Enlarge image

CITY OF ADAK, ALASKA

P.O. BOX 2011 - ADAK, ALASKA 99546-2011

Phone: (907) 592-4500 - Fax: (907) 592-4262

http://www.adak-ak.us

SALES TAX RETURN

NOTICE: The Adak Municipal Code §4.06 details the application, exemptions, collections and remittance of sales tax. This report is invalid unless completed in detail. The

report must be filed even if no receipts for the month. Information provided on this form is confidential subject to AMC §4.06.90.

ALL RETURNS MUST BE FILED - INCLUDING NO SALES

No sales for the month Final Tax Return ---------------> Date Closed/Sold:

City Tax ID #: For Calendar Month/Year:

Business Name:

Address:

1. DETERMINATION OF GROSS RECEIPTS/REVENUE:

A. Sales A.

B. Rentals B.

C. Services C.

TOTAL GROSS RECEIPTS/REVENUE (Add lines A thru C): 1.

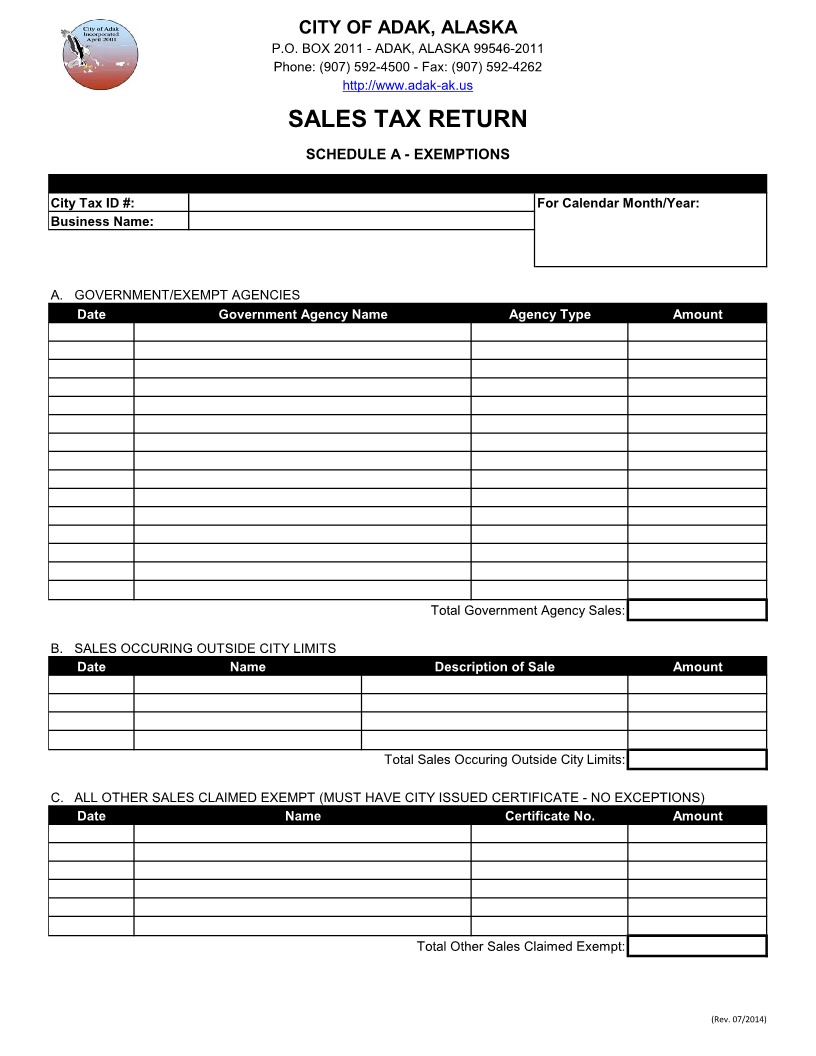

2. DETERMINATION OF EXEMPT SALES

A. Government Agencies A.

B. Sales Occuring Outside City Limits B.

C. Other C.

TOTAL EXEMPT SALES (Add lines A thru C): 2.

3. SALES SUBJECT TO SALES TAX (Subtract line 2 from line 1): 3.

4. SALES TAX AT 4% (Multiply line 3 by .04): 4.

5. PENALTY FOR LATE/NON-PAYMENT OF TAX (if applicable): 5.

6. INTEREST FOR LATE/NON-PAYMENT OF TAX (if applicable): 6.

7. TOTAL DUE (Add lines 4 through 6): 7.

MONTHLY SALES TAX RETURNS MUST BE FILED BY THE LAST BUSINESS DAY OF THE MONTH FOLLOWING THE

CALENDAR MONTH IN WHICH TAXES WERE COLLECTED.

FAILURE TO FILE A REPORT AS REQUIRED WILL RESULT IN A DELINQUENT PENALTY OF 5% PER MONTH OR FRACTION

THEREOF AND 10% PER MONTH FOR THE FOLLOWING MONTH. ADDITIONALLY A DELINQUENT INTEREST OF 10.5% PER

ANNUM OF THE DELINQUENT TAX WILL BE ASSESSED AND DUE.

IF PENALTY AND/OR INTEREST ARE INCORRECTLY CALCULATED THE DIFFERENCE WILL BE INVOICED WHICH WILL BE

IMMEDIATELY DUE AND PAYABLE.

I CERTIFY UNDER PENALTY OF PERJURY THAT THIS RETURN (INCLUDING ANY ACCOMPANYING STATEMENTS HAS BEEN

EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND COMPLETE RETURN.

SIGNATURE & TITLE Date

(Rev. 07/2014)