Enlarge image

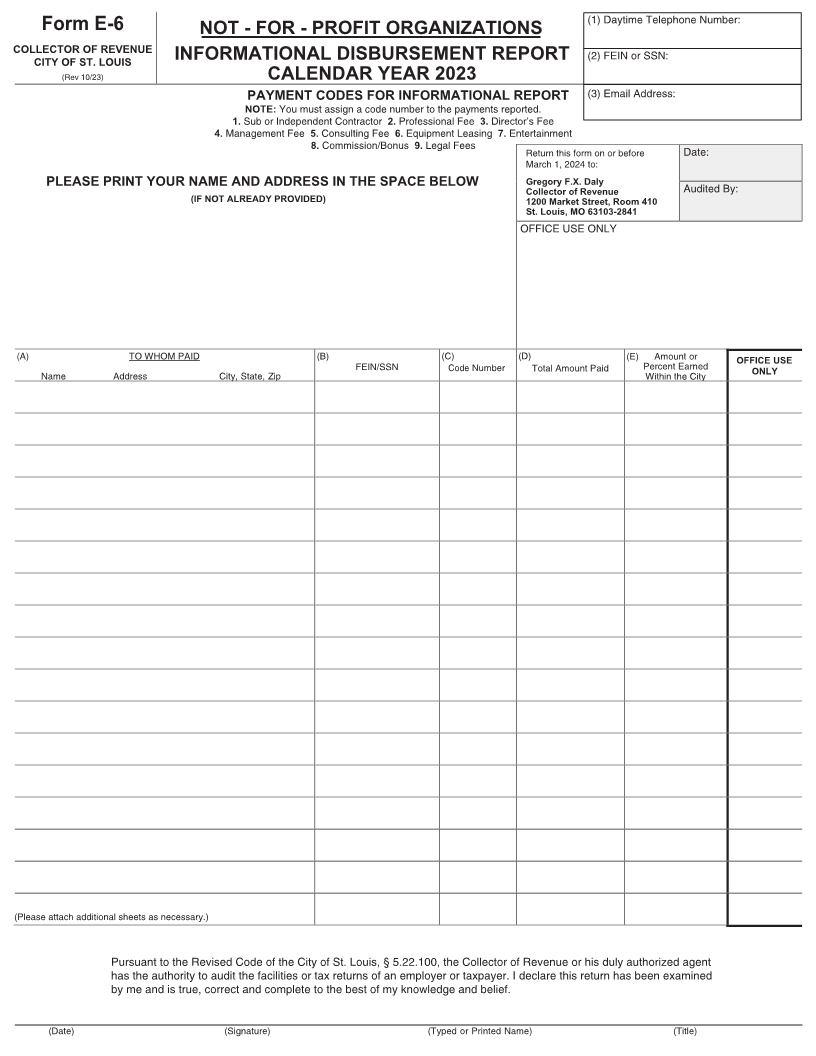

(1) Daytime Telephone Number:

Form E-6 NOT - FOR - PROFIT ORGANIZATIONS

COLLECTOR OF REVENUE INFORMATIONAL DISBURSEMENT REPORT (2) FEIN or SSN:

CITY OF ST. LOUIS

(Rev 10/23) CALENDAR YEAR 2023

PAYMENT CODES FOR INFORMATIONAL REPORT (3) Email Address:

NOTE: You must assign a code number to the payments reported.

1. Sub or Independent Contractor 2. Professional Fee 3. Director’s Fee

4. Management Fee 5. Consulting Fee 6. Equipment Leasing 7. Entertainment

8. Commission/Bonus 9. Legal Fees Return this form on or before Date:

March 1, 2024 to:

PLEASE PRINT YOUR NAME AND ADDRESS IN THE SPACE BELOW Gregory F.X. Daly Audited By:

Collector of Revenue

(IF NOT ALREADY PROVIDED) 1200 Market Street, Room 410

St. Louis, MO 63103-2841

OFFICE USE ONLY

(A) TO WHOM PAID (B) (C) (D) (E) Amount or OFFICE USE

FEIN/SSN Code Number Total Amount Paid Percent Earned

Name Address City, State, Zip Within the City ONLY

(Please attach additional sheets as necessary.)

Pursuant to the Revised Code of the City of St. Louis, § 5.22.100, the Collector of Revenue or his duly authorized agent

has the authority to audit the facilities or tax returns of an employer or taxpayer. I declare this return has been examined

by me and is true, correct and complete to the best of my knowledge and belief.

(Date) (Signature) (Typed or Printed Name) (Title)