Enlarge image

Revised 12/2023

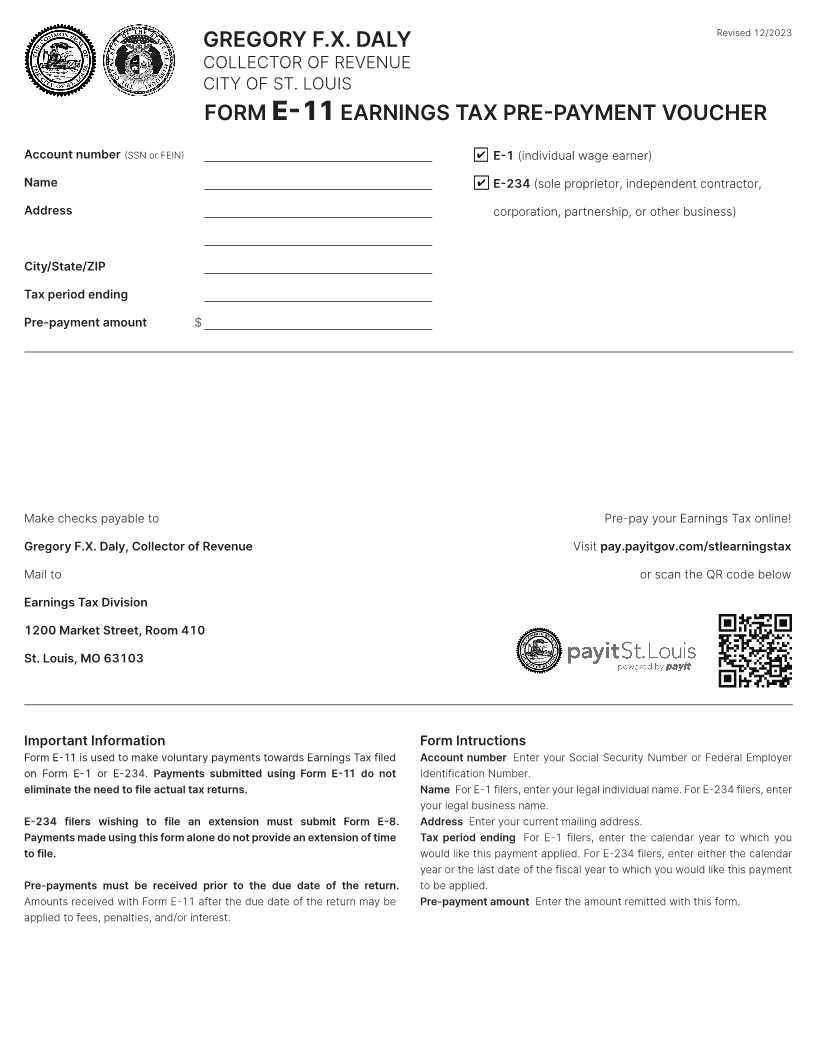

FORM E-11 EARNINGS TAX PRE-PAYMENT VOUCHER

Account number (SSN or FEIN) ⬜✔ E-1 (individual wage earner)

Name ⬜✔ E-234 (sole proprietor, independent contractor,

Address corporation, partnership, or other business)

City/State/ZIP

Tax period ending

Pre-payment amount $

Make checks payable to: Pre-pay your Earnings Tax online!

Gregory F.X. Daly, Collector of Revenue Visit pay.payitgov.com/stlearningstax

Mail to: or scan the QR code below

Earnings Tax Division

1200 Market Street, Room 410

St. Louis, MO 63103

Important Information Form Intructions

Form E-11 is used to make voluntary payments towards Earnings Tax filed Account number: Enter your Social Security Number or Federal Employer

on Form E-1 or E-234. Payments submitted using Form E-11 do not Identification Number.

eliminate the need to file actual tax returns. Name: For E-1 filers, enter your legal individual name. For E-234 filers, enter

your legal business name.

E-234 filers wishing to file an extension must submit Form E-8. Address: Enter your current mailing address.

Payments made using this form alone do not provide an extension of time Tax period ending: For E-1 filers, enter the calendar year to which you

to file. would like this payment applied. For E-234 filers, enter either the calendar

year or the last date of the fiscal year to which you would like this payment

Pre-payments must be received prior to the due date of the return. to be applied.

Amounts received with Form E-11 after the due date of the return may be Pre-payment amount: Enter the amount remitted with this form.

applied to fees, penalties, and/or interest.