Enlarge image

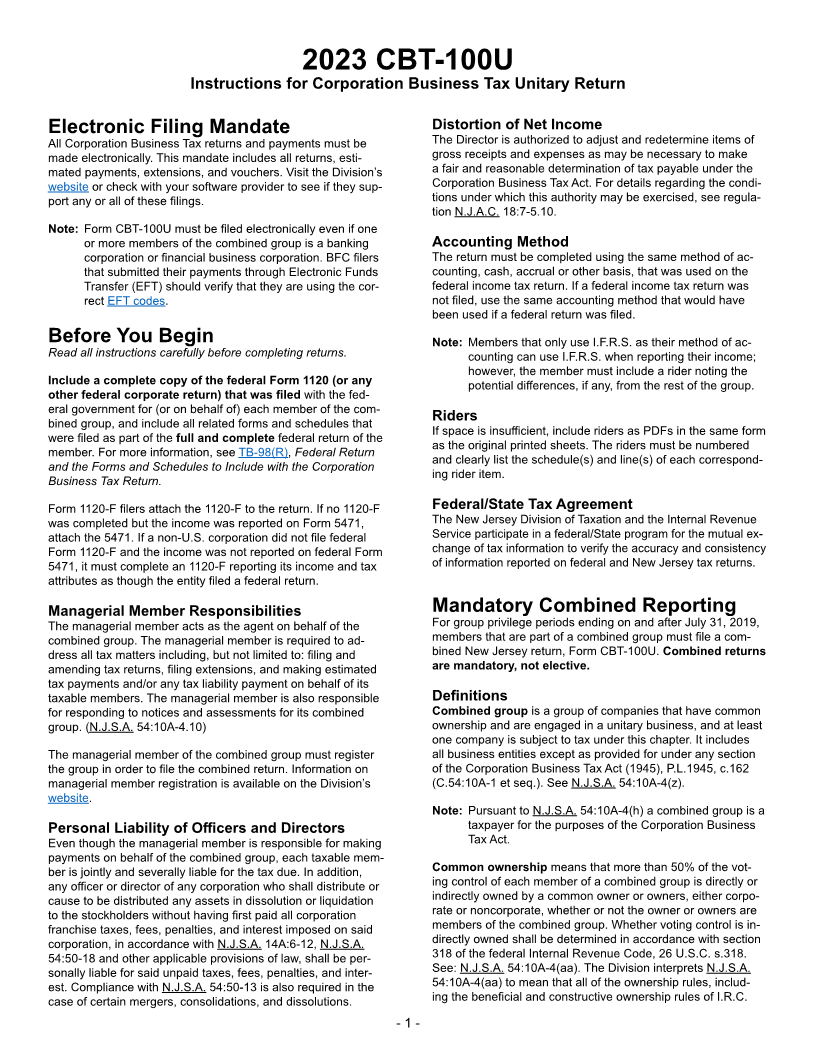

2023 CBT-100U

Instructions for Corporation Business Tax Unitary Return

Electronic Filing Mandate Distortion of Net Income

All Corporation Business Tax returns and payments must be The Director is authorized to adjust and redetermine items of

made electronically. This mandate includes all returns, esti- gross receipts and expenses as may be necessary to make

mated payments, extensions, and vouchers. Visit the Division’s a fair and reasonable determination of tax payable under the

website or check with your software provider to see if they sup- Corporation Business Tax Act. For details regarding the condi-

port any or all of these filings. tions under which this authority may be exercised, see regula-

tion N.J.A.C. 18:7-5.10.

Note: Form CBT-100U must be filed electronically even if one

or more members of the combined group is a banking Accounting Method

corporation or financial business corporation. BFC filers The return must be completed using the same method of ac-

that submitted their payments through Electronic Funds counting, cash, accrual or other basis, that was used on the

Transfer (EFT) should verify that they are using the cor- federal income tax return. If a federal income tax return was

rect EFT codes. not filed, use the same accounting method that would have

been used if a federal return was filed.

Before You Begin Note: Members that only use I.F.R.S. as their method of ac-

Read all instructions carefully before completing returns. counting can use I.F.R.S. when reporting their income;

however, the member must include a rider noting the

Include a complete copy of the federal Form 1120 (or any potential differences, if any, from the rest of the group.

other federal corporate return) that was filed with the fed-

eral government for (or on behalf of) each member of the com-

bined group, and include all related forms and schedules that Riders

If space is insufficient, include riders as PDFs in the same form

were filed as part of the full and complete federal return of the

as the original printed sheets. The riders must be numbered

member. For more information, see TB-98(R), Federal Return

and clearly list the schedule(s) and line(s) of each correspond-

and the Forms and Schedules to Include with the Corporation

ing rider item.

Business Tax Return.

Form 1120-F filers attach the 1120-F to the return. If no 1120-F Federal/State Tax Agreement

was completed but the income was reported on Form 5471, The New Jersey Division of Taxation and the Internal Revenue

attach the 5471. If a non-U.S. corporation did not file federal Service participate in a federal/State program for the mutual ex-

Form 1120-F and the income was not reported on federal Form change of tax information to verify the accuracy and consistency

5471, it must complete an 1120-F reporting its income and tax of information reported on federal and New Jersey tax returns.

attributes as though the entity filed a federal return.

Managerial Member Responsibilities Mandatory Combined Reporting

The managerial member acts as the agent on behalf of the For group privilege periods ending on and after July 31, 2019,

combined group. The managerial member is required to ad- members that are part of a combined group must file a com-

dress all tax matters including, but not limited to: filing and bined New Jersey return, Form CBT-100U. Combined returns

amending tax returns, filing extensions, and making estimated are mandatory, not elective.

tax payments and/or any tax liability payment on behalf of its

taxable members. The managerial member is also responsible Definitions

for responding to notices and assessments for its combined Combined group is a group of companies that have common

group. (N.J.S.A. 54:10A-4.10) ownership and are engaged in a unitary business, and at least

one company is subject to tax under this chapter. It includes

The managerial member of the combined group must register all business entities except as provided for under any section

the group in order to file the combined return. Information on of the Corporation Business Tax Act (1945), P.L.1945, c.162

managerial member registration is available on the Division’s (C.54:10A-1 et seq.). See N.J.S.A. 54:10A-4(z).

website.

Note: Pursuant to N.J.S.A. 54:10A-4(h) a combined group is a

Personal Liability of Officers and Directors taxpayer for the purposes of the Corporation Business

Even though the managerial member is responsible for making Tax Act.

payments on behalf of the combined group, each taxable mem-

ber is jointly and severally liable for the tax due. In addition, Common ownership means that more than 50% of the vot-

any officer or director of any corporation who shall distribute or ing control of each member of a combined group is directly or

cause to be distributed any assets in dissolution or liquidation indirectly owned by a common owner or owners, either corpo-

to the stockholders without having first paid all corporation rate or noncorporate, whether or not the owner or owners are

franchise taxes, fees, penalties, and interest imposed on said members of the combined group. Whether voting control is in-

corporation, in accordance with N.J.S.A. 14A:6-12, N.J.S.A. directly owned shall be determined in accordance with section

54:50-18 and other applicable provisions of law, shall be per- 318 of the federal Internal Revenue Code, 26 U.S.C. s.318.

sonally liable for said unpaid taxes, fees, penalties, and inter- See: N.J.S.A. 54:10A-4(aa). The Division interprets N.J.S.A.

est. Compliance with N.J.S.A. 54:50-13 is also required in the 54:10A-4(aa) to mean that all of the ownership rules, includ-

case of certain mergers, consolidations, and dissolutions. ing the beneficial and constructive ownership rules of I.R.C.

- 1 -