- 2 -

Enlarge image

|

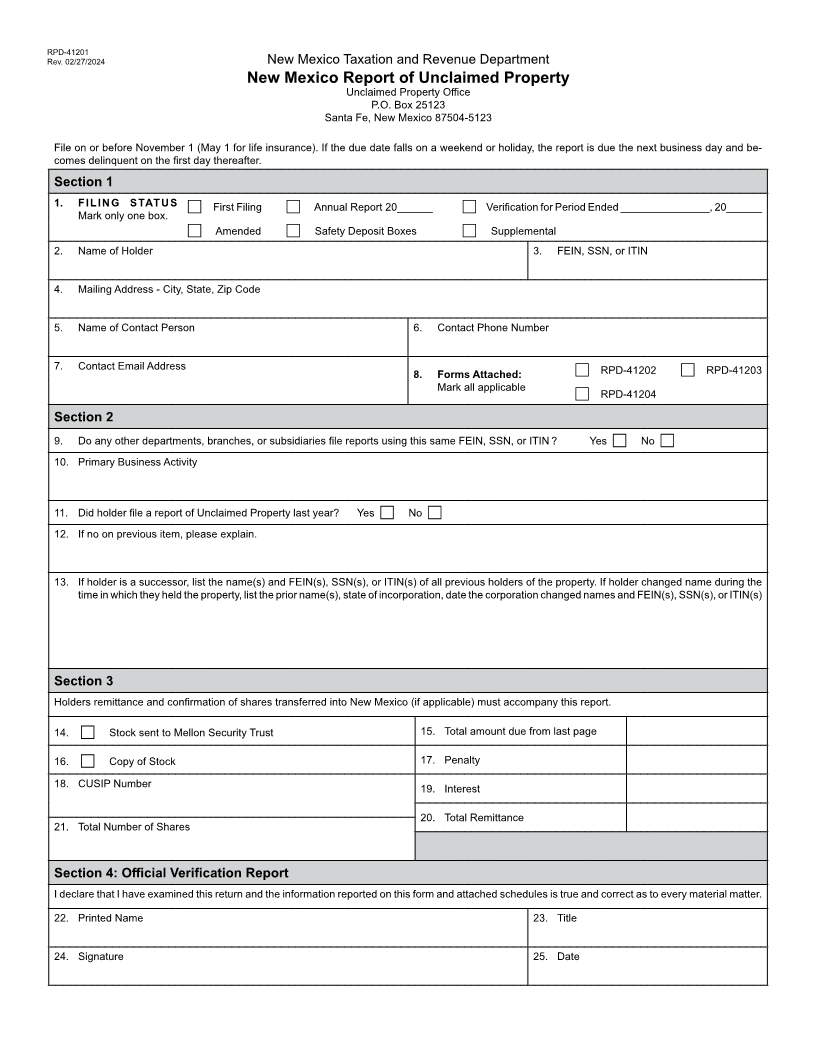

RPD-41201

Rev. 02/27/2024 New Mexico Taxation and Revenue Department

New Mexico Report of Unclaimed Property

Instructions

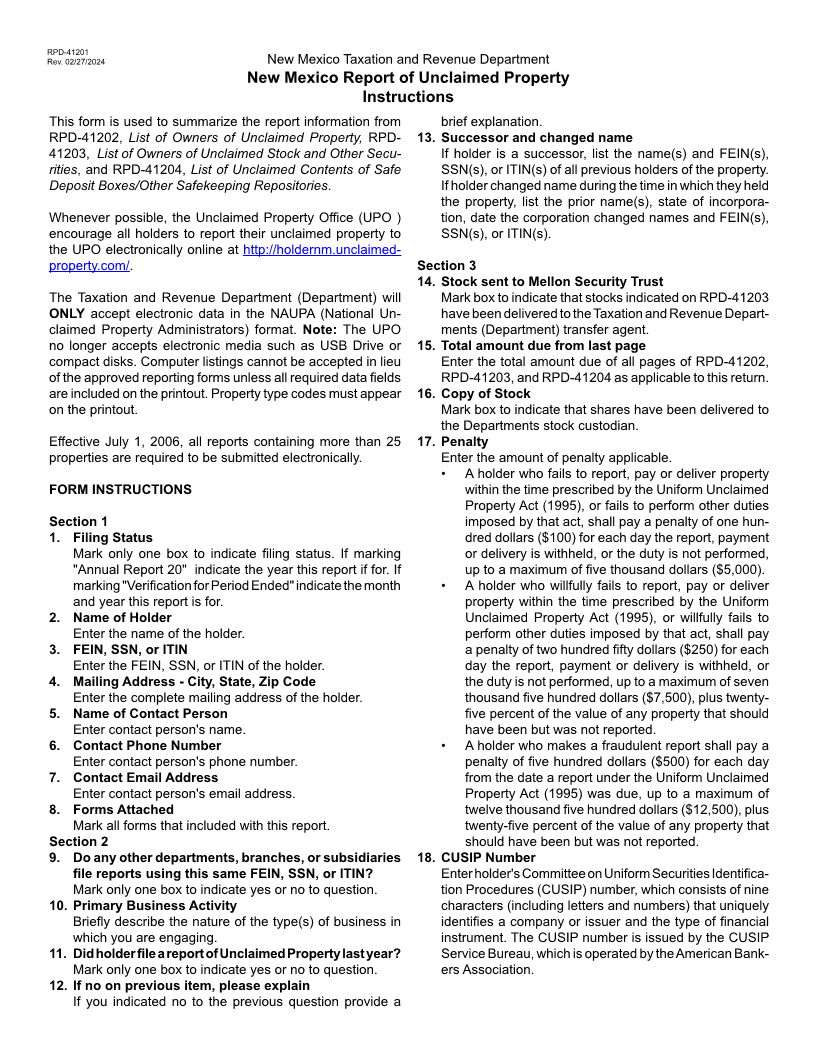

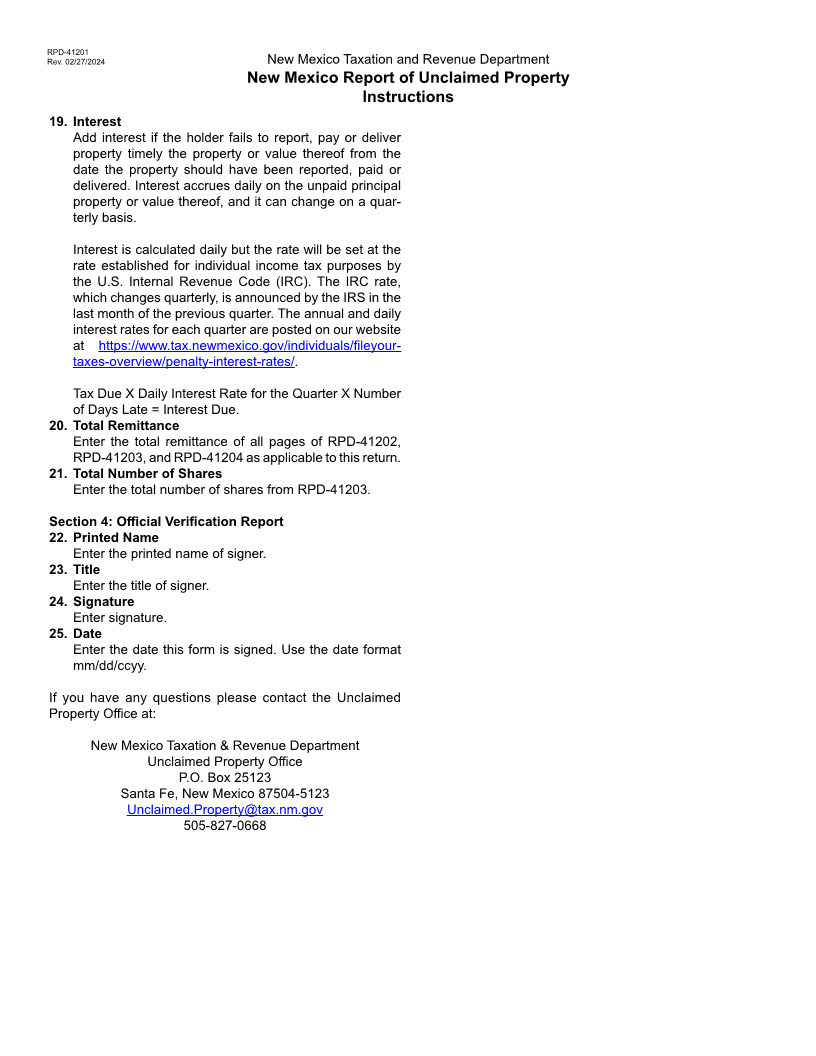

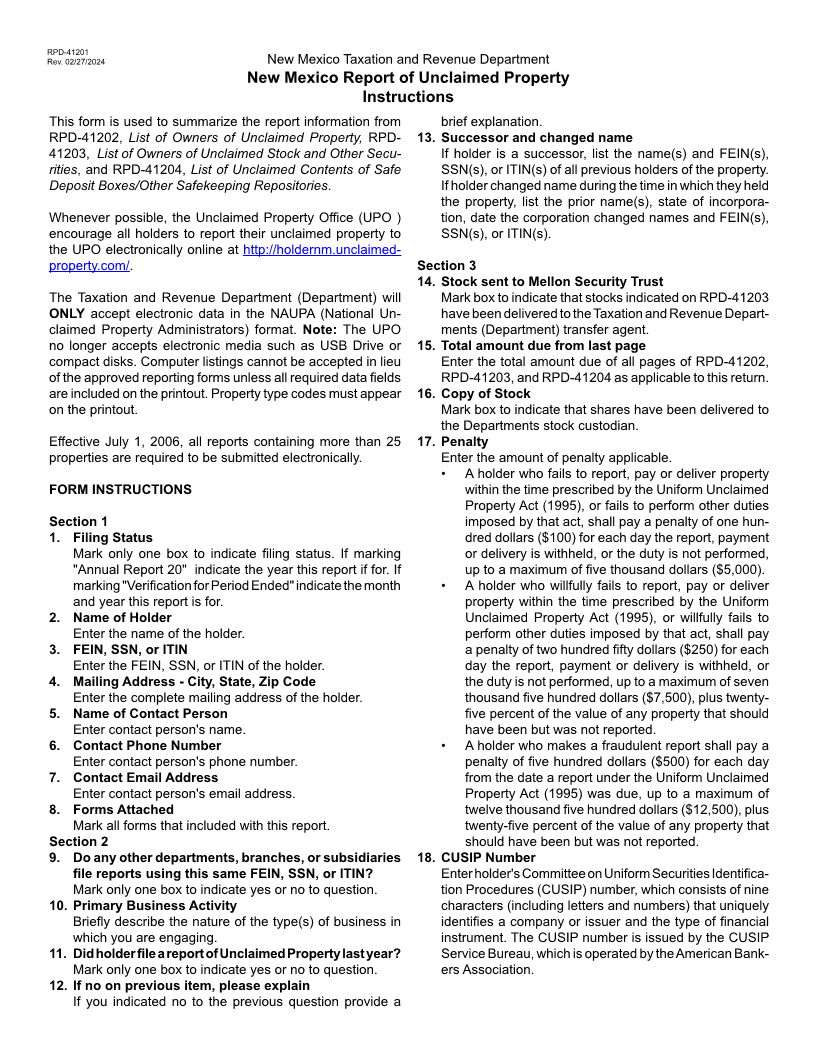

This form is used to summarize the report information from brief explanation.

RPD-41202, List of Owners of Unclaimed Property, RPD- 13. Successor and changed name

41203, List of Owners of Unclaimed Stock and Other Secu- If holder is a successor, list the name(s) and FEIN(s),

rities, and RPD-41204, List of Unclaimed Contents of Safe SSN(s), or ITIN(s) of all previous holders of the property.

Deposit Boxes/Other Safekeeping Repositories. If holder changed name during the time in which they held

the property, list the prior name(s), state of incorpora-

Whenever possible, the Unclaimed Property Office (UPO ) tion, date the corporation changed names and FEIN(s),

encourage all holders to report their unclaimed property to SSN(s), or ITIN(s).

the UPO electronically online at http://holdernm.unclaimed-

property.com/. Section 3

14. Stock sent to Mellon Security Trust

The Taxation and Revenue Department (Department) will Mark box to indicate that stocks indicated on RPD-41203

ONLY accept electronic data in the NAUPA (National Un- have been delivered to the Taxation and Revenue Depart-

claimed Property Administrators) format. Note: The UPO ments (Department) transfer agent.

no longer accepts electronic media such as USB Drive or 15. Total amount due from last page

compact disks. Computer listings cannot be accepted in lieu Enter the total amount due of all pages of RPD-41202,

of the approved reporting forms unless all required data fields RPD-41203, and RPD-41204 as applicable to this return.

are included on the printout. Property type codes must appear 16. Copy of Stock

on the printout. Mark box to indicate that shares have been delivered to

the Departments stock custodian.

Effective July 1, 2006, all reports containing more than 25 17. Penalty

properties are required to be submitted electronically. Enter the amount of penalty applicable.

• A holder who fails to report, pay or deliver property

FORM INSTRUCTIONS within the time prescribed by the Uniform Unclaimed

Property Act (1995), or fails to perform other duties

Section 1 imposed by that act, shall pay a penalty of one hun-

1. Filing Status dred dollars ($100) for each day the report, payment

Mark only one box to indicate filing status. If marking or delivery is withheld, or the duty is not performed,

"Annual Report 20" indicate the year this report if for. If up to a maximum of five thousand dollars ($5,000).

marking "Verification for Period Ended" indicate the month • A holder who willfully fails to report, pay or deliver

and year this report is for. property within the time prescribed by the Uniform

2. Name of Holder Unclaimed Property Act (1995), or willfully fails to

Enter the name of the holder. perform other duties imposed by that act, shall pay

3. FEIN, SSN, or ITIN a penalty of two hundred fifty dollars ($250) for each

Enter the FEIN, SSN, or ITIN of the holder. day the report, payment or delivery is withheld, or

4. Mailing Address - City, State, Zip Code the duty is not performed, up to a maximum of seven

Enter the complete mailing address of the holder. thousand five hundred dollars ($7,500), plus twenty-

5. Name of Contact Person five percent of the value of any property that should

Enter contact person's name. have been but was not reported.

6. Contact Phone Number • A holder who makes a fraudulent report shall pay a

Enter contact person's phone number. penalty of five hundred dollars ($500) for each day

7. Contact Email Address from the date a report under the Uniform Unclaimed

Enter contact person's email address. Property Act (1995) was due, up to a maximum of

8. Forms Attached twelve thousand five hundred dollars ($12,500), plus

Mark all forms that included with this report. twenty-five percent of the value of any property that

Section 2 should have been but was not reported.

9. Do any other departments, branches, or subsidiaries 18. CUSIP Number

file reports using this same FEIN, SSN, or ITIN? Enter holder's Committee on Uniform Securities Identifica-

Mark only one box to indicate yes or no to question. tion Procedures (CUSIP) number, which consists of nine

10. Primary Business Activity characters (including letters and numbers) that uniquely

Briefly describe the nature of the type(s) of business in identifies a company or issuer and the type of financial

which you are engaging. instrument. The CUSIP number is issued by the CUSIP

11. Did holder file a report of Unclaimed Property last year? Service Bureau, which is operated by the American Bank-

Mark only one box to indicate yes or no to question. ers Association.

12. If no on previous item, please explain

If you indicated no to the previous question provide a

|