Enlarge image

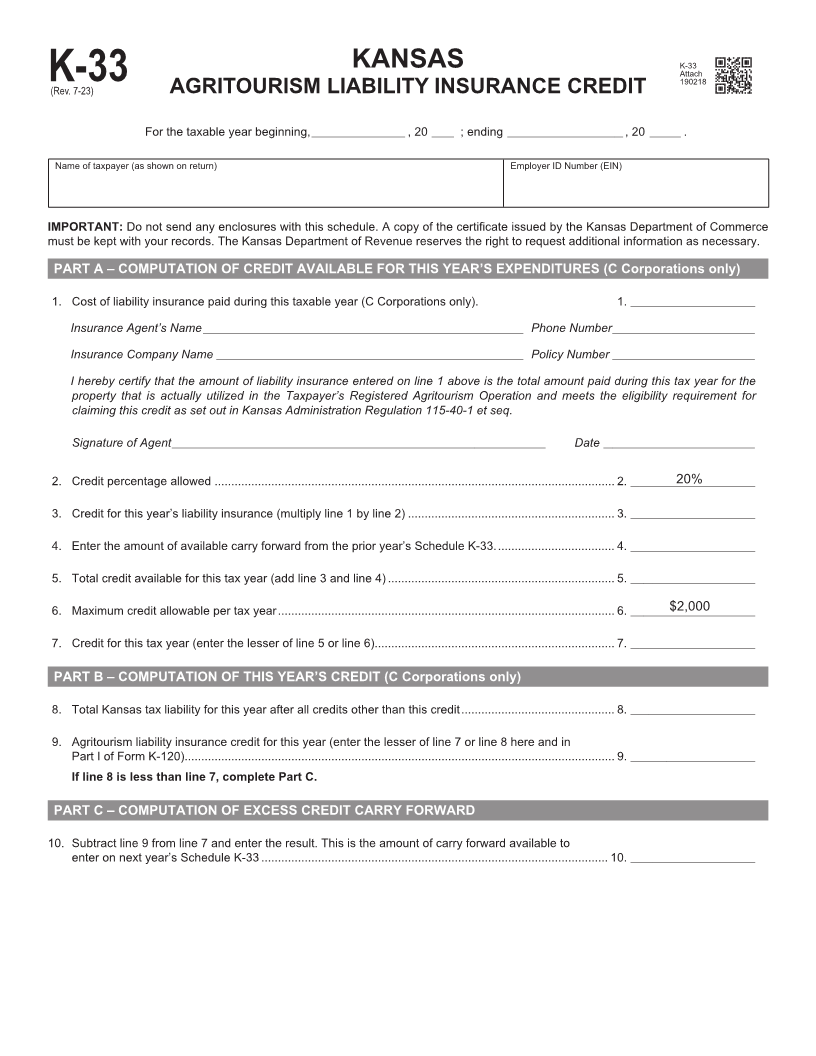

KANSAS K-33

Attach

190218

K-33(Rev. 7-23) AGRITOURISM LIABILITY INSURANCE CREDIT

For the taxable year beginning, _____________________ , 20 _____ ; ending __________________________ , 20 _______ .

Name of taxpayer (as shown on return) Employer ID Number (EIN)

IMPORTANT: Do not send any enclosures with this schedule. A copy of the certificate issued by the Kansas Department of Commerce

must be kept with your records. The Kansas Department of Revenue reserves the right to request additional information as necessary.

PART A – COMPUTATION OF CREDIT AVAILABLE FOR THIS YEAR’S EXPENDITURES (C Corporations only)

1. Cost of liability insurance paid during this taxable year (C Corporations only). 1. ____________________________

Insurance Agent’s Name ________________________________________________________________________ Phone Number ________________________________

Insurance Company Name _____________________________________________________________________ Policy Number ________________________________

I hereby certify that the amount of liability insurance entered on line 1 above is the total amount paid during this tax year for the

property that is actually utilized in the Taxpayer’s Registered Agritourism Operation and meets the eligibility requirement for

claiming this credit as set out in Kansas Administration Regulation 115-40-1 et seq.

Signature of Agent ____________________________________________________________________________________ Date __________________________________

2. Credit percentage allowed ........................................................................................................................ 2. ____________________________20%

3. Credit for this year’s liability insurance (multiply line 1 by line 2) .............................................................. 3. ____________________________

4. Enter the amount of available carry forward from the prior year’s Schedule K-33. ................................... 4. ____________________________

5. Total credit available for this tax year (add line 3 and line 4) .................................................................... .5 ____________________________

6. Maximum credit allowable per tax year ..................................................................................................... 6. ____________________________$2,000

7. Credit for this tax year (enter the lesser of line 5 or line 6)........................................................................ 7. ____________________________

PART B – COMPUTATION OF THIS YEAR’S CREDIT (C Corporations only)

8. Total Kansas tax liability for this year after all credits other than this credit .............................................. 8. ____________________________

9. Agritourism liability insurance credit for this year (enter the lesser of line 7 or line 8 here and in

Part I of Form K-120)................................................................................................................................. 9. ____________________________

If line 8 is less than line 7, complete Part C.

PART C – COMPUTATION OF EXCESS CREDIT CARRY FORWARD

10. Subtract line 9 from line 7 and enter the result. This is the amount of carry forward available to

enter on next year’s Schedule K-33 ........................................................................................................ 10. ____________________________