- 2 -

Enlarge image

|

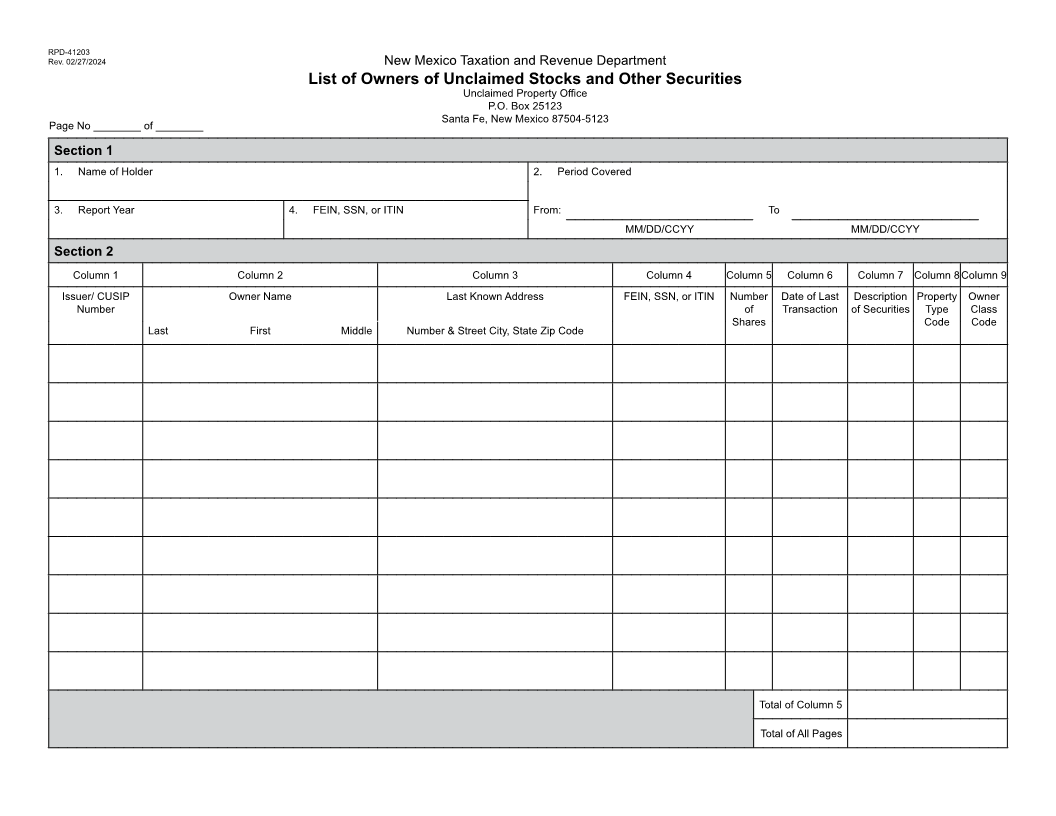

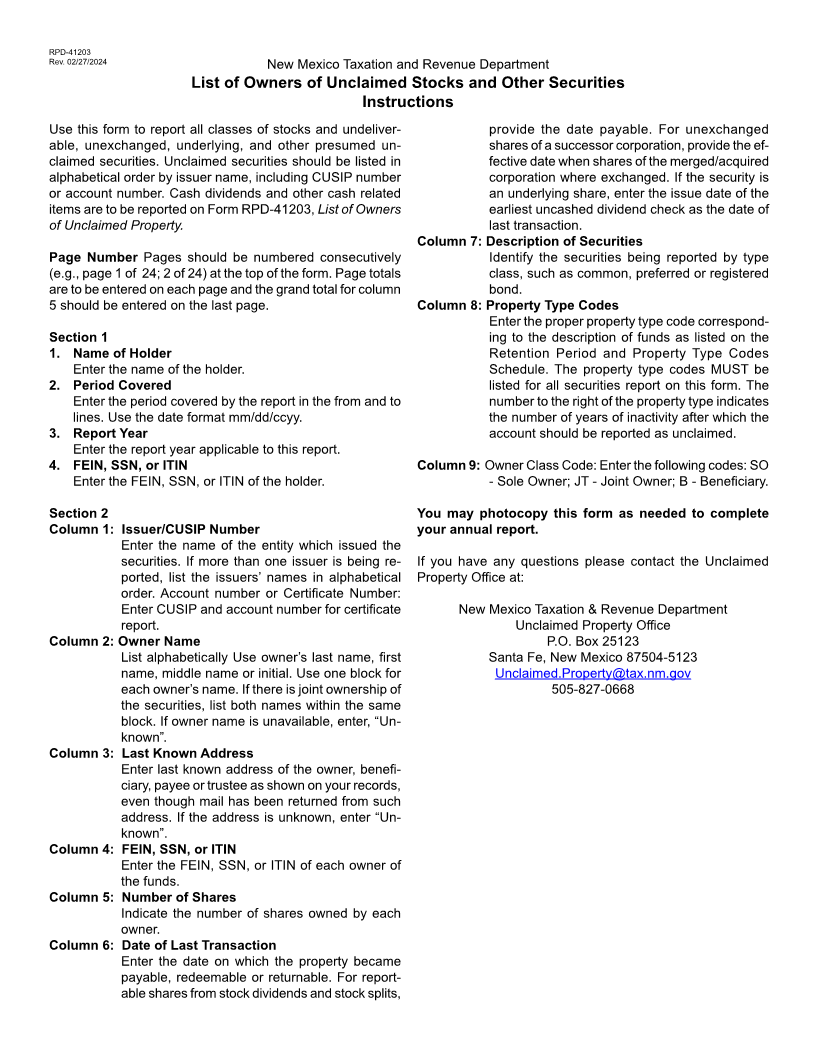

RPD-41203

Rev. 02/27/2024 New Mexico Taxation and Revenue Department

List of Owners of Unclaimed Stocks and Other Securities

Instructions

Use this form to report all classes of stocks and undeliver- provide the date payable. For unexchanged

able, unexchanged, underlying, and other presumed un- shares of a successor corporation, provide the ef-

claimed securities. Unclaimed securities should be listed in fective date when shares of the merged/acquired

alphabetical order by issuer name, including CUSIP number corporation where exchanged. If the security is

or account number. Cash dividends and other cash related an underlying share, enter the issue date of the

items are to be reported on Form RPD-41203, List of Owners earliest uncashed dividend check as the date of

of Unclaimed Property. last transaction.

Column 7: Description of Securities

Page Number Pages should be numbered consecutively Identify the securities being reported by type

(e.g., page 1 of 24; 2 of 24) at the top of the form. Page totals class, such as common, preferred or registered

are to be entered on each page and the grand total for column bond.

5 should be entered on the last page. Column 8: Property Type Codes

Enter the proper property type code correspond-

Section 1 ing to the description of funds as listed on the

1. Name of Holder Retention Period and Property Type Codes

Enter the name of the holder. Schedule. The property type codes MUST be

2. Period Covered listed for all securities report on this form. The

Enter the period covered by the report in the from and to number to the right of the property type indicates

lines. Use the date format mm/dd/ccyy. the number of years of inactivity after which the

3. Report Year account should be reported as unclaimed.

Enter the report year applicable to this report.

4. FEIN, SSN, or ITIN Column 9: Owner Class Code: Enter the following codes: SO

Enter the FEIN, SSN, or ITIN of the holder. - Sole Owner; JT - Joint Owner; B - Beneficiary.

Section 2 You may photocopy this form as needed to complete

Column 1: Issuer/CUSIP Number your annual report.

Enter the name of the entity which issued the

securities. If more than one issuer is being re- If you have any questions please contact the Unclaimed

ported, list the issuers’ names in alphabetical Property Office at:

order. Account number or Certificate Number:

Enter CUSIP and account number for certificate New Mexico Taxation & Revenue Department

report. Unclaimed Property Office

Column 2: Owner Name P.O. Box 25123

List alphabetically Use owner’s last name, first Santa Fe, New Mexico 87504-5123

name, middle name or initial. Use one block for Unclaimed.Property@tax.nm.gov

each owner’s name. If there is joint ownership of 505-827-0668

the securities, list both names within the same

block. If owner name is unavailable, enter, “Un-

known”.

Column 3: Last Known Address

Enter last known address of the owner, benefi-

ciary, payee or trustee as shown on your records,

even though mail has been returned from such

address. If the address is unknown, enter “Un-

known”.

Column 4: FEIN, SSN, or ITIN

Enter the FEIN, SSN, or ITIN of each owner of

the funds.

Column 5: Number of Shares

Indicate the number of shares owned by each

owner.

Column 6: Date of Last Transaction

Enter the date on which the property became

payable, redeemable or returnable. For report-

able shares from stock dividends and stock splits,

|