Enlarge image

D8E3<=;<, @- <, B 4 6 ! " # $% &'(%) '!(*

" #P H% !!x K

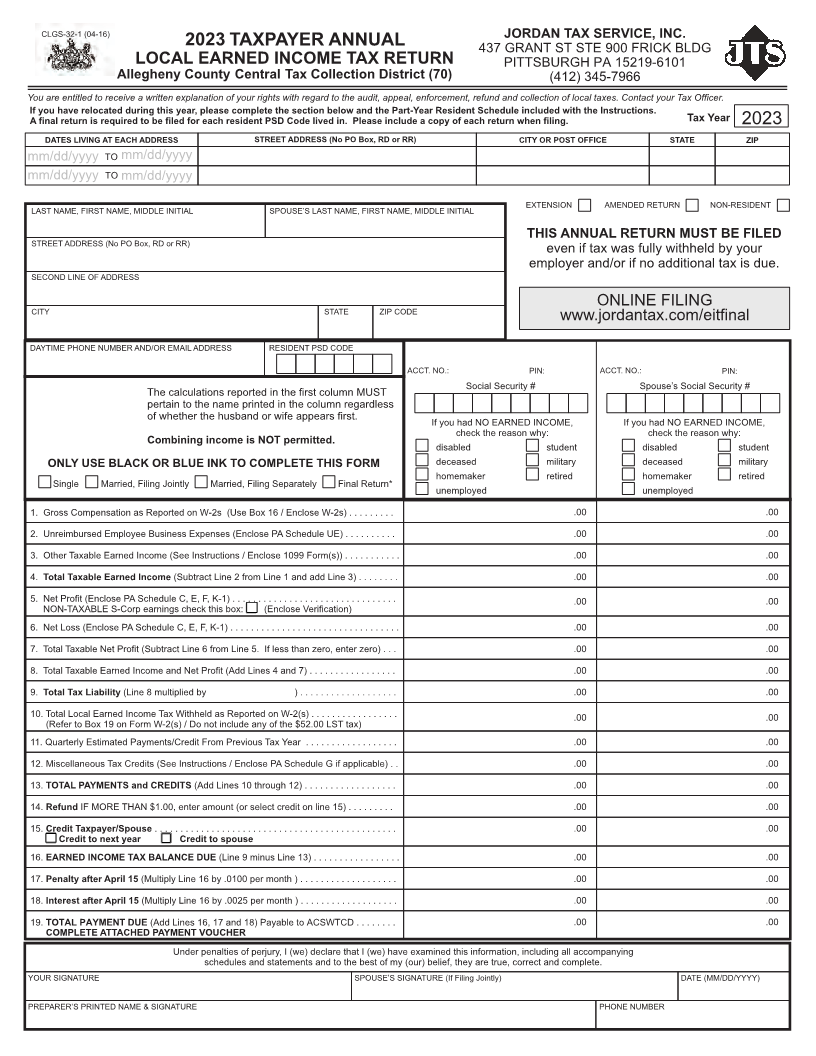

2023 437 GRANT ST STE 900 FRICK BLDG

K ( K % !% '!( z% " # %"x ! PITTSBURGH PA 15219-6101

* * II (O~ Central "FG (O* * I~O ~J~ N R 0 @A,;B =A:<+>CC

' O FI JI* OF~I J ~ IFJ) * IFI O* I~I ~I I~O I* O F ~I PFJ~HIFJ II~ $I* I * I ~ ~I '~J~O*

F* JI~J JIJI ~O I * I OJ IF JII~ P$ (OI * I * P* IFI * I F O O IF JI~J I * * "FG HIFJ 2023

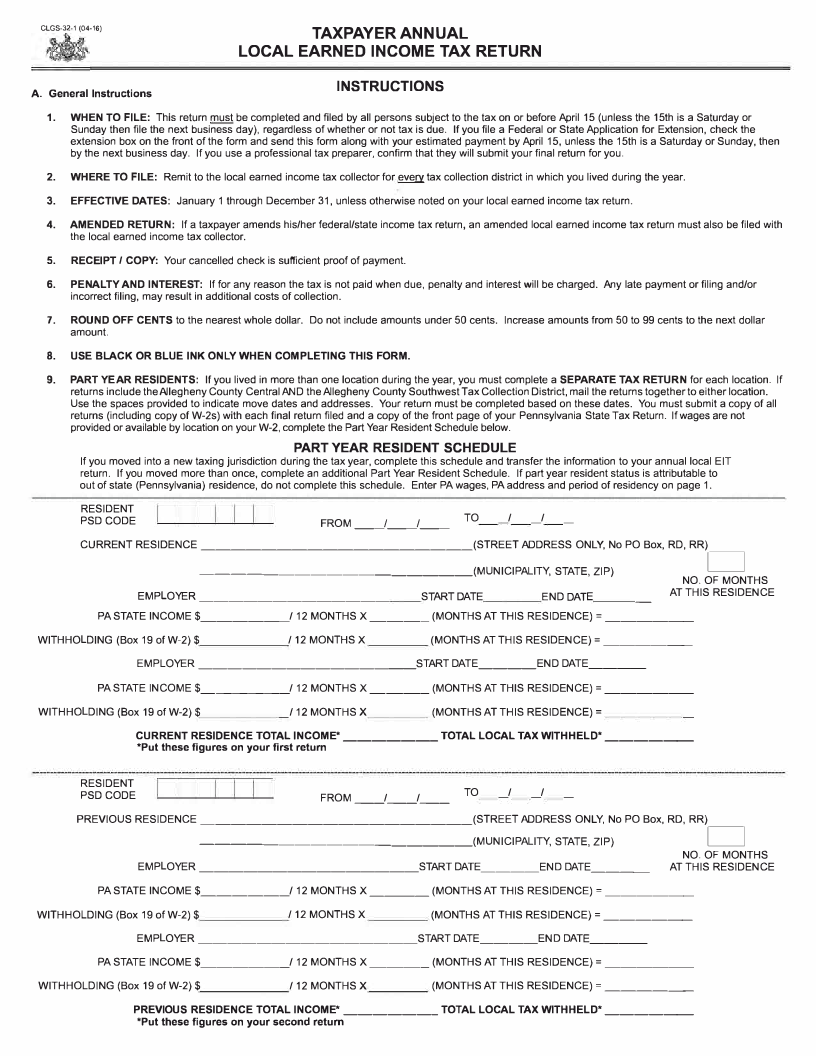

"%$ K'&'!L " % (M %$$ $" %%" %$$ N!O P QOG) OJ R ('"H P $" SS'(% $" "% T'P

mm/dd/yyyy 1V mm/dd/yyyy

mm/dd/yyyy 1V mm/dd/yyyy

6[16Y32VY /X6Y565 461Z4Y YVY<463256Y1

LAST NAME, FIRST NAME, MIDDLE INITIAL SPOUSE’S LAST NAME, FIRST NAME, MIDDLE INITIAL

"M'$ !!x K %"x ! zx$" Q% S'K%

STREET ADDRESS (No PO Box, RD or RR) aam ^g d_} n_l gb``e n^dhha`i re e\bc

asp`\eac _miU\c ^g m\ _ii^d^\m_` d_} ^l iba{

SECOND LINE OF ADDRESS

VY82Y6 u282YE

CITY STATE ZIP CODE nnn{\ci_md_}{]\sUa^dg^m_`

5/W12X6 07VY6 YZX.64 /Y5UV4 6X/28 /554633 463256Y1 035 DV56

/DD1{ YV{o 02Yo /DD1{ YV{o 02Yo

3\]^_` 3a]bc^de f 3p\blaql 3\]^_` 3a]bc^de f

1ha ]_`]b`_d^\ml cap\cdai ^m dha g^cld ]\`bsm XZ31

pacd_^m d\ dha m_sa pc^mdai ^m dha ]\`bsm cat_ci`all

\g nhadhac dha hblr_mi \c n^ga _ppa_cl g^cld{ 2g e\b h_i YV 6/4Y65 2YDVX6j 2g e\b h_i YV 6/4Y65 2YDVX6j

]ha]k dha ca_l\m nheo ]ha]k dha ca_l\m nheo

(O OI ! " IJ~~I*

i^l_r`ai ldbiamd i^l_r`ai ldbiamd

!KH x$% QK (y QKx% '!y " ( zPK%"% "M'$ S z ia]a_lai s^`^d_ce ia]a_lai s^`^d_ce

h\sas_kac cad^cai h\sas_kac cad^cai

3^mt`a X_cc^aij u^`^mt v\^md`e X_cc^aij u^`^mt 3ap_c_da`e u^m_` 4adbcmw

bmasp`\eai bmasp`\eai

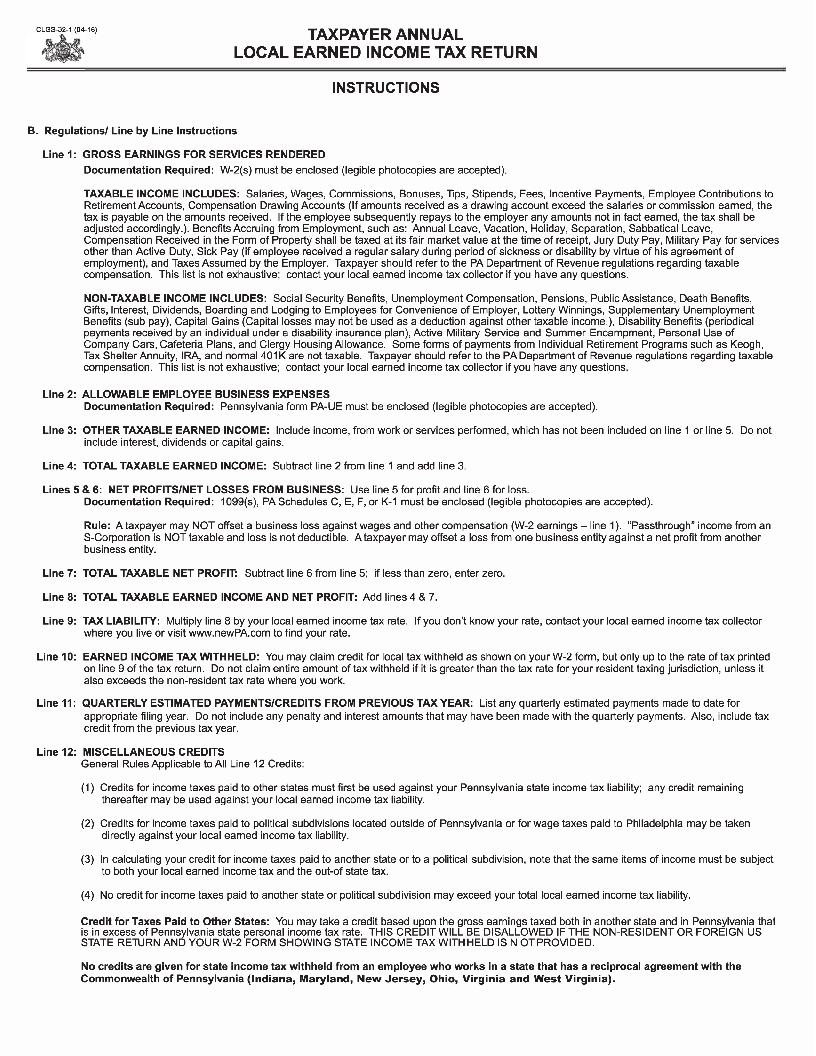

,{ Ec\ll D\spaml_d^\m _l 4ap\cdai \m |<; s @Zla .\} ,C U 6m]`\la |<; B { { { { { { { s . . {-- {--

;{ Zmca^srbclai 6sp`\eaa .bl^mall 6}pamlal @6m]`\la 0/ 3]haib`a Z6B { { { { { { { { { { {-- {--

={ Vdhac 1_}_r`a 6_cmai 2m]\sa @3aa 2mldcb]d^\ml U 6m]`\la ,->> u\cs@lBB { { { { { { { { { { { {-- {--

A{ "O~F* "FGF* I %FJI 'OI @3brdc_]d 8^ma ; gc\s 8^ma , _mi _ii 8^ma =B { { { { { { { { {-- {--

:{ Yad 0c\g^d @6m]`\la 0/ 3]haib`a Dj 6j uj 9<,B { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { {-- {--

YVY<1/[/.86 3<D\cp a_cm^mtl ]ha]k dh^l r\}o @6m]`\la

ac^g^]_d^\mB

C{ Yad 8\ll @6m]`\la 0/ 3]haib`a Dj 6j uj 9<,B { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { {-- {--

+{ 1\d_` 1_}_r`a Yad 0c\g^d @3brdc_]d 8^ma C gc\s 8^ma :{ 2g `all dh_m ac\j amdac ac\B { { { {-- {--

?{ 1\d_` 1_}_r`a 6_cmai 2m]\sa _mi Yad 0c\g^d @/ii 8^mal A _mi +B { { { { { { { { { { { { { { { { { {-- {--

>{ "O~F* "FG KF* ~ @8^ma ? sb`d^p`^ai re B { { { { { { { { { { { { { { { { { { { {-- {--

,-{ 1\d_` 8\]_` 6_cmai 2m]\sa 1_} |^dhha`i _l 4ap\cdai \m |<;@lB { { { { { { { { { { { { { { { { { {-- {--

@4agac d\ .\} ,> \m u\cs |<;@lB U 5\ m\d ^m]`bia _me \g dha :;{-- 831 d_}B

,,{ b_cdac`e 6ld^s_dai 0_esamdlUDcai^d uc\s 0ca^\bl 1_} Wa_c { { { { { { { { { { { { { { { { { { {-- {--

,;{ X^l]a``_ma\bl 1_} Dcai^dl @3aa 2mldcb]d^\ml U 6m]`\la 0/ 3]haib`a E ^g _pp`^]_r`aB { { {-- {--

,={ " " K P Hz%!"$ F ( % '"$ @/ii 8^mal ,- dhc\bth ,;B { { { { { { { { { { { { { { { { { { {-- {--

,A{ I 2u XV46 17/Y ,{--j amdac _s\bmd @\c la`a]d ]cai^d \m `^ma ,:B { { { { { { { { { {-- {--

,:{ (JI~ "FGFIJ$OI { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { { {-- {--

(JI~ ~O IG~ IFJ (JI~ ~O OI

,C{ % !% '!( z% " # Q K !(% x% @8^ma > s^mbl 8^ma ,=B { { { { { { { { { { { { { { { { { {-- {--

,+{ PIF* ~ F~IJ J* @Xb`d^p`e 8^ma ,C re {-,-- pac s\mdh B { { { { { { { { { { { { { { { { { { { {-- {--

,?{ '~IJI~ F~IJ J* @Xb`d^p`e 8^ma ,C re {--;: pac s\mdh B { { { { { { { { { { { { { { { { { { { {-- {--

,>{ " " K P Hz%!" x% @/ii 8^mal ,Cj ,+ _mi ,?B Payable to ACSWTCD . . . . . .{ { {-- {--

( zPK%"% "" (M% P Hz%!" & x(M%

Zmiac pam_`d^al \g pacbcej 2 @naB ia]`_ca dh_d 2 @naB h_a a}_s^mai dh^l ^mg\cs_d^\mj ^m]`bi^mt _`` _]]\sp_me^mt

l]haib`al _mi ld_dasamdl _mi d\ dha rald \g se @\bcB ra`^agj dhae _ca dcbaj ]\cca]d _mi ]\sp`ada{

WVZ4 32EY/1Z46 30VZ36q3 32EY/1Z46 @2g u^`^mt v\^md`eB 5/16 @XXU55UWWWWB

0460/464q3 042Y165 Y/X6 32EY/1Z46 07VY6 YZX.64