Enlarge image

KANSAS DEPARTMENT OF REVENUE

2024 W-2 SPECIFICATIONS FOR ELECTRONIC FILING

EFW2 FORMAT

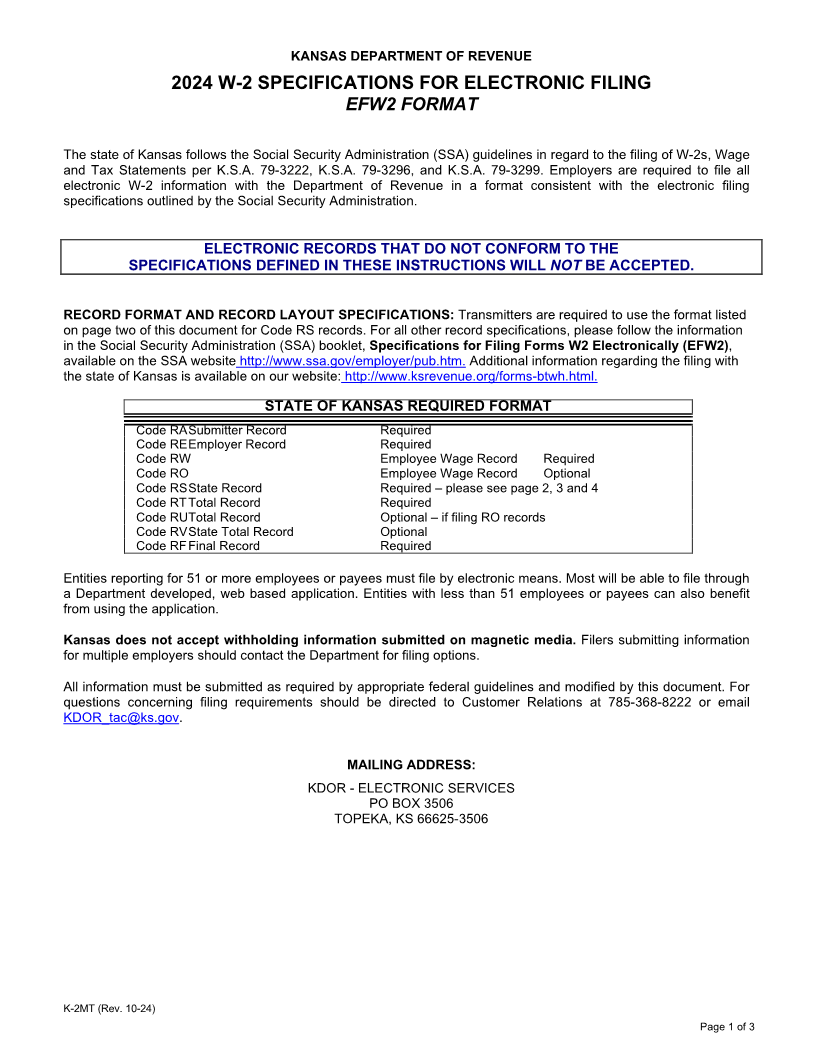

The state of Kansas follows the Social Security Administration (SSA) guidelines in regard to the filing of W-2s, Wage

and Tax Statements per K.S.A. 79-3222, K.S.A. 79-3296, and K.S.A. 79-3299. Employers are required to file all

electronic W-2 information with the Department of Revenue in a format consistent with the electronic filing

specifications outlined by the Social Security Administration.

ELECTRONIC RECORDS THAT DO NOT CONFORM TO THE

SPECIFICATIONS DEFINED IN THESE INSTRUCTIONS WILL NOT BE ACCEPTED.

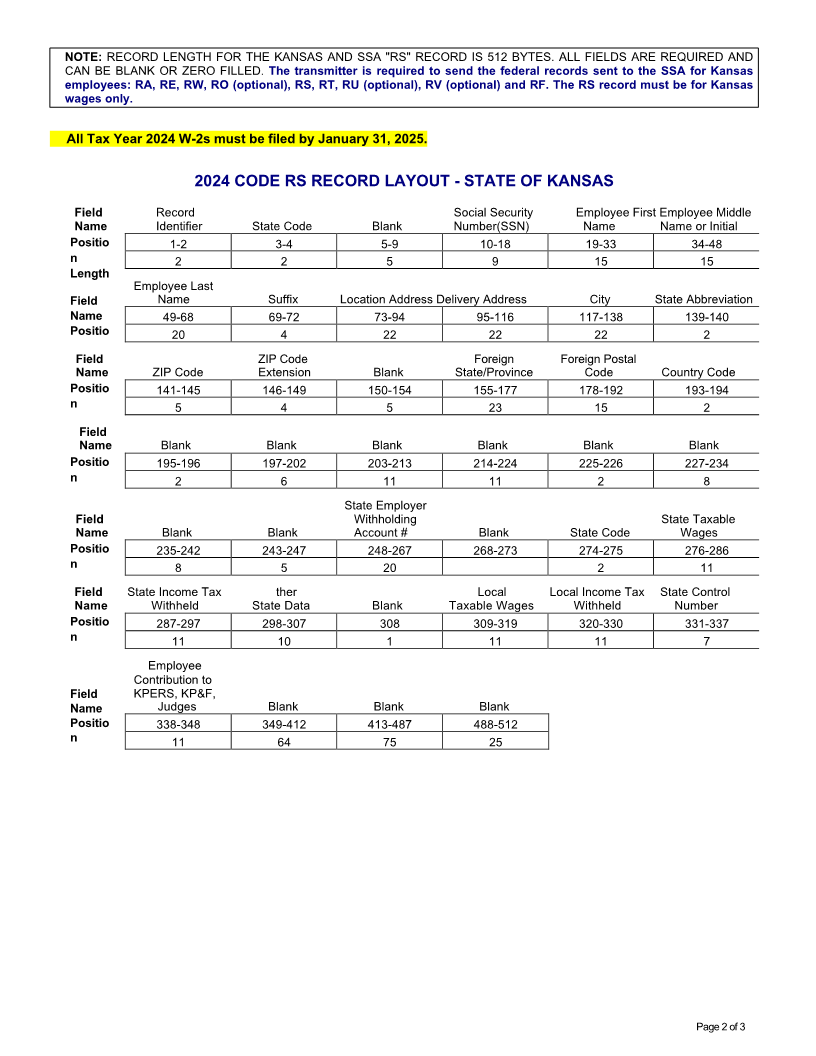

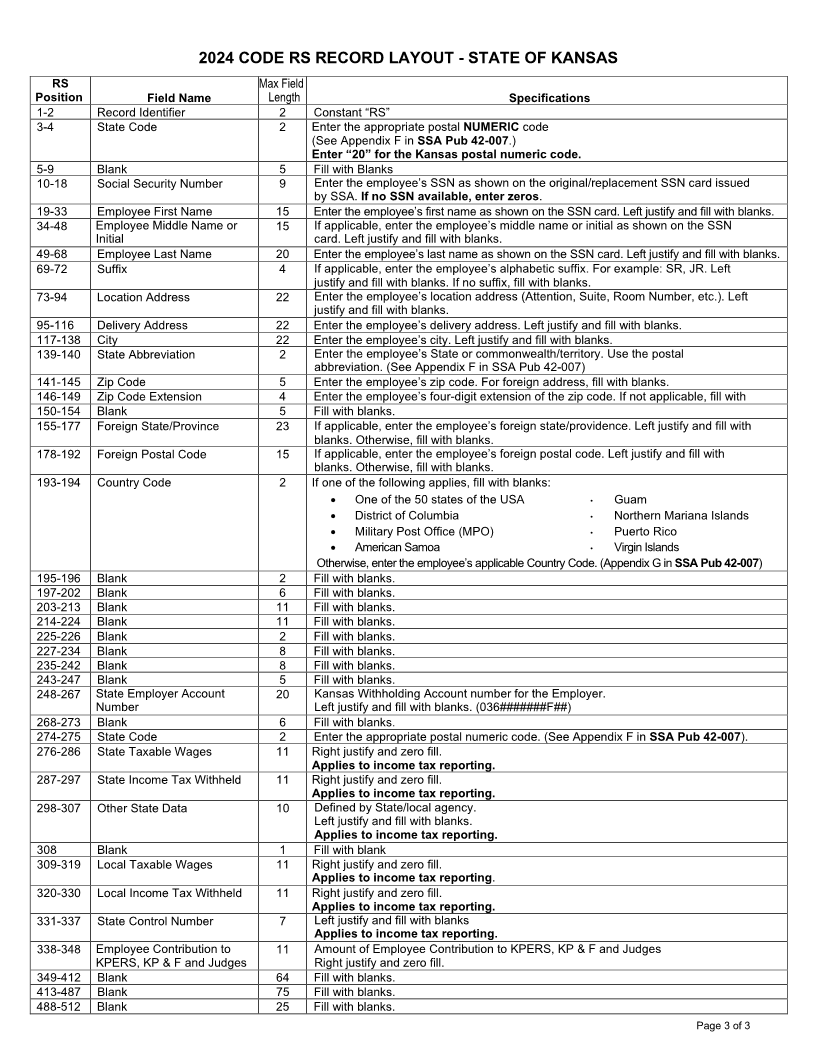

RECORD FORMAT AND RECORD LAYOUT SPECIFICATIONS: Transmitters are required to use the format listed

on page two of this document for Code RS records. For all other record specifications, please follow the information

in the Social Security Administration (SSA) booklet, Specifications for Filing Forms W2 Electronically (EFW2),

available on the SSA website http://www.ssa.gov/employer/pub.htm. Additional information regarding the filing with

the state of Kansas is available on our website: http://www.ksrevenue.org/forms-btwh.html.

STATE OF KANSAS REQUIRED FORMAT

Code RA Submitter Record Required

Code RE Employer Record Required

Code RW Employee Wage Record Required

Code RO Employee Wage Record Optional

Code RS State Record Required – please see page 2, 3 and 4

Code RT Total Record Required

Code RUTotal Record Optional – if filing RO records

Code RV State Total Record Optional

Code RF Final Record Required

Entities reporting for 51 or more employees or payees must file by electronic means. Most will be able to file through

a Department developed, web based application. Entities with less than 51 employees or payees can also benefit

from using the application.

Kansas does not accept withholding information submitted on magnetic media. Filers submitting information

for multiple employers should contact the Department for filing options.

All information must be submitted as required by appropriate federal guidelines and modified by this document. For

questions concerning filing requirements should be directed to Customer Relations at 785-368-8222 or email

KDOR_tac@ks.gov.

MAILING ADDRESS:

KDOR - ELECTRONIC SERVICES

PO BOX 3506

TOPEKA, KS 66625-3506

K-2MT (Rev. 10-24)

Page 1 of 3