Enlarge image

RPD-41206

Rev. 02/27/2024 New Mexico Taxation and Revenue Department

Holder's Request For Reimbursement

Unclaimed Property Office

P.O. Box 25123

Santa Fe, New Mexico 87504-5123

Page No ________ of ________

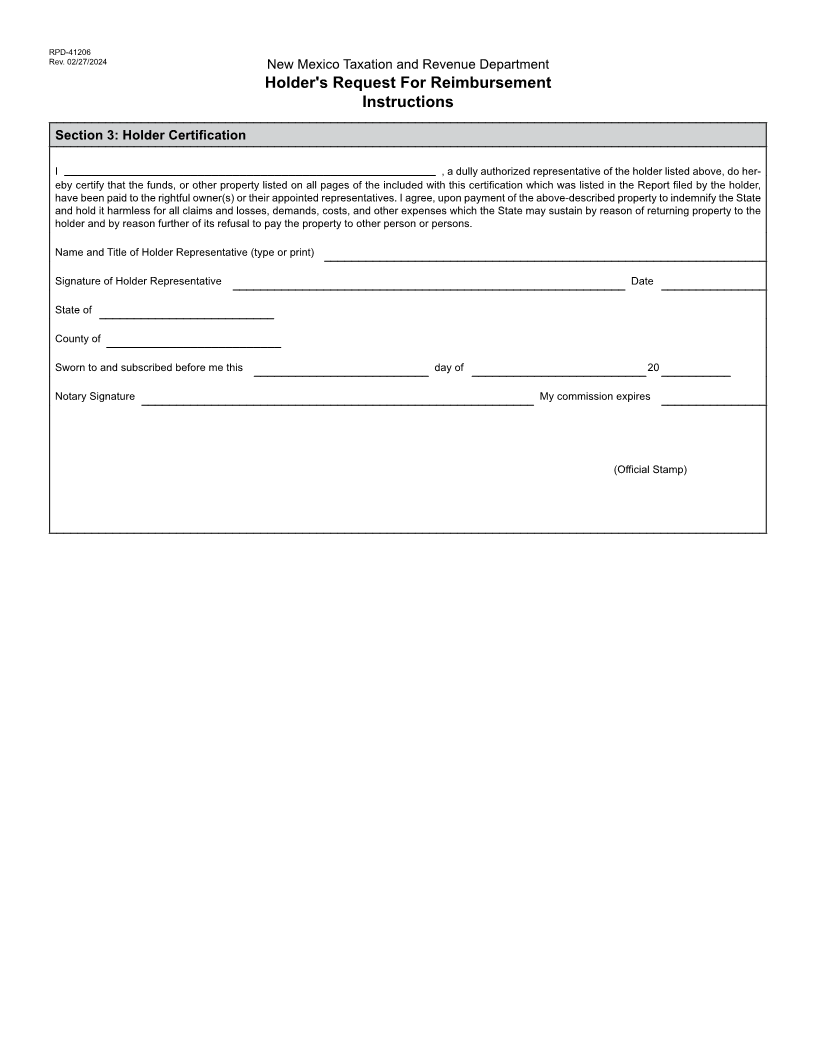

Section 1

1. Name of Holder 2. Report Year 3. FEIN, SSN, or ITIN

4. Mailing Address - City, State, Zip Code

5. Name of Contact Person 6. Contact Phone Number 7. Contact Email Address

Section 2

If amount was remitted in error, attach a separate sheet detailing the error.

Column 1 Column 2 Column 3 Column 4 Column 5 Column 6 Column 7 Column 8 Column 9

Owner's Name and Address Claimant’s Name and Address Property Account Refer- Date Paid Dollar Total Type of Check Amount

(Exactly as on report) (If different than owner) Type ence Number to Owner or Amount/ Request for (Mark only one) Remitted in

Code (If aggregate Date Account Number Reimburse- Error (Mark

specify) Reactivated of Shares ment

only One)

c Standalone c Yes

c Combined c No

c Standalone c Yes

c Combined c No

c Standalone c Yes

c Combined c No

c Standalone c Yes

c Combined c No

c Standalone c Yes

c Combined c No

c Standalone c Yes

c Combined c No

Total of Column 7 to be issued as a combined check

Total of All Pages