Enlarge image

New Mexico

Taxation and Revenue Department

FYI-104

FOR YOUR NFORMATIONI

Tax Information/Policy Office P.O. Box 630 Santa Fe, New Mexico 87504-0630

NEW MEXICO

WITHHOLDING TAX

Effective January 1, 2024

This publication contains general information on the New Mexico withholding tax and tax tables for the

percentage method of withholding. Taxpayers should be aware that subsequent legislation, regulations, court

decisions, revenue rulings, notices and announcements may affect the accuracy of its contents. For more

information, please contact the nearest tax district field office or check the department’s web site at

https://www.tax.newmexico.gov/.

CONTENTS

General Information For New Mexico Withholding Tax ..................................................................... 2

Who Must Withhold .......................................................................................................................... 2

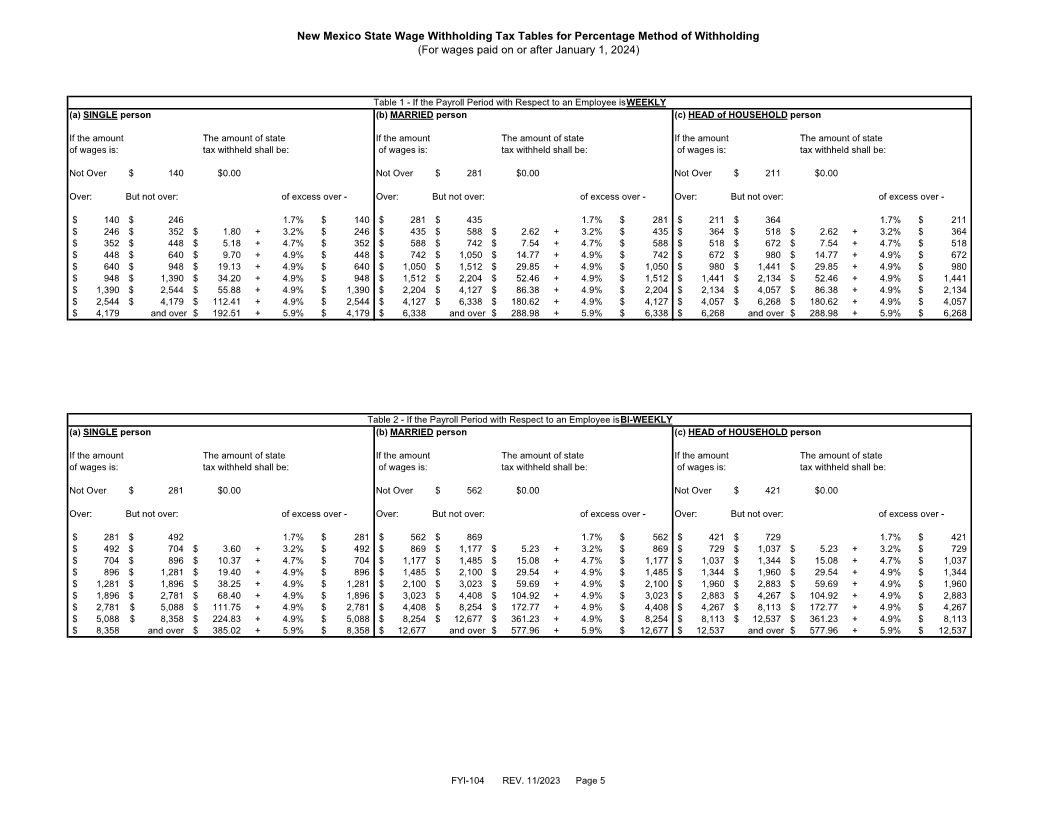

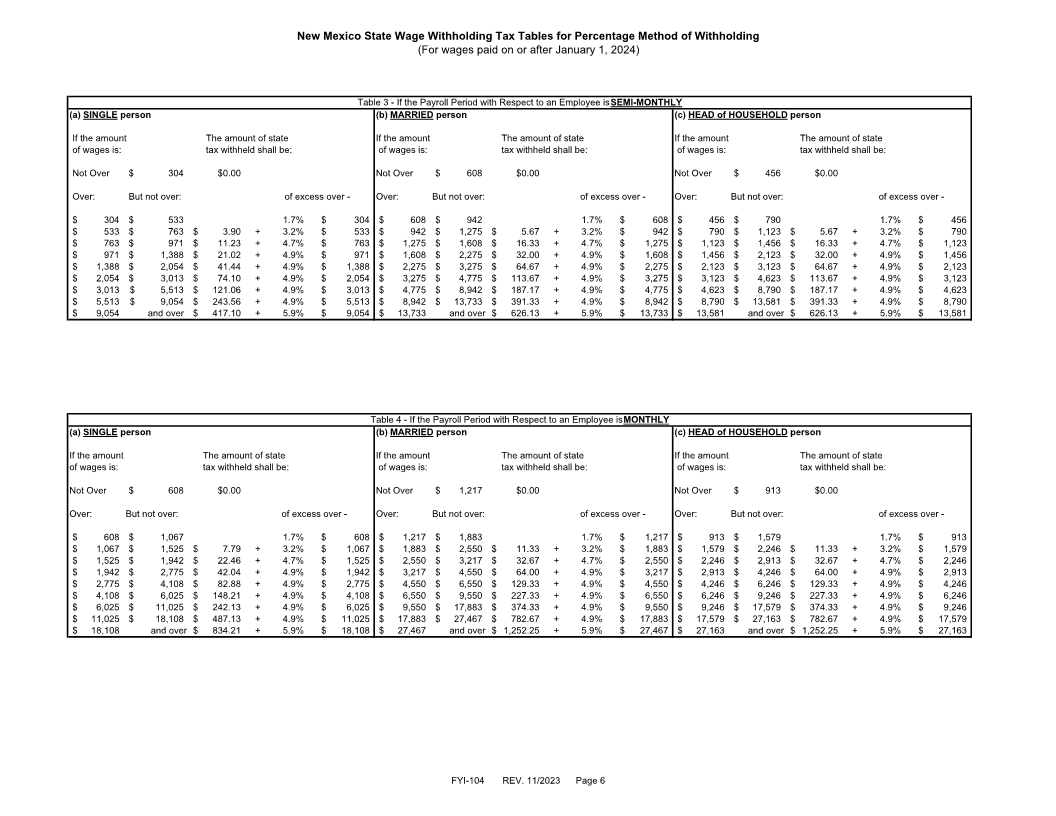

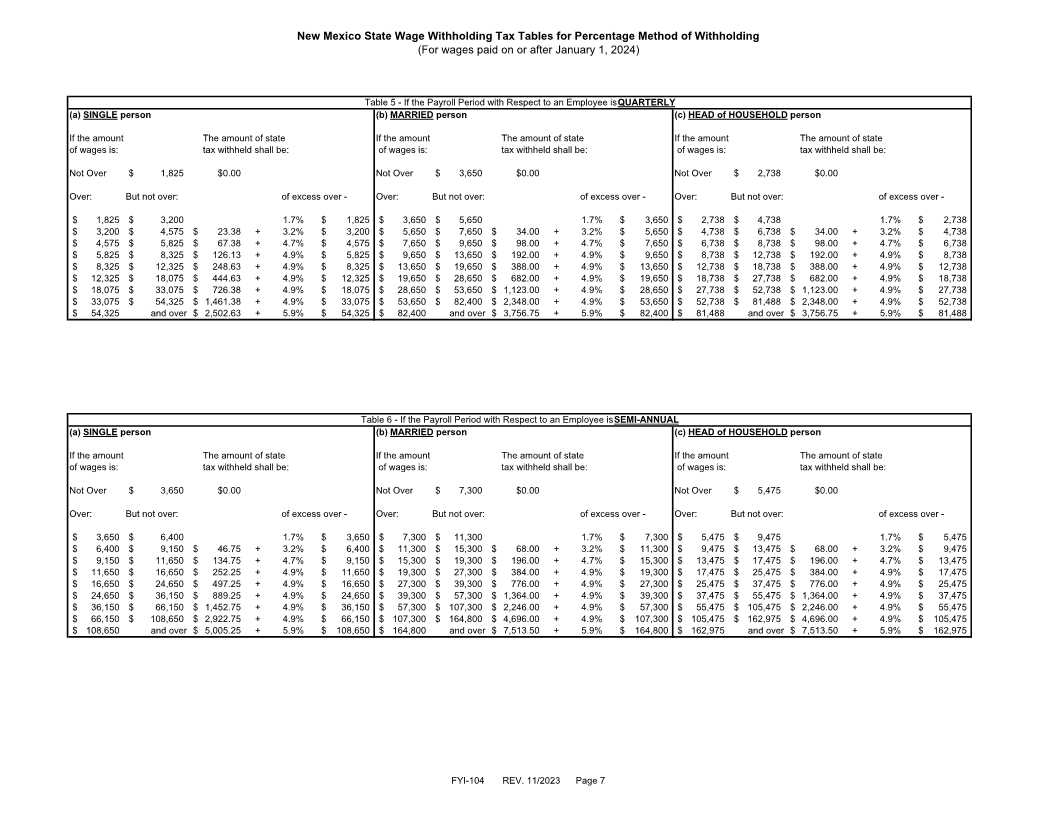

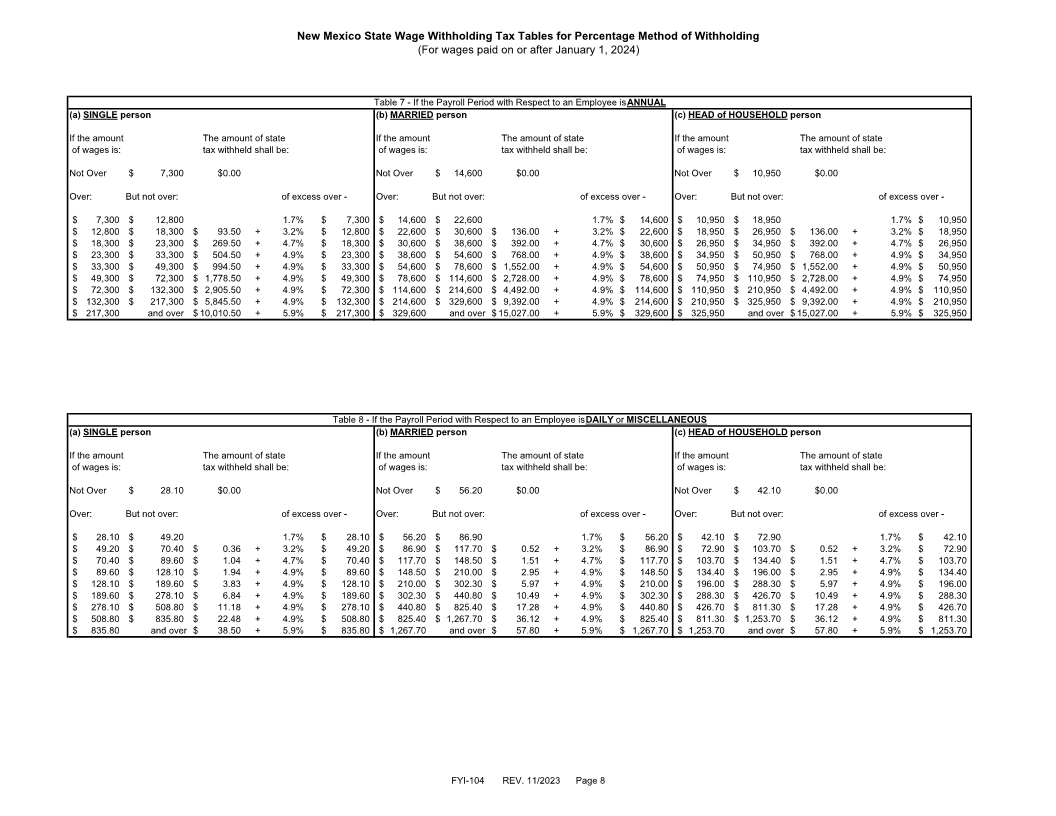

Amount to Withhold .......................................................................................................................... 2

How to use the Withholding Tax Tables .......................................................................................... 2

How to Report and Pay Withholding Taxes ..................................................................................... 3

Additional Withholding Amounts ...................................................................................................... 3

Withholding on Gambling Winnings ................................................................................................. 3

Annual Withholding Statements ....................................................................................................... 3

Annual Reconciliation ....................................................................................................................... 4

Withholding from Irregular, Supplemental Wages, or Fringe Benefits ............................................. 4

Special Situations ............................................................................................................................. 4

For Further Information .................................................................................................................... 4

FYI-104 REV. 11/2023 page 1