- 18 -

Enlarge image

|

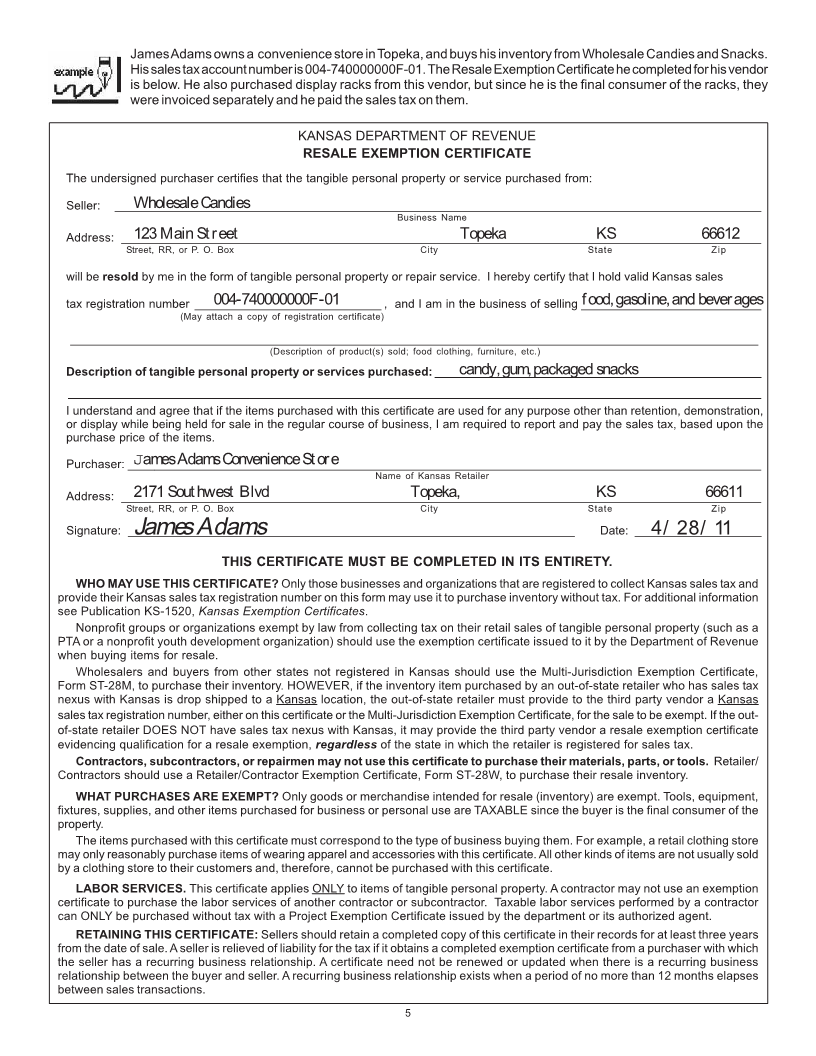

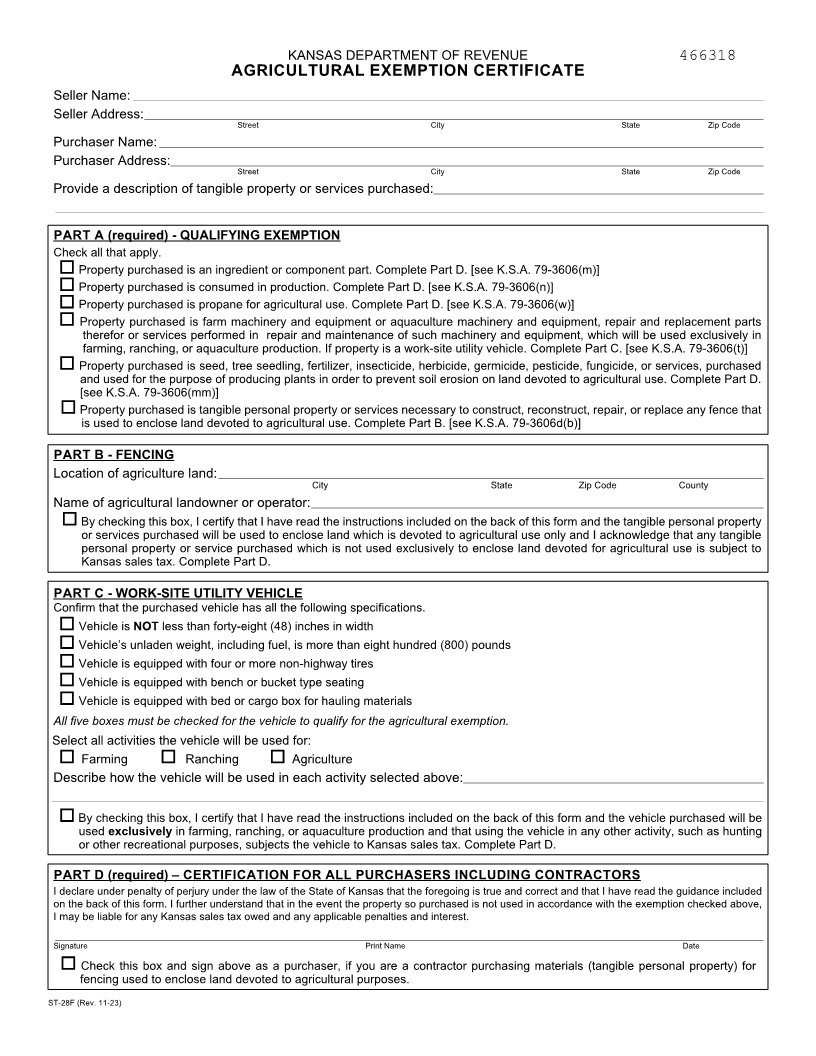

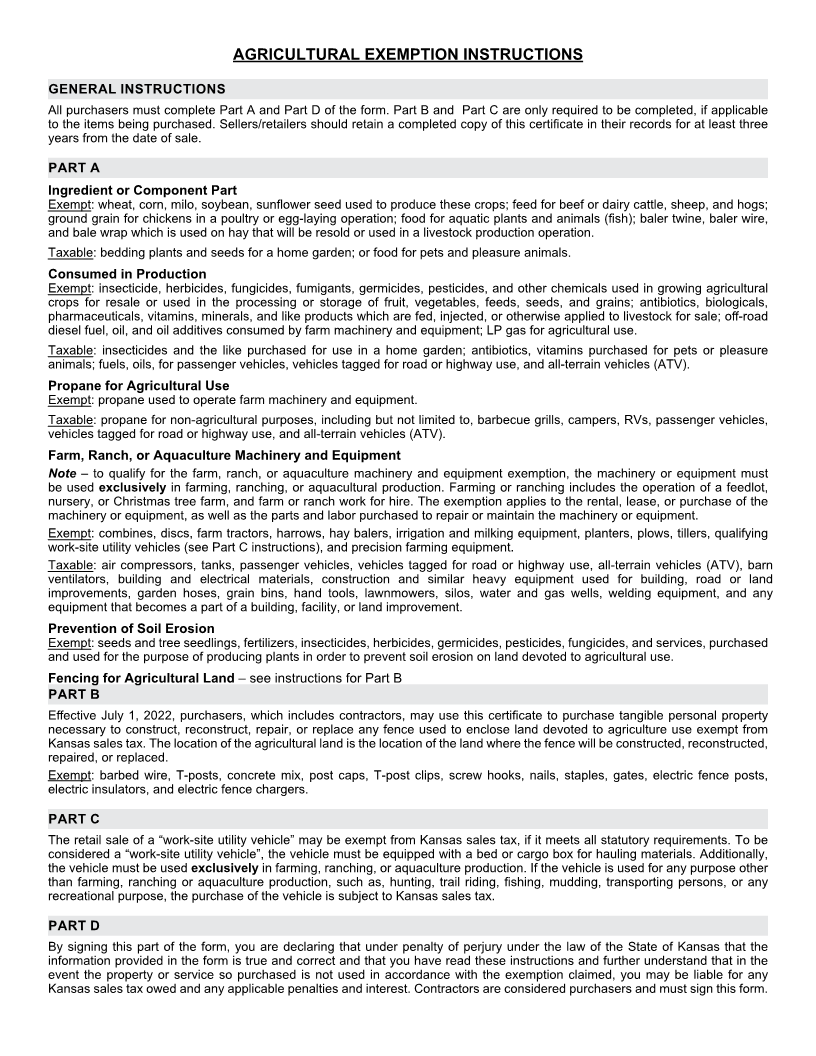

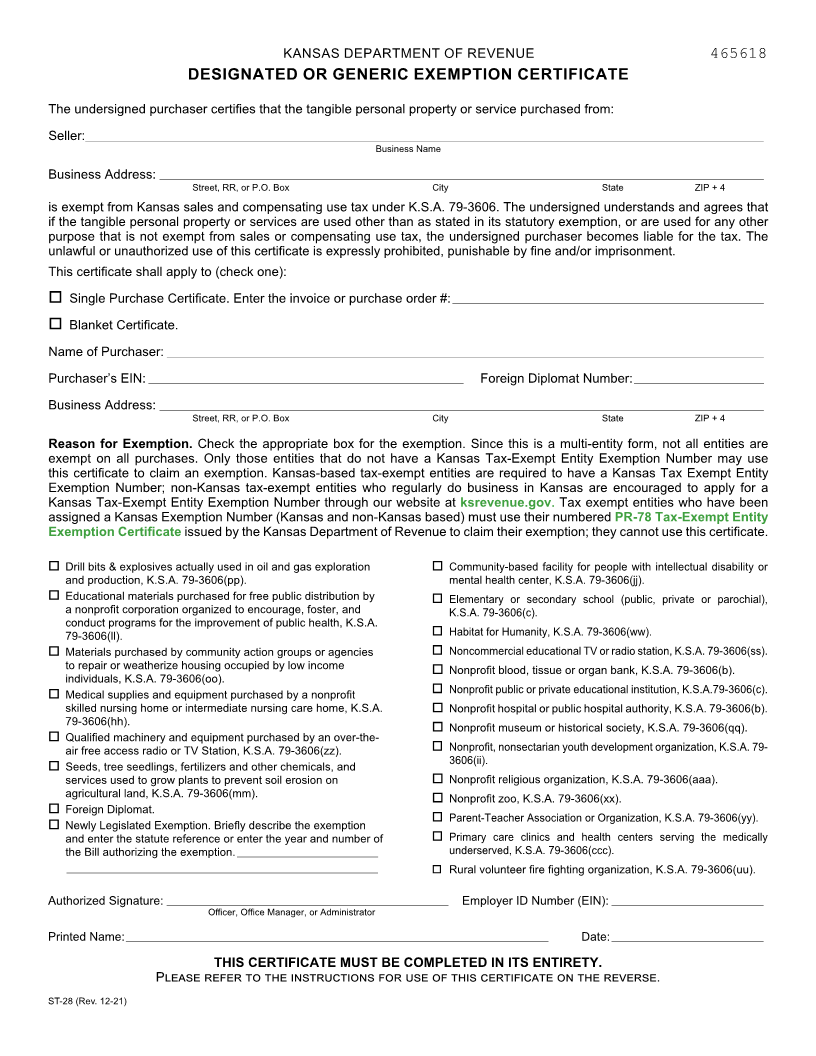

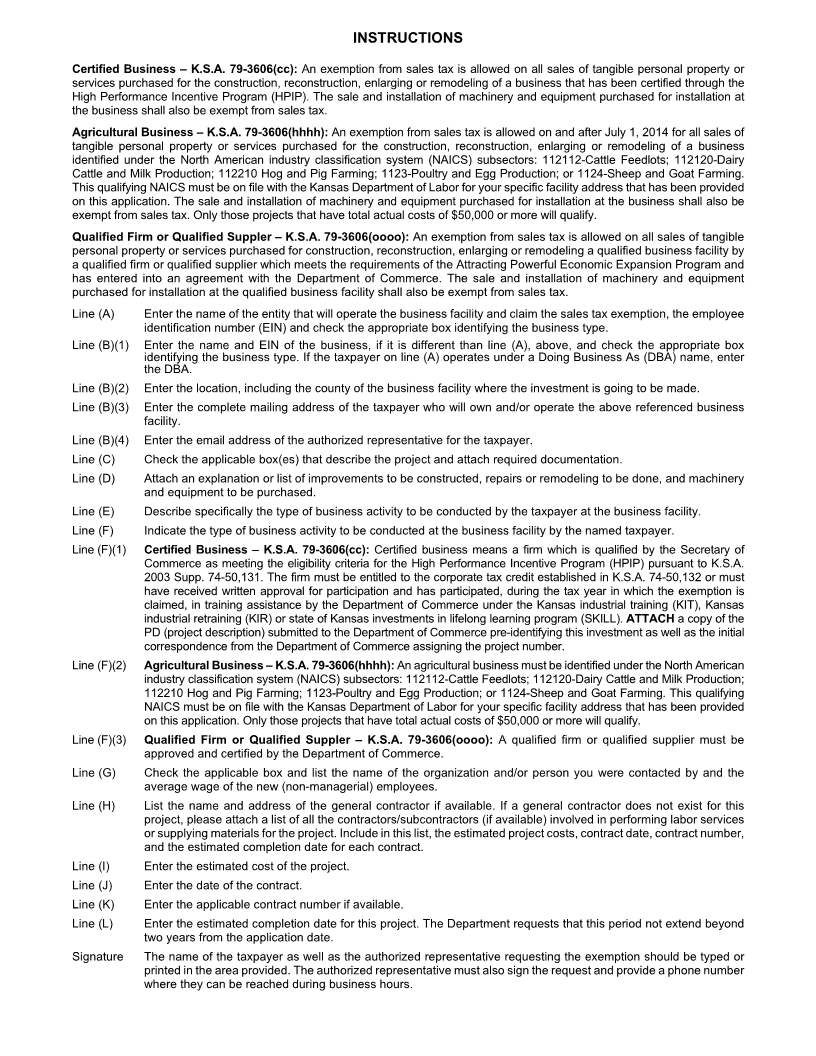

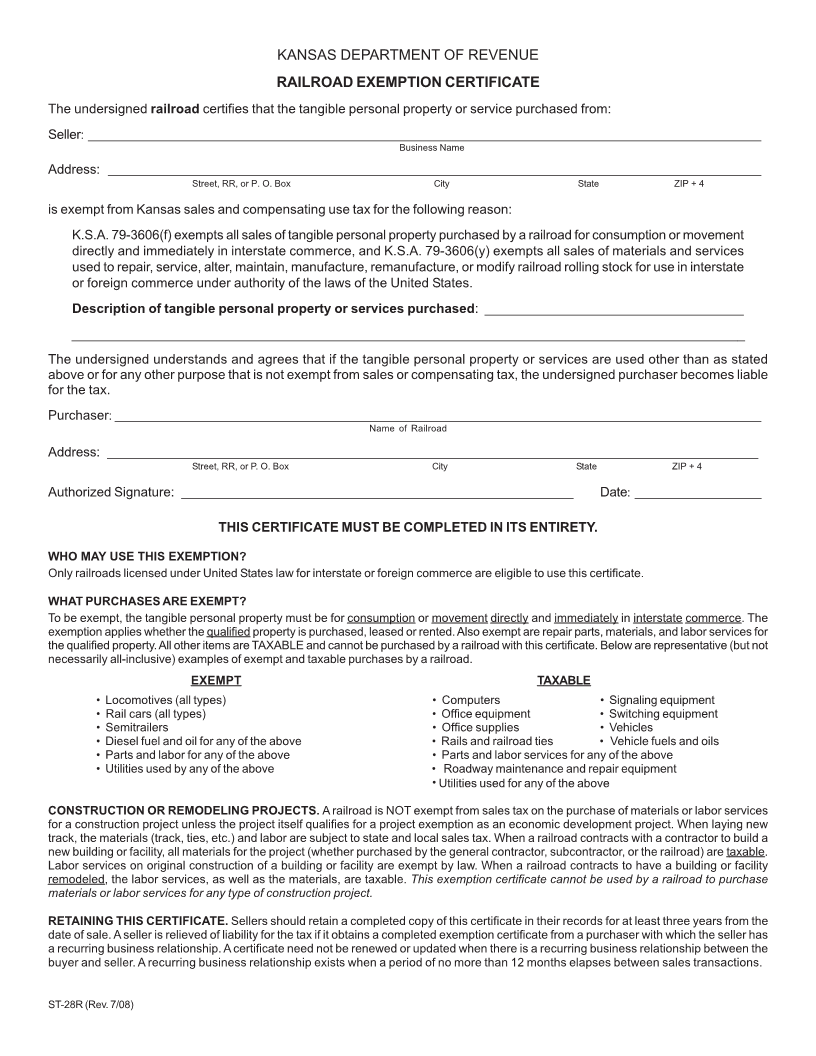

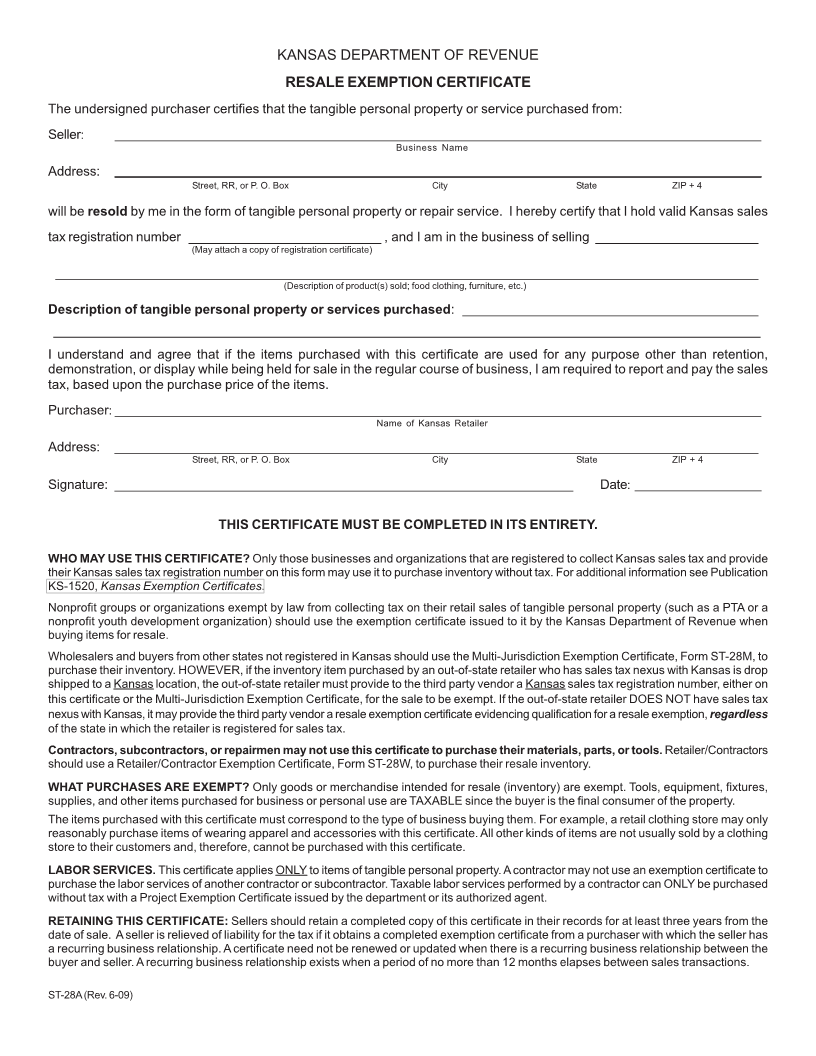

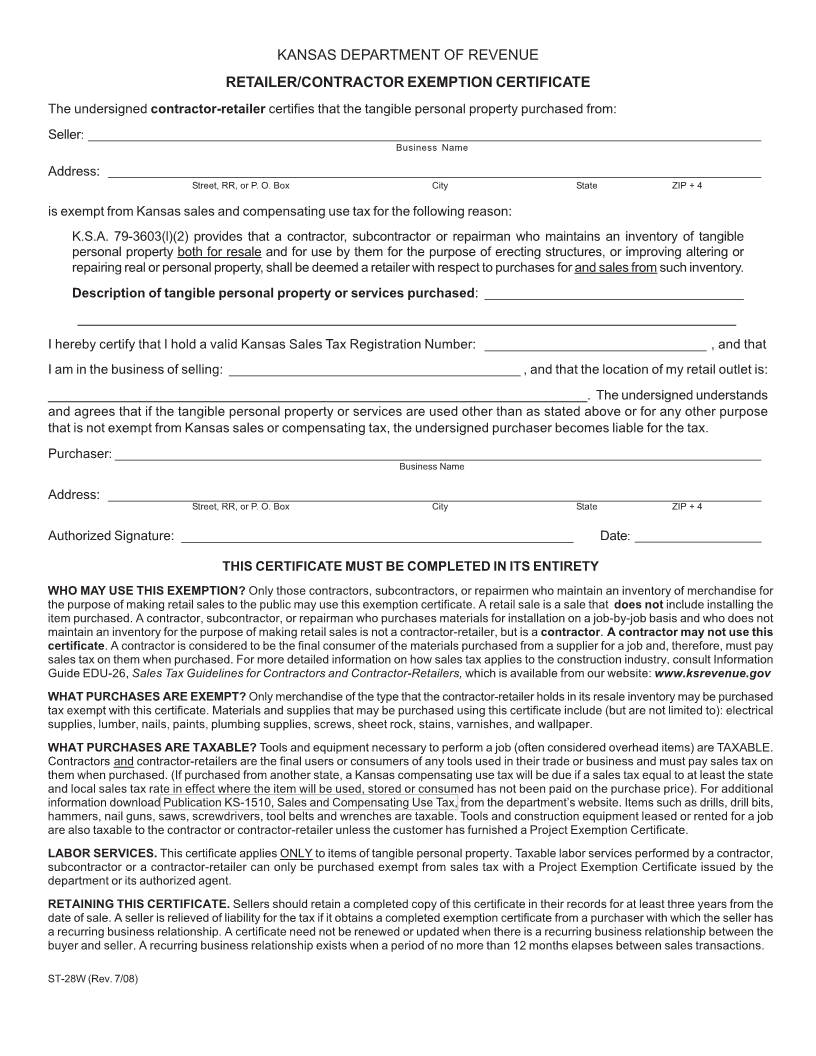

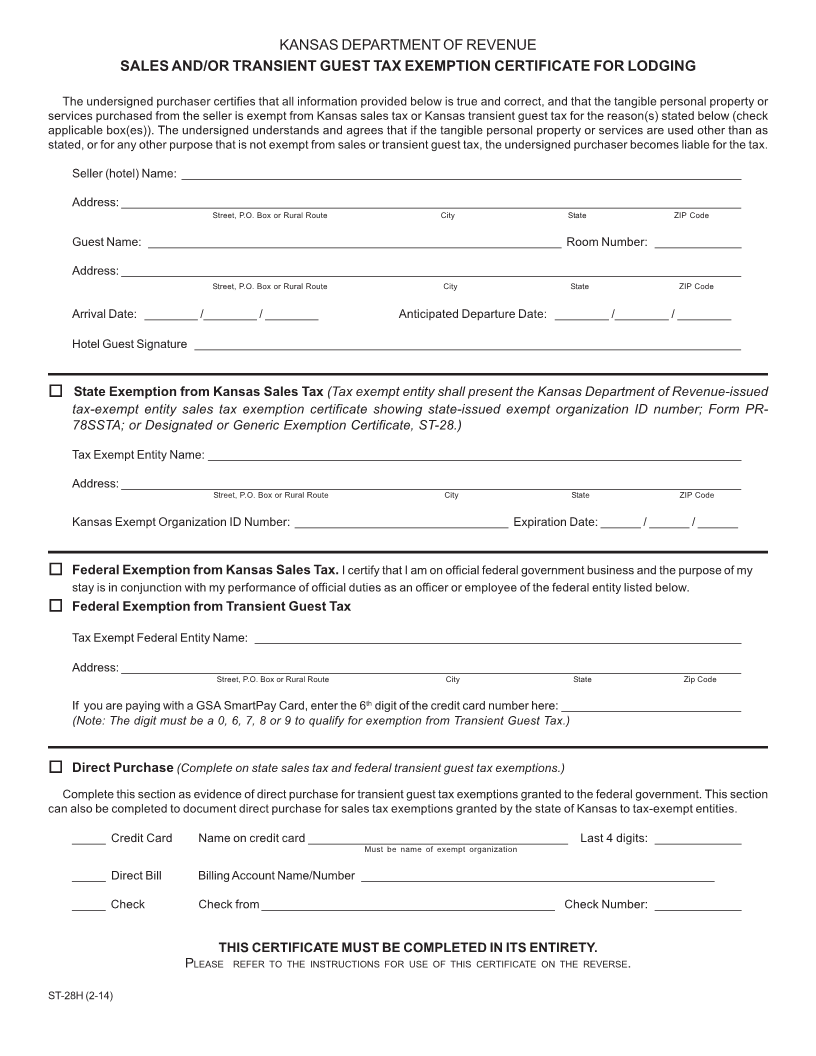

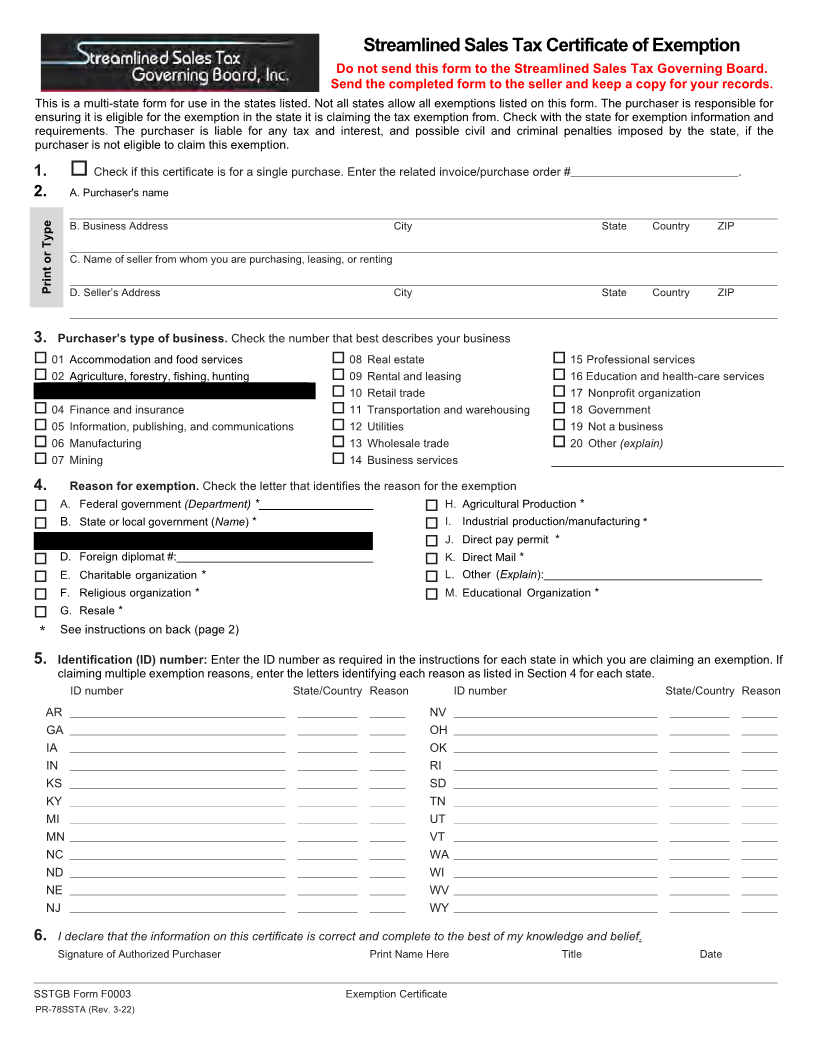

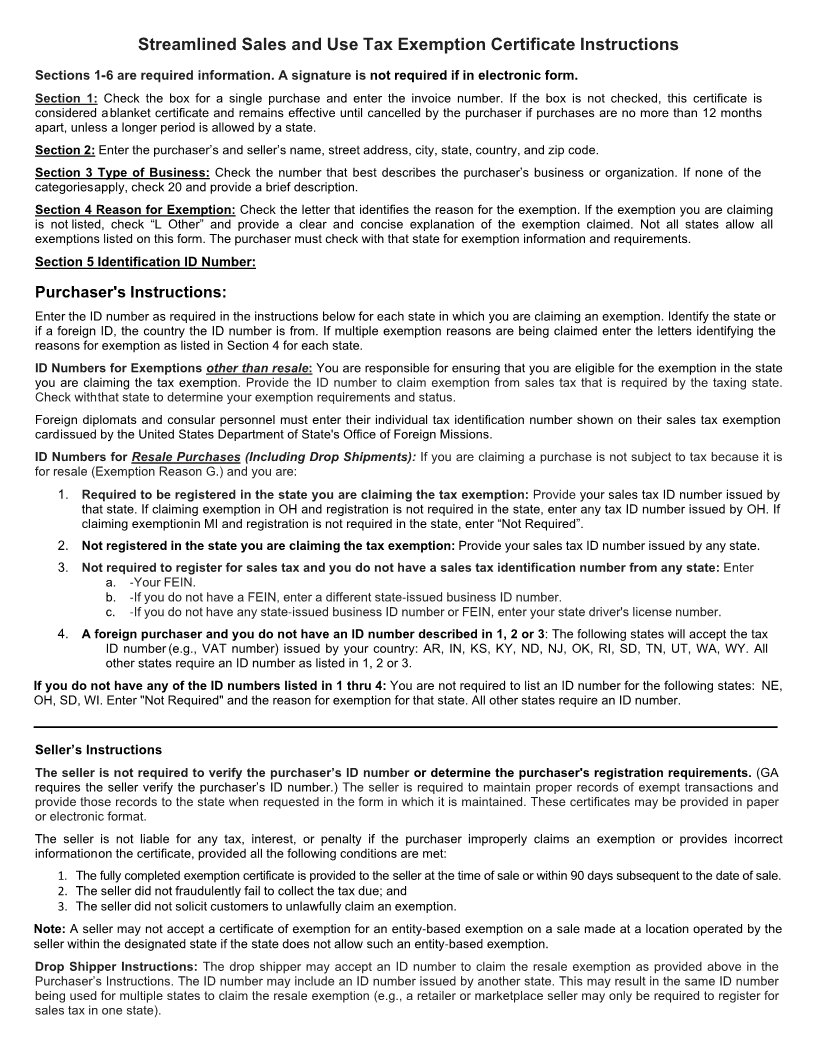

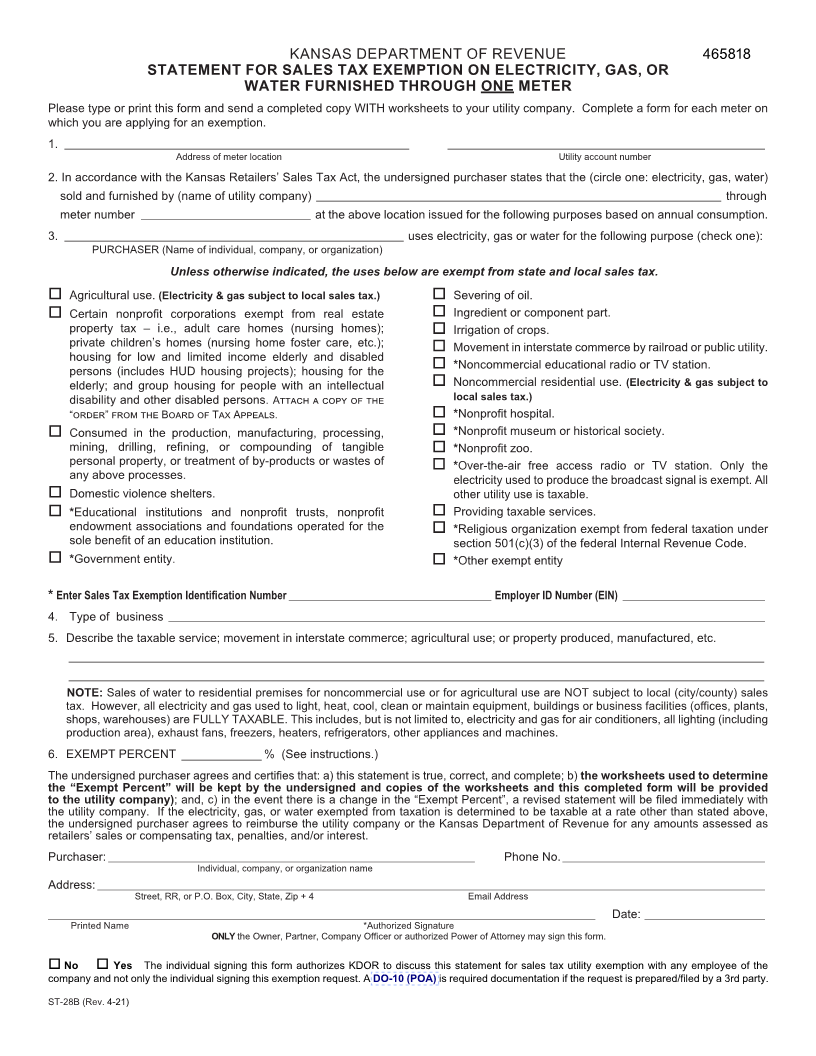

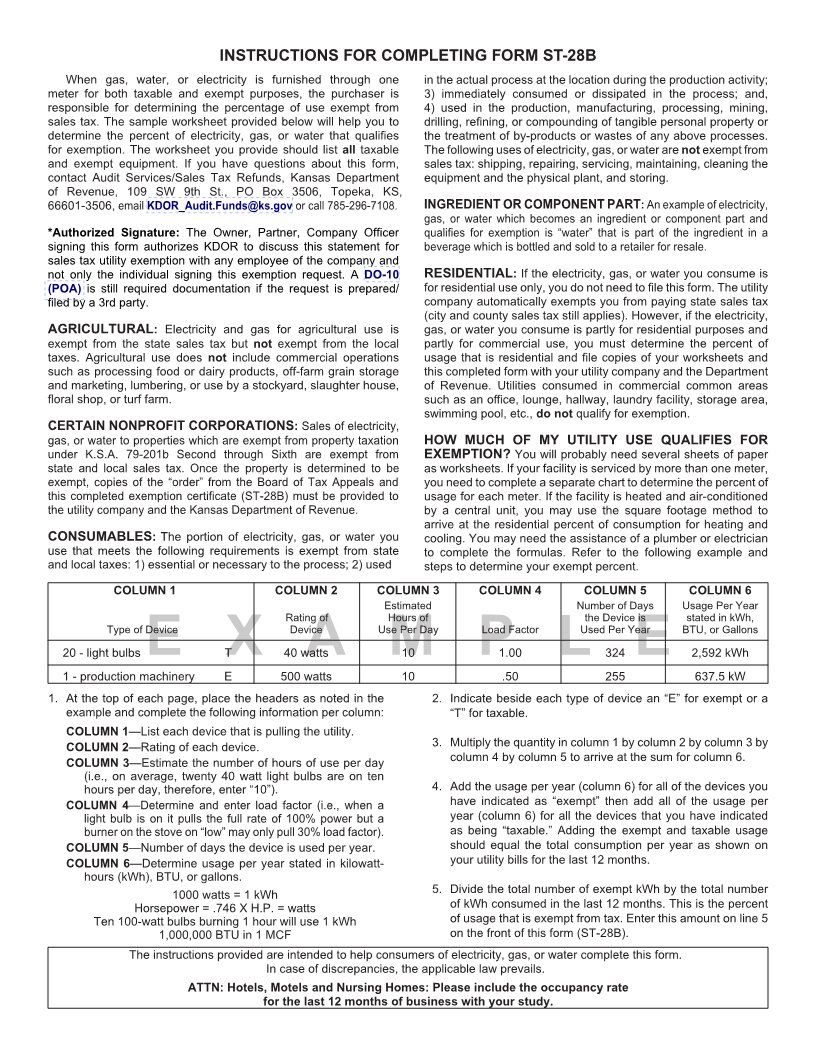

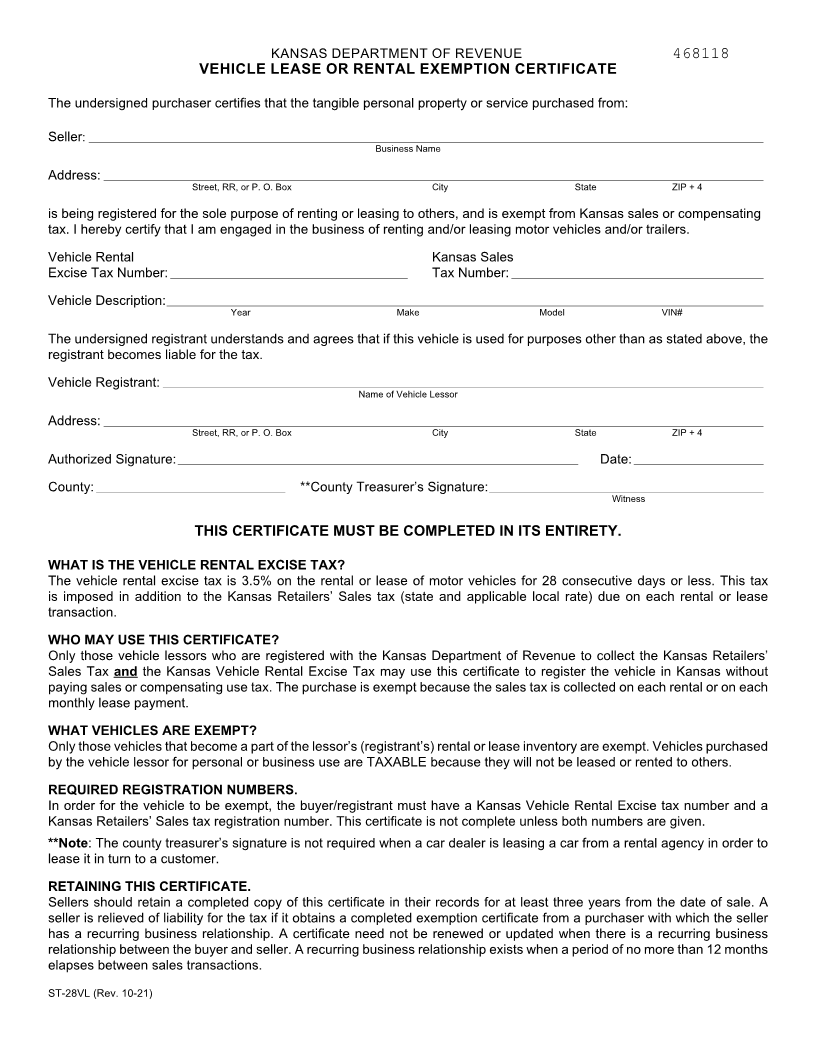

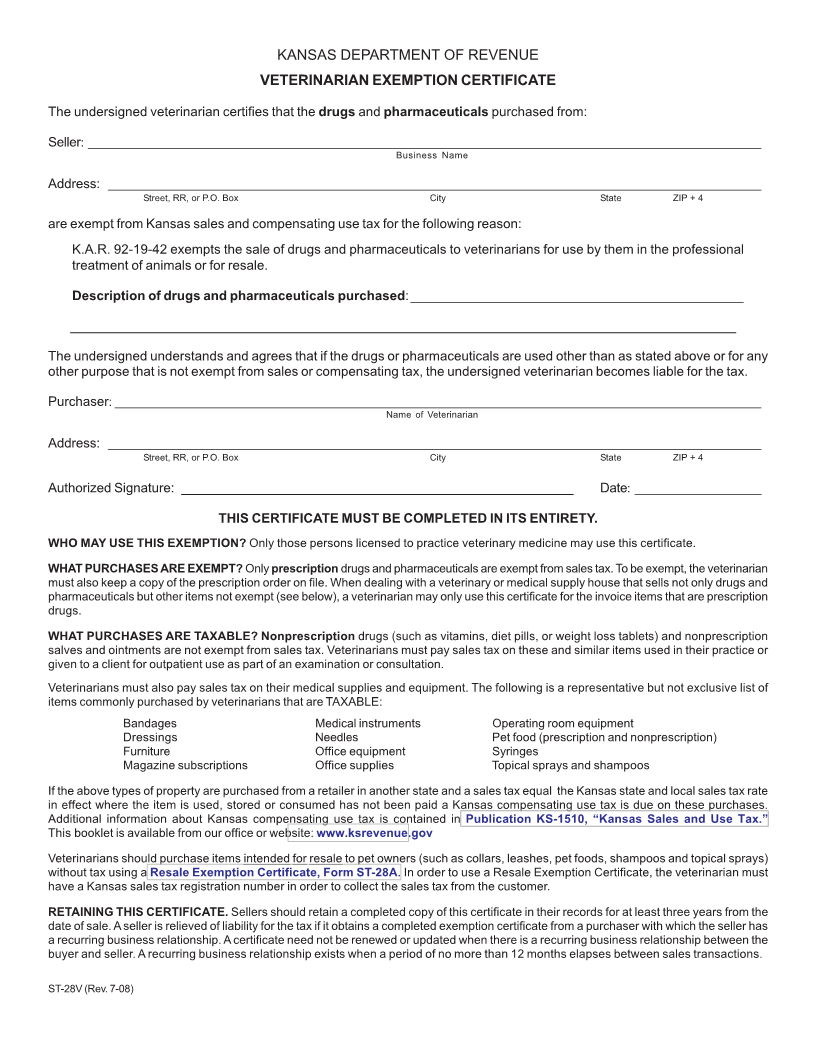

AGRICULTURAL EXEMPTION INSTRUCTIONS

GENERAL INSTRUCTIONS

All purchasers must complete Part A and Part D of the form. Part B and Part C are only required to be completed, if applicable

to the items being purchased. Sellers/retailers should retain a completed copy of this certificate in their records for at least three

years from the date of sale.

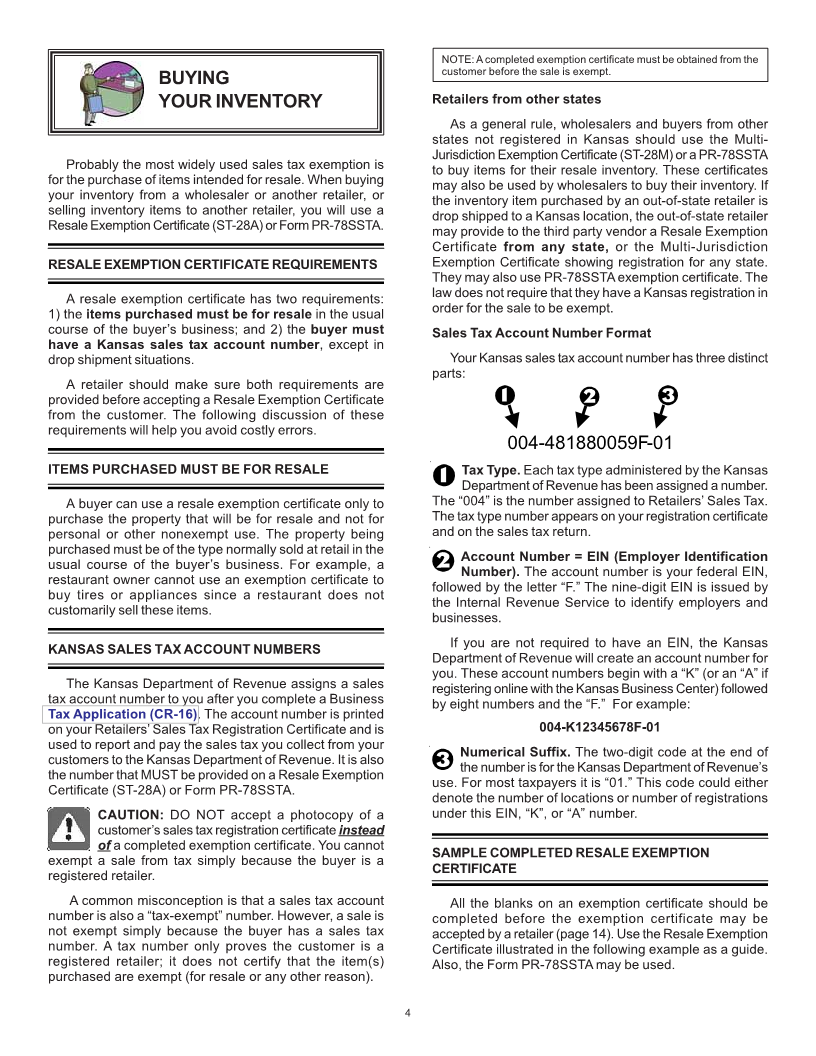

PART A

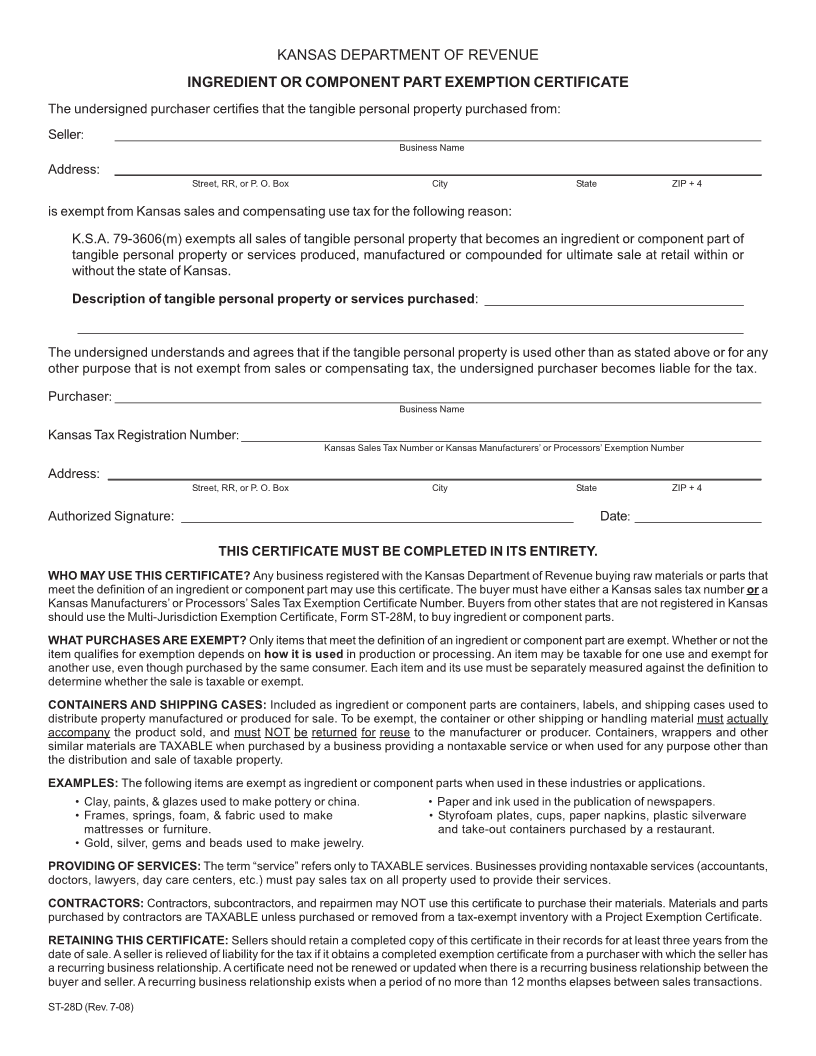

Ingredient or Component Part

Exempt: wheat, corn, milo, soybean, sunflower seed used to produce these crops; feed for beef or dairy cattle, sheep, and hogs;

ground grain for chickens in a poultry or egg-laying operation; food for aquatic plants and animals (fish); baler twine, baler wire,

and bale wrap which is used on hay that will be resold or used in a livestock production operation.

Taxable: bedding plants and seeds for a home garden; or food for pets and pleasure animals.

Consumed in Production

Exempt: insecticide, herbicides, fungicides, fumigants, germicides, pesticides, and other chemicals used in growing agricultural

crops for resale or used in the processing or storage of fruit, vegetables, feeds, seeds, and grains; antibiotics, biologicals,

pharmaceuticals, vitamins, minerals, and like products which are fed, injected, or otherwise applied to livestock for sale; off-road

diesel fuel, oil, and oil additives consumed by farm machinery and equipment; LP gas for agricultural use.

Taxable: insecticides and the like purchased for use in a home garden; antibiotics, vitamins purchased for pets or pleasure

animals; fuels, oils, for passenger vehicles, vehicles tagged for road or highway use, and all-terrain vehicles (ATV).

Propane for Agricultural Use

Exempt: propane used to operate farm machinery and equipment.

Taxable: propane for non-agricultural purposes, including but not limited to, barbecue grills, campers, RVs, passenger vehicles,

vehicles tagged for road or highway use, and all-terrain vehicles (ATV).

Farm, Ranch, or Aquaculture Machinery and Equipment

Note – to qualify for the farm, ranch, or aquaculture machinery and equipment exemption, the machinery or equipment must

be used exclusively in farming, ranching, or aquacultural production. Farming or ranching includes the operation of a feedlot,

nursery, or Christmas tree farm, and farm or ranch work for hire. The exemption applies to the rental, lease, or purchase of the

machinery or equipment, as well as the parts and labor purchased to repair or maintain the machinery or equipment.

Exempt: combines, discs, farm tractors, harrows, hay balers, irrigation and milking equipment, planters, plows, tillers, qualifying

work-site utility vehicles (see Part C instructions), and precision farming equipment.

Taxable: air compressors, tanks, passenger vehicles, vehicles tagged for road or highway use, all-terrain vehicles (ATV), barn

ventilators, building and electrical materials, construction and similar heavy equipment used for building, road or land

improvements, garden hoses, grain bins, hand tools, lawnmowers, silos, water and gas wells, welding equipment, and any

equipment that becomes a part of a building, facility, or land improvement.

Prevention of Soil Erosion

Exempt: seeds and tree seedlings, fertilizers, insecticides, herbicides, germicides, pesticides, fungicides, and services, purchased

and used for the purpose of producing plants in order to prevent soil erosion on land devoted to agricultural use.

Fencing for Agricultural Land – see instructions for Part B

PART B

Effective July 1, 2022, purchasers, which includes contractors, may use this certificate to purchase tangible personal property

necessary to construct, reconstruct, repair, or replace any fence used to enclose land devoted to agriculture use exempt from

Kansas sales tax. The location of the agricultural land is the location of the land where the fence will be constructed, reconstructed,

repaired, or replaced.

Exempt: barbed wire, T-posts, concrete mix, post caps, T-post clips, screw hooks, nails, staples, gates, electric fence posts,

electric insulators, and electric fence chargers.

PART C

The retail sale of a “work-site utility vehicle” may be exempt from Kansas sales tax, if it meets all statutory requirements. To be

considered a “work-site utility vehicle”, the vehicle must be equipped with a bed or cargo box for hauling materials. Additionally,

the vehicle must be used exclusively in farming, ranching, or aquaculture production. If the vehicle is used for any purpose other

than farming, ranching or aquaculture production, such as, hunting, trail riding, fishing, mudding, transporting persons, or any

recreational purpose, the purchase of the vehicle is subject to Kansas sales tax.

PART D

By signing this part of the form, you are declaring that under penalty of perjury under the law of the State of Kansas that the

information provided in the form is true and correct and that you have read these instructions and further understand that in the

event the property or service so purchased is not used in accordance with the exemption claimed, you may be liable for any

Kansas sales tax owed and any applicable penalties and interest. Contractors are considered purchasers and must sign this form.

|