- 2 -

Enlarge image

|

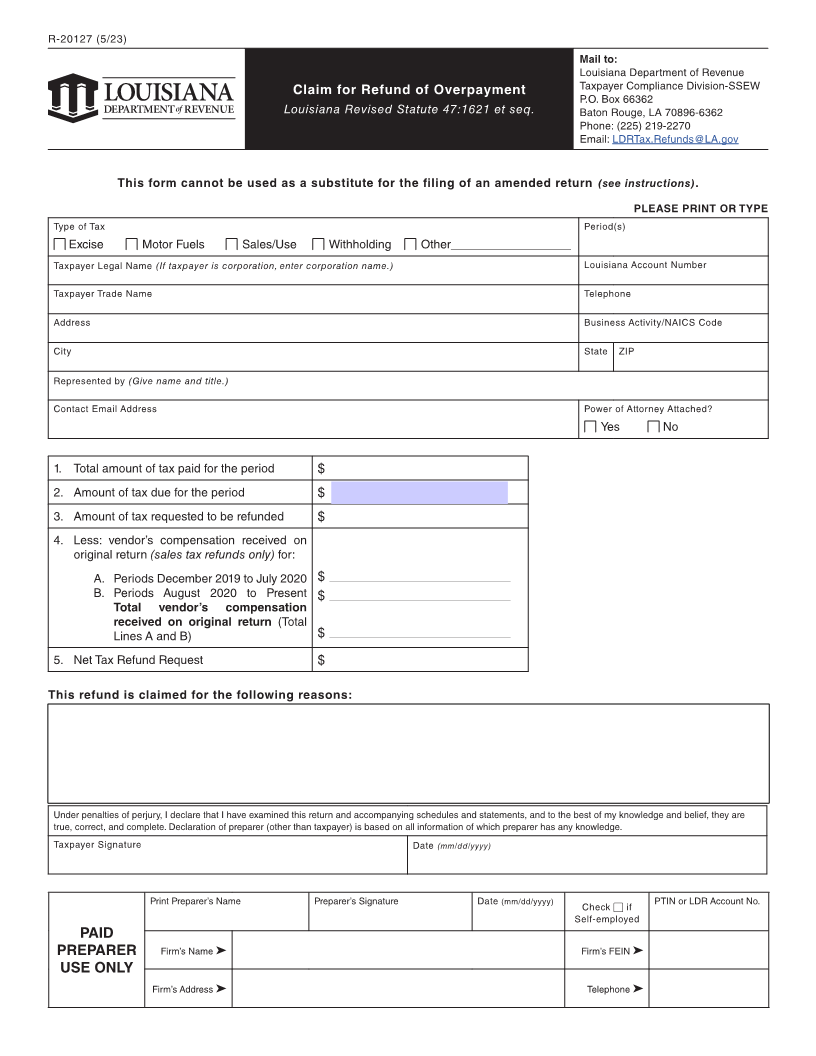

INSTRUCTIONS

Claim for Refund of Overpayment (R-20127)

General Information

The Louisiana Department of Revenue has limited authority to issue refunds of overpayments. The Department can only refund an

overpayment if there is express statutory authority to issue the refund.

Louisiana Revised Statute 47:1520.2 requires the electronic filing of all schedules and invoices for all sales tax refund claims of $25,000

or more and for all refund claims made by a tax preparer on behalf of the taxpayer, regardless of the amount of the refund requested.

See Revenue Information Bulletin No. 16-040. Send an email to LDRTax.Refunds@LA.gov to request that a secure portal be opened for

sending documentation electronically.

If your refund request is a natural disaster refund request, you must use Form R-1362, Natural Disaster Claim for Refund of Sales Taxes

Paid. If your refund request is a pollution control device refund, you must use Form R-1349, Pollution Control Equipment Sales/Use Tax

Exemption/Refund Application. These forms are available on our website or by contacting the Department.

This form should be used to file refund claims for Excise tax, Motor Fuels tax, Sales/Use tax, Withholding tax and certain other taxes

designated by the Taxpayer Compliance Division. Do not use this form as a substitute for the filing of an amended return or to correct an error

on a previously filed tax return. Claims for refunds of Severance Tax must be filed electronically in the form of an amended return.

Amended sales/use tax returns should be filed for the following reasons:

1. Gross sales of tangible personal property reported on Line 1 are greater or less than reported on the original return.

2. Cost of tangible personal property reported on Line 2 is greater or less than reported on the original return.

3. Leases, rentals, or services reported on Line 3 are greater or less than reported on the original return.

4. Total allowable deductions as reported on Line 5 (Schedule A) are greater or less than reported on the original return.

5. Excess tax collected on Line 8 is greater or less than reported on the original return.

6. If for any reason, the amounts reported on an original sales and use tax return change, an amended return must be filed.

Specific Instructions

1. Check the appropriate tax box.

2. Fill in the tax periods included in the refund claim.

3. Taxpayer’s Legal name. If the taxpayer is a corporation, enter the legal corporation name.

4. Louisiana revenue account number – self-explanatory.

5. Taxpayer’s trade name.

6. Business street address – self-explanatory.

7. City, State, Zip Code – self-explanatory.

8. Telephone – telephone contact number of claimant and/or claimant’s representative.

9. Business Activity/NAICS Code - Enter the business activity/NAICS (North American Industry Classifications System) code found

on the taxpayer’s federal income tax return.

10. Name of claimant or business hired to submit claim information. Please submit a power of attorney form with the refund claim.

11. Contact email address - self-explanatory.

12. Box 1 – total tax paid on the original return for the periods listed on the claim form.

13. Box 2 – total tax actually due for the periods listed on the claim form.

14. Box 3 – requested refund amount.

15. Box 4 – subtract vendor’s compensation received on original return. This box applies only if the original sales/use tax return was

filed and paid timely. Due to different rates, separate vendor’s compensation for (A) periods December 2019 to July 2020, and (B)

periods starting August 2020 going forward.

16. Box 5 - Net Tax Refund Request – self-explanatory.

17. State reasons for refund request.

18. Please sign and date your refund request.

If your Claim for Refund was prepared by a paid preparer, that person must also sign in the appropriate space, complete the information in

the “PAID PREPARER USE ONLY” box and enter his or her identification number in the space provided under the box. If the paid preparer

has a PTIN, that must be entered in the space provided under the box, otherwise enter the FEIN or LDR account number. If the paid

preparer represents a firm, the firm’s FEIN must be entered in the “PAID PREPARER USE ONLY” box. Failure of the paid preparer to sign

or provide an identification number will result in assessment on the preparer of the unidentified preparer penalty. The penalty of $50 is for

each occurrence of failing to sign or providing identification number.

|