Enlarge image

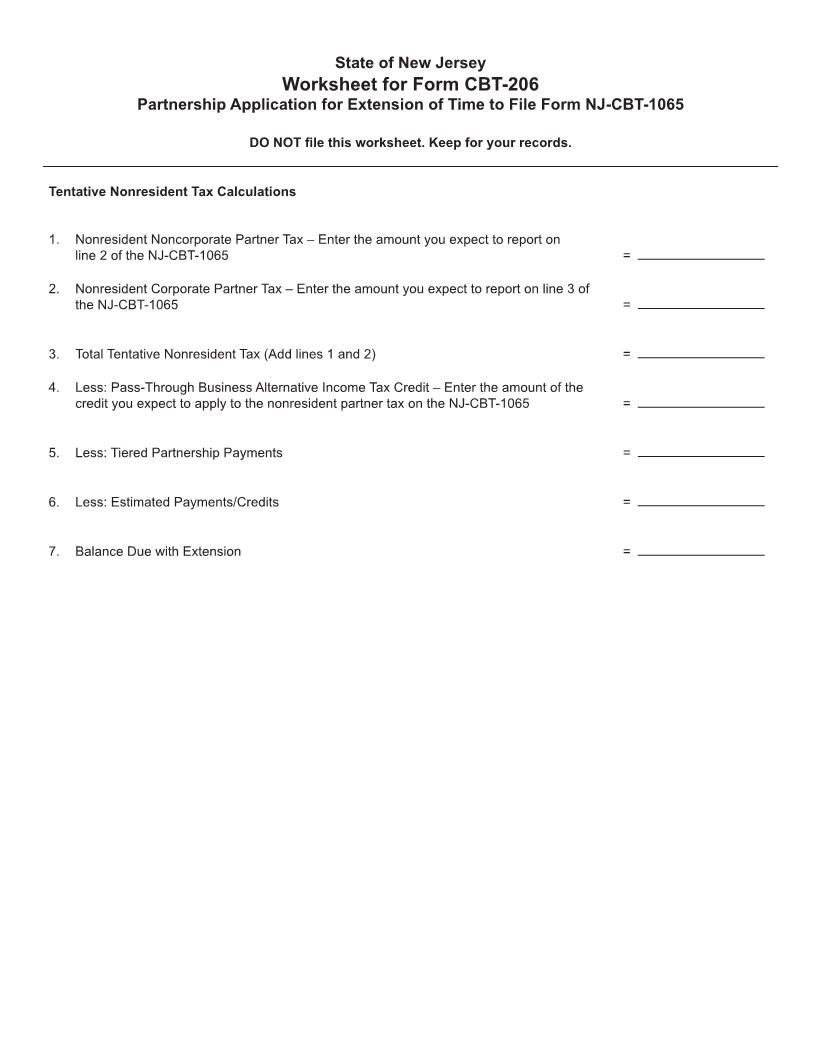

State of New Jersey

Worksheet for Form CBT-206

Partnership Application for Extension of Time to File Form NJ-CBT-1065

DO NOT file this worksheet. Keep for your records.

Tentative Nonresident Tax Calculations

1. Nonresident Noncorporate Partner Tax – Enter the amount you expect to report on

line 2 of the NJ-CBT-1065 =

2. Nonresident Corporate Partner Tax – Enter the amount you expect to report on line 3 of

the NJ-CBT-1065 =

3. Total Tentative Nonresident Tax (Add lines 1 and 2) =

4. Less: Pass-Through Business Alternative Income Tax Credit – Enter the amount of the

credit you expect to apply to the nonresident partner tax on the NJ-CBT-1065 =

5. Less: Tiered Partnership Payments =

6. Less: Estimated Payments/Credits =

7. Balance Due with Extension =