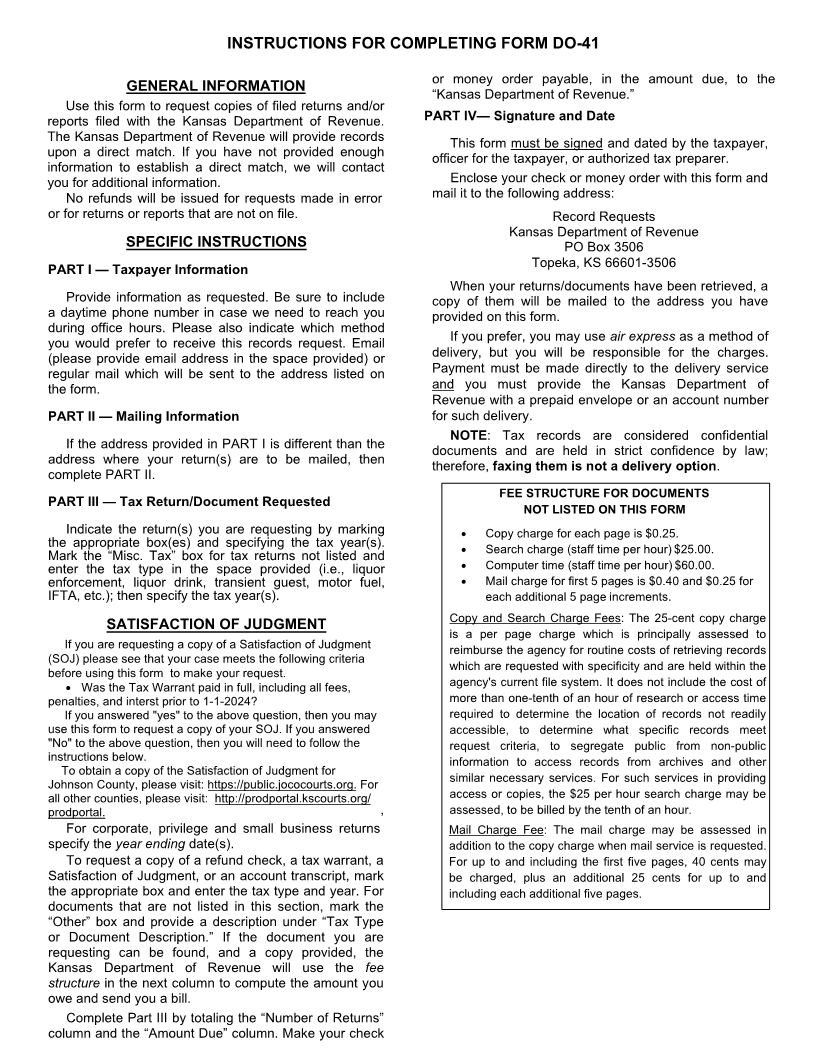

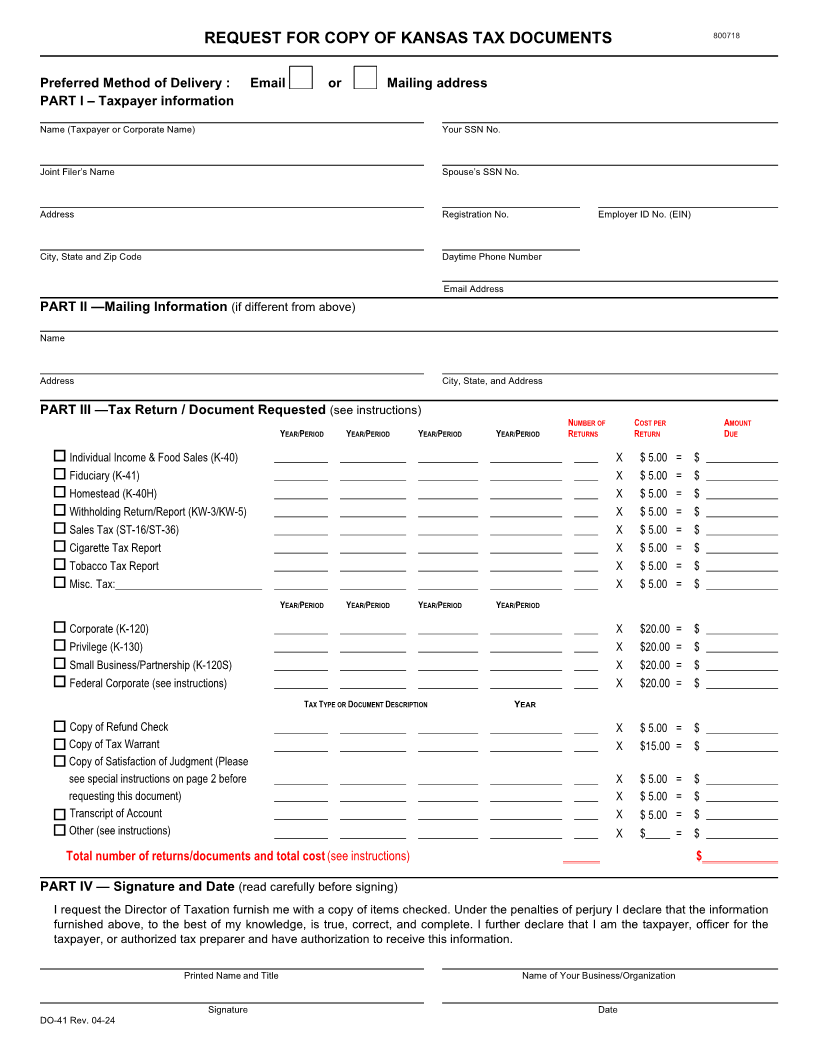

Enlarge image

800718

REQUEST FOR COPY OF KANSAS TAX DOCUMENTS

Preferred Method of Delivery : Email or Mailing address

PART I – Taxpayer information

Name (Taxpayer or Corporate Name) Your SSN No.

Joint Filer’s Name Spouse’s SSN No.

Address Registration No. Employer ID No. (EIN)

City, State and Zip Code Daytime Phone Number

Email Address

PART II —Mailing Information (if different from above)

Name

Address City, State, and Address

PART III —Tax Return / Document Requested (see instructions)

NUMBER OF COST PER AMOUNT

YEAR/PERIOD YEAR/PERIOD YEAR/PERIOD YEAR/PERIOD RETURNS RETURN DUE

Individual Income & Food Sales (K-40) X $ 5.00 = $

Fiduciary (K-41) X $ 5.00 = $

Homestead (K-40H) X $ 5.00 = $

Withholding Return/Report (KW-3/KW-5) X $ 5.00 = $

Sales Tax (ST-16/ST-36) X $ 5.00 = $

Cigarette Tax Report X $ 5.00 = $

Tobacco Tax Report X $ 5.00 = $

Misc. Tax: X $ 5.00 = $

YEAR/PERIOD YEAR/PERIOD YEAR/PERIOD YEAR/PERIOD

Corporate (K-120) X $20.00 = $

Privilege (K-130) X $20.00 = $

Small Business/Partnership (K-120S) X $20.00 = $

Federal Corporate (see instructions) X $20.00 = $

TAX TYPE OR OCUMENT D ESCRIPTIOND YEAR

Copy of Refund Check X $ 5.00 = $

Copy of Tax Warrant X $15.00 = $

Copy of Satisfaction of Judgment ( Please

see special instructions on page 2 before X $ 5.00 = $

requesting this document ) X $ 5.00 = $

Transcript of Account X $ 5.00 = $

Other (see instructions) X $ = $

Total number of returns/documents and total cost (see instructions) $

PART IV — Signature and Date (read carefully before signing)

I request the Director of Taxation furnish me with a copy of items checked. Under the penalties of perjury I declare that the information

furnished above, to the best of my knowledge, is true, correct, and complete. I further declare that I am the taxpayer, officer for the

taxpayer, or authorized tax preparer and have authorization to receive this information.

Printed Name and Title Name of Your Business/Organization

Signature Date

DO-41 Rev.04-2 4