Enlarge image

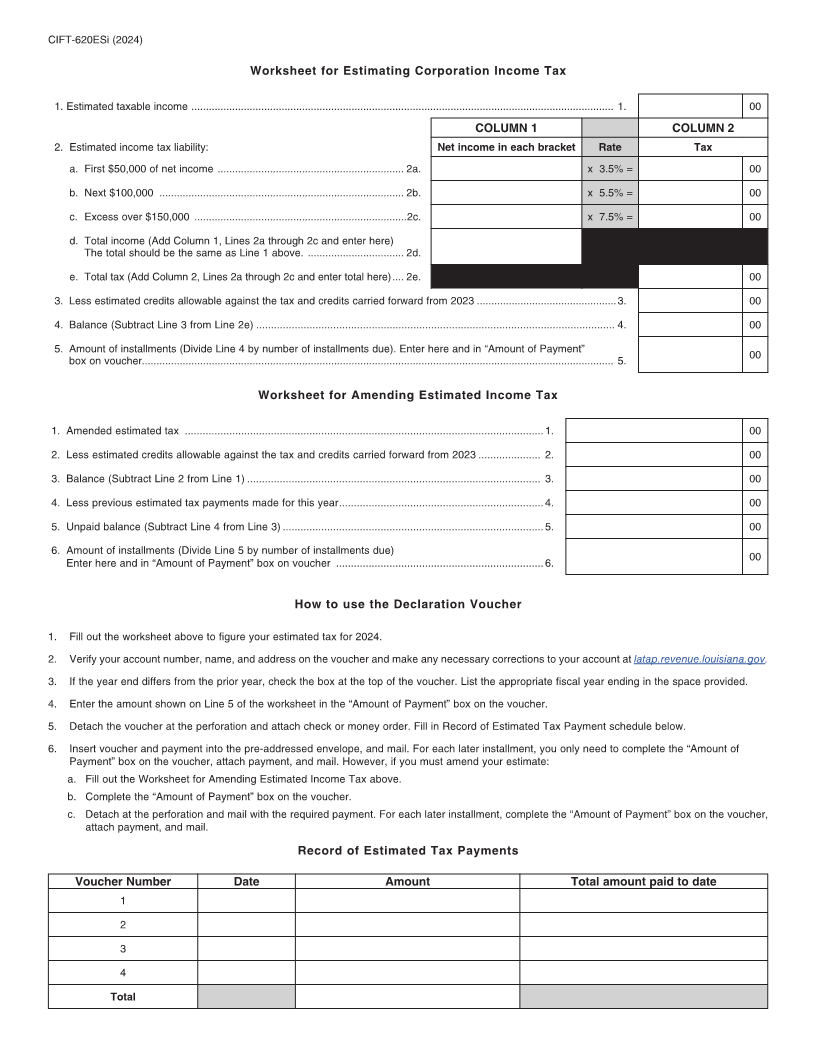

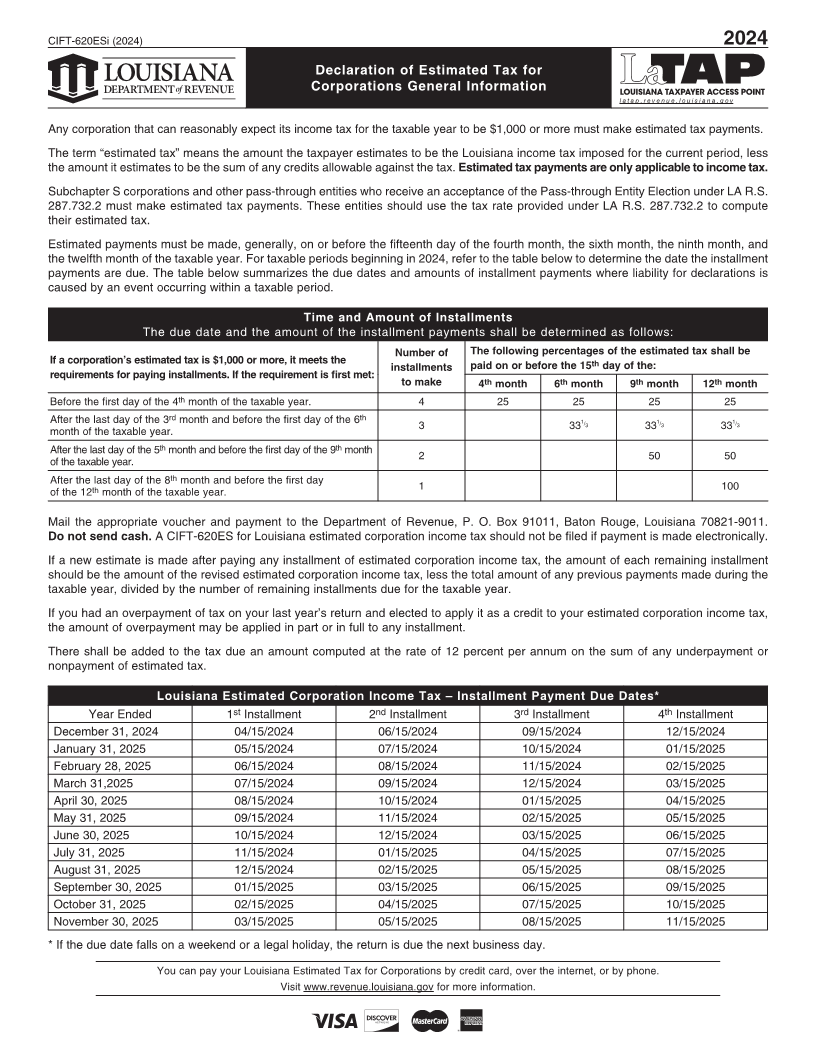

CIFT-620ESi (2024) 2024 Declaration of Estimated Tax for Corporations General Information lat ap.r e venue.louisiana.go v Any corporation that can reasonably expect its income tax for the taxable year to be $1,000 or more must make estimated tax payments. The term “estimated tax” means the amount the taxpayer estimates to be the Louisiana income tax imposed for the current period, less the amount it estimates to be the sum of any credits allowable against the tax. Estimated tax payments are only applicable to income tax. Subchapter S corporations and other pass-through entities who receive an acceptance of the Pass-through Entity Election under LA R.S. 287.732.2 must make estimated tax payments. These entities should use the tax rate provided under LA R.S. 287.732.2 to compute their estimated tax. Estimated payments must be made, generally, on or before the fifteenth day of the fourth month, the sixth month, the ninth month, and the twelfth month of the taxable year. For taxable periods beginning in 2024, refer to the table below to determine the date the installment payments are due. The table below summarizes the due dates and amounts of installment payments where liability for declarations is caused by an event occurring within a taxable period. Time and Amount of Installments The due date and the amount of the installment payments shall be determined as follows: Number of The following percentages of the estimated tax shall be If a corporation’s estimated tax is $1,000 or more, it meets the paid on or before the 15 thday of the: installments requirements for paying installments. If the requirement is first met: th 6 thmonth 9 thmonth 12 thmonth to make 4 month Before the first day of the 4 thmonth of the taxable year. 4 25 25 25 25 After the last day of the 3 rdmonth and before the first day of the 6 th 1 / 3 331 / 3 331 / 3 month of the taxable year. 3 33 After the last day of theth5 month and before the first day of theth9 month of the taxable year. 2 50 50 After the last day of the 8 thmonth and before the first day of the 12 thmonth of the taxable year. 1 100 Mail the appropriate voucher and payment to the Department of Revenue, P. O. Box 91011, Baton Rouge, Louisiana 70821-9011. Do not send cash. A CIFT-620ES for Louisiana estimated corporation income tax should not be filed if payment is made electronically. If a new estimate is made after paying any installment of estimated corporation income tax, the amount of each remaining installment should be the amount of the revised estimated corporation income tax, less the total amount of any previous payments made during the taxable year, divided by the number of remaining installments due for the taxable year. If you had an overpayment of tax on your last year’s return and elected to apply it as a credit to your estimated corporation income tax, the amount of overpayment may be applied in part or in full to any installment. There shall be added to the tax due an amount computed at the rate of 12 percent per annum on the sum of any underpayment or nonpayment of estimated tax. Louisiana Estimated Corporation Income Tax – Installment Payment Due Dates* Year Ended 1 stInstallment 2 ndInstallment 3 rdInstallment 4 thInstallment December 31, 2024 04/15/2024 06/15/2024 09/15/2024 12/15/2024 January 31, 2025 05/15/2024 07/15/2024 10/15/2024 01/15/2025 February 28, 2025 06/15/2024 08/15/2024 11/15/2024 02/15/2025 March 31,2025 07/15/2024 09/15/2024 12/15/2024 03/15/2025 April 30, 2025 08/15/2024 10/15/2024 01/15/2025 04/15/2025 May 31, 2025 09/15/2024 11/15/2024 02/15/2025 05/15/2025 June 30, 2025 10/15/2024 12/15/2024 03/15/2025 06/15/2025 July 31, 2025 11/15/2024 01/15/2025 04/15/2025 07/15/2025 August 31, 2025 12/15/2024 02/15/2025 05/15/2025 08/15/2025 September 30, 2025 01/15/2025 03/15/2025 06/15/2025 09/15/2025 October 31, 2025 02/15/2025 04/15/2025 07/15/2025 10/15/2025 November 30, 2025 03/15/2025 05/15/2025 08/15/2025 11/15/2025 * If the due date falls on a weekend or a legal holiday, the return is due the next business day. You can pay your Louisiana Estimated Tax for Corporations by credit card, over the internet, or by phone. Visit www.revenue.louisiana.gov for more information.