Enlarge image

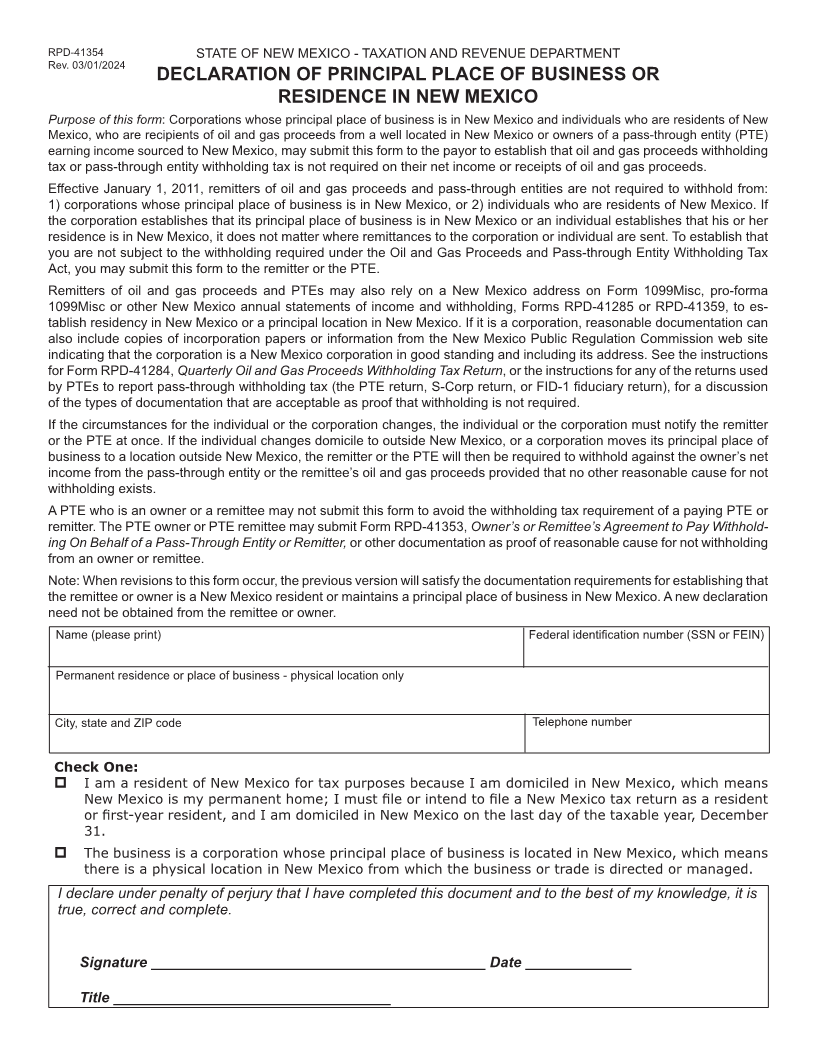

RPD-41354 STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

Rev. 03/01/2024

DECLARATION OF PRINCIPAL PLACE OF BUSINESS OR

RESIDENCE IN NEW MEXICO

Purpose of this form: Corporations whose principal place of business is in New Mexico and individuals who are residents of New

Mexico, who are recipients of oil and gas proceeds from a well located in New Mexico or owners of a pass-through entity (PTE)

earning income sourced to New Mexico, may submit this form to the payor to establish that oil and gas proceeds withholding

tax or pass-through entity withholding tax is not required on their net income or receipts of oil and gas proceeds.

Effective January 1, 2011, remitters of oil and gas proceeds and pass-through entities are not required to withhold from:

1) corporations whose principal place of business is in New Mexico, or 2) individuals who are residents of New Mexico. If

the corporation establishes that its principal place of business is in New Mexico or an individual establishes that his or her

residence is in New Mexico, it does not matter where remittances to the corporation or individual are sent. To establish that

you are not subject to the withholding required under the Oil and Gas Proceeds and Pass-through Entity Withholding Tax

Act, you may submit this form to the remitter or the PTE.

Remitters of oil and gas proceeds and PTEs may also rely on a New Mexico address on Form 1099Misc, pro-forma

1099Misc or other New Mexico annual statements of income and withholding, Forms RPD-41285 or RPD-41359, to es-

tablish residency in New Mexico or a principal location in New Mexico. If it is a corporation, reasonable documentation can

also include copies of incorporation papers or information from the New Mexico Public Regulation Commission web site

indicating that the corporation is a New Mexico corporation in good standing and including its address. See the instructions

for Form RPD-41284, Quarterly Oil and Gas Proceeds Withholding Tax Return, or the instructions for any of the returns used

by PTEs to report pass-through withholding tax (the PTE return, S-Corp return, or FID-1 fiduciary return), for a discussion

of the types of documentation that are acceptable as proof that withholding is not required.

If the circumstances for the individual or the corporation changes, the individual or the corporation must notify the remitter

or the PTE at once. If the individual changes domicile to outside New Mexico, or a corporation moves its principal place of

business to a location outside New Mexico, the remitter or the PTE will then be required to withhold against the owner’s net

income from the pass-through entity or the remittee’s oil and gas proceeds provided that no other reasonable cause for not

withholding exists.

A PTE who is an owner or a remittee may not submit this form to avoid the withholding tax requirement of a paying PTE or

remitter. The PTE owner or PTE remittee may submit Form RPD-41353, Owner’s or Remittee’s Agreement to Pay Withhold-

ing On Behalf of a Pass-Through Entity or Remitter, or other documentation as proof of reasonable cause for not withholding

from an owner or remittee.

Note: When revisions to this form occur, the previous version will satisfy the documentation requirements for establishing that

the remittee or owner is a New Mexico resident or maintains a principal place of business in New Mexico. A new declaration

need not be obtained from the remittee or owner.

Name (please print) Federal identification number (SSN or FEIN)

Permanent residence or place of business - physical location only

City, state and ZIP code Telephone number

Check One:

I am a resident of New Mexico for tax purposes because I am domiciled in New Mexico, which means

New Mexico is my permanent home; I must file or intend to file a New Mexico tax return as a resident

or first-year resident, and I am domiciled in New Mexico on the last day of the taxable year, December

31.

The business is a corporation whose principal place of business is located in New Mexico, which means

there is a physical location in New Mexico from which the business or trade is directed or managed.

I declare under penalty of perjury that I have completed this document and to the best of my knowledge, it is

true, correct and complete.

Signature _________________________________________ Date _____________

Title __________________________________