Enlarge image

IT-540ESi (2023) 2023

Declaration of Estimated Tax for Individuals

General Information and Instructions

lat ap.r e venue.louisiana.go v

This document explains the requirements for certain individuals Exception to the January 15th Declaration Requirement

to pay estimated income tax on taxable income that is not subject R.S. 47:116(F) provides an exception from the estimated

to withholding, such as income from self-employment, interest, tax payment amendment requirement or original declaration

dividends, rents, and other taxable income such as unemployment requirement due January 15th if the taxpayer files their individual

compensation that the individual does not choose to make volun- income tax return by January 31 and pays the total amount due.

tary withholding. It also provides a worksheet for estimating the Note: Filing a declaration, amended declaration, or paying the

amount of estimated income tax to be paid. last installment by January 15th, or filing an income tax return by

January 31st, will not relieve you of the underpayment penalty if

Who Must Make Estimated Tax Payments you failed to pay the estimated income tax that was due earlier in

Louisiana income tax law, R.S. 47:116, requires individuals the year.

to make estimated income tax payments if the individual’s

estimated Louisiana income tax after credits and taxes withheld How to Pay Estimated Tax

can reasonably be expected to exceed $1,000 for a single filer or

$2,000 for joint filers. Pay by Check or Money Order using the Estimated Tax Payment

Voucher

Married couples should file a joint declaration of estimated income Estimated tax payments can be paid by check or money order

tax unless they file separately using different tax years. If a couple to the Department of Revenue, and mailed with the Louisiana

files a joint declaration but files their income tax separately, the Estimated Tax Declaration Voucher, Form IT-540ES. The payment

estimated tax paid may be treated as the estimated tax of either must be postmarked on or before the payment’s due date. The

spouse or may be divided between them in any manner. payment and voucher should be mailed to the Department of

Revenue, P.O. Box 91007, Baton Rouge, Louisiana 70821-9007.

Special Rules for Farmers and Fishermen

Individuals who earn at least two-thirds of their gross income Pay Electronically

from farming or fishing are allowed to file only one estimated tax Paying electronically ensures timely receipt of payments. When

payment of the full amount due on or before January 15, of the you pay electronically, there is no check to write and no voucher to

succeeding taxable year. In addition, if the farmer or fisherman files mail. Payments can be made 24 hours a day, 7 days a week and

their income tax return on or before March 1, of the succeeding proof of payment will be confirmed electronically.

year and pays the total tax due, payment of estimated tax is not

required. Electronic payments can be made using the following convenient,

safe, and secure electronic payment options:

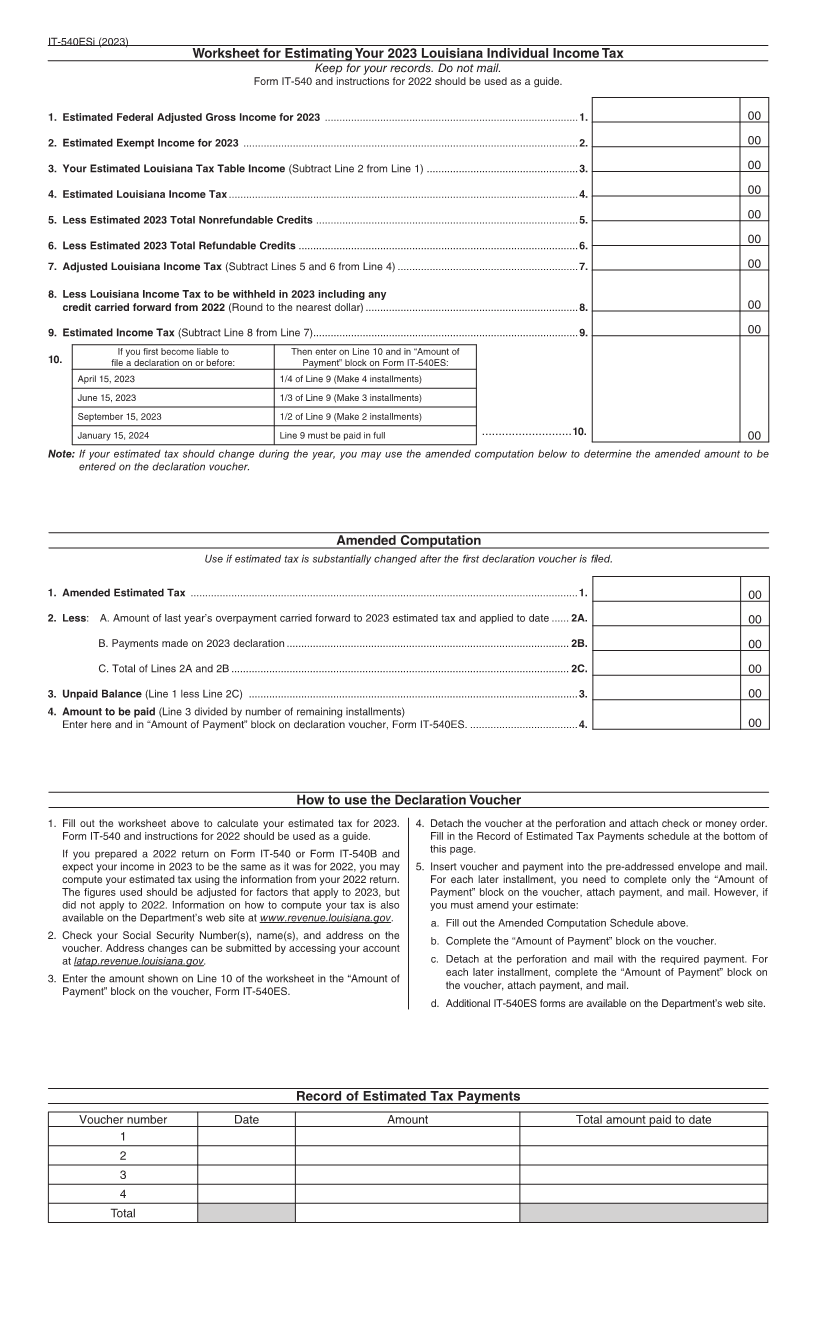

How to Calculate Your Estimated Tax • For online transfers directly from your checking or savings

Use the Worksheet on page 2 for calculating your estimated account at no cost to you, go to www.revenue.louisiana.gov/

income tax based on your next year’s estimated adjusted gross latap

income to determine your Louisiana estimated tax table income. • For payment by credit card, go to www.revenue.louisiana.gov.

Using the tax tables from the current year, to determine your

estimated Louisiana income tax less nonrefundable and refundable It is not necessary to file the estimated payment voucher, Form

tax credits and estimated income tax withheld. IT-540ES, if the payment is made electronically.

Estimated Tax Payment Due Dates When is a Penalty Applied

The estimated individual income tax may be paid in full with the Revised Statute 47:118 provides for a 12 percent penalty for

first declaration or in equal installments as follows: underpayment of estimated income tax. The penalty may be

1st payment ............................................ April 15, 2023 imposed if you did not pay enough estimated tax for the year or did

2nd payment .......................................... June 15, 2023 not make estimated payments on time or in the required amount.

The penalty is imposed on each underpayment for the number of

3rd payment ........................................... September 15, 2023 days it was unpaid.

4th payment ........................................... January 15, 2024 For more information on calculating the underpayment penalty,

see the instructions for the Underpayment of Individual Income

Note: If a due date for an estimated tax payment falls on a Tax Penalty Computation, Form R-210R-i on the Department’s

weekend or legal holiday, the payment is due on the next website. If you owe underpayment penalty, calculate the penalty

business day. amount using Form R-210R.

Fiscal year filers—the estimated tax payment due dates for Revised Statute 47:118(I) authorizes waiver of the underpayment

taxpayers who file on a fiscal basis are as follows: penalty if an application for waiver of the penalty is submitted within

1st payment ................15th day of the 4th month of the one year of tax return’s due date. To qualify for penalty waiver, the

fiscal year taxpayer must demonstrate that they acted in good faith and that

the failure to make the proper estimated payments was attributable

2nd payment ................15th day of the 6th month of the to extraordinary circumstances beyond the taxpayer’s control.

fiscal year To request underpayment penalty waiver, use Form R-20128,

3rd payment .................15th day of the 9th month of the Request for Waiver of Penalties.

fiscal year

4th payment .................15th day of the 1st month following

the close of the fiscal year

Changes in Income or Exemptions—Amended Declarations

If the taxpayer’s expected income or exemptions changes so that

the taxpayer becomes liable for paying estimated income tax or

the estimated income tax amount changes, the estimated tax

payments should be calculated or revised using the appropriate

worksheet and the payments adjusted as of the next estimated

payment due date.

You can pay your Louisiana Estimated Tax for Individuals by Credit Card, over

the Internet, or by phone. Visit www.revenue.louisiana.gov for more information.