Enlarge image

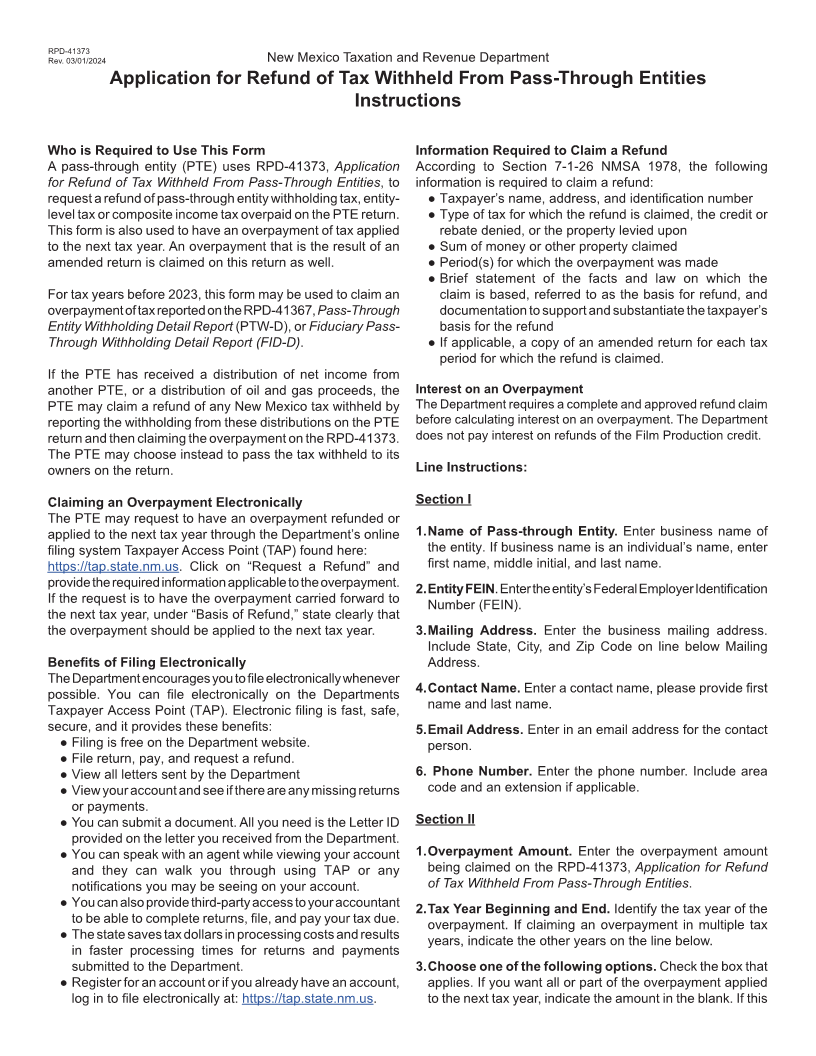

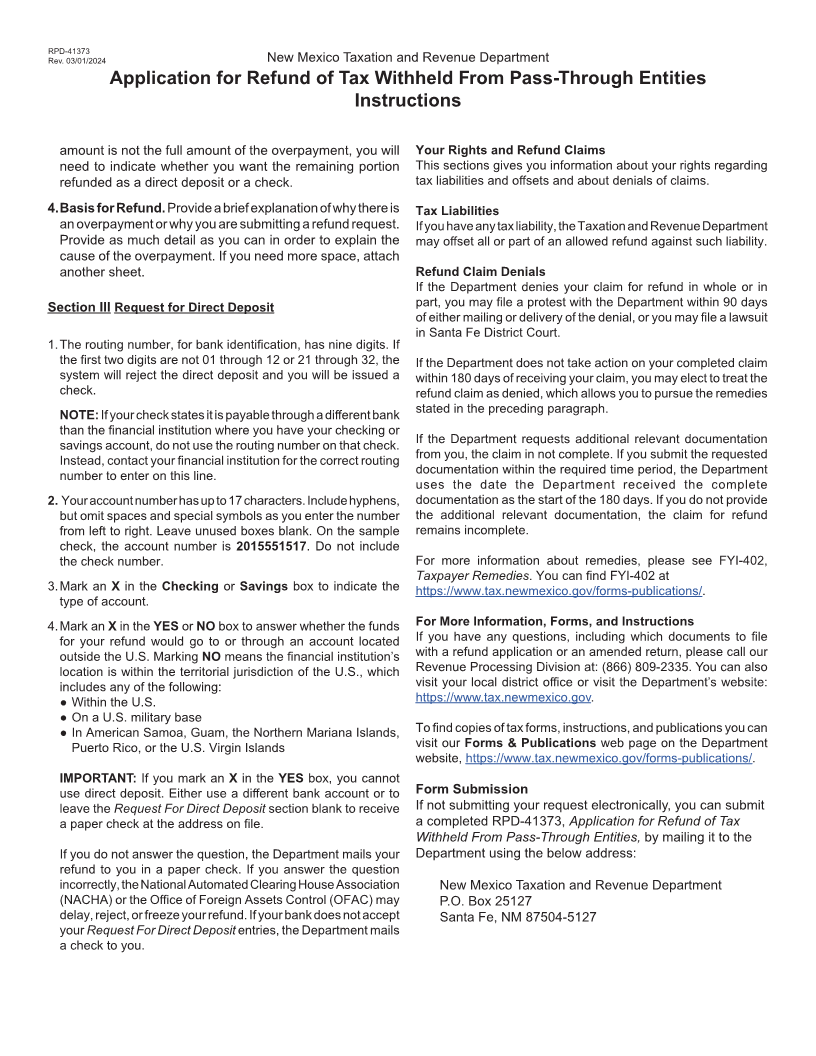

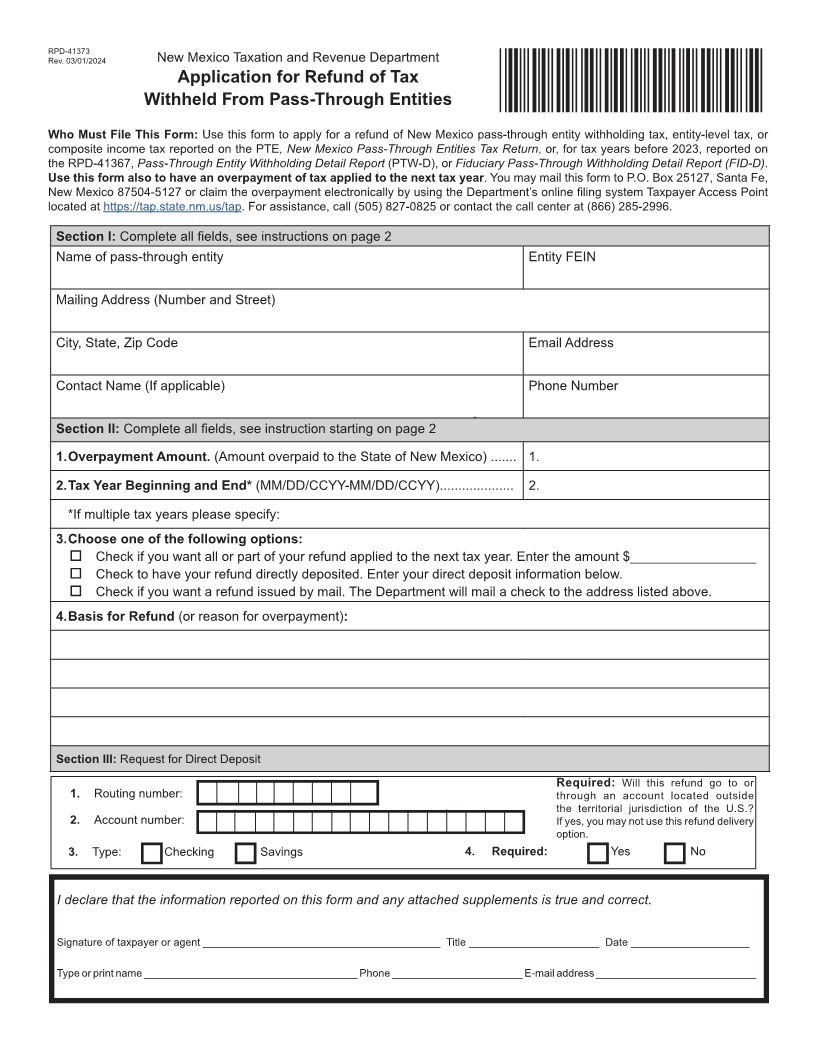

RPD-41373 Rev. 03/01/2024 New Mexico Taxation and Revenue Department Application for Refund of Tax Withheld From Pass-Through Entities *447480200* Who Must File This Form: Use this form to apply for a refund of New Mexico pass-through entity withholding tax, entity-level tax, or composite income tax reported on the PTE , New Mexico Pass-Through Entities Tax Return, or, for tax years before 2023, reported on the RPD-41367,Pass-Through Entity Withholding Detail Report(PTW-D), orFiduciary Pass-Through Withholding Detail Report (FID-D). Use this form also to have an overpayment of tax applied to the next tax year. You may mail this form to P.O. Box 25127, Santa Fe, New Mexico 87504-5127 or claim the overpayment electronically by using the Department’s online filing system Taxpayer Access Point located at https://tap.state.nm.us/tap. For assistance, call (505) 827-0825 or contact the call center at (866) 285-2996. Section I: Complete all fields, see instructions on page 2 Name of pass-through entity Entity FEIN Mailing Address (Number and Street) City, State, Zip Code Email Address Contact Name (If applicable) Phone Number Complete all fields, see instruction starting on page 2 $ Section II: 1. Overpayment Amount. (Amount overpaid to the State of New Mexico) ....... 1. 2. Tax Year Beginning and End* (MM/DD/CCYY-MM/DD/CCYY).................... 2. *If multiple tax years please specify: 3. Choose one of the following options: o Check if you want all or part of your refund applied to the next tax year. Enter the amount $_________________ o Check to have your refund directly deposited. Enter your direct deposit information below. o Check if you want a refund issued by mail. The Department will mail a check to the address listed above. 4. Basis for Refund (or reason for overpayment): Section III: Request for Direct Deposit Required: Will this refund go to or 1. Routing number: through an account located outside the territorial jurisdiction of the U.S.? 2. Account number: If yes, you may not use this refund delivery option. 3. Type: Checking Savings 4. Required: Yes No I declare that the information reported on this form and any attached supplements is true and correct. Signature of taxpayer or agent ________________________________________ Title ______________________ Date ____________________ Type or print name ____________________________________ Phone ______________________ E-mail address ___________________________