- 3 -

Enlarge image

|

Page 2

E-585E

Web

11-18 General Instructions

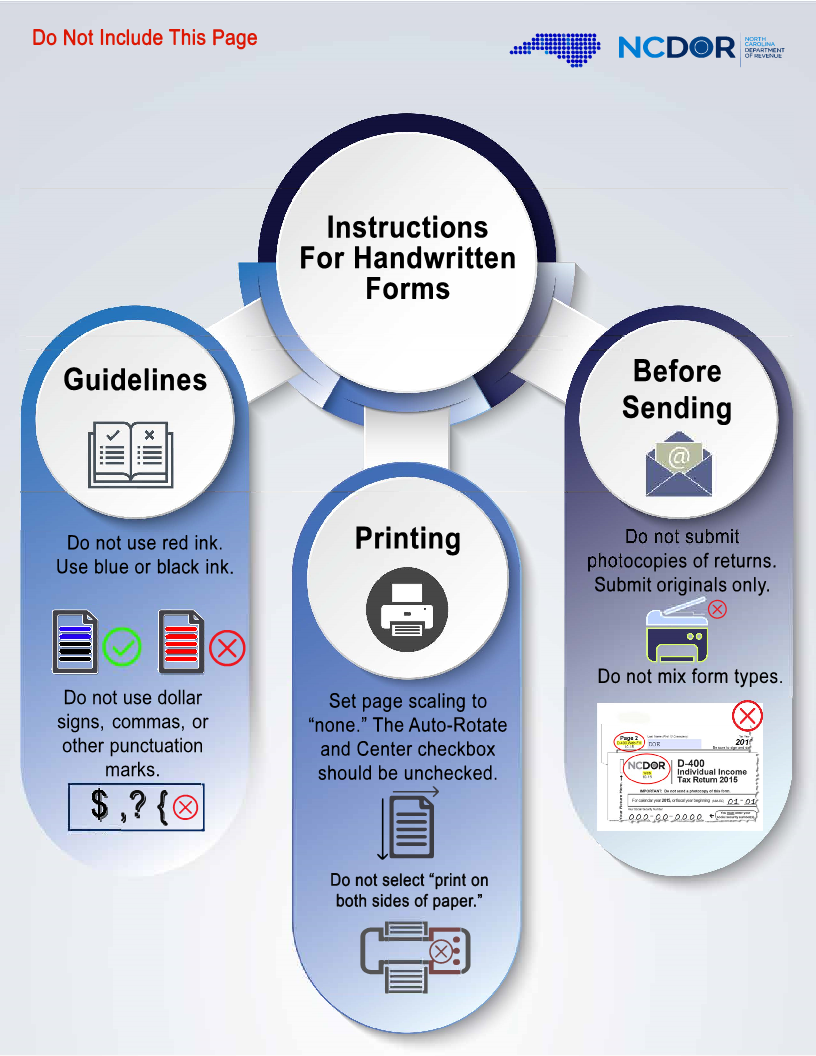

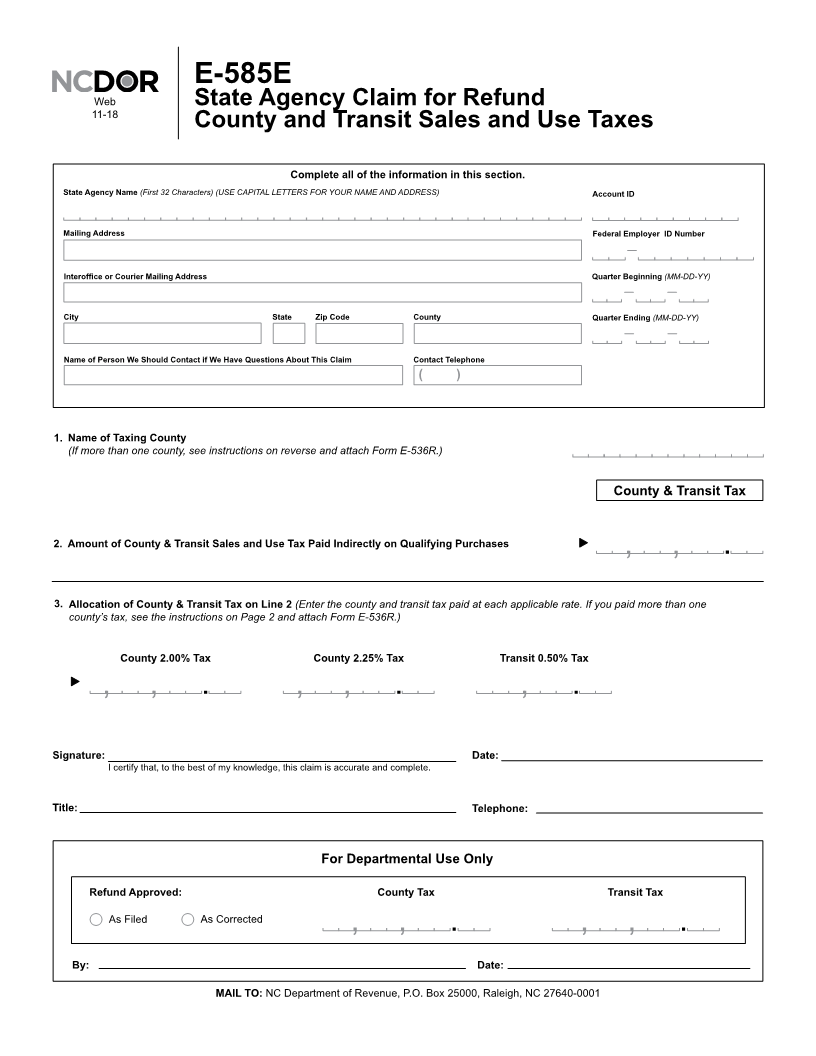

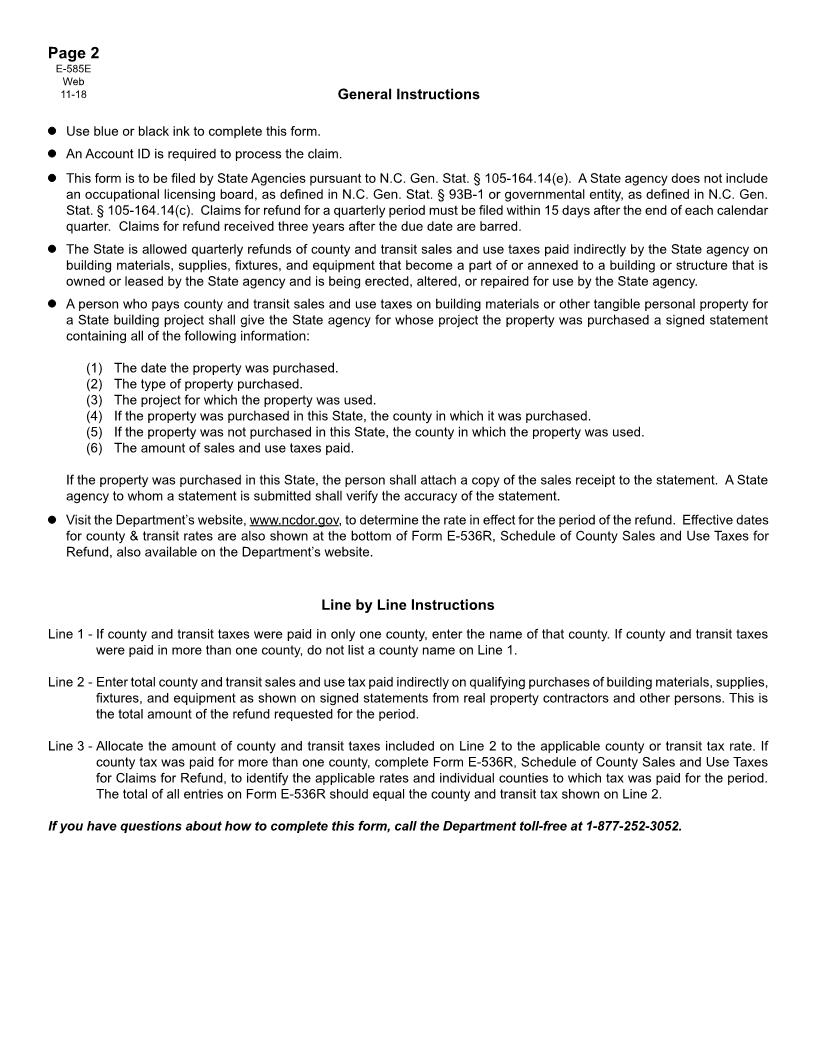

Use blue or black ink to complete this form.

An Account ID is required to process the claim.

This form is to be filed by State Agencies pursuant to N.C. Gen. Stat. § 105-164.14(e). A State agency does not include

an occupational licensing board, as defined in N.C. Gen. Stat. § 93B-1 or governmental entity, as defined in N.C. Gen.

Stat. § 105-164.14(c). Claims for refund for a quarterly period must be filed within 15 days after the end of each calendar

quarter. Claims for refund received three years after the due date are barred.

The State is allowed quarterly refunds of county and transit sales and use taxes paid indirectly by the State agency on

building materials, supplies, fixtures, and equipment that become a part of or annexed to a building or structure that is

owned or leased by the State agency and is being erected, altered, or repaired for use by the State agency.

A person who pays county and transit sales and use taxes on building materials or other tangible personal property for

a State building project shall give the State agency for whose project the property was purchased a signed statement

containing all of the following information:

(1) The date the property was purchased.

(2) The type of property purchased.

(3) The project for which the property was used.

(4) If the property was purchased in this State, the county in which it was purchased.

(5) If the property was not purchased in this State, the county in which the property was used.

(6) The amount of sales and use taxes paid.

If the property was purchased in this State, the person shall attach a copy of the sales receipt to the statement. A State

agency to whom a statement is submitted shall verify the accuracy of the statement.

Visit the Department’s website, www.ncdor.gov, to determine the rate in effect for the period of the refund. Effective dates

for county & transit rates are also shown at the bottom of Form E-536R, Schedule of County Sales and Use Taxes for

Refund, also available on the Department’s website.

Line by Line Instructions

Line 1 - If county and transit taxes were paid in only one county, enter the name of that county. If county and transit taxes

were paid in more than one county, do not list a county name on Line 1.

Line 2 - Enter total county and transit sales and use tax paid indirectly on qualifying purchases of building materials, supplies,

fixtures, and equipment as shown on signed statements from real property contractors and other persons. This is

the total amount of the refund requested for the period.

Line 3 - Allocate the amount of county and transit taxes included on Line 2 to the applicable county or transit tax rate. If

county tax was paid for more than one county, complete Form E-536R, Schedule of County Sales and Use Taxes

for Claims for Refund, to identify the applicable rates and individual counties to which tax was paid for the period.

The total of all entries on Form E-536R should equal the county and transit tax shown on Line 2.

If you have questions about how to complete this form, call the Department toll-free at 1-877-252-3052.

|