- 2 -

Enlarge image

|

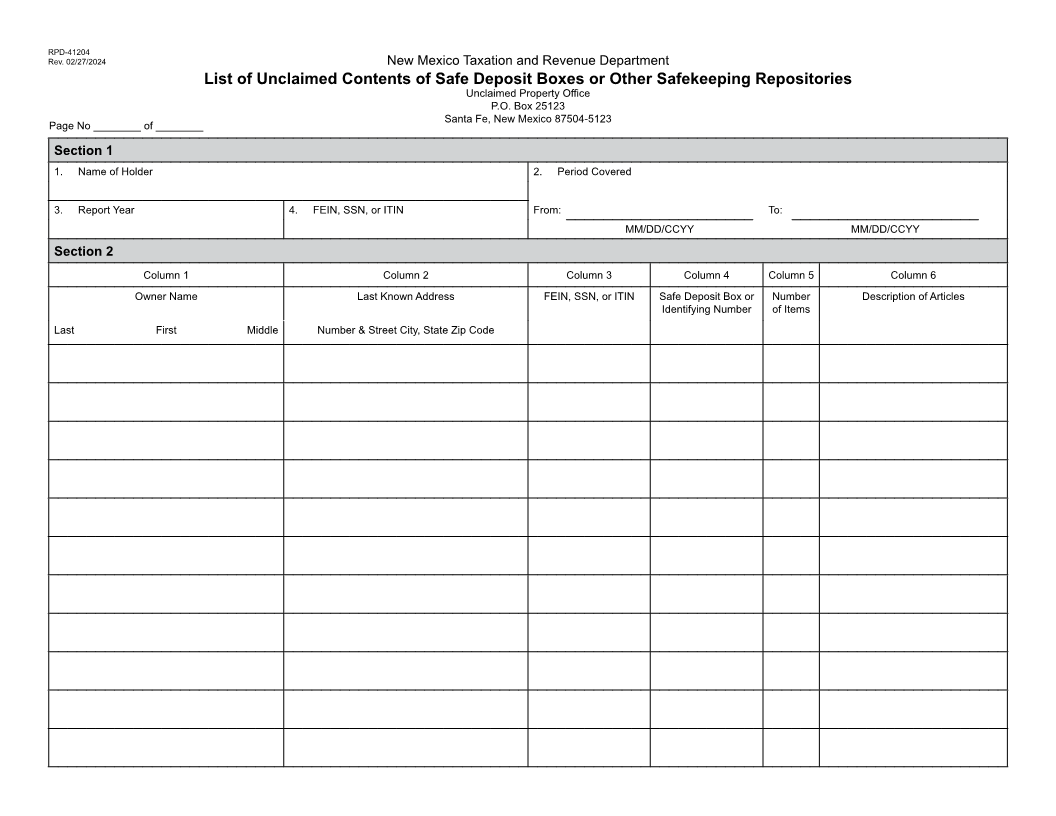

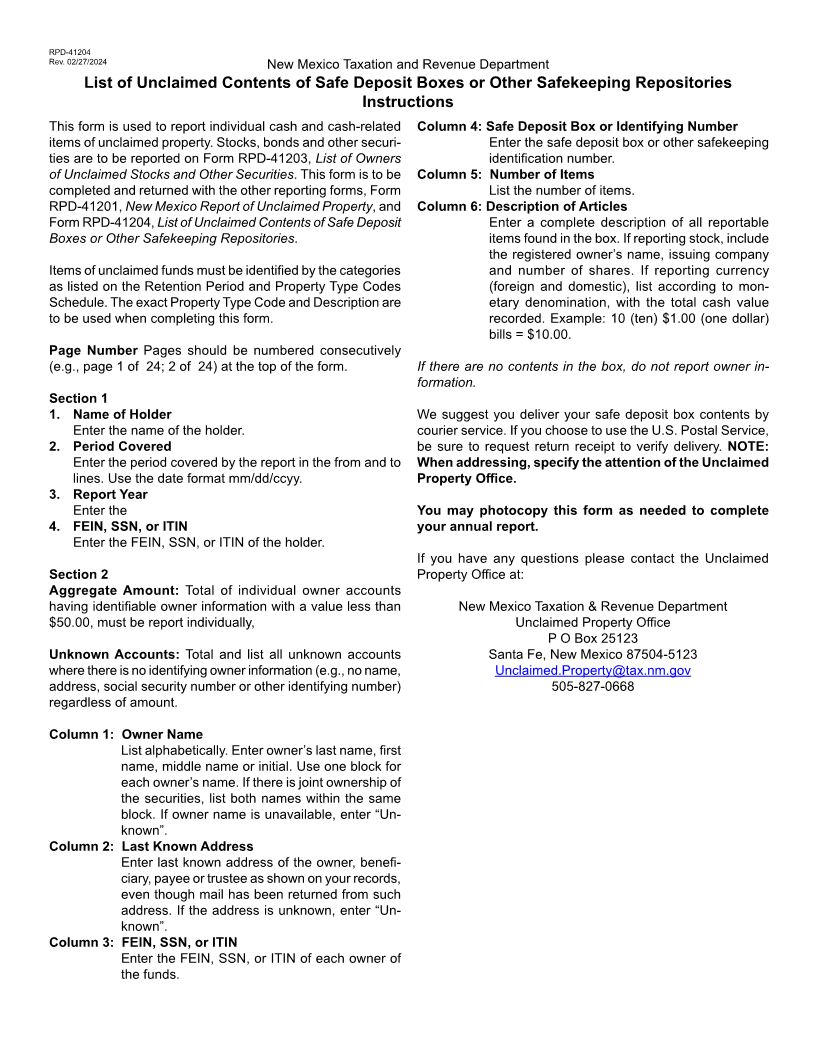

RPD-41204

Rev. 02/27/2024 New Mexico Taxation and Revenue Department

List of Unclaimed Contents of Safe Deposit Boxes or Other Safekeeping Repositories

Instructions

This form is used to report individual cash and cash-related Column 4: Safe Deposit Box or Identifying Number

items of unclaimed property. Stocks, bonds and other securi- Enter the safe deposit box or other safekeeping

ties are to be reported on Form RPD-41203, List of Owners identification number.

of Unclaimed Stocks and Other Securities. This form is to be Column 5: Number of Items

completed and returned with the other reporting forms, Form List the number of items.

RPD-41201, New Mexico Report of Unclaimed Property, and Column 6: Description of Articles

Form RPD-41204, List of Unclaimed Contents of Safe Deposit Enter a complete description of all reportable

Boxes or Other Safekeeping Repositories. items found in the box. If reporting stock, include

the registered owner’s name, issuing company

Items of unclaimed funds must be identified by the categories and number of shares. If reporting currency

as listed on the Retention Period and Property Type Codes (foreign and domestic), list according to mon-

Schedule. The exact Property Type Code and Description are etary denomination, with the total cash value

to be used when completing this form. recorded. Example: 10 (ten) $1.00 (one dollar)

bills = $10.00.

Page Number Pages should be numbered consecutively

(e.g., page 1 of 24; 2 of 24) at the top of the form. If there are no contents in the box, do not report owner in-

formation.

Section 1

1. Name of Holder We suggest you deliver your safe deposit box contents by

Enter the name of the holder. courier service. If you choose to use the U.S. Postal Service,

2. Period Covered be sure to request return receipt to verify delivery. NOTE:

Enter the period covered by the report in the from and to When addressing, specify the attention of the Unclaimed

lines. Use the date format mm/dd/ccyy. Property Office.

3. Report Year

Enter the You may photocopy this form as needed to complete

4. FEIN, SSN, or ITIN your annual report.

Enter the FEIN, SSN, or ITIN of the holder.

If you have any questions please contact the Unclaimed

Section 2 Property Office at:

Aggregate Amount: Total of individual owner accounts

having identifiable owner information with a value less than New Mexico Taxation & Revenue Department

$50.00, must be report individually, Unclaimed Property Office

P O Box 25123

Unknown Accounts: Total and list all unknown accounts Santa Fe, New Mexico 87504-5123

where there is no identifying owner information (e.g., no name, Unclaimed.Property@tax.nm.gov

address, social security number or other identifying number) 505-827-0668

regardless of amount.

Column 1: Owner Name

List alphabetically. Enter owner’s last name, first

name, middle name or initial. Use one block for

each owner’s name. If there is joint ownership of

the securities, list both names within the same

block. If owner name is unavailable, enter “Un-

known”.

Column 2: Last Known Address

Enter last known address of the owner, benefi-

ciary, payee or trustee as shown on your records,

even though mail has been returned from such

address. If the address is unknown, enter “Un-

known”.

Column 3: FEIN, SSN, or ITIN

Enter the FEIN, SSN, or ITIN of each owner of

the funds.

|