Enlarge image

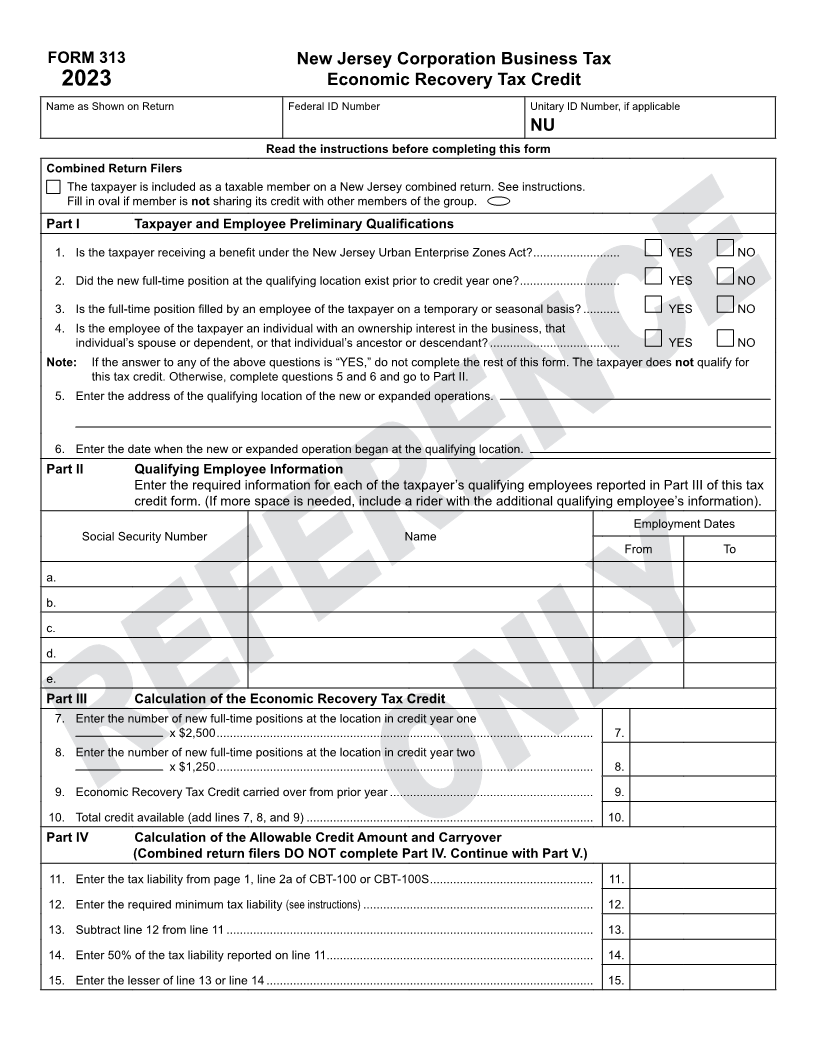

FORM 313 New Jersey Corporation Business Tax

2023 Economic Recovery Tax Credit

Name as Shown on Return Federal ID Number Unitary ID Number, if applicable

NU

Read the instructions before completing this form

Combined Return Filers

The taxpayer is included as a taxable member on a New Jersey combined return. See instructions.

Fill in oval if member is not sharing its credit with other members of the group.

Part I Taxpayer and Employee Preliminary Qualifications

1. Is the taxpayer receiving a benefit under the New Jersey Urban Enterprise Zones Act? .......................... YES NO

2. Did the new full-time position at the qualifying location exist prior to credit year one? .............................. YES NO

3. Is the full-time position filled by an employee of the taxpayer on a temporary or seasonal basis? ........... YES NO

4. Is the employee of the taxpayer an individual with an ownership interest in the business, that

individual’s spouse or dependent, or that individual’s ancestor or descendant? ....................................... YES NO

Note: If the answer to any of the above questions is “YES,” do not complete the rest of this form. The taxpayer does not qualify for

this tax credit. Otherwise, complete questions 5 and 6 and go to Part II.

5. Enter the address of the qualifying location of the new or expanded operations.

6. Enter the date when the new or expanded operation began at the qualifying location.

Part II Qualifying Employee Information

Enter the required information for each of the taxpayer’s qualifying employees reported in Part III of this tax

credit form. (If more space is needed, include a rider with the additional qualifying employee’s information).

Employment Dates

Social Security Number Name

From To

a.

b.

c.

d.

e.

Part III Calculation of the Economic Recovery Tax Credit

7. Enter the number of new full-time positions at the location in credit year one

x $2,500 ................................................................................................................. 7.

8. Enter the number of new full-time positions at the location in credit year two

x $1,250 ................................................................................................................. 8.

9. Economic Recovery Tax Credit carried over from prior year ............................................................. 9.

10. Total credit available (add lines 7, 8, and 9) ...................................................................................... 10.

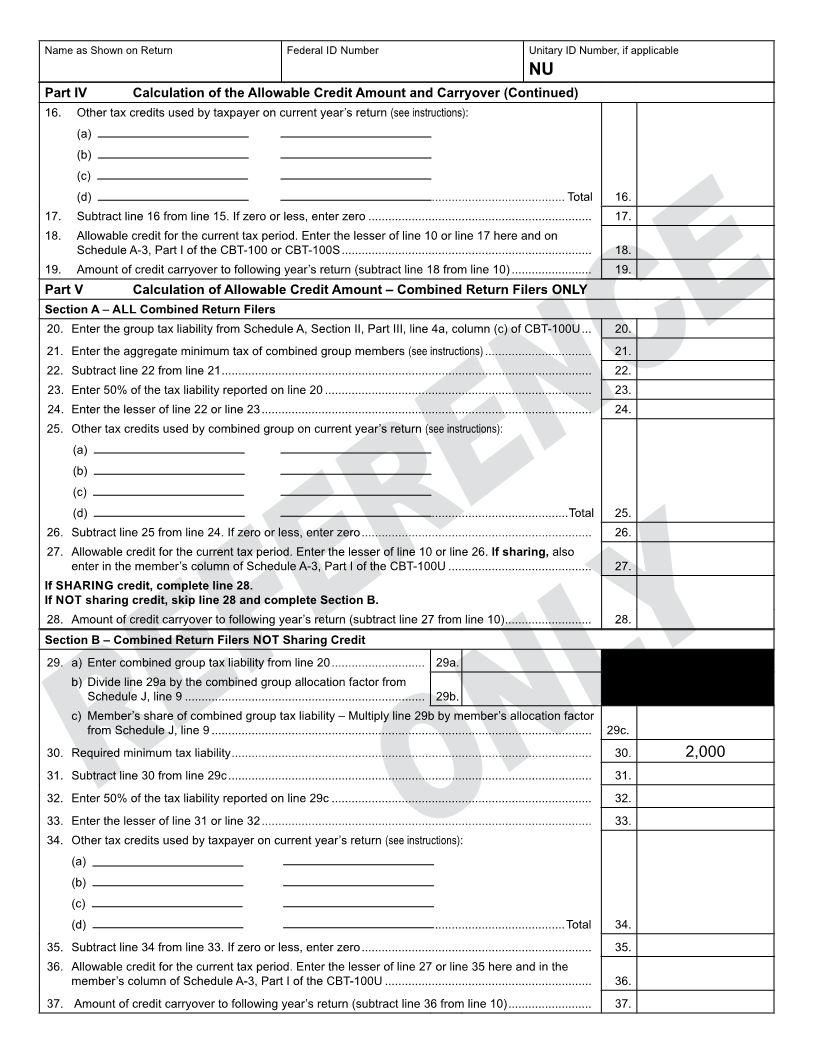

Part IV Calculation of the Allowable Credit Amount and Carryover

(Combined return filers DO NOT complete Part IV. Continue with Part V.)

11. Enter the tax liability from page 1, line 2a of CBT-100 or CBT-100S ................................................. 11.

12. Enter the required minimum tax liability (see instructions) ..................................................................... 12.

13. Subtract line 12 from line 11 .............................................................................................................. 13.

14. Enter 50% of the tax liability reported on line 11 ................................................................................ 14.

15. Enter the lesser of line 13 or line 14 .................................................................................................. 15.