- 25 -

Enlarge image

|

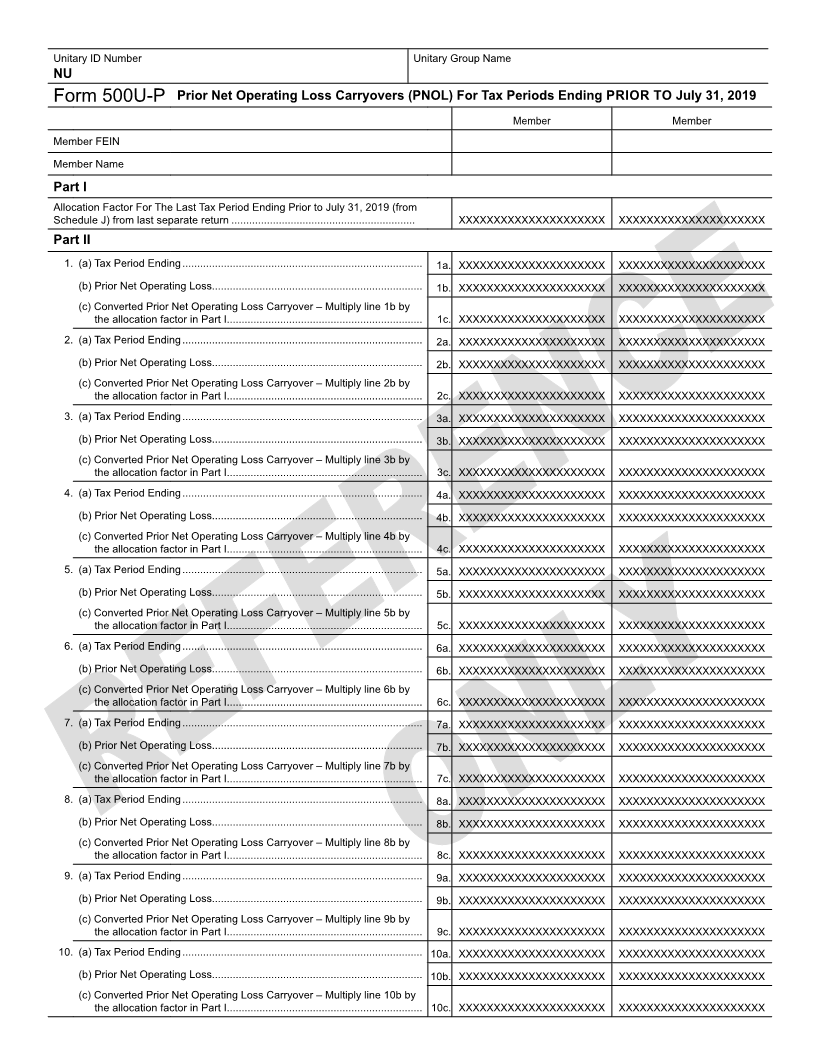

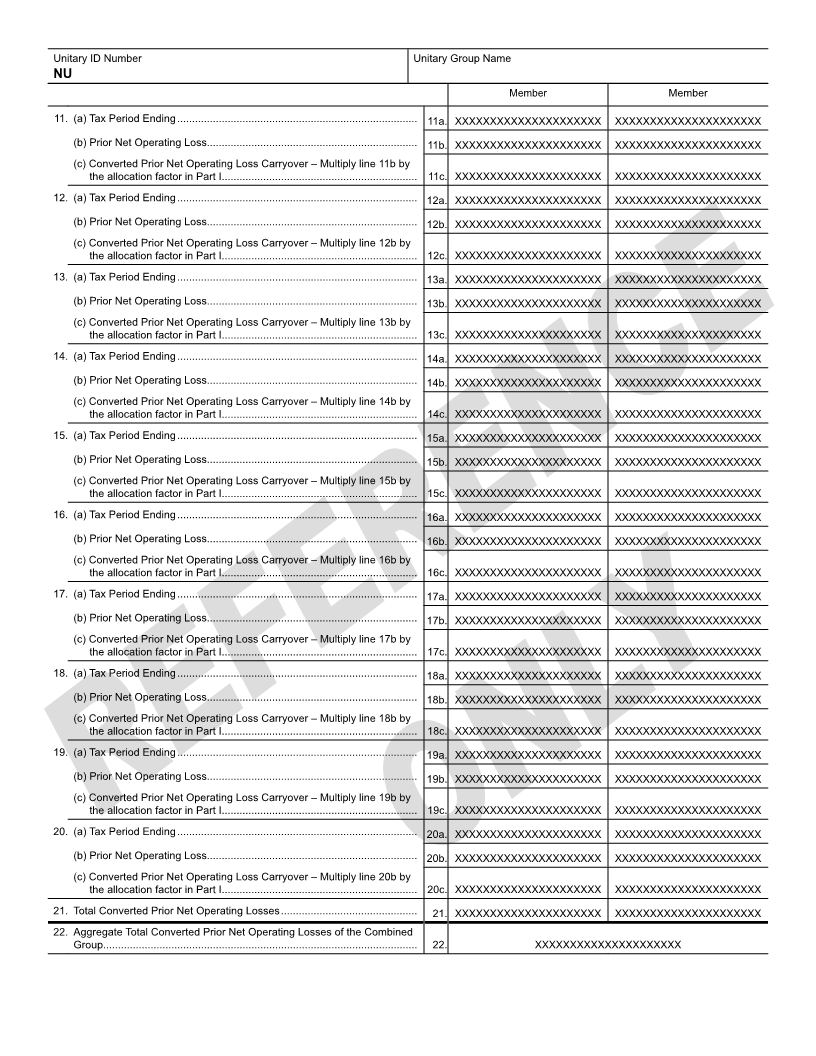

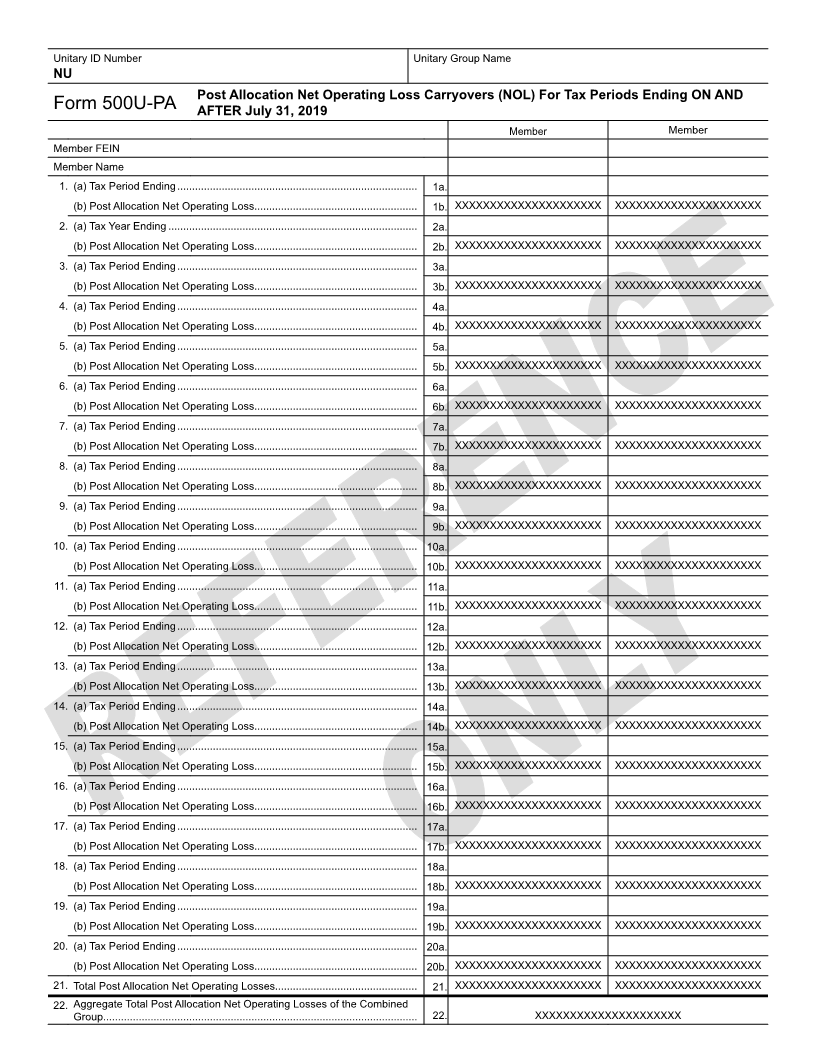

Unitary ID Number Unitary Group Name

NU

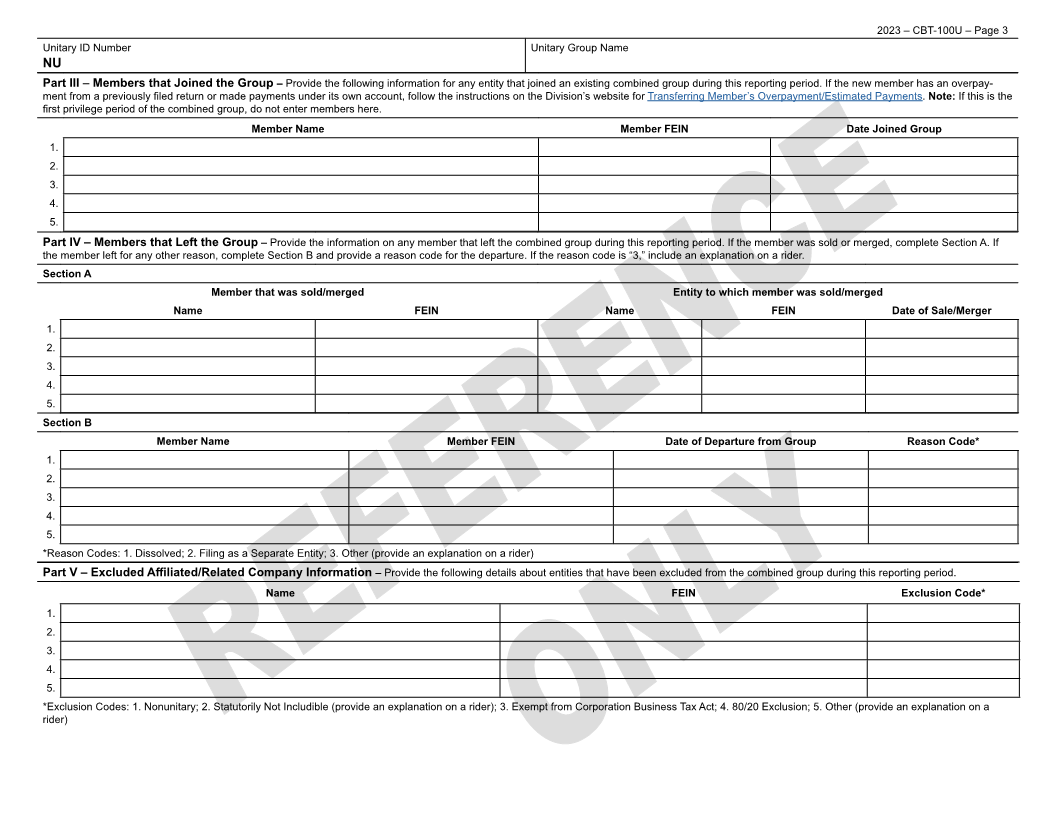

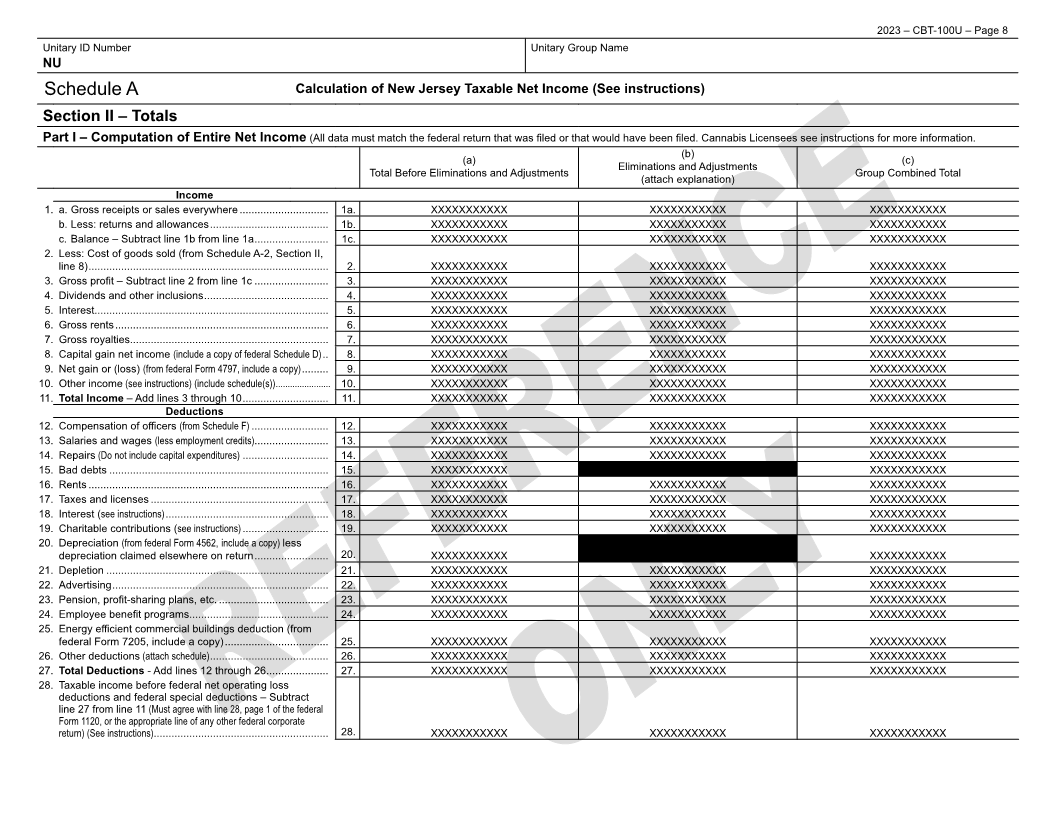

Computation of Prior Net Operating Loss Conversion Carryover (PNOL) and Post

Form 500U Allocation Net Operating Loss (NOL) Deductions

Complete this form only if the allocated entire net income/(loss) from Schedule A, Section II, Part II, line 23 is positive (income).

Section A – Computation of Prior Net Operating Losses (PNOL) Deduction from periods ending PRIOR to July 31, 2019

Group Combined

1. Prior Net Operating Loss Conversion Carryover (PNOL) – Enter the amount from Form 500U-P, Part II,

line 22 ......................................................................................................................................................... 1. XXXXXXXXXXXXXX

2. Enter the portion of line 1 previously deducted (see instructions) .................................................................. 2. XXXXXXXXXXXXXX

3. Enter the portion of line 1 that expired........................................................................................................ 3. XXXXXXXXXXXXXX

4. Enter any discharge of indebtedness excluded from federal taxable income in the current tax period

pursuant to subparagraph (A), (B), or (C) of paragraph (1) of subsection (a) of IRC § 108*...................... 4. XXXXXXXXXXXXXX

5. PNOL available in the current tax year – Subtract lines 2, 3, and 4 from line 1................................................... 5. XXXXXXXXXXXXXX

6. Enter the amount from Schedule A, Section II, Part II, line 23 (if zero or less, enter zero) .......................... 6. XXXXXXXXXXXXXX

7. Current tax year’s PNOL deduction – Enter the lesser of line 5 or line 6 here and on Section B, line 7

and Section C, line 1 .................................................................................................................................. 7. XXXXXXXXXXXXXX

* If the allocated discharge of indebtedness exceeds the amount of PNOL that is available and the member has post allocation net operating loss carry-

over in Form 500U Section B, carry the remaining balance to line 5 of Section B (see instructions).

Section B – Post Allocation Net Operating Losses (NOLs) For Tax Years Ending ON AND AFTER July 31, 2019

Group Combined

1. Post Allocation Net Operating Loss Carryover – Enter the amount from Form 500U-PA, line 22 .............. 1. XXXXXXXXXXXXXX

2. Enter the portion of line 1 previously deducted (see instructions) ................................................................... 2. XXXXXXXXXXXXXX

3. Enter the portion of line 1 that expired (after 20 privilege periods) .................................................................... 3. XXXXXXXXXXXXXX

(see instructions) .......................................................................................................................................

4. Enter the amount of any adjustments required under provisions of the federal Internal Revenue Code 4. XXXXXXXXXXXXXX

5. Post Allocation NOL Available – Subtract lines 2, 3, and 4, from line 1 (if zero or less, enter zero) (see

instructions) (include rider detailing any adjustments)................................................................................ 5. XXXXXXXXXXXXXX

6. Enter the amount from Schedule A, Section II, Part II, line 23 ....................................................................... 6. XXXXXXXXXXXXXX

7. Enter the PNOL claimed on Section A, line 7 .............................................................................................. 7. XXXXXXXXXXXXXX

8. Taxable Net Income subject to Post-Allocation Net Operating Loss (NOL) deduction – Subtract line 7

from line 6 (if zero or less, enter zero and on line 2 of section 3 and stop here) ........................................ 8. XXXXXXXXXXXXXX

9. Portion of line 5 generated for privilege periods ending after July 31, 2019, but beginning before

August 1, 2023 ........................................................................................................................................... 9. XXXXXXXXXXXXXX

10. Portion of line 5 generated for privilege periods beginning after July 31, 2023 .......................................... 10. XXXXXXXXXXXXXX

11. Subtract line 9 from line 8 ........................................................................................................................... 11. XXXXXXXXXXXXXX

12. Enter 80% of line 11 ................................................................................................................................... 12. XXXXXXXXXXXXXX

13. Add line 9 to the lesser of line 10 or line 12................................................................................................ 13. XXXXXXXXXXXXXX

14. Amount of combined group’s current year NOL deduction. Enter the lesser of line 8 or line 13 here and

on Section C, line 2 .................................................................................................................................... 14. XXXXXXXXXXXXXX

Section C – Total Net Operating Loss Deduction

1. Current tax year’s PNOL deduction (from Section A, line 7) ...................................................................... 1. XXXXXXXXXXXXXX

2. Current tax year’s NOL deduction (from Section B, line 14) ....................................................................... 2. XXXXXXXXXXXXXX

3. Total Net Operating Losses used in current tax year – Add lines 1 and 2. Enter here and on Schedule A,

Section II, Part II, line 24, column (c).......................................................................................................... 3. XXXXXXXXXXXXXX

|