Enlarge image

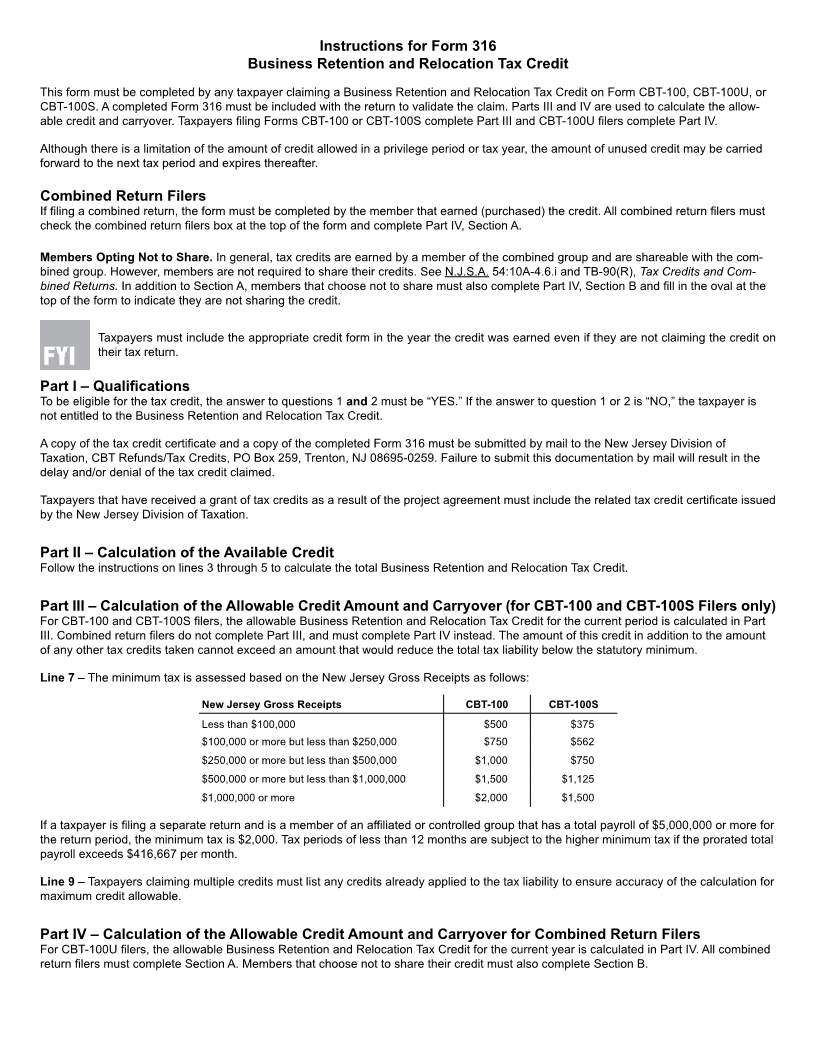

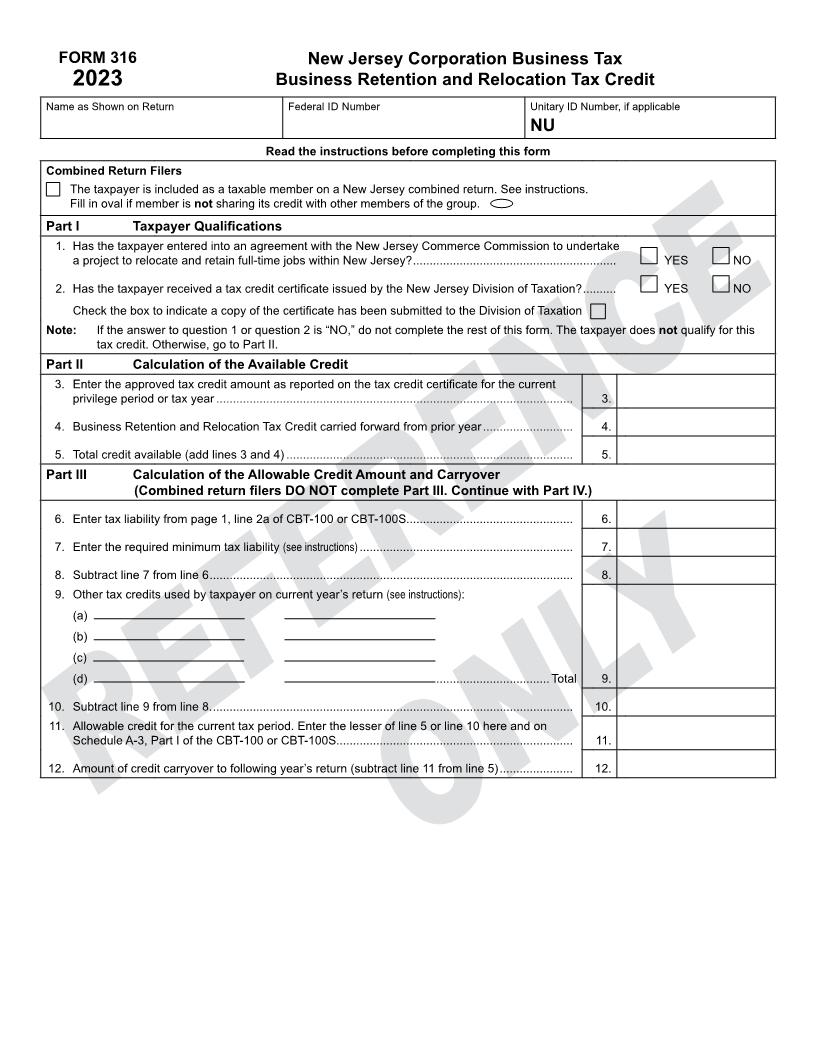

FORM 316 New Jersey Corporation Business Tax

2023 Business Retention and Relocation Tax Credit

Name as Shown on Return Federal ID Number Unitary ID Number, if applicable

NU

Read the instructions before completing this form

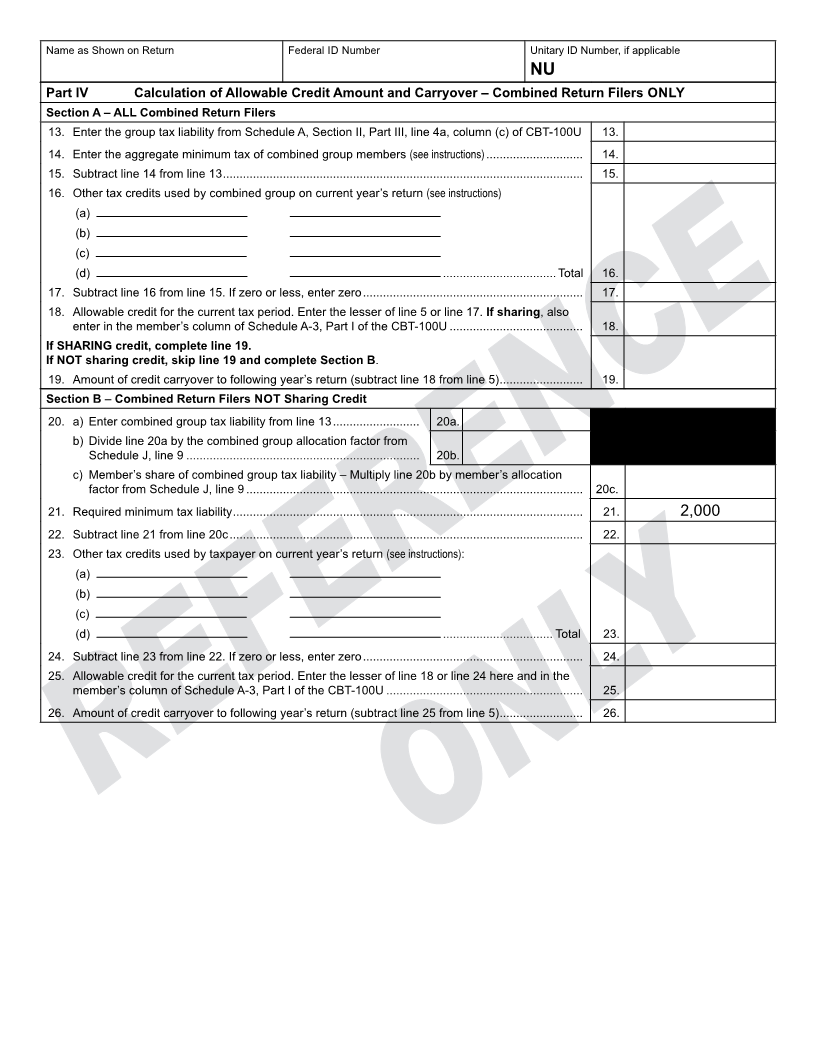

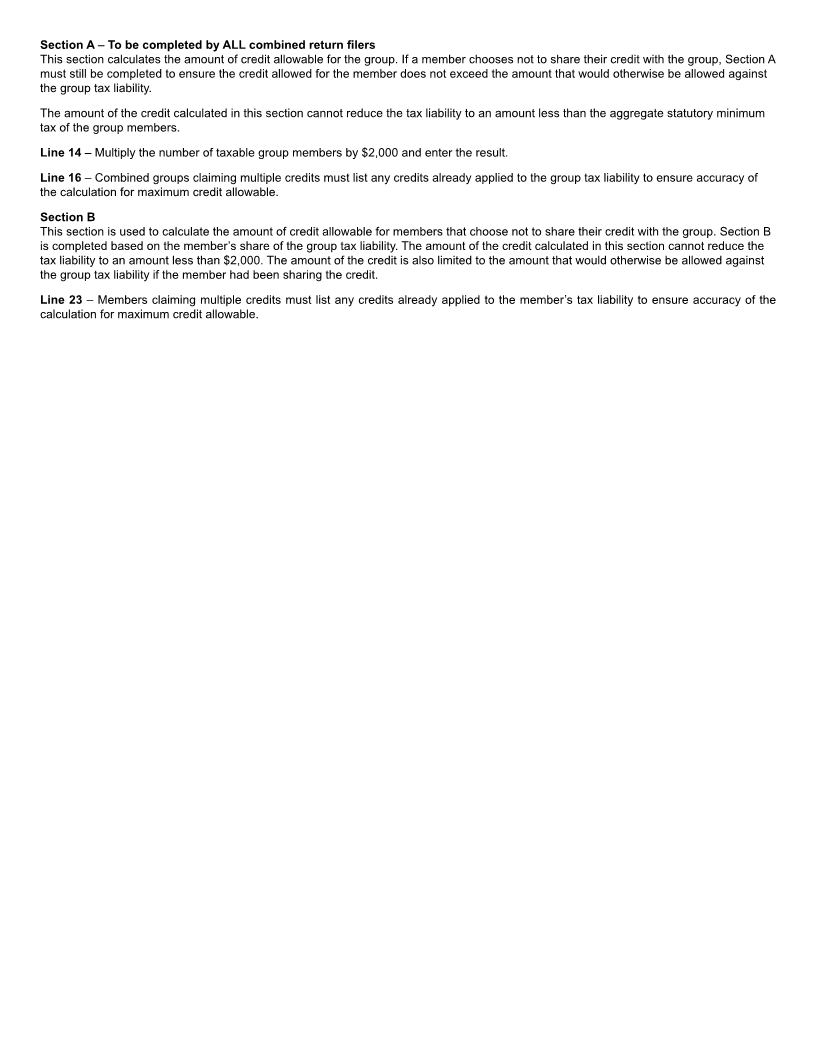

Combined Return Filers

The taxpayer is included as a taxable member on a New Jersey combined return. See instructions.

Fill in oval if member is not sharing its credit with other members of the group.

Part I Taxpayer Qualifications

1. Has the taxpayer entered into an agreement with the New Jersey Commerce Commission to undertake

a project to relocate and retain full-time jobs within New Jersey? ............................................................. YES NO

2. Has the taxpayer received a tax credit certificate issued by the New Jersey Division of Taxation? .......... YES NO

Check the box to indicate a copy of the certificate has been submitted to the Division of Taxation

Note: If the answer to question 1 or question 2 is “NO,” do not complete the rest of this form. The taxpayer does not qualify for this

tax credit. Otherwise, go to Part II.

Part II Calculation of the Available Credit

3. Enter the approved tax credit amount as reported on the tax credit certificate for the current

privilege period or tax year ........................................................................................................... 3.

4. Business Retention and Relocation Tax Credit carried forward from prior year ........................... 4.

5. Total credit available (add lines 3 and 4) ...................................................................................... 5.

Part III Calculation of the Allowable Credit Amount and Carryover

(Combined return filers DO NOT complete Part III. Continue with Part IV.)

6. Enter tax liability from page 1, line 2a of CBT-100 or CBT-100S.................................................. 6.

7. Enter the required minimum tax liability (see instructions) ................................................................ 7.

8. Subtract line 7 from line 6 ............................................................................................................. 8.

9. Other tax credits used by taxpayer on current year’s return (see instructions):

(a)

(b)

(c)

(d) .................................. Total 9.

10. Subtract line 9 from line 8. ............................................................................................................ 10.

11. Allowable credit for the current tax period. Enter the lesser of line 5 or line 10 here and on

Schedule A-3, Part I of the CBT-100 or CBT-100S....................................................................... 11.

12. Amount of credit carryover to following year’s return (subtract line 11 from line 5) ...................... 12.