Enlarge image

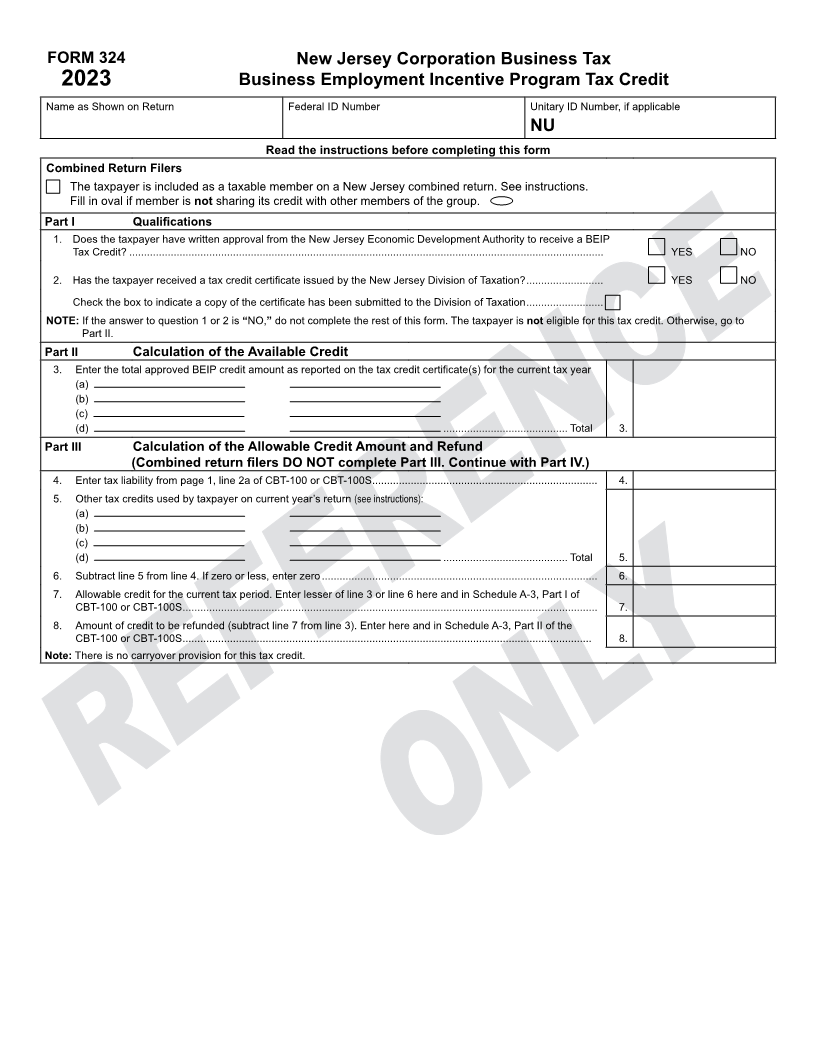

FORM 324 New Jersey Corporation Business Tax

2023 Business Employment Incentive Program Tax Credit

Name as Shown on Return Federal ID Number Unitary ID Number, if applicable

NU

Read the instructions before completing this form

Combined Return Filers

The taxpayer is included as a taxable member on a New Jersey combined return. See instructions.

Fill in oval if member is not sharing its credit with other members of the group.

Part I Qualifications

1. Does the taxpayer have written approval from the New Jersey Economic Development Authority to receive a BEIP

Tax Credit? ................................................................................................................................................................ YES NO

2. Has the taxpayer received a tax credit certificate issued by the New Jersey Division of Taxation? .......................... YES NO

Check the box to indicate a copy of the certificate has been submitted to the Division of Taxation ..........................

NOTE: If the answer to question 1 or 2 is “NO, ”do not complete the rest of this form. The taxpayer is not eligible for this tax credit. Otherwise, go to

Part II.

Part II Calculation of the Available Credit

3. Enter the total approved BEIP credit amount as reported on the tax credit certificate(s) for the current tax year

(a)

(b)

(c)

(d) .......................................... Total 3.

Part III Calculation of the Allowable Credit Amount and Refund

(Combined return filers DO NOT complete Part III. Continue with Part IV.)

4. Enter tax liability from page 1, line 2a of CBT-100 or CBT-100S ............................................................................ 4.

5. Other tax credits used by taxpayer on current year’s return (see instructions):

(a)

(b)

(c)

(d) .......................................... Total 5.

6. Subtract line 5 from line 4. If zero or less, enter zero ............................................................................................. 6.

7. Allowable credit for the current tax period. Enter lesser of line 3 or line 6 here and in Schedule A-3, Part I of

CBT-100 or CBT-100S ............................................................................................................................................ 7.

8. Amount of credit to be refunded (subtract line 7 from line 3). Enter here and in Schedule A-3, Part II of the

CBT-100 or CBT-100S .......................................................................................................................................... 8.

Note: There is no carryover provision for this tax credit.