Enlarge image

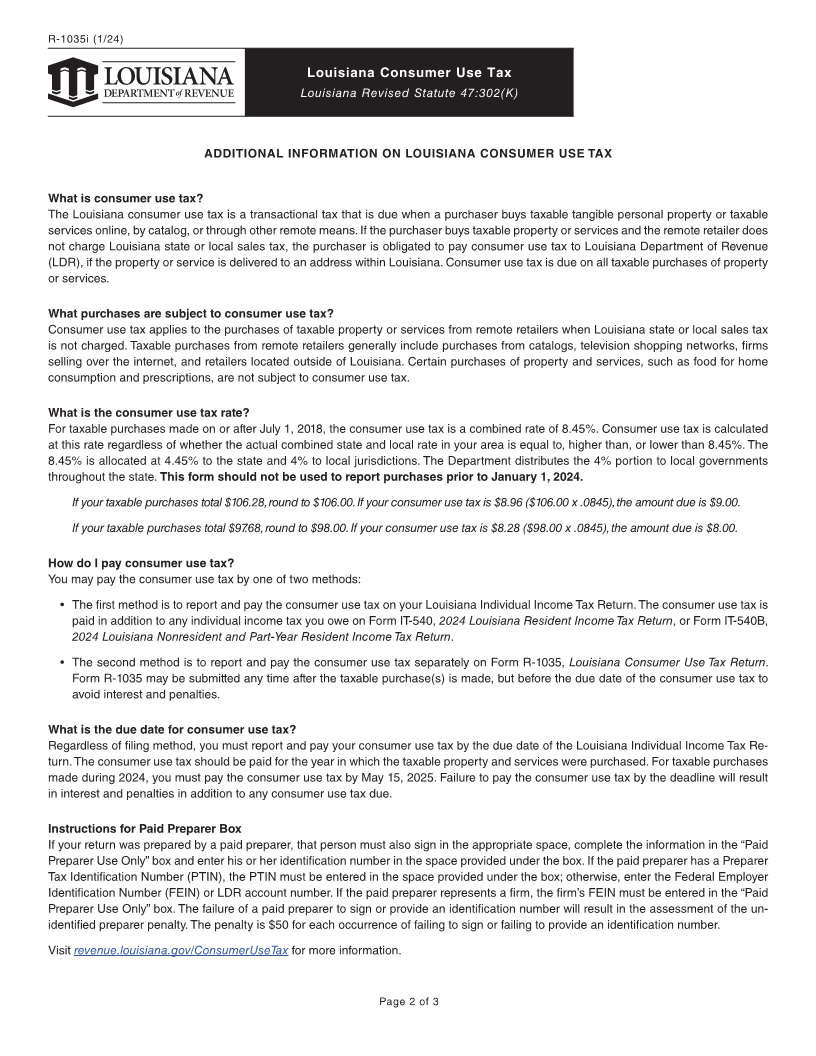

R-1035 (1/24)

PURCHASES MADE IN

Louisiana Consumer Use Tax CALENDAR YEAR

Louisiana Revised Statute 47:302(K)

2024

Your First Name MI Last Name Suffix

➜ Your Social

Security Number

If Joint Return, Spouse’s Name MI Last Name Suffix

➜ Spouse’s Social

Security Number

Current Home Address (number and street including rural route) Unit Type Number

➜ Area code and

daytime telephone

City, Town, or APO State ZIP number

➜

Foreign Nation, if not United States (do not abbreviate)

➜

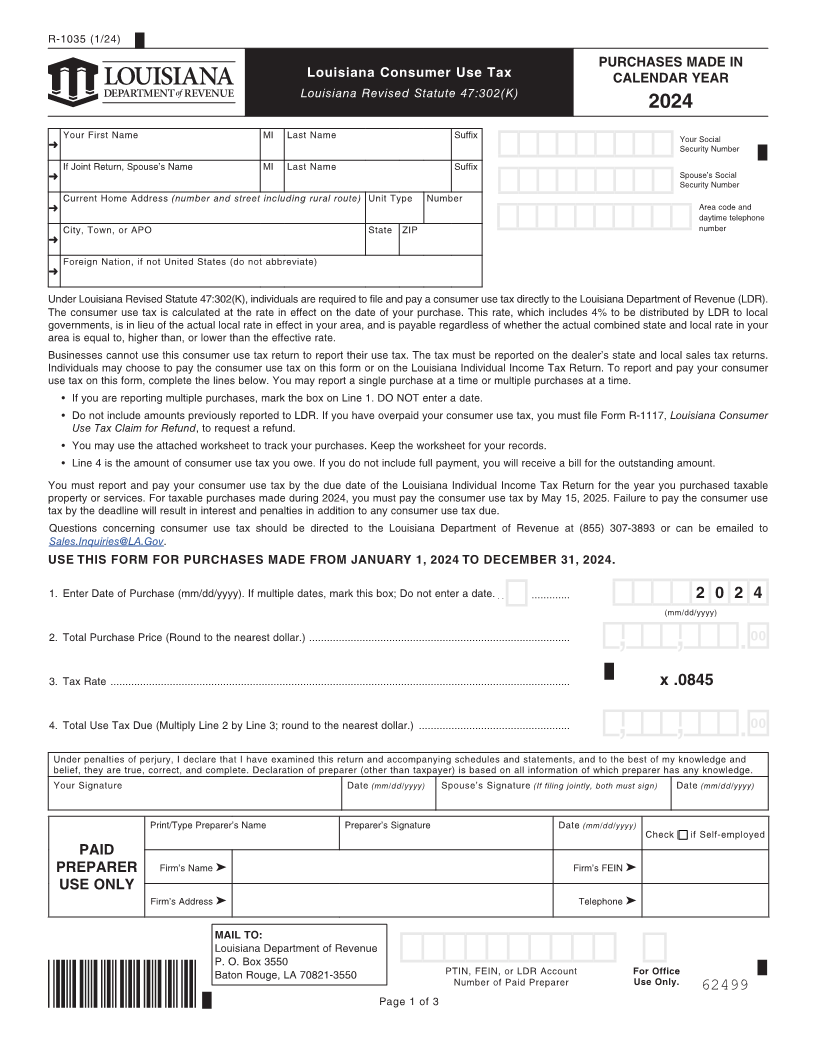

Under Louisiana Revised Statute 47:302(K), individuals are required to file and pay a consumer use tax directly to the Louisiana Department of Revenue (LDR).

The consumer use tax is calculated at the rate in effect on the date of your purchase. This rate, which includes 4% to be distributed by LDR to local

governments, is in lieu of the actual local rate in effect in your area, and is payable regardless of whether the actual combined state and local rate in your

area is equal to, higher than, or lower than the effective rate.

Businesses cannot use this consumer use tax return to report their use tax. The tax must be reported on the dealer’s state and local sales tax returns.

Individuals may choose to pay the consumer use tax on this form or on the Louisiana Individual Income Tax Return. To report and pay your consumer

use tax on this form, complete the lines below. You may report a single purchase at a time or multiple purchases at a time.

• If you are reporting multiple purchases, mark the box on Line 1. DO NOT enter a date.

• Do not include amounts previously reported to LDR. If you have overpaid your consumer use tax, you must file Form R-1117, Louisiana Consumer

Use Tax Claim for Refund, to request a refund.

• You may use the attached worksheet to track your purchases. Keep the worksheet for your records.

• Line 4 is the amount of consumer use tax you owe. If you do not include full payment, you will receive a bill for the outstanding amount.

You must report and pay your consumer use tax by the due date of the Louisiana Individual Income Tax Return for the year you purchased taxable

property or services. For taxable purchases made during 2024, you must pay the consumer use tax by May 15, 2025. Failure to pay the consumer use

tax by the deadline will result in interest and penalties in addition to any consumer use tax due.

Questions concerning consumer use tax should be directed to the Louisiana Department of Revenue at (855) 307-3893 or can be emailed to

Sales.Inquiries@LA.Gov.

USE THIS FORM FOR PURCHASES MADE FROM JANUARY 1, 2024 TO DECEMBER 31, 2024.

1. Enter Date of Purchase (mm/dd/yyyy). If multiple dates, mark this box; Do not enter a date. ............. 2 0 2 4

(mm/dd/yyyy)

2. Total Purchase Price (Round to the nearest dollar.) ........................................................................................

3. Tax Rate ........................................................................................................................................................... x .0845

4. Total Use Tax Due (Multiply Line 2 by Line 3; round to the nearest dollar.) ...................................................

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and

belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your Signature Date (mm/dd/yyyy) Spouse’s Signature (If filing jointly, both must sign) Date (mm/dd/yyyy)

Print/Type Preparer’s Name Preparer’s Signature Date (mm/dd/yyyy)

Check ■■ if Self-employed

PAID

PREPARER Firm’s Name ➤ Firm’s FEIN ➤

USE ONLY

Firm’s Address ➤ Telephone ➤

MAIL TO:

Louisiana Department of Revenue

P. O. Box 3550

Baton Rouge, LA 70821-3550 PTIN, FEIN, or LDR Account For Office

Number of Paid Preparer Use Only.

62499

Page 1 of 3