Enlarge image

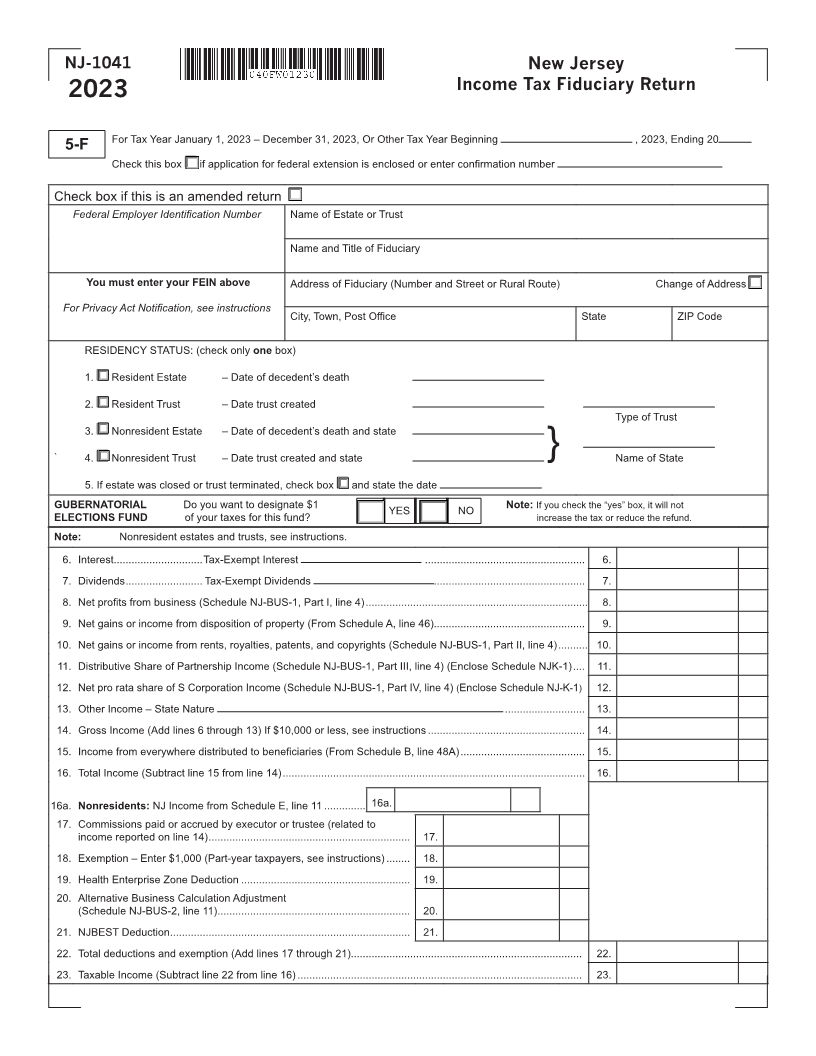

NJ-1041 New Jersey

Income Tax Fiduciary Return

2023

For Tax Year January 1, 2023 – December 31, 2023, Or Other Tax Year Beginning , 2023, Ending 20

5-F

Check this box if application for federal extension is enclosed or enter confirmation number

Check box if this is an amended return

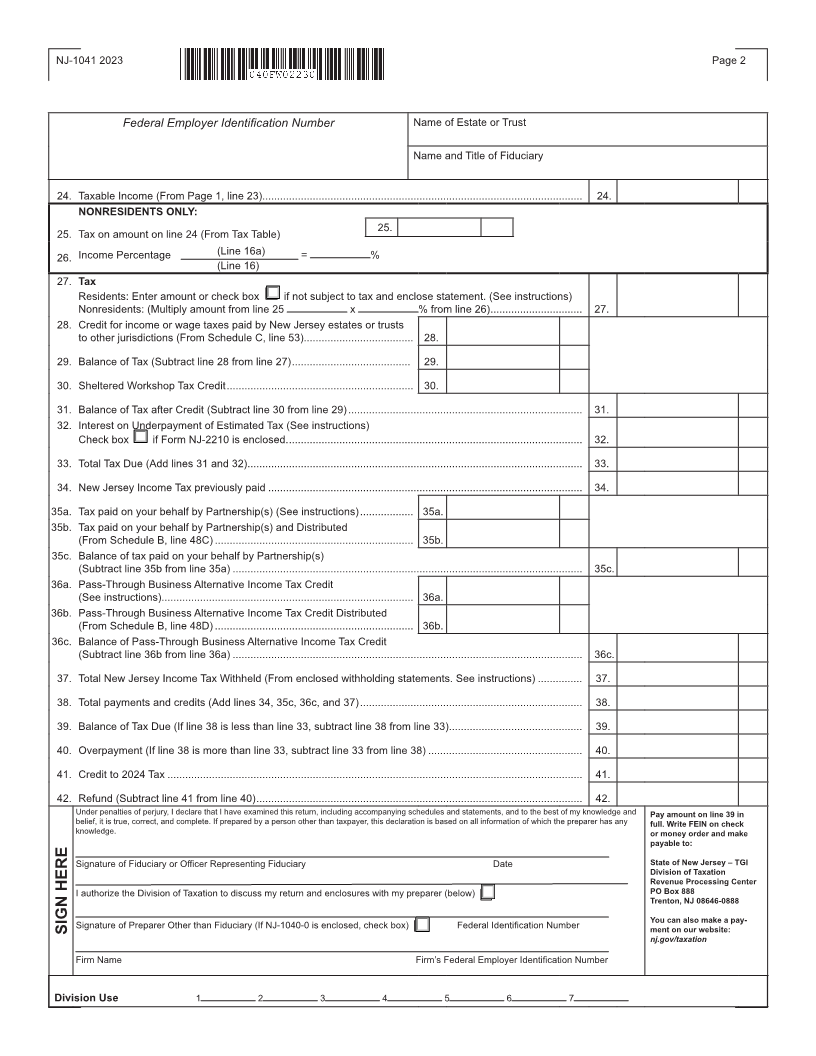

Federal Employer Identification Number Name of Estate or Trust

Name and Title of Fiduciary

You must enter your FEIN above Address of Fiduciary (Number and Street or Rural Route) Change of Address

For Privacy Act Notification, see instructions

City, Town, Post Office State ZIP Code

RESIDENCY STATUS: (check only one box)

1. Resident Estate – Date of decedent’s death

2. Resident Trust – Date trust created

Type of Trust

3. Nonresident Estate – Date of decedent’s death and state

` 4. Nonresident Trust – Date trust created and state } Name of State

5. If estate was closed or trust terminated, check box and state the date

GUBERNATORIAL Do you want to designate $1 YES NO Note: If you check the “yes” box, it will notincrease the tax or reduce the refund.

ELECTIONS FUND of your taxes for this fund?

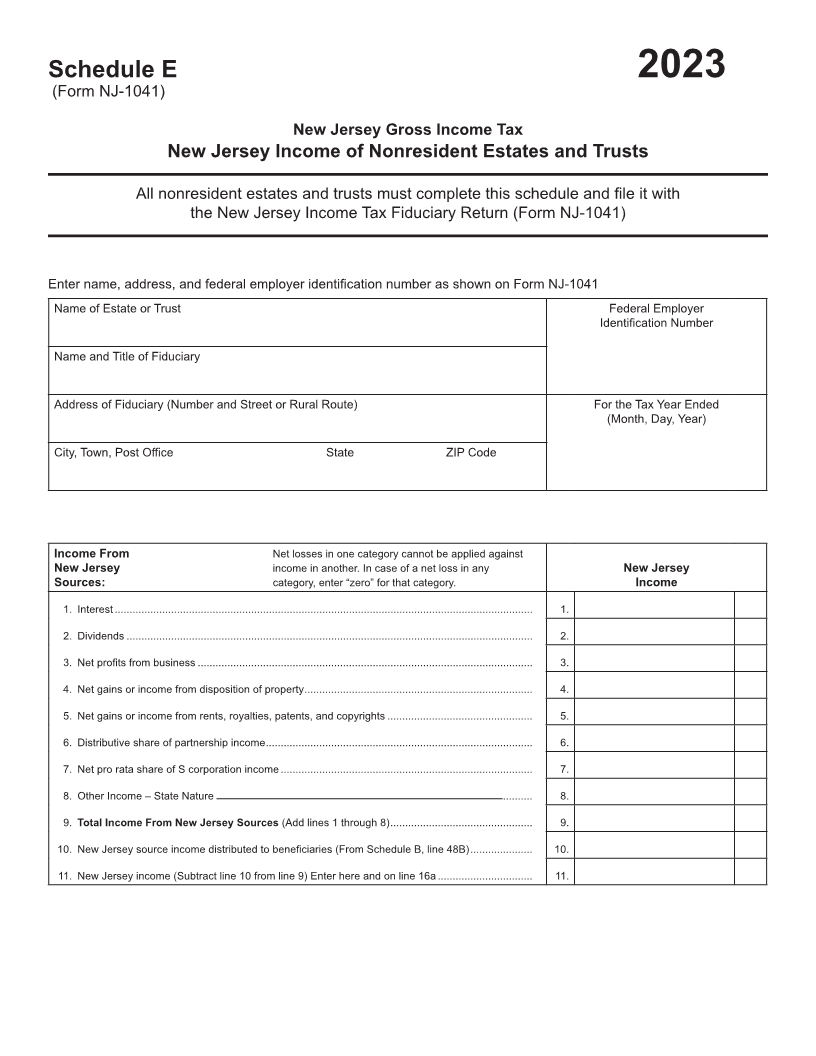

Note: Nonresident estates and trusts, see instructions.

6. Interest..............................Tax-Exempt Interest ...................................................... 6.

7. Dividends .......................... Tax-Exempt Dividends ................................................... 7.

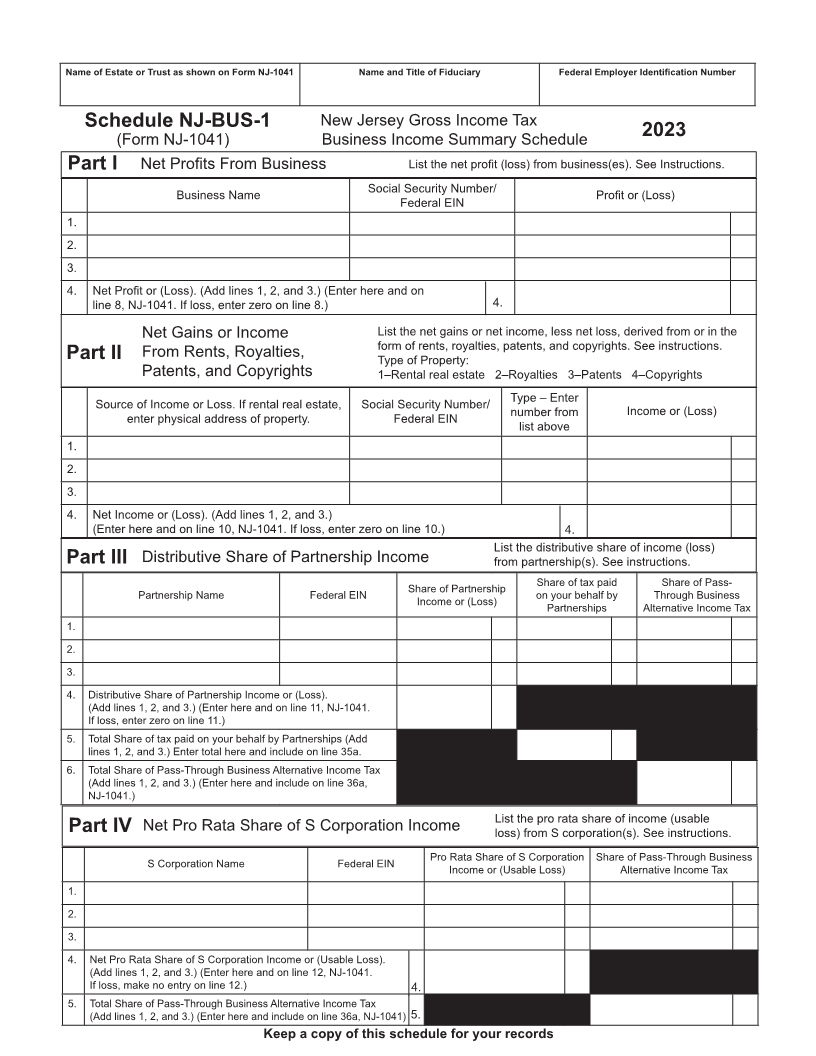

8. Net profits from business (Schedule NJ-BUS-1, Part I, line 4) ........................................................................... 8.

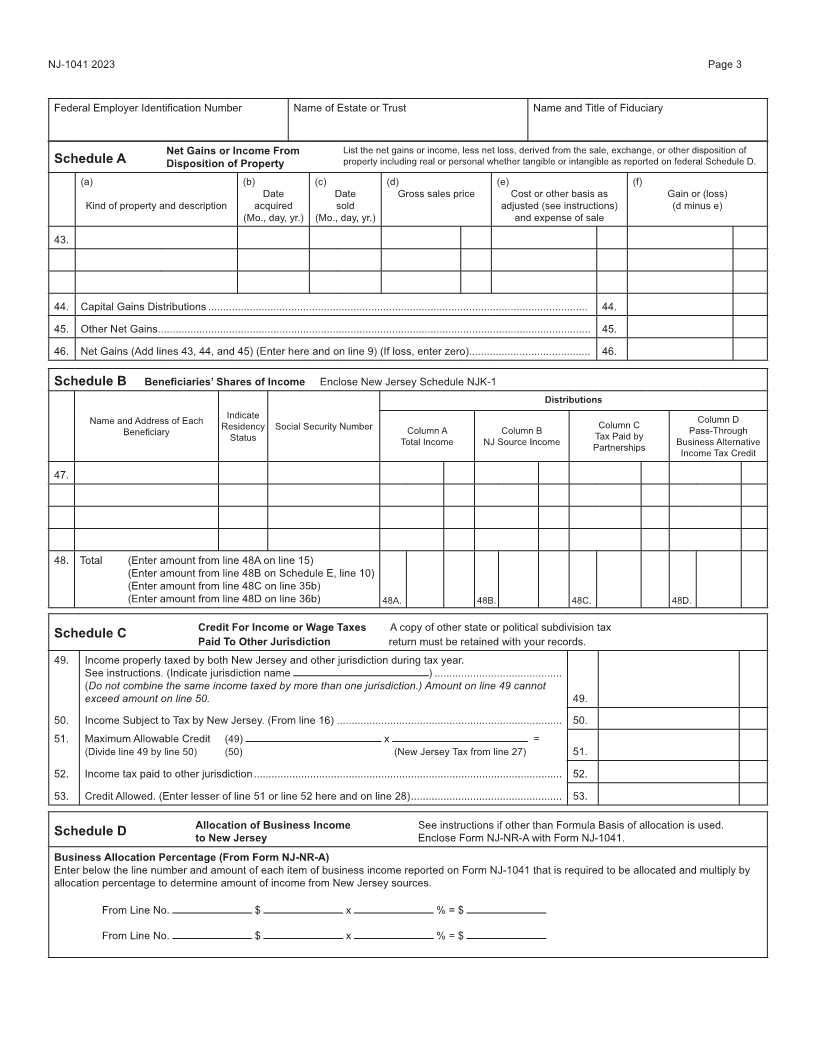

9. Net gains or income from disposition of property (From Schedule A, line 46)................................................... 9.

10. Net gains or income from rents, royalties, patents, and copyrights (Schedule NJ-BUS-1, Part II, line 4) .......... 10.

11. Distributive Share of Partnership Income (Schedule NJ-BUS-1, Part III, line 4) (Enclose Schedule NJK-1) .... 11.

12. Net pro rata share of S Corporation Income (Schedule NJ-BUS-1, Part IV, line 4) ( Enclose Schedule NJ- -K)1 12.

13. Other Income – State Nature ........................... 13.

14. Gross Income (Add lines 6 through 13) If $10,000 or less, see instructions ..................................................... 14.

15. Income from everywhere distributed to beneficiaries (From Schedule B, line 48A) .......................................... 15.

16. Total Income (Subtract line 15 from line 14) ...................................................................................................... 16.

16a. Nonresidents: NJ Income from Schedule E, line 11 .............. 16a.

17. Commissions paid or accrued by executor or trustee (related to

income reported on line 14) .................................................................... 17.

18. Exemption – Enter $1,000 (Part-year taxpayers, see instructions) ........ 18.

19. Health Enterprise Zone Deduction ......................................................... 19.

20. Alternative Business Calculation Adjustment

(Schedule NJ-BUS-2, line 11) ................................................................. 20.

21. NJBEST Deduction ................................................................................. 21.

22. Total deductions and exemption (Add lines 17 through 21).............................................................................. 22.

23. Taxable Income (Subtract line 22 from line 16) ................................................................................................ 23.