Enlarge image

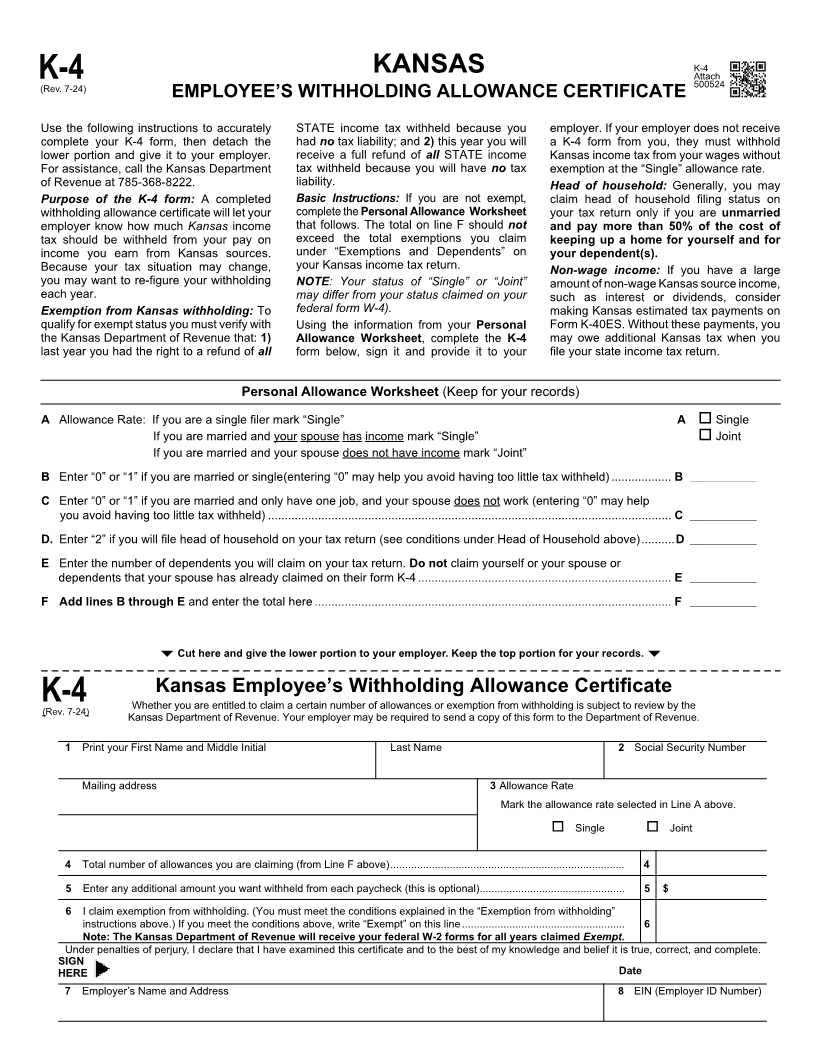

K-4

KANSAS Attach

K-4(Rev. 7-24) 500524

EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE

Use the following instructions to accurately STATE income tax withheld because you employer. If your employer does not receive

complete your K-4 form, then detach the had no tax liability; and 2)this year you will a K-4 form from you, they must withhold

lower portion and give it to your employer. receive a full refund of all STATE income Kansas income tax from your wages without

For assistance, call the Kansas Department tax withheld because you will have no tax exemption at the “Single” allowance rate.

of Revenue at 785-368-8222. liability. Head of household: Generally, you may

Purpose of the K-4 form: A completed Basic Instructions: If you are not exempt, claim head of household filing status on

withholding allowance certificate will let your complete the Personal Allowance Worksheet your tax return only if you are unmarried

employer know how much Kansas income that follows. The total on line F should not and pay more than 50% of the cost of

tax should be withheld from your pay on exceed the total exemptions you claim keeping up a home for yourself and for

income you earn from Kansas sources. under “Exemptions and Dependents” on your dependent(s).

Because your tax situation may change, your Kansas income tax return. Non-wage income: If you have a large

you may want to re-figure your withholding NOTE: Your status of “Single” or “Joint” amount of non-wage Kansas source income,

each year. may differ from your status claimed on your such as interest or dividends, consider

Exemption from Kansas withholding: To federal form W-4). making Kansas estimated tax payments on

qualify for exempt status you must verify with Using the information from your Personal Form K-40ES. Without these payments, you

the Kansas Department of Revenue that: 1) Allowance Worksheet, complete the K-4 may owe additional Kansas tax when you

last year you had the right to a refund of all form below, sign it and provide it to your file your state income tax return.

Personal Allowance Worksheet (Keep for your records)

A Allowance Rate: If you are a single filer mark “Single” A o Single

If you are married and your spouse has income mark “Single” o Joint

If you are married and your spouse does not have income mark “Joint”

B Enter “0” or “1” if you are married or single(entering “0” may help you avoid having too little tax withheld) .................. B __________________

C Enter “0” or “1” if you are married and only have one job, and your spouse does not work (entering “0” may help

you avoid having too little tax withheld) ......................................................................................................................... C __________________

D. Enter “2” if you will file head of household on your tax return (see conditions under Head of Household above) .......... D __________________

E Enter the number of dependents you will claim on your tax return. Do not claim yourself or your spouse or

dependents that your spouse has already claimed on their form K-4 ............................................................................ E __________________

F Add lines B through E and enter the total here ........................................................................................................... F __________________

Cut here and give the lower portion to your employer. Keep the top portion for your records.

Kansas Employee’s Withholding Allowance Certificate

K-4(Rev. 7-24) Whether you are entitled to claim a certain number of allowances or exemption from withholding is subject to review by the

Kansas Department of Revenue. Your employer may be required to send a copy of this form to the Department of Revenue.

1 Print your First Name and Middle Initial Last Name 2 Social Security Number

Mailing address 3 Allowance Rate

Mark the allowance rate selected in Line A above.

o Single o Joint

4 Total number of allowances you are claiming (from Line F above) ............................................................................... 4

5 Enter any additional amount you want withheld from each paycheck (this is optional) ................................................. 5 $

6 I claim exemption from withholding. (You must meet the conditions explained in the “Exemption from withholding”

instructions above.) If you meet the conditions above, write “Exempt” on this line ....................................................... 6

Note: The Kansas Department of Revenue will receive your federal W-2 forms for all years claimed Exempt.

Under penalties of perjury, I declare that I have examined this certificate and to the best of my knowledge and belief it is true, correct, and complete.

SIGN

HERE Date

7 Employer’s Name and Address 8 EIN (Employer ID Number)