Enlarge image

KANSAS DEPARTMENT OF REVENUE

2024 INFORMATION RETURNS SPECIFICATIONS FOR ELECTRONIC FILING

The Kansas Department of Revenue no longer accepts 1099s reports filed on magnetic media. Kansas requires,

however, that filers with 51 or more records per type of information return file by electronic means. Most will be able to

file through a Department developed, web based application. Filers with less than 51 records can also benefit from

using the application. All 1099s must be filed by January 31 following the end of the calendar year. Additional information

regarding the Kansas electronic filing process with the state of Kansas is available on our website:

http://www.ksrevenue.gov/forms-btwh.html.

The State of Kansas follows the IRS guidelines in regard to the filing of Information Returns per K.S.A. 79-3222. The

most common of these returns are 1099s. Refer to IRS Publication 1220 for file layouts which are available on the IRS

website: http://www.irs.gov/pub/irs-pdf/p1220.pdf.

The following information provides a brief overview of specifications for those employers who are either required or to

submit information returns by electronic means in lieu of paper returns.

ELECTRONIC RECORDS THAT DO NOT CONFORM TO THE

SPECIFICATIONS DEFINED IN THESE INSTRUCTIONS WILL NOT BE ACCEPTED.

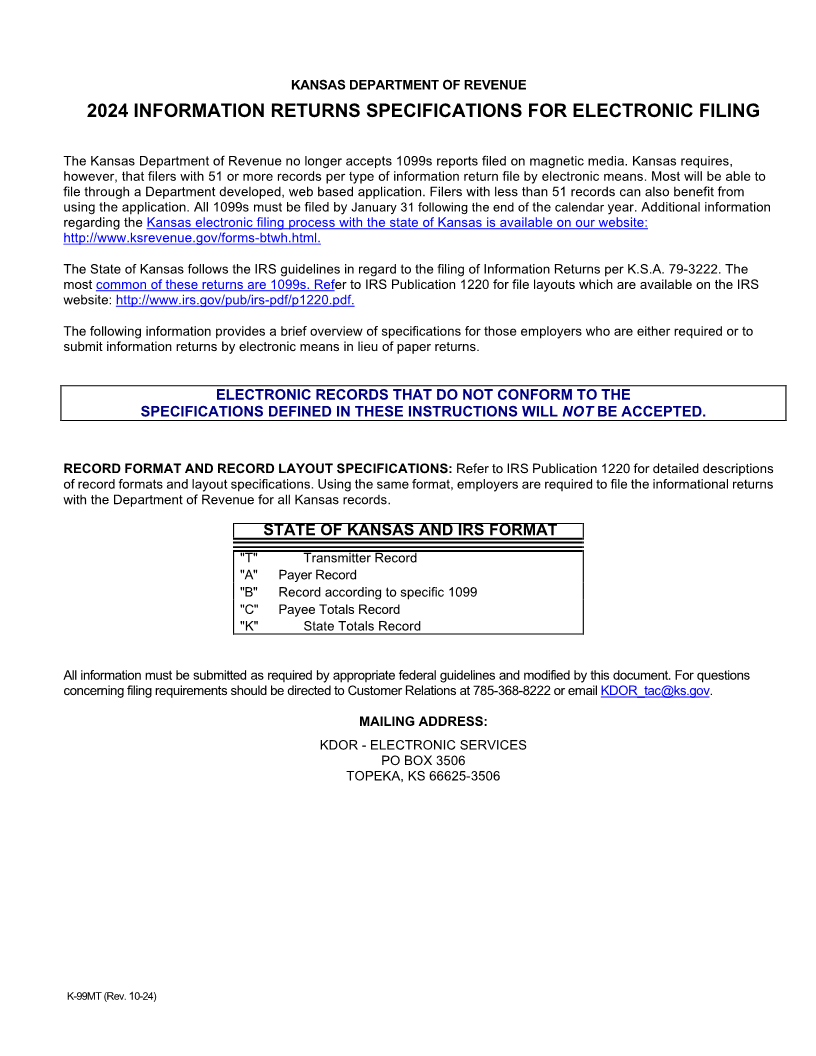

RECORD FORMAT AND RECORD LAYOUT SPECIFICATIONS: Refer to IRS Publication 1220 for detailed descriptions

of record formats and layout specifications. Using the same format, employers are required to file the informational returns

with the Department of Revenue for all Kansas records.

STATE OF KANSAS AND IRS FORMAT

"T" Transmitter Record

"A" Payer Record

"B" Record according to specific 1099

"C" Payee Totals Record

"K" State Totals Record

All information must be submitted as required by appropriate federal guidelines and modified by this document. For questions

concerning filing requirements should be directed to Customer Relations at 785-368-8222 or email KDOR_tac@ks.gov.

MAILING ADDRESS:

KDOR - ELECTRONIC SERVICES

PO BOX 3506

TOPEKA, KS 66625-3506

K-99MT (Rev. 10-24)