Enlarge image

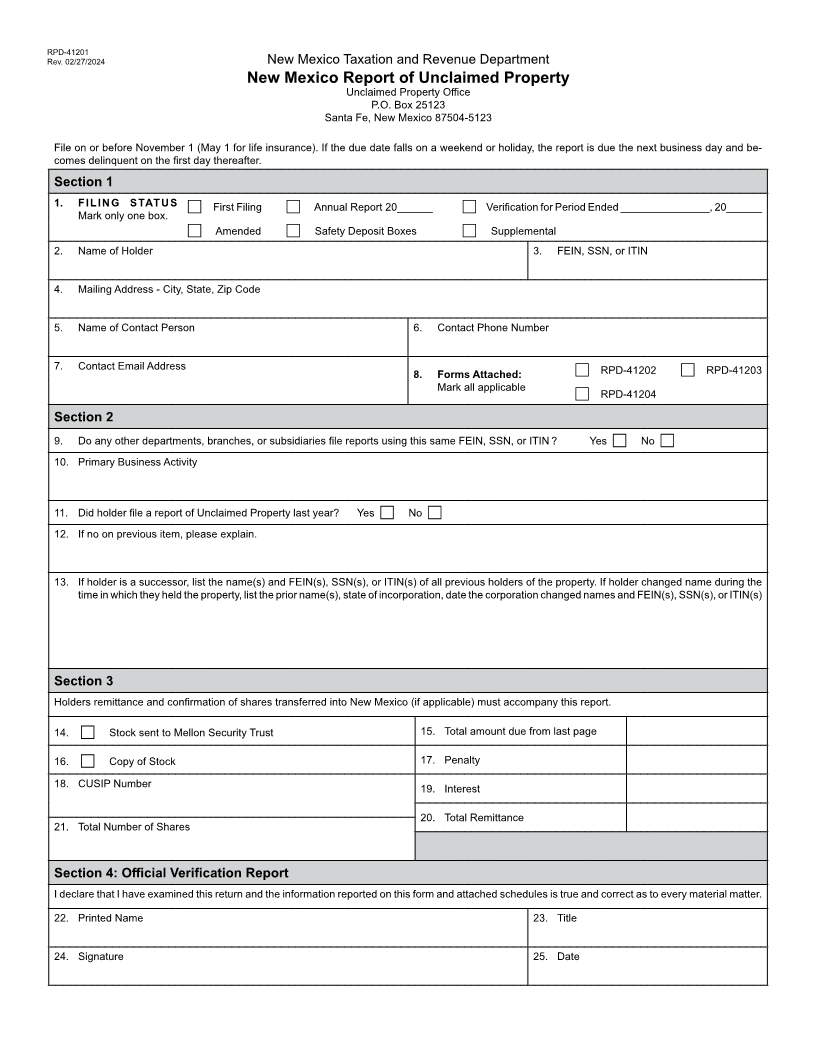

RPD-41201

Rev. 02/27/2024 New Mexico Taxation and Revenue Department

New Mexico Report of Unclaimed Property

Unclaimed Property Office

P.O. Box 25123

Santa Fe, New Mexico 87504-5123

File on or before November 1 (May 1 for life insurance). If the due date falls on a weekend or holiday, the report is due the next business day and be-

comes delinquent on the first day thereafter.

Section 1

1. FILING STATUS c First Filing c Annual Report 20______ c Verification for Period Ended _______________, 20______

Mark only one box.

c Amended c Safety Deposit Boxes c Supplemental

2. Name of Holder 3. FEIN, SSN, or ITIN

4. Mailing Address - City, State, Zip Code

5. Name of Contact Person 6. Contact Phone Number

7. Contact Email Address c RPD-41202 c RPD-41203

8. Forms Attached:

Mark all applicable c RPD-41204

Section 2

9. Do any other departments, branches, or subsidiaries file reports using this same FEIN, SSN, or ITIN ? Yes c No c

10. Primary Business Activity

11. Did holder file a report of Unclaimed Property last year? Yes c No c

12. If no on previous item, please explain.

13. If holder is a successor, list the name(s) and FEIN(s), SSN(s), or ITIN(s) of all previous holders of the property. If holder changed name during the

time in which they held the property, list the prior name(s), state of incorporation, date the corporation changed names and FEIN(s), SSN(s), or ITIN(s)

Section 3

Holders remittance and confirmation of shares transferred into New Mexico (if applicable) must accompany this report.

14. c Stock sent to Mellon Security Trust 15. Total amount due from last page

16. c Copy of Stock 17. Penalty

18. CUSIP Number 19. Interest

20. Total Remittance

21. Total Number of Shares

Section 4: Official Verification Report

I declare that I have examined this return and the information reported on this form and attached schedules is true and correct as to every material matter.

22. Printed Name 23. Title

24. Signature 25. Date