Enlarge image

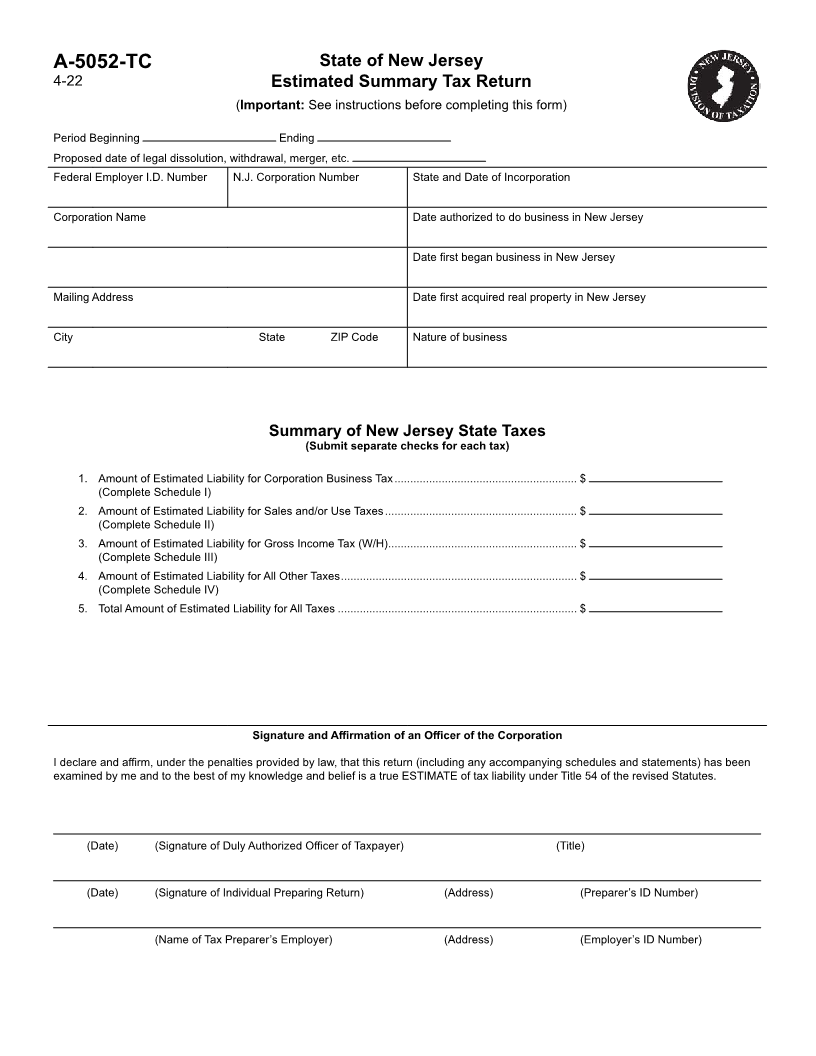

A-5052-TC State of New Jersey

4-22 Estimated Summary Tax Return

(Important: See instructions before completing this form)

Period Beginning Ending

Proposed date of legal dissolution, withdrawal, merger, etc.

Federal Employer I.D. Number N.J. Corporation Number State and Date of Incorporation

Corporation Name Date authorized to do business in New Jersey

Date first began business in New Jersey

Mailing Address Date first acquired real property in New Jersey

City State ZIP Code Nature of business

Summary of New Jersey State Taxes

(Submit separate checks for each tax)

1. Amount of Estimated Liability for Corporation Business Tax .......................................................... $

(Complete Schedule I)

2. Amount of Estimated Liability for Sales and/or Use Taxes ............................................................. $

(Complete Schedule II)

3. Amount of Estimated Liability for Gross Income Tax (W/H) ............................................................ $

(Complete Schedule III)

4. Amount of Estimated Liability for All Other Taxes ........................................................................... $

(Complete Schedule IV)

5. Total Amount of Estimated Liability for All Taxes ............................................................................ $

Signature and Affirmation of an Officer of the Corporation

I declare and affirm, under the penalties provided by law, that this return (including any accompanying schedules and statements) has been

examined by me and to the best of my knowledge and belief is a true ESTIMATE of tax liability under Title 54 of the revised Statutes.

(Date) (Signature of Duly Authorized Officer of Taxpayer) (Title)

(Date) (Signature of Individual Preparing Return) (Address) (Preparer’s ID Number)

(Name of Tax Preparer’s Employer) (Address) (Employer’s ID Number)