- 2 -

Enlarge image

|

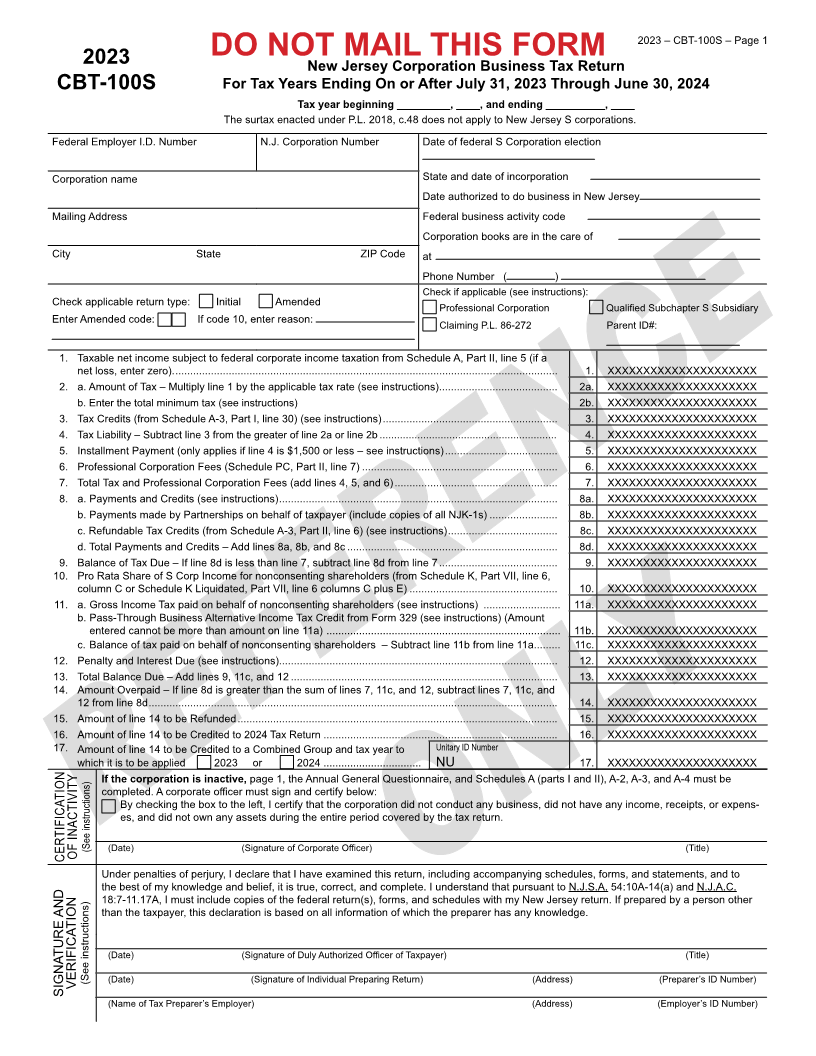

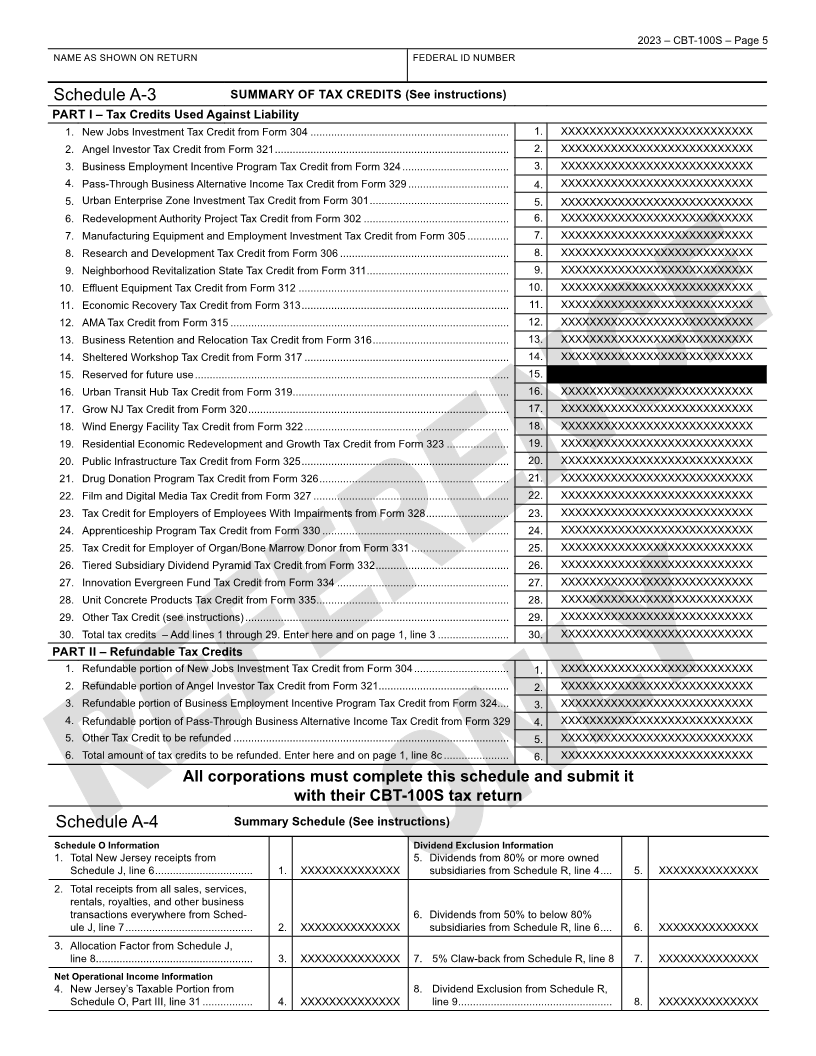

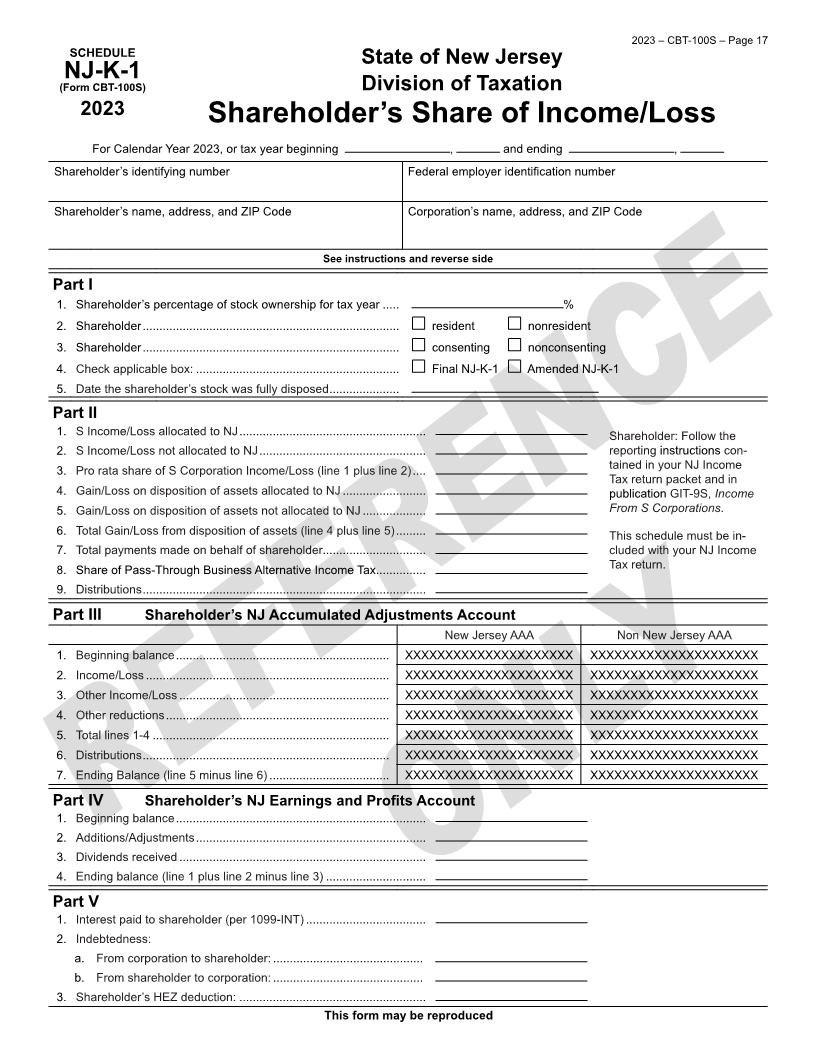

2023 – CBT-100S – Page 1

2023 DO NOT MAIL THIS FORM

New Jersey Corporation Business Tax Return

CBT-100S For Tax Years Ending On or After July 31, 2023 Through June 30, 2024

Tax year beginning _________, ____, and ending __________, ____

The surtax enacted under P.L. 2018, c.48 does not apply to New Jersey S corporations.

Federal Employer I.D. Number N.J. Corporation Number Date of federal S Corporation election

Corporation name State and date of incorporation

Date authorized to do business in New Jersey

Mailing Address Federal business activity code

Corporation books are in the care of

City State ZIP Code at

Phone Number ( )

Check if applicable (see instructions):

Check applicable return type: Initial Amended Professional Corporation Qualified Subchapter S Subsidiary

Enter Amended code: If code 10, enter reason: Claiming P.L. 86-272 Parent ID#:

1. Taxable net income subject to federal corporate income taxation from Schedule A, Part II, line 5 (if a

net loss, enter zero). ................................................................................................................................. 1. XXXXXXXXXXXXXXXXXXXXX

2. a. Amount of Tax – Multiply line 1 by the applicable tax rate (see instructions) ........................................ 2a. XXXXXXXXXXXXXXXXXXXXX

b. Enter the total minimum tax (see instructions) 2b. XXXXXXXXXXXXXXXXXXXXX

3. Tax Credits (from Schedule A-3, Part I, line 30) (see instructions) ........................................................... 3. XXXXXXXXXXXXXXXXXXXXX

4. Tax Liability – Subtract line 3 from the greater of line 2a or line 2b ............................................................. 4. XXXXXXXXXXXXXXXXXXXXX

5. Installment Payment (only applies if line 4 is $1,500 or less – see instructions) ...................................... 5. XXXXXXXXXXXXXXXXXXXXX

6. Professional Corporation Fees (Schedule PC, Part II, line 7) .................................................................. 6. XXXXXXXXXXXXXXXXXXXXX

7. Total Tax and Professional Corporation Fees (add lines 4, 5, and 6) ....................................................... 7. XXXXXXXXXXXXXXXXXXXXX

8. a. Payments and Credits (see instructions) .............................................................................................. 8a. XXXXXXXXXXXXXXXXXXXXX

b. Payments made by Partnerships on behalf of taxpayer (include copies of all NJK-1s) ....................... 8b. XXXXXXXXXXXXXXXXXXXXX

c. Refundable Tax Credits (from Schedule A-3, Part II, line 6) (see instructions) ..................................... 8c. XXXXXXXXXXXXXXXXXXXXX

d. Total Payments and Credits – Add lines 8a, 8b, and 8c ....................................................................... 8d. XXXXXXXXXXXXXXXXXXXXX

9. Balance of Tax Due – If line 8d is less than line 7, subtract line 8d from line 7 ........................................ 9. XXXXXXXXXXXXXXXXXXXXX

10. Pro Rata Share of S Corp Income for nonconsenting shareholders (from Schedule K, Part VII, line 6,

column C or Schedule K Liquidated, Part VII, line 6 columns C plus E) .................................................. 10. XXXXXXXXXXXXXXXXXXXXX

11. a. Gross Income Tax paid on behalf of nonconsenting shareholders (see instructions) .......................... 11a. XXXXXXXXXXXXXXXXXXXXX

b. Pass-Through Business Alternative Income Tax Credit from Form 329 (see instructions) (Amount

entered cannot be more than amount on line 11a) ............................................................................... 11b. XXXXXXXXXXXXXXXXXXXXX

c. Balance of tax paid on behalf of nonconsenting shareholders – Subtract line 11b from line 11a ......... 11c. XXXXXXXXXXXXXXXXXXXXX

12. Penalty and Interest Due (see instructions).............................................................................................. 12. XXXXXXXXXXXXXXXXXXXXX

13. Total Balance Due – Add lines 9, 11c, and 12 .......................................................................................... 13. XXXXXXXXXXXXXXXXXXXXX

14. Amount Overpaid – If line 8d is greater than the sum of lines 7, 11c, and 12, subtract lines 7, 11c, and

12 from line 8d .......................................................................................................................................... 14. XXXXXXXXXXXXXXXXXXXXX

15. Amount of line 14 to be Refunded ............................................................................................................ 15. XXXXXXXXXXXXXXXXXXXXX

16. Amount of line 14 to be Credited to 2024 Tax Return ............................................................................... 16. XXXXXXXXXXXXXXXXXXXXX

17. Amount of line 14 to be Credited to a Combined Group and tax year to Unitary ID Number

which it is to be applied 2023 or 2024 ................................. NU 17. XXXXXXXXXXXXXXXXXXXXX

If the corporation is inactive, page 1, the Annual General Questionnaire, and Schedules A (parts I and II), A-2, A-3, and A-4 must be

completed. A corporate officer must sign and certify below:

By checking the box to the left, I certify that the corporation did not conduct any business, did not have any income, receipts, or expens-

es, and did not own any assets during the entire period covered by the tax return.

(See instructions)

CERTIFICATION OF INACTIVITY (Date) (Signature of Corporate Officer) (Title)

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules, forms, and statements, and to

the best of my knowledge and belief, it is true, correct, and complete. I understand that pursuant to N.J.S.A. 54:10A-14(a) and N.J.A.C.

18:7-11.17A, I must include copies of the federal return(s), forms, and schedules with my New Jersey return. If prepared by a person other

than the taxpayer, this declaration is based on all information of which the preparer has any knowledge.

(Date) (Signature of Duly Authorized Officer of Taxpayer) (Title)

VERIFICATION (See instructions) (Date) (Signature of Individual Preparing Return) (Address) (Preparer’s ID Number)

SIGNATURE AND

(Name of Tax Preparer’s Employer) (Address) (Employer’s ID Number)

|