Enlarge image

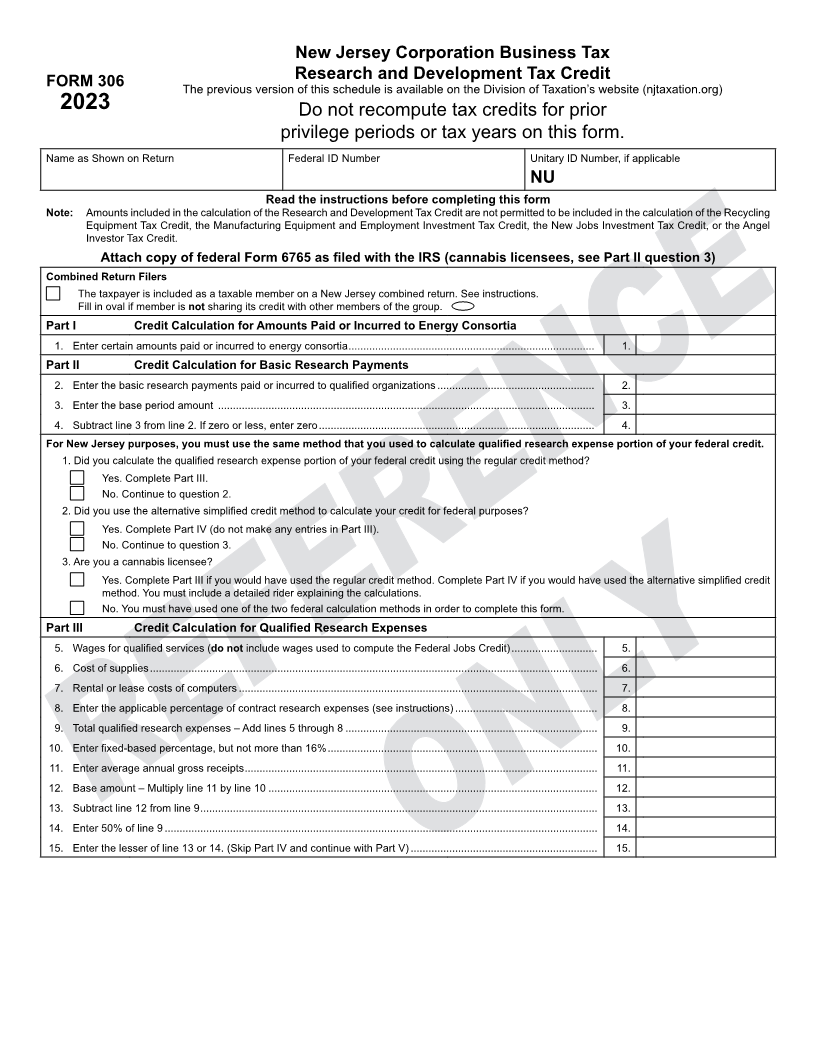

New Jersey Corporation Business Tax

Research and Development Tax Credit

FORM 306 The previous version of this schedule is available on the Division of Taxation’s website (njtaxation.org)

2023 Do not recompute tax credits for prior

privilege periods or tax years on this form.

Name as Shown on Return Federal ID Number Unitary ID Number, if applicable

NU

Read the instructions before completing this form

Note: Amounts included in the calculation of the Research and Development Tax Credit are not permitted to be included in the calculation of the Recycling

Equipment Tax Credit, the Manufacturing Equipment and Employment Investment Tax Credit, the New Jobs Investment Tax Credit, or the Angel

Investor Tax Credit.

Attach copy of federal Form 6765 as filed with the IRS (cannabis licensees, see Part II question 3)

Combined Return Filers

The taxpayer is included as a taxable member on a New Jersey combined return. See instructions.

Fill in oval if member is not sharing its credit with other members of the group.

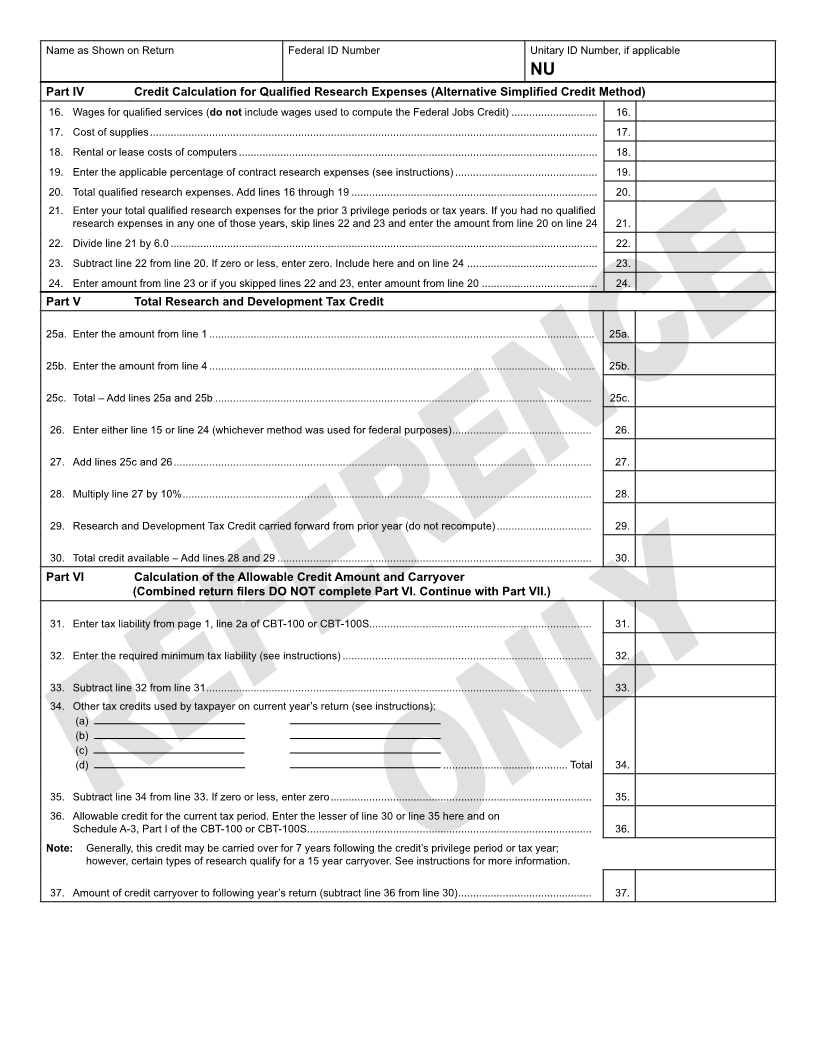

Part I Credit Calculation for Amounts Paid or Incurred to Energy Consortia

1. Enter certain amounts paid or incurred to energy consortia ................................................................................... 1.

Part II Credit Calculation for Basic Research Payments

2. Enter the basic research payments paid or incurred to qualified organizations ..................................................... 2.

3. Enter the base period amount ............................................................................................................................... 3.

4. Subtract line 3 from line 2. If zero or less, enter zero ............................................................................................. 4.

For New Jersey purposes, you must use the same method that you used to calculate qualified research expense portion of your federal credit.

1. Did you calculate the qualified research expense portion of your federal credit using the regular credit method?

Yes. Complete Part III.

No. Continue to question 2.

2. Did you use the alternative simplified credit method to calculate your credit for federal purposes?

Yes. Complete Part IV (do not make any entries in Part III).

No. Continue to question 3.

3. Are you a cannabis licensee?

Yes. Complete Part III if you would have used the regular credit method. Complete Part IV if you would have used the alternative simplified credit

method. You must include a detailed rider explaining the calculations.

No. You must have used one of the two federal calculation methods in order to complete this form.

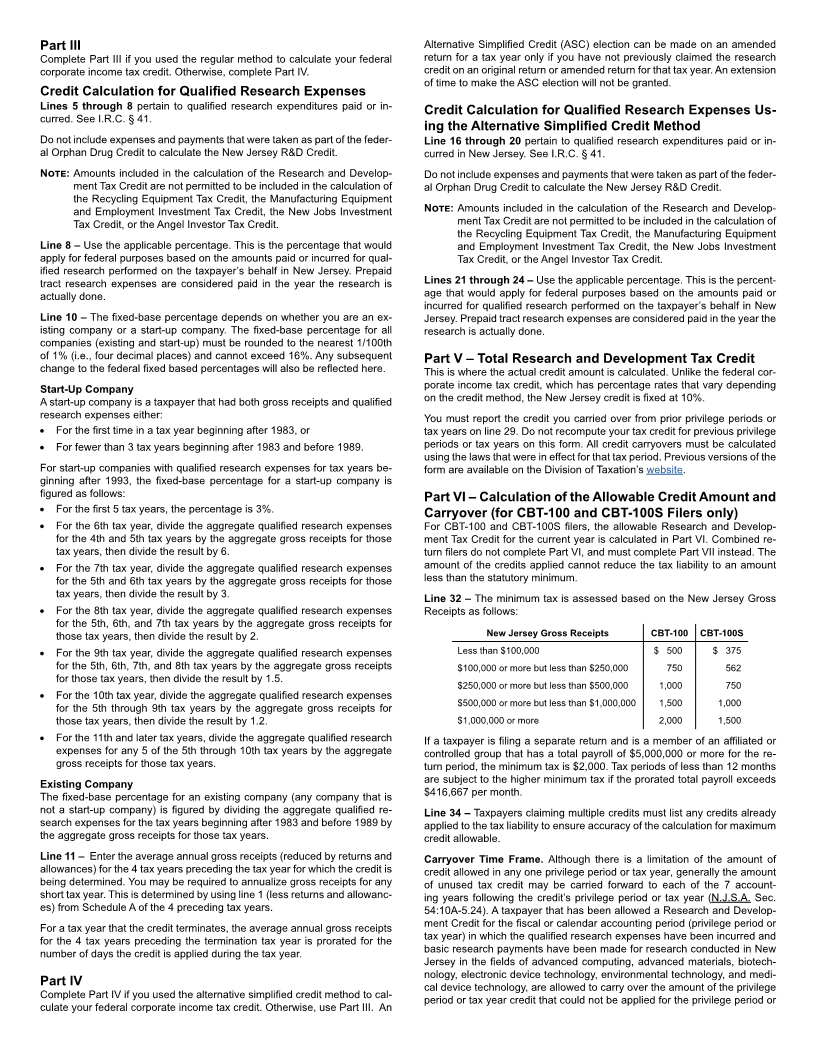

Part III Credit Calculation for Qualified Research Expenses

5. Wages for qualified services (do not include wages used to compute the Federal Jobs Credit) ............................. 5.

6. Cost of supplies ....................................................................................................................................................... 6.

7. Rental or lease costs of computers ......................................................................................................................... 7.

8. Enter the applicable percentage of contract research expenses (see instructions) ................................................ 8.

9. Total qualified research expenses – Add lines 5 through 8 ..................................................................................... 9.

10. Enter fixed-based percentage, but not more than 16% ........................................................................................... 10.

11. Enter average annual gross receipts ....................................................................................................................... 11.

12. Base amount – Multiply line 11 by line 10 ............................................................................................................... 12.

13. Subtract line 12 from line 9 ...................................................................................................................................... 13.

14. Enter 50% of line 9 .................................................................................................................................................. 14.

15. Enter the lesser of line 13 or 14. (Skip Part IV and continue with Part V) ............................................................... 15.