Section 4 Fair Market Value x 80% - Loan Balance = Asset Value C Section 4 Line 22e QSV Section 4 Line 22f Step 4: Business Equipment - Section 4 Fair Market Value x 80% - Loan Balance = Asset Value D Section 4 Line 23e QSV Section 4 Line 23f Step 5: Business Leins, Judgements and Other Liabilities - Section 4 Balance due E Line 24d Step 6: Total Equity in Assets Held F (A+B+C+D)-E = F Step 7: Disposable Income Analysis - Section 5 Total Monthly Income (line 35) G Less Total Monthly Expenses (line 48) H Disposable Monthly Income: I G-H = I Step 8: Proposed Offer Amount not enter amounts** Do below $0.00. in assets equity If disposable calculationsincome or are less than $0.00, enter $0.00. Equity in Assets Held (F) J Disposable Monthly Income (I) x 60 (months) = K I x 60 Reasonable Collection Potential (RCP) L J + K = L Allowance for Accounting/Legal Fees (not to exceed $2,000-must provide receipt) M Proposed Amount Offered in Compromise (must be greater than 0) N L-M = N 20% Deposit (see instruction for exceptions) O N x 20% = 0