Enlarge image

KANSAS Transient

Guest Tax Return

Form TG-1 (Rev. 12-21)

Line 5 Credit Memo. If you received a credit memo from the

Need to make a quick payment? Kansas Department of Revenue, enter the amount

It’s simple — pay your transient guest tax electronically. from that memo on line 5. If filing an amended return,

Visit ksrevenue.gov enter total amount previously paid for this filing period.

and log in to the Kansas Customer Service Center. Line 6 Amount of Tax Due. Subtract line 5 from line 4 and

enter result.

GENERAL INFORMATION Line 7 Penalty. If filing a late return, enter the amount of

penalty due. See our website for current penalty rates.

• The due date is the 25th day of the month following the

ending date of this return. Line 8 Interest. If filing a late return, enter the amount of

• You must file a return even if there were no taxable sales. interest due. See our website for current interest rates.

• Keep a copy of your return for your records. Line 9 Total Due. Add lines 6, 7, and 8 and enter result.

• Write your tax account number on your check or money

order and make payable to “Kansas Transient Guest Tax”. PART II

Mail your return and payment to: KDOR-Miscellaneous Tax,

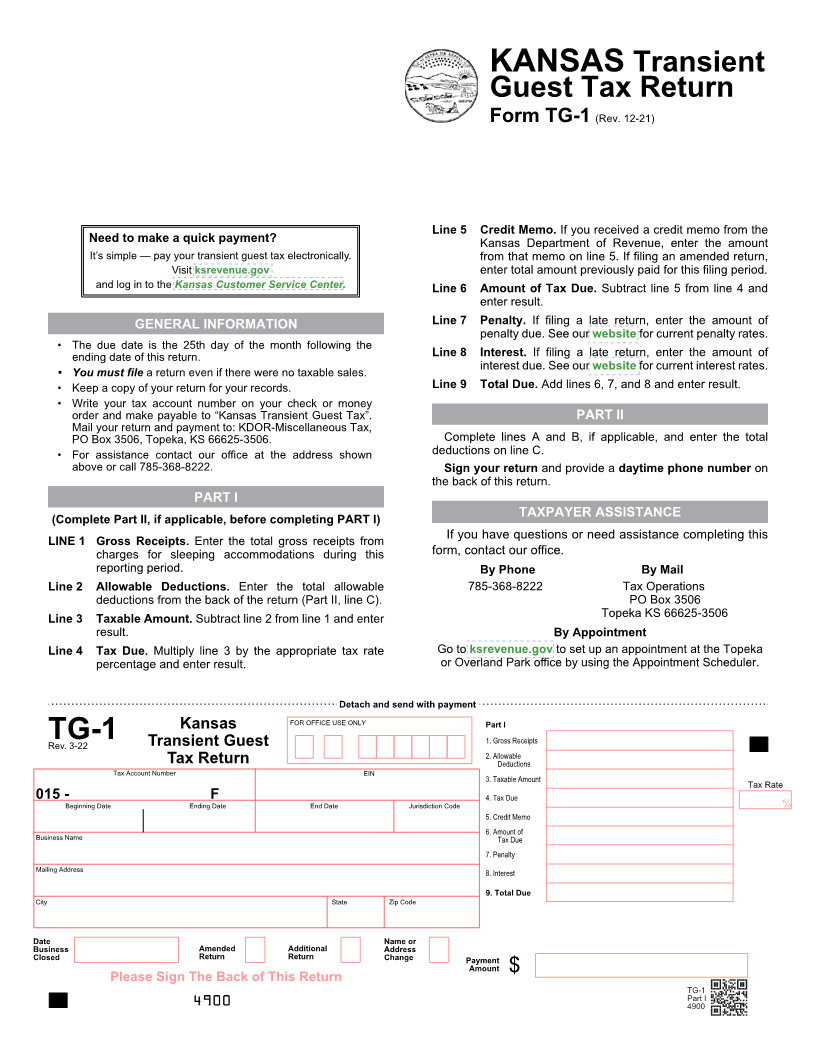

PO Box 3506, Topeka, KS 66625-3506. Complete lines A and B, if applicable, and enter the total

• For assistance contact our office at the address shown deductions on line C.

above or call 785-368-8222. Sign your return and provide a daytime phone number on

the back of this return.

PART I

(Complete Part II, if applicable, before completing PART I) TAXPAYER ASSISTANCE

LINE 1 Gross Receipts. Enter the total gross receipts from If you have questions or need assistance completing this

charges for sleeping accommodations during this form, contact our office.

reporting period. By Phone By Mail

Line 2 Allowable Deductions. Enter the total allowable 785-368-8222 Tax Operations

deductions from the back of the return (Part II, line C). PO Box 3506

Line 3 Taxable Amount. Subtract line 2 from line 1 and enter Topeka KS 66625-3506

result. By Appointment

Line 4 Tax Due. Multiply line 3 by the appropriate tax rate Go to ksrevenue.gov to set up an appointment at the Topeka

percentage and enter result. or Overland Park office by using the Appointment Scheduler.

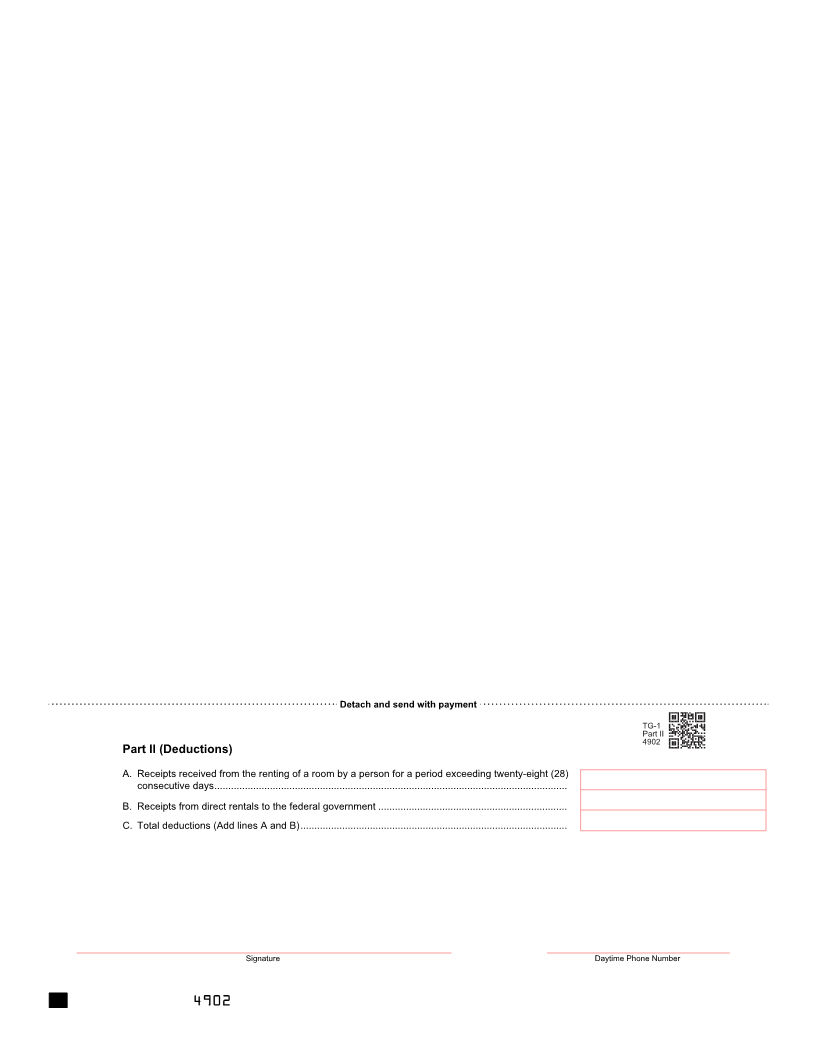

Detach and send with payment

FOR OFFICE USE ONLY Part l

Kansas

Rev. 3-22TG-1 Transient Guest 1. Gross Receipts

2. Allowable

Tax Return Deductions

Tax Account Number EIN 3. Taxable Amount Tax Rate

4. Tax Due

015 -Beginning Date EndingFDate End Date Jurisdiction Code %

5. Credit Memo

Business Name 6. Amount of

Tax Due

7. Penalty

Mailing Address 8. Interest

9. Total Due

City State Zip Code

Date Name or

Business Amended Additional Address

Closed Return Return Change Payment

Amount $

Please Sign The Back of This Return

TG-1

4900 Part I

4900