Enlarge image

2023 CBT-100

General Instructions for New Jersey Corporation Business Tax Return and Related Forms

Electronic Filing Mandate Distortion of Net Income

All taxpayers and tax preparers must file Corporation Business The Director is authorized to adjust and redetermine items of

Tax returns and make payments electronically. This mandate gross receipts and expenses as may be necessary to make

includes all returns, estimated payments, extensions, and a fair and reasonable determination of tax payable under the

vouchers. Visit the Division’s website or check with your soft- Corporation Business Tax Act. For details regarding the condi-

ware provider to see if they support any or all of these filings. tions under which this authority may be exercised, see regula-

tion N.J.A.C. 18:7-5.10.

Note: For privilege periods ending on and after July 31, 2023,

banking corporations and financial business corpora- Accounting Method

tions that are separate filers will use Form CBT-100 to The return must be completed using the same method of ac-

file their returns (previously these entities may have filed counting, cash, accrual or other basis, that was employed in

Form BFC-1). This also means that these filers are now the taxpayer’s federal income tax return.

subject to the electronic filing requirements for all tax fil-

ings and payments. BFC filers that submitted their pay- Federal/State Tax Agreement

ments through Electronic Funds Transfer (EFT) should The New Jersey Division of Taxation and the Internal Revenue

verify that they are using the correct EFT codes. Service participate in a federal/State program for the mutual

exchange of tax information to verify the accuracy and consis-

To file and pay the annual report electronically, visit the Division tency of information reported on federal and New Jersey tax

of Revenue and Enterprise Services’ website. returns.

Form BFC-1 has been discontinued. Schedule A-7

and Schedule L have also been discontinued. For Corporations Required to File

In general, every corporation existing under the laws of the

privilege periods ending on and after July 31, 2023, State of New Jersey is required to file a Corporation Business

banking corporations and financial business Tax return.

corporations that are separate filers must use Form CBT-

100. In addition, any ancillary forms (e.g., Form BFC-200T) In addition, a return must be filed by every foreign corporation

have also been discontinued. The corresponding Corporation that:

Business Tax form will be used for all prospective filings.

1. Holds a general certificate of authority to do business in

this State issued by the Secretary of State; or

2. Holds a certificate, license, or other authorization issued

Before You Begin by any other department or agency of this State authoriz-

Read all instructions carefully before completing returns. ing the company to engage in corporate activity within this

State; or

Include a complete copy of the federal Form 1120 (or any

other federal corporate return filed) and all related forms 3. Does business in this State; or

and schedules. See Technical Bulletin, TB-98(R), Federal 4. Employs or owns capital within this State; or

Return and the Forms and Schedules to Include with the Cor- 5. Employs or owns property in this State; or

poration Business Tax Return. Corporations that are part of a

federal consolidated group must include a federal income tax 6. Maintains an office in this State; or

return and the consolidating schedules showing the income 7. Derives receipts within this State that meet the thresholds

statement, balance sheets, and all other supporting information for bright-line economic nexus; or

for the taxpayer. 8. Engages in contacts within this State; or

Form 1120-F filers attach the 1120-F to the return. If no 1120-F 9. Maintains a stock of goods in New Jersey and makes de-

was completed but the income was reported on Form 5471, liveries to customers from such stock.

attach the 5471. If a non-U.S. corporation did not file federal

A foreign corporation that is a partner of a New Jersey part-

Form 1120-F and the income was not reported on federal Form

nership is deemed subject to tax in the State and must file a

5471, it must complete an 1120-F reporting its income and tax

return.

attributes as though the entity filed a federal return.

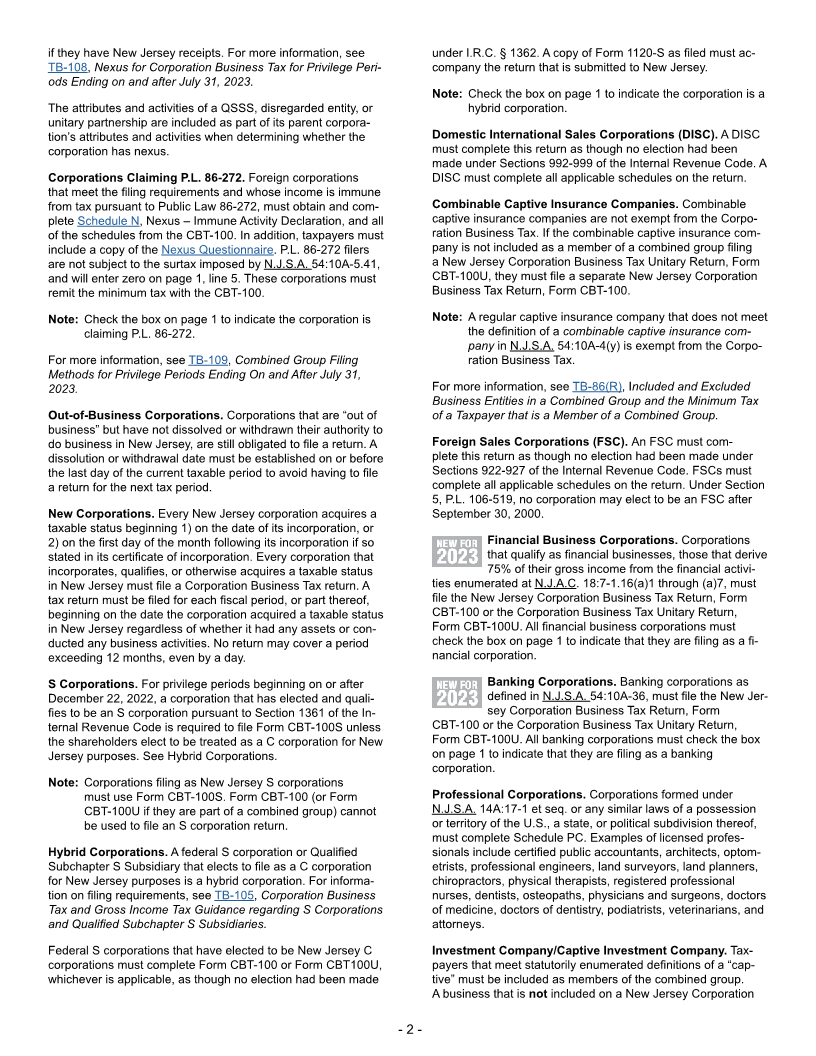

Nexus. For privilege periods ending on and after

Personal Liability of Officers and Directors July 31, 2023, corporations deriving receipts from

Any officer or director of any corporation who shall distribute or sources in New Jersey will be deemed to have

cause to be distributed any assets in dissolution or liquidation bright-line economic nexus if during the corporation’s tax year:

to the stockholders without having first paid all corporation

franchise taxes, fees, penalties and interest imposed on said • The receipts derived from New Jersey sources are more

corporation, in accordance with N.J.S.A. 14A:6-12, N.J.S.A. than $100,000, or

54:50-18 and other applicable provisions of law, shall be per-

sonally liable for said unpaid taxes, fees, penalties, and inter- • 200 or more separate transactions are delivered to custom-

est. Compliance with N.J.S.A. 54:50-13 is also required in the ers in New Jersey.

case of certain mergers, consolidations, and dissolutions. Corporations that do not meet either threshold above, and

do not create nexus in another way, do not have nexus even

- 1 -