Enlarge image

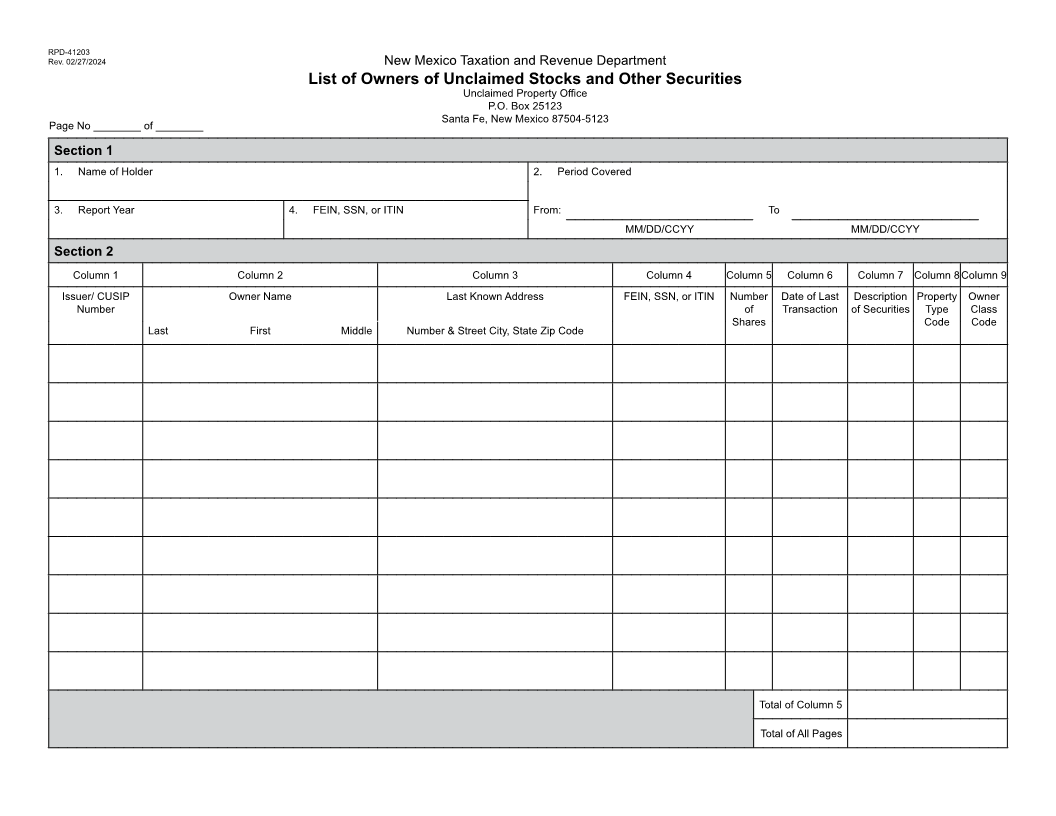

RPD-41203

Rev. 02/27/2024 New Mexico Taxation and Revenue Department

List of Owners of Unclaimed Stocks and Other Securities

Unclaimed Property Office

P.O. Box 25123

Santa Fe, New Mexico 87504-5123

Page No ________ of ________

Section 1

1. Name of Holder 2. Period Covered

3. Report Year 4. FEIN, SSN, or ITIN From: To

MM/DD/CCYY MM/DD/CCYY

Section 2

Column 1 Column 2 Column 3 Column 4 Column 5 Column 6 Column 7 Column 8Column 9

Issuer/ CUSIP Owner Name Last Known Address FEIN, SSN, or ITIN Number Date of Last Description Property Owner

Number of Transaction of Securities Type Class

Shares Code Code

Last First Middle Number & Street City, State Zip Code

Total of Column 5

Total of All Pages