Enlarge image

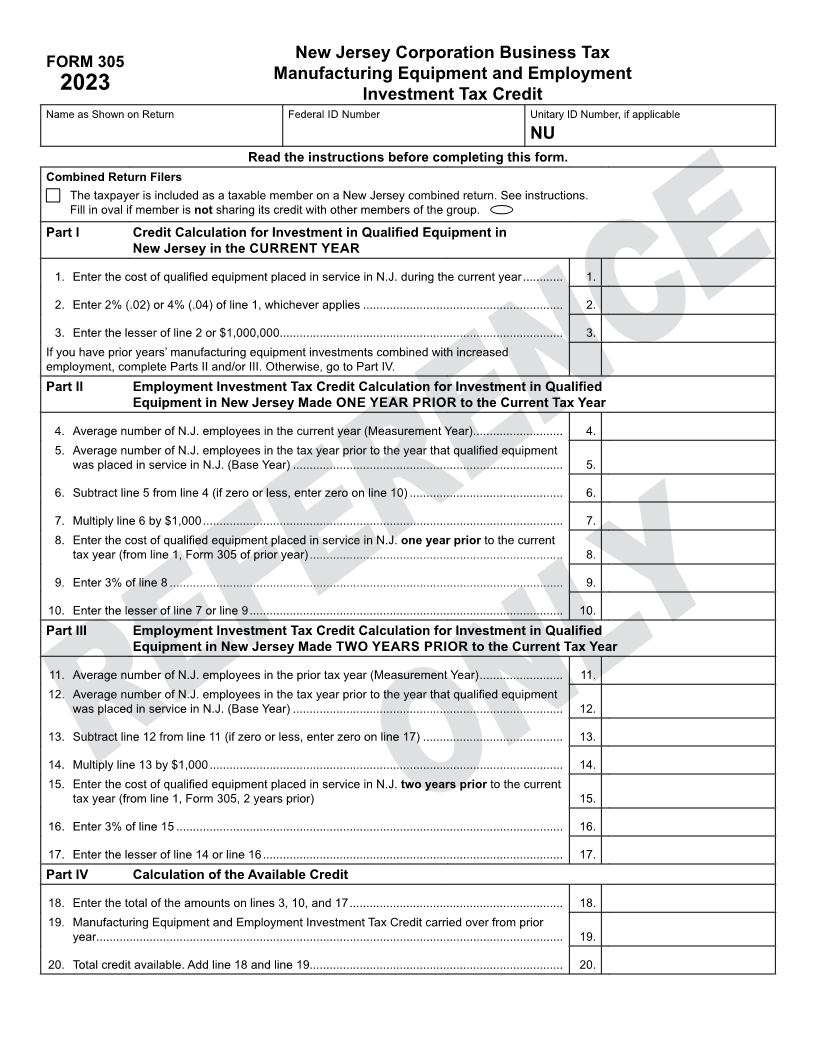

New Jersey Corporation Business Tax

FORM 305

Manufacturing Equipment and Employment

2023

Investment Tax Credit

Name as Shown on Return Federal ID Number Unitary ID Number, if applicable

NU

Read the instructions before completing this form.

Combined Return Filers

The taxpayer is included as a taxable member on a New Jersey combined return. See instructions.

Fill in oval if member is not sharing its credit with other members of the group.

Part I Credit Calculation for Investment in Qualified Equipment in

New Jersey in the CURRENT YEAR

1. Enter the cost of qualified equipment placed in service in N.J. during the current year ............ 1.

2. Enter 2% (.02) or 4% (.04) of line 1, whichever applies ............................................................ 2.

3. Enter the lesser of line 2 or $1,000,000..................................................................................... 3.

If you have prior years’ manufacturing equipment investments combined with increased

employment, complete Parts II and/or III. Otherwise, go to Part IV.

Part II Employment Investment Tax Credit Calculation for Investment in Qualified

Equipment in New Jersey Made ONE YEAR PRIOR to the Current Tax Year

4. Average number of N.J. employees in the current year (Measurement Year) ........................... 4.

5. Average number of N.J. employees in the tax year prior to the year that qualified equipment

was placed in service in N.J. (Base Year) ................................................................................. 5.

6. Subtract line 5 from line 4 (if zero or less, enter zero on line 10) .............................................. 6.

7. Multiply line 6 by $1,000 ............................................................................................................ 7.

8. Enter the cost of qualified equipment placed in service in N.J. one year prior to the current

tax year (from line 1, Form 305 of prior year) ............................................................................ 8.

9. Enter 3% of line 8 ...................................................................................................................... 9.

10. Enter the lesser of line 7 or line 9 .............................................................................................. 10.

Part III Employment Investment Tax Credit Calculation for Investment in Qualified

Equipment in New Jersey Made TWO YEARS PRIOR to the Current Tax Year

11. Average number of N.J. employees in the prior tax year (Measurement Year) ......................... 11.

12. Average number of N.J. employees in the tax year prior to the year that qualified equipment

was placed in service in N.J. (Base Year) ................................................................................. 12.

13. Subtract line 12 from line 11 (if zero or less, enter zero on line 17) .......................................... 13.

14. Multiply line 13 by $1,000 .......................................................................................................... 14.

15. Enter the cost of qualified equipment placed in service in N.J. two years prior to the current

tax year (from line 1, Form 305, 2 years prior) 15.

16. Enter 3% of line 15 .................................................................................................................... 16.

17. Enter the lesser of line 14 or line 16 .......................................................................................... 17.

Part IV Calculation of the Available Credit

18. Enter the total of the amounts on lines 3, 10, and 17 ................................................................ 18.

19. Manufacturing Equipment and Employment Investment Tax Credit carried over from prior

year............................................................................................................................................ 19.

20. Total credit available. Add line 18 and line 19............................................................................ 20.