Enlarge image

CAUTION

These forms are for reference only.

DO NOT mail to the Division of Taxation.

Form CBT-100 and all related forms and

schedules must be filed electronically. See

our website for more information.

Enlarge image |

CAUTION

These forms are for reference only.

DO NOT mail to the Division of Taxation.

Form CBT-100 and all related forms and

schedules must be filed electronically. See

our website for more information.

|

Enlarge image |

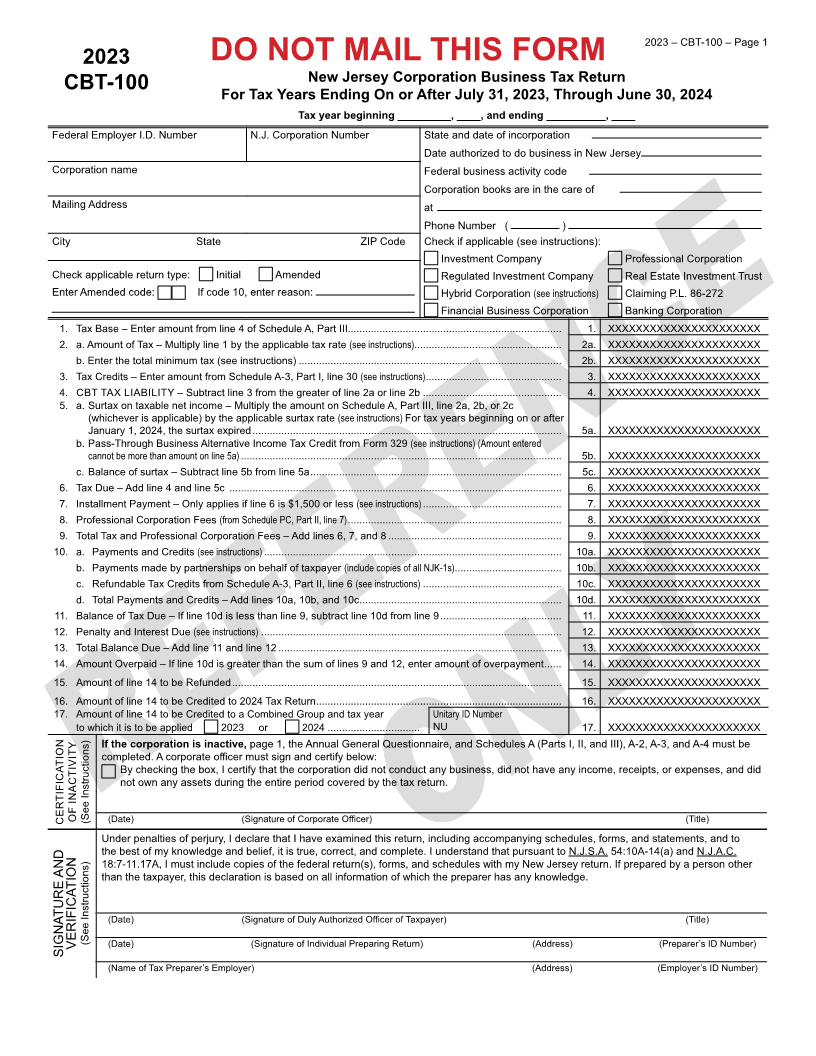

2023 – CBT-100 – Page 1

2023 DO NOT MAIL THIS FORM

New Jersey Corporation Business Tax Return

CBT-100

For Tax Years Ending On or After July 31, 2023, Through June 30, 2024

Tax year beginning _________, ____, and ending __________, ____

Federal Employer I.D. Number N.J. Corporation Number State and date of incorporation

Date authorized to do business in New Jersey

Corporation name Federal business activity code

Corporation books are in the care of

Mailing Address at

Phone Number ( )

City State ZIP Code Check if applicable (see instructions):

Investment Company Professional Corporation

Check applicable return type: Initial Amended Regulated Investment Company Real Estate Investment Trust

Enter Amended code: If code 10, enter reason: Hybrid Corporation (see instructions) Claiming P.L. 86-272

Financial Business Corporation Banking Corporation

1. Tax Base – Enter amount from line 4 of Schedule A, Part III.......................................................................... 1. XXXXXXXXXXXXXXXXXXXXXX

2. a. Amount of Tax – Multiply line 1 by the applicable tax rate (see instructions)................................................... 2a. XXXXXXXXXXXXXXXXXXXXXX

b. Enter the total minimum tax (see instructions) ........................................................................................... 2b. XXXXXXXXXXXXXXXXXXXXXX

3. Tax Credits – Enter amount from Schedule A-3, Part I, line 30 (see instructions) ............................................... 3. XXXXXXXXXXXXXXXXXXXXXX

4. CBT TAX LIABILITY – Subtract line 3 from the greater of line 2a or line 2b ................................................ 4. XXXXXXXXXXXXXXXXXXXXXX

5. a. Surtax on taxable net income – Multiply the amount on Schedule A, Part III, line 2a, 2b, or 2c

(whichever is applicable) by the applicable surtax rate (see instructions) For tax years beginning on or after

January 1, 2024, the surtax expired ........................................................................................................... 5a. XXXXXXXXXXXXXXXXXXXXXX

b. Pass-Through Business Alternative Income Tax Credit from Form 329 (see instructions) (Amount entered

cannot be more than amount on line 5a) ............................................................................................................... 5b. XXXXXXXXXXXXXXXXXXXXXX

c. Balance of surtax – Subtract line 5b from line 5a ....................................................................................... 5c. XXXXXXXXXXXXXXXXXXXXXX

6. Tax Due – Add line 4 and line 5c ................................................................................................................... 6. XXXXXXXXXXXXXXXXXXXXXX

7. Installment Payment – Only applies if line 6 is $1,500 or less (see instructions) ................................................ 7. XXXXXXXXXXXXXXXXXXXXXX

8. Professional Corporation Fees (from Schedule PC, Part II, line 7) .......................................................................... 8. XXXXXXXXXXXXXXXXXXXXXX

9. Total Tax and Professional Corporation Fees – Add lines 6, 7, and 8 ............................................................ 9. XXXXXXXXXXXXXXXXXXXXXX

10. a. Payments and Credits (see instructions) ....................................................................................................... 10a. XXXXXXXXXXXXXXXXXXXXXX

b. Payments made by partnerships on behalf of taxpayer (include copies of all NJK-1s) ..................................... 10b. XXXXXXXXXXXXXXXXXXXXXX

c. Refundable Tax Credits from Schedule A-3, Part II, line 6 (see instructions) ................................................ 10c. XXXXXXXXXXXXXXXXXXXXXX

d. Total Payments and Credits – Add lines 10a, 10b, and 10c ...................................................................... 10d. XXXXXXXXXXXXXXXXXXXXXX

11. Balance of Tax Due – If line 10d is less than line 9, subtract line 10d from line 9 .......................................... 11. XXXXXXXXXXXXXXXXXXXXXX

12. Penalty and Interest Due (see instructions) ........................................................................................................ 12. XXXXXXXXXXXXXXXXXXXXXX

13. Total Balance Due – Add line 11 and line 12 .................................................................................................. 13. XXXXXXXXXXXXXXXXXXXXXX

14. Amount Overpaid – If line 10d is greater than the sum of lines 9 and 12, enter amount of overpayment ...... 14. XXXXXXXXXXXXXXXXXXXXXX

15. Amount of line 14 to be Refunded .................................................................................................................. 15. XXXXXXXXXXXXXXXXXXXXXX

16. Amount of line 14 to be Credited to 2024 Tax Return ..................................................................................... 16. XXXXXXXXXXXXXXXXXXXXXX

17. Amount of line 14 to be Credited to a Combined Group and tax year Unitary ID Number

to which it is to be applied 2023 or 2024 ................................ NU 17. XXXXXXXXXXXXXXXXXXXXXX

If the corporation is inactive, page 1, the Annual General Questionnaire, and Schedules A (Parts I, II, and III), A-2, A-3, and A-4 must be

completed. A corporate officer must sign and certify below:

By checking the box, I certify that the corporation did not conduct any business, did not have any income, receipts, or expenses, and did

not own any assets during the entire period covered by the tax return.

CERTIFICATION OF INACTIVITY (See Instructions) (Date) (Signature of Corporate Officer) (Title)

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules, forms, and statements, and to

the best of my knowledge and belief, it is true, correct, and complete. I understand that pursuant to N.J.S.A. 54:10A-14(a) and N.J.A.C.

18:7-11.17A, I must include copies of the federal return(s), forms, and schedules with my New Jersey return. If prepared by a person other

than the taxpayer, this declaration is based on all information of which the preparer has any knowledge.

(Date) (Signature of Duly Authorized Officer of Taxpayer) (Title)

VERIFICATION (See Instructions) (Date) (Signature of Individual Preparing Return) (Address) (Preparer’s ID Number)

SIGNATURE AND

(Name of Tax Preparer’s Employer) (Address) (Employer’s ID Number)

|

Enlarge image |

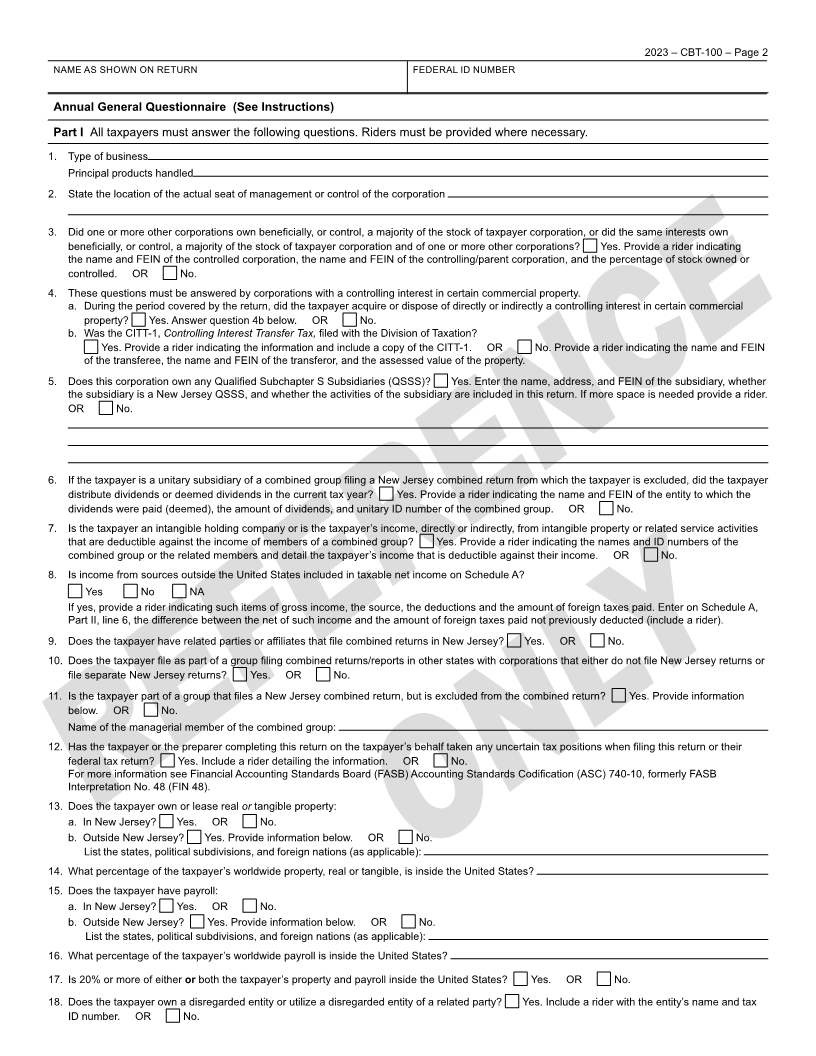

2023 – CBT-100 – Page 2

NAME AS SHOWN ON RETURN FEDERAL ID NUMBER

Annual General Questionnaire (See Instructions)

Part I All taxpayers must answer the following questions. Riders must be provided where necessary.

1. Type of business

Principal products handled

2. State the location of the actual seat of management or control of the corporation

3. Did one or more other corporations own beneficially, or control, a majority of the stock of taxpayer corporation, or did the same interests own

beneficially, or control, a majority of the stock of taxpayer corporation and of one or more other corporations? Yes. Provide a rider indicating

the name and FEIN of the controlled corporation, the name and FEIN of the controlling/parent corporation, and the percentage of stock owned or

controlled. OR No.

4. These questions must be answered by corporations with a controlling interest in certain commercial property.

a. During the period covered by the return, did the taxpayer acquire or dispose of directly or indirectly a controlling interest in certain commercial

property? Yes. Answer question 4b below. OR No.

b. Was the CITT-1, Controlling Interest Transfer Tax, filed with the Division of Taxation?

Yes. Provide a rider indicating the information and include a copy of the CITT-1. OR No. Provide a rider indicating the name and FEIN

of the transferee, the name and FEIN of the transferor, and the assessed value of the property.

5. Does this corporation own any Qualified Subchapter S Subsidiaries (QSSS)? Yes. Enter the name, address, and FEIN of the subsidiary, whether

the subsidiary is a New Jersey QSSS, and whether the activities of the subsidiary are included in this return. If more space is needed provide a rider.

OR No.

6. If the taxpayer is a unitary subsidiary of a combined group filing a New Jersey combined return from which the taxpayer is excluded, did the taxpayer

distribute dividends or deemed dividends in the current tax year? Yes. Provide a rider indicating the name and FEIN of the entity to which the

dividends were paid (deemed), the amount of dividends, and unitary ID number of the combined group. OR No.

7. Is the taxpayer an intangible holding company or is the taxpayer’s income, directly or indirectly, from intangible property or related service activities

that are deductible against the income of members of a combined group? Yes. Provide a rider indicating the names and ID numbers of the

combined group or the related members and detail the taxpayer’s income that is deductible against their income. OR No.

8. Is income from sources outside the United States included in taxable net income on Schedule A?

Yes No NA

If yes, provide a rider indicating such items of gross income, the source, the deductions and the amount of foreign taxes paid. Enter on Schedule A,

Part II, line 6, the difference between the net of such income and the amount of foreign taxes paid not previously deducted (include a rider).

9. Does the taxpayer have related parties or affiliates that file combined returns in New Jersey? Yes. OR No.

10. Does the taxpayer file as part of a group filing combined returns/reports in other states with corporations that either do not file New Jersey returns or

file separate New Jersey returns? Yes. OR No.

11. Is the taxpayer part of a group that files a New Jersey combined return, but is excluded from the combined return? Yes. Provide information

below. OR No.

Name of the managerial member of the combined group:

12. Has the taxpayer or the preparer completing this return on the taxpayer’s behalf taken any uncertain tax positions when filing this return or their

federal tax return? Yes. Include a rider detailing the information. OR No.

For more information see Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 740-10, formerly FASB

Interpretation No. 48 (FIN 48).

13. Does the taxpayer own or lease real ortangible property:

a. In New Jersey? Yes. OR No.

b. Outside New Jersey? Yes. Provide information below. OR No.

List the states, political subdivisions, and foreign nations (as applicable):

14. What percentage of the taxpayer’s worldwide property, real or tangible, is inside the United States?

15. Does the taxpayer have payroll:

a. In New Jersey? Yes. OR No.

b. Outside New Jersey? Yes. Provide information below. OR No.

List the states, political subdivisions, and foreign nations (as applicable):

16. What percentage of the taxpayer’s worldwide payroll is inside the United States?

17. Is 20% or more of either orboth the taxpayer’s property and payroll inside the United States? Yes. OR No.

18. Does the taxpayer own a disregarded entity or utilize a disregarded entity of a related party? Yes. Include a rider with the entity’s name and tax

ID number. OR No.

|

Enlarge image |

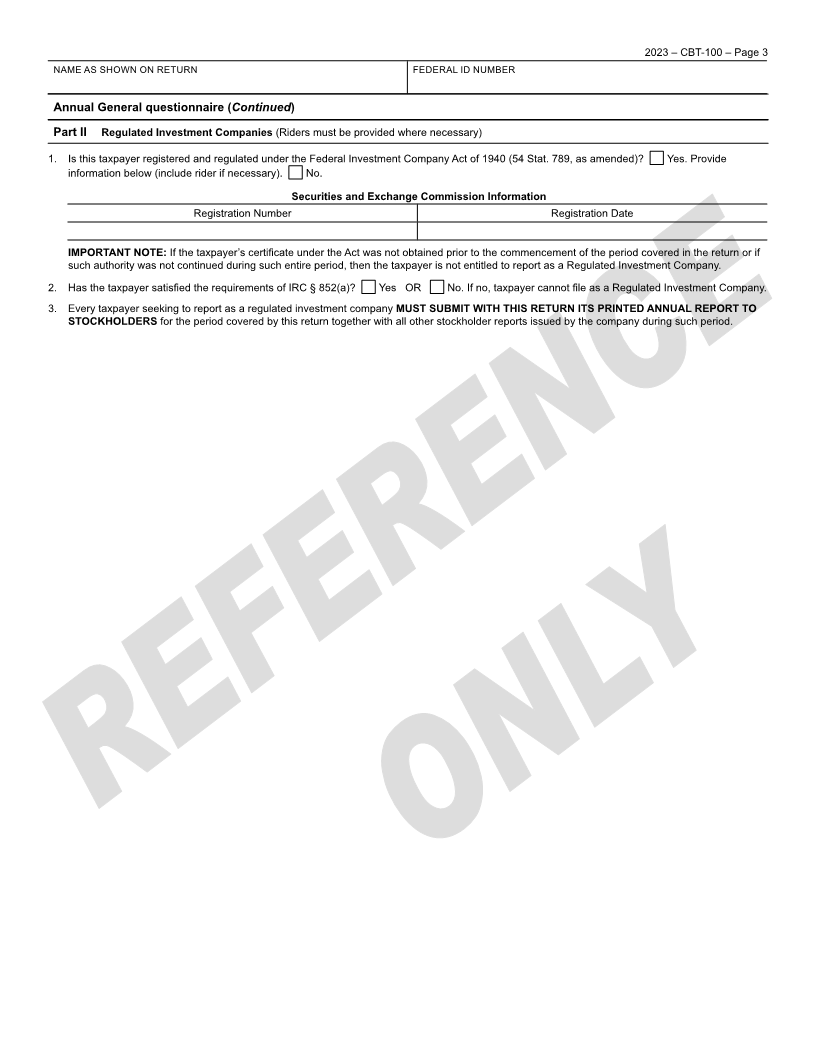

2023 – CBT-100 – Page 3

NAME AS SHOWN ON RETURN FEDERAL ID NUMBER

Annual General questionnaire (Continued)

Part II Regulated Investment Companies (Riders must be provided where necessary)

1. Is this taxpayer registered and regulated under the Federal Investment Company Act of 1940 (54 Stat. 789, as amended)? Yes. Provide

information below (include rider if necessary). No.

Securities and Exchange Commission Information

Registration Number Registration Date

IMPORTANT NOTE: If the taxpayer’s certificate under the Act was not obtained prior to the commencement of the period covered in the return or if

such authority was not continued during such entire period, then the taxpayer is not entitled to report as a Regulated Investment Company.

2. Has the taxpayer satisfied the requirements of IRC § 852(a)? Yes OR No. If no, taxpayer cannot file as a Regulated Investment Company.

3. Every taxpayer seeking to report as a regulated investment company MUST SUBMIT WITH THIS RETURN ITS PRINTED ANNUAL REPORT TO

STOCKHOLDERS for the period covered by this return together with all other stockholder reports issued by the company during such period.

|

Enlarge image |

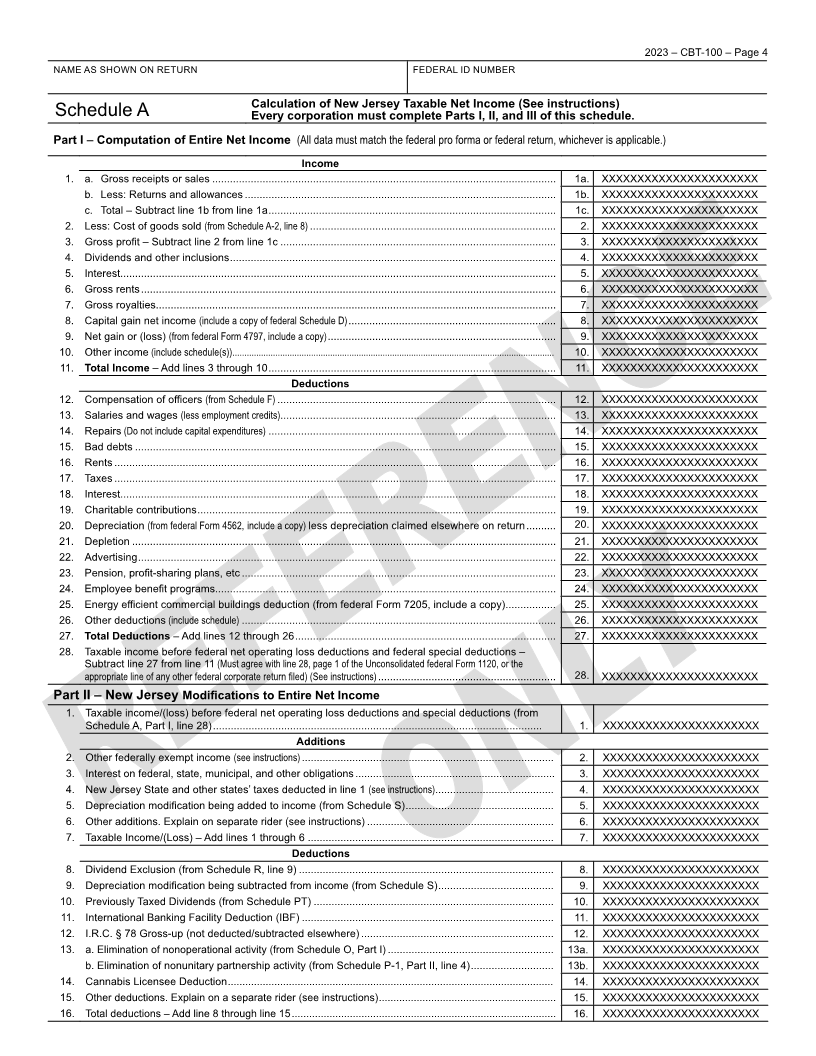

2023 – CBT-100 – Page 4

NAME AS SHOWN ON RETURN FEDERAL ID NUMBER

Calculation of New Jersey Taxable Net Income (See instructions)

Schedule A Every corporation must complete Parts I, II, and III of this schedule.

Part I – Computation of Entire Net Income (All data must match the federal pro forma or federal return, whichever is applicable.)

Income

1. a. Gross receipts or sales .................................................................................................................... 1a. XXXXXXXXXXXXXXXXXXXXXX

b. Less: Returns and allowances ......................................................................................................... 1b. XXXXXXXXXXXXXXXXXXXXXX

c. Total – Subtract line 1b from line 1a ................................................................................................. 1c. XXXXXXXXXXXXXXXXXXXXXX

2. Less: Cost of goods sold (from Schedule A-2, line 8) ................................................................................... 2. XXXXXXXXXXXXXXXXXXXXXX

3. Gross profit – Subtract line 2 from line 1c ............................................................................................. 3. XXXXXXXXXXXXXXXXXXXXXX

4. Dividends and other inclusions .............................................................................................................. 4. XXXXXXXXXXXXXXXXXXXXXX

5. Interest................................................................................................................................................... 5. XXXXXXXXXXXXXXXXXXXXXX

6. Gross rents ............................................................................................................................................ 6. XXXXXXXXXXXXXXXXXXXXXX

7. Gross royalties....................................................................................................................................... 7. XXXXXXXXXXXXXXXXXXXXXX

8. Capital gain net income (include a copy of federal Schedule D) ...................................................................... 8. XXXXXXXXXXXXXXXXXXXXXX

9. Net gain or (loss) (from federal Form 4797, include a copy) ............................................................................. 9. XXXXXXXXXXXXXXXXXXXXXX

10. Other income (include schedule(s)) ....................................................................................................................................... 10. XXXXXXXXXXXXXXXXXXXXXX

11. Total Income – Add lines 3 through 10 ................................................................................................. 11. XXXXXXXXXXXXXXXXXXXXXX

Deductions

12. Compensation of officers (from Schedule F) .............................................................................................. 12. XXXXXXXXXXXXXXXXXXXXXX

13. Salaries and wages (less employment credits)............................................................................................. 13. XXXXXXXXXXXXXXXXXXXXXX

14. Repairs (Do not include capital expenditures) ................................................................................................. 14. XXXXXXXXXXXXXXXXXXXXXX

15. Bad debts .............................................................................................................................................. 15. XXXXXXXXXXXXXXXXXXXXXX

16. Rents ..................................................................................................................................................... 16. XXXXXXXXXXXXXXXXXXXXXX

17. Taxes ..................................................................................................................................................... 17. XXXXXXXXXXXXXXXXXXXXXX

18. Interest................................................................................................................................................... 18. XXXXXXXXXXXXXXXXXXXXXX

19. Charitable contributions ......................................................................................................................... 19. XXXXXXXXXXXXXXXXXXXXXX

20. Depreciation (from federal Form 4562, include a copy) less depreciation claimed elsewhere on return .......... 20. XXXXXXXXXXXXXXXXXXXXXX

21. Depletion ............................................................................................................................................... 21. XXXXXXXXXXXXXXXXXXXXXX

22. Advertising ............................................................................................................................................. 22. XXXXXXXXXXXXXXXXXXXXXX

23. Pension, profit-sharing plans, etc .......................................................................................................... 23. XXXXXXXXXXXXXXXXXXXXXX

24. Employee benefit programs................................................................................................................... 24. XXXXXXXXXXXXXXXXXXXXXX

25. Energy efficient commercial buildings deduction (from federal Form 7205, include a copy) ................. 25. XXXXXXXXXXXXXXXXXXXXXX

26. Other deductions (include schedule) .......................................................................................................... 26. XXXXXXXXXXXXXXXXXXXXXX

27. Total Deductions – Add lines 12 through 26 ........................................................................................ 27. XXXXXXXXXXXXXXXXXXXXXX

28. Taxable income before federal net operating loss deductions and federal special deductions –

Subtract line 27 from line 11 (Must agree with line 28, page 1 of the Unconsolidated federal Form 1120, or the

appropriate line of any other federal corporate return filed) (See instructions) ............................................................ 28. XXXXXXXXXXXXXXXXXXXXXX

Part II – New Jersey Modifications to Entire Net Income

1. Taxable income/(loss) before federal net operating loss deductions and special deductions (from

Schedule A, Part I, line 28) ............................................................................................................... 1. XXXXXXXXXXXXXXXXXXXXXX

Additions

2. Other federally exempt income (see instructions) ..................................................................................... 2. XXXXXXXXXXXXXXXXXXXXXX

3. Interest on federal, state, municipal, and other obligations .................................................................... 3. XXXXXXXXXXXXXXXXXXXXXX

4. New Jersey State and other states’ taxes deducted in line 1 (see instructions) ........................................ 4. XXXXXXXXXXXXXXXXXXXXXX

5. Depreciation modification being added to income (from Schedule S) .................................................. 5. XXXXXXXXXXXXXXXXXXXXXX

6. Other additions. Explain on separate rider (see instructions) ............................................................... 6. XXXXXXXXXXXXXXXXXXXXXX

7. Taxable Income/(Loss) – Add lines 1 through 6 ................................................................................... 7. XXXXXXXXXXXXXXXXXXXXXX

Deductions

8. Dividend Exclusion (from Schedule R, line 9) ...................................................................................... 8. XXXXXXXXXXXXXXXXXXXXXX

9. Depreciation modification being subtracted from income (from Schedule S) ....................................... 9. XXXXXXXXXXXXXXXXXXXXXX

10. Previously Taxed Dividends (from Schedule PT) ................................................................................. 10. XXXXXXXXXXXXXXXXXXXXXX

11. International Banking Facility Deduction (IBF) ..................................................................................... 11. XXXXXXXXXXXXXXXXXXXXXX

12. I.R.C. § 78 Gross-up (not deducted/subtracted elsewhere) ................................................................. 12. XXXXXXXXXXXXXXXXXXXXXX

13. a. Elimination of nonoperational activity (from Schedule O, Part I) ........................................................ 13a. XXXXXXXXXXXXXXXXXXXXXX

b. Elimination of nonunitary partnership activity (from Schedule P-1, Part II, line 4) ............................ 13b. XXXXXXXXXXXXXXXXXXXXXX

14. Cannabis Licensee Deduction ................................................................................................................ 14. XXXXXXXXXXXXXXXXXXXXXX

15. Other deductions. Explain on a separate rider (see instructions) ............................................................. 15. XXXXXXXXXXXXXXXXXXXXXX

16. Total deductions – Add line 8 through line 15 ........................................................................................... 16. XXXXXXXXXXXXXXXXXXXXXX

|

Enlarge image |

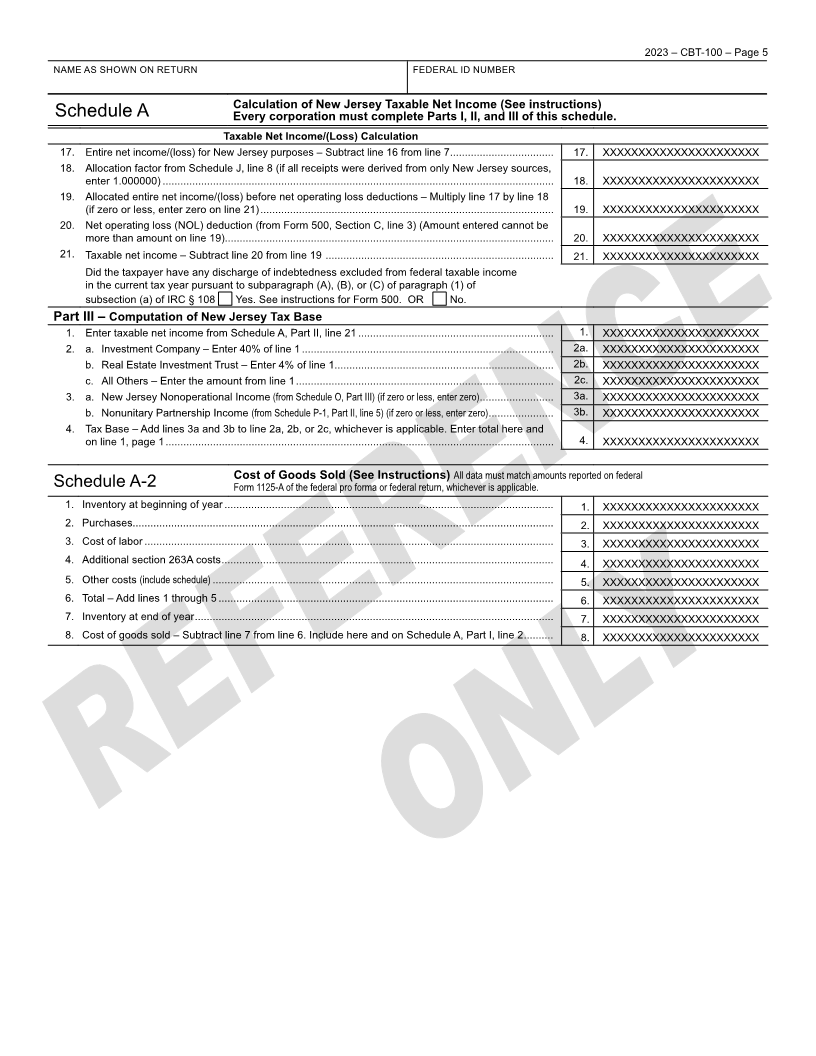

2023 – CBT-100 – Page 5

NAME AS SHOWN ON RETURN FEDERAL ID NUMBER

Calculation of New Jersey Taxable Net Income (See instructions)

Schedule A Every corporation must complete Parts I, II, and III of this schedule.

Taxable Net Income/(Loss) Calculation

17. Entire net income/(loss) for New Jersey purposes – Subtract line 16 from line 7 ................................... 17. XXXXXXXXXXXXXXXXXXXXXX

18. Allocation factor from Schedule J, line 8 (if all receipts were derived from only New Jersey sources,

enter 1.000000) .................................................................................................................................... 18. XXXXXXXXXXXXXXXXXXXXXX

19. Allocated entire net income/(loss) before net operating loss deductions – Multiply line 17 by line 18

(if zero or less, enter zero on line 21) ................................................................................................... 19. XXXXXXXXXXXXXXXXXXXXXX

20. Net operating loss (NOL) deduction (from Form 500, Section C, line 3) (Amount entered cannot be

more than amount on line 19)............................................................................................................... 20. XXXXXXXXXXXXXXXXXXXXXX

21. Taxable net income – Subtract line 20 from line 19 ............................................................................. 21. XXXXXXXXXXXXXXXXXXXXXX

Did the taxpayer have any discharge of indebtedness excluded from federal taxable income

in the current tax year pursuant to subparagraph (A), (B), or (C) of paragraph (1) of

subsection (a) of IRC § 108 Yes. See instructions for Form 500. OR No.

Part III – Computation of New Jersey Tax Base

1. Enter taxable net income from Schedule A, Part II, line 21 .................................................................. 1. XXXXXXXXXXXXXXXXXXXXXX

2. a. Investment Company – Enter 40% of line 1 ..................................................................................... 2a. XXXXXXXXXXXXXXXXXXXXXX

b. Real Estate Investment Trust – Enter 4% of line 1.......................................................................... 2b. XXXXXXXXXXXXXXXXXXXXXX

c. All Others – Enter the amount from line 1 ....................................................................................... 2c. XXXXXXXXXXXXXXXXXXXXXX

3. a. New Jersey Nonoperational Income (from Schedule O, Part III) (if zero or less, enter zero) ......................... 3a. XXXXXXXXXXXXXXXXXXXXXX

b. Nonunitary Partnership Income (from Schedule P-1, Part II, line 5) (if zero or less, enter zero) ...................... 3b. XXXXXXXXXXXXXXXXXXXXXX

4. Tax Base – Add lines 3a and 3b to line 2a, 2b, or 2c, whichever is applicable. Enter total here and

on line 1, page 1 ................................................................................................................................... 4. XXXXXXXXXXXXXXXXXXXXXX

Cost of Goods Sold (See Instructions) All data must match amounts reported on federal

Schedule A-2 Form 1125-A of the federal pro forma or federal return, whichever is applicable.

1. Inventory at beginning of year ............................................................................................................... 1. XXXXXXXXXXXXXXXXXXXXXX

2. Purchases.............................................................................................................................................. 2. XXXXXXXXXXXXXXXXXXXXXX

3. Cost of labor .......................................................................................................................................... 3. XXXXXXXXXXXXXXXXXXXXXX

4. Additional section 263A costs ................................................................................................................ 4. XXXXXXXXXXXXXXXXXXXXXX

5. Other costs (include schedule) ................................................................................................................... 5. XXXXXXXXXXXXXXXXXXXXXX

6. Total – Add lines 1 through 5 ................................................................................................................. 6. XXXXXXXXXXXXXXXXXXXXXX

7. Inventory at end of year ......................................................................................................................... 7. XXXXXXXXXXXXXXXXXXXXXX

8. Cost of goods sold – Subtract line 7 from line 6. Include here and on Schedule A, Part I, line 2 .......... 8. XXXXXXXXXXXXXXXXXXXXXX

|

Enlarge image |

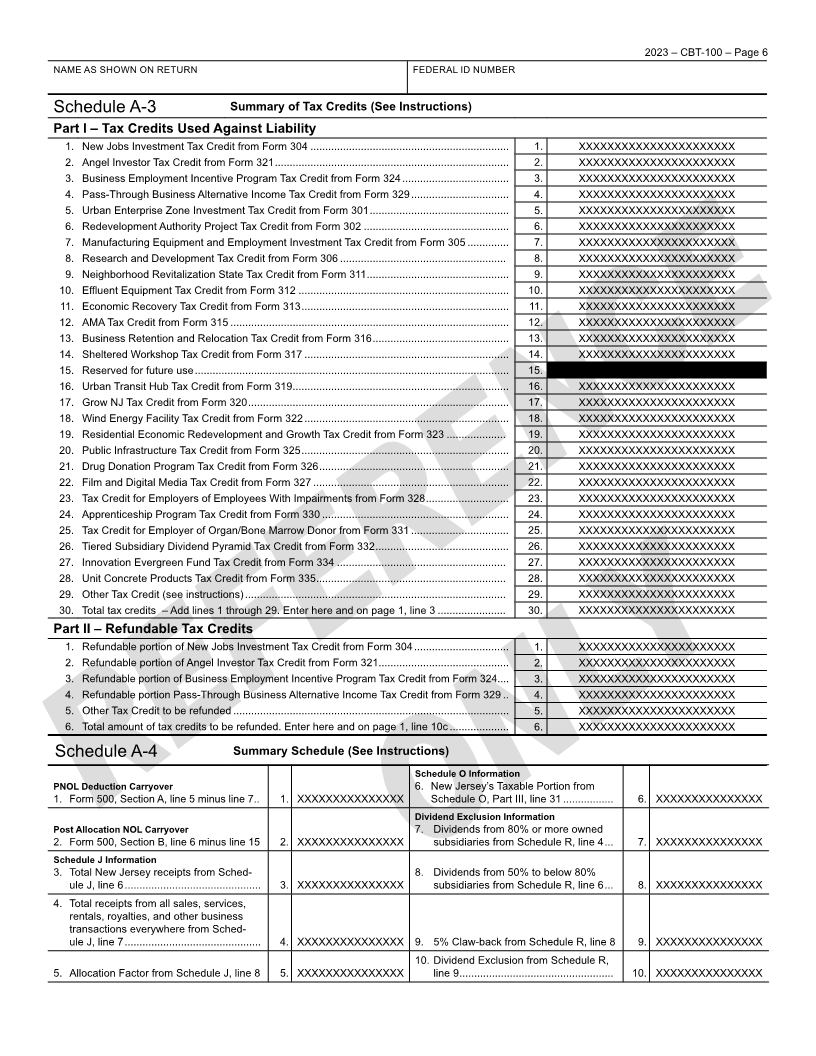

2023 – CBT-100 – Page 6

NAME AS SHOWN ON RETURN FEDERAL ID NUMBER

Schedule A-3 Summary of Tax Credits (See Instructions)

Part I – Tax Credits Used Against Liability

1. New Jobs Investment Tax Credit from Form 304 ................................................................... 1. XXXXXXXXXXXXXXXXXXXXXX

2. Angel Investor Tax Credit from Form 321 ............................................................................... 2. XXXXXXXXXXXXXXXXXXXXXX

3. Business Employment Incentive Program Tax Credit from Form 324 .................................... 3. XXXXXXXXXXXXXXXXXXXXXX

4. Pass-Through Business Alternative Income Tax Credit from Form 329 ................................. 4. XXXXXXXXXXXXXXXXXXXXXX

5. Urban Enterprise Zone Investment Tax Credit from Form 301 ............................................... 5. XXXXXXXXXXXXXXXXXXXXXX

6. Redevelopment Authority Project Tax Credit from Form 302 ................................................. 6. XXXXXXXXXXXXXXXXXXXXXX

7. Manufacturing Equipment and Employment Investment Tax Credit from Form 305 .............. 7. XXXXXXXXXXXXXXXXXXXXXX

8. Research and Development Tax Credit from Form 306 ........................................................ 8. XXXXXXXXXXXXXXXXXXXXXX

9. Neighborhood Revitalization State Tax Credit from Form 311 ................................................ 9. XXXXXXXXXXXXXXXXXXXXXX

10. Effluent Equipment Tax Credit from Form 312 ....................................................................... 10. XXXXXXXXXXXXXXXXXXXXXX

11. Economic Recovery Tax Credit from Form 313 ...................................................................... 11. XXXXXXXXXXXXXXXXXXXXXX

12. AMA Tax Credit from Form 315 .............................................................................................. 12. XXXXXXXXXXXXXXXXXXXXXX

13. Business Retention and Relocation Tax Credit from Form 316 .............................................. 13. XXXXXXXXXXXXXXXXXXXXXX

14. Sheltered Workshop Tax Credit from Form 317 ..................................................................... 14. XXXXXXXXXXXXXXXXXXXXXX

15. Reserved for future use .......................................................................................................... 15. XXXXXXXXXXXXXXXXXXXXXX

16. Urban Transit Hub Tax Credit from Form 319 ......................................................................... 16. XXXXXXXXXXXXXXXXXXXXXX

17. Grow NJ Tax Credit from Form 320 ........................................................................................ 17. XXXXXXXXXXXXXXXXXXXXXX

18. Wind Energy Facility Tax Credit from Form 322 ..................................................................... 18. XXXXXXXXXXXXXXXXXXXXXX

19. Residential Economic Redevelopment and Growth Tax Credit from Form 323 .................... 19. XXXXXXXXXXXXXXXXXXXXXX

20. Public Infrastructure Tax Credit from Form 325 ...................................................................... 20. XXXXXXXXXXXXXXXXXXXXXX

21. Drug Donation Program Tax Credit from Form 326 ................................................................ 21. XXXXXXXXXXXXXXXXXXXXXX

22. Film and Digital Media Tax Credit from Form 327 .................................................................. 22. XXXXXXXXXXXXXXXXXXXXXX

23. Tax Credit for Employers of Employees With Impairments from Form 328 ............................ 23. XXXXXXXXXXXXXXXXXXXXXX

24. Apprenticeship Program Tax Credit from Form 330 ............................................................... 24. XXXXXXXXXXXXXXXXXXXXXX

25. Tax Credit for Employer of Organ/Bone Marrow Donor from Form 331 ................................. 25. XXXXXXXXXXXXXXXXXXXXXX

26. Tiered Subsidiary Dividend Pyramid Tax Credit from Form 332 ............................................. 26. XXXXXXXXXXXXXXXXXXXXXX

27. Innovation Evergreen Fund Tax Credit from Form 334 ......................................................... 27. XXXXXXXXXXXXXXXXXXXXXX

28. Unit Concrete Products Tax Credit from Form 335 ................................................................ 28. XXXXXXXXXXXXXXXXXXXXXX

29. Other Tax Credit (see instructions) ........................................................................................ 29. XXXXXXXXXXXXXXXXXXXXXX

30. Total tax credits – Add lines 1 through 29. Enter here and on page 1, line 3 ....................... 30. XXXXXXXXXXXXXXXXXXXXXX

Part II – Refundable Tax Credits

1. Refundable portion of New Jobs Investment Tax Credit from Form 304 ................................ 1. XXXXXXXXXXXXXXXXXXXXXX

2. Refundable portion of Angel Investor Tax Credit from Form 321 ............................................ 2. XXXXXXXXXXXXXXXXXXXXXX

3. Refundable portion of Business Employment Incentive Program Tax Credit from Form 324 .... 3. XXXXXXXXXXXXXXXXXXXXXX

4. Refundable portion Pass-Through Business Alternative Income Tax Credit from Form 329 .. 4. XXXXXXXXXXXXXXXXXXXXXX

5. Other Tax Credit to be refunded ............................................................................................. 5. XXXXXXXXXXXXXXXXXXXXXX

6. Total amount of tax credits to be refunded. Enter here and on page 1, line 10c .................... 6. XXXXXXXXXXXXXXXXXXXXXX

Schedule A-4 Summary Schedule (See Instructions)

Schedule O Information

PNOL Deduction Carryover 6. New Jersey’s Taxable Portion from

1. Form 500, Section A, line 5 minus line 7 .. 1. XXXXXXXXXXXXXXX Schedule O, Part III, line 31 ................. 6. XXXXXXXXXXXXXXX

Dividend Exclusion Information

Post Allocation NOL Carryover 7. Dividends from 80% or more owned

2. Form 500, Section B, line 6 minus line 15 2. XXXXXXXXXXXXXXX subsidiaries from Schedule R, line 4 ... 7. XXXXXXXXXXXXXXX

Schedule J Information

3. Total New Jersey receipts from Sched- 8. Dividends from 50% to below 80%

ule J, line 6 .............................................. 3. XXXXXXXXXXXXXXX subsidiaries from Schedule R, line 6 ... 8. XXXXXXXXXXXXXXX

4. Total receipts from all sales, services,

rentals, royalties, and other business

transactions everywhere from Sched-

ule J, line 7 .............................................. 4. XXXXXXXXXXXXXXX 9. 5% Claw-back from Schedule R, line 8 9. XXXXXXXXXXXXXXX

10. Dividend Exclusion from Schedule R,

5. Allocation Factor from Schedule J, line 8 5. XXXXXXXXXXXXXXX line 9 .................................................... 10. XXXXXXXXXXXXXXX

|

Enlarge image |

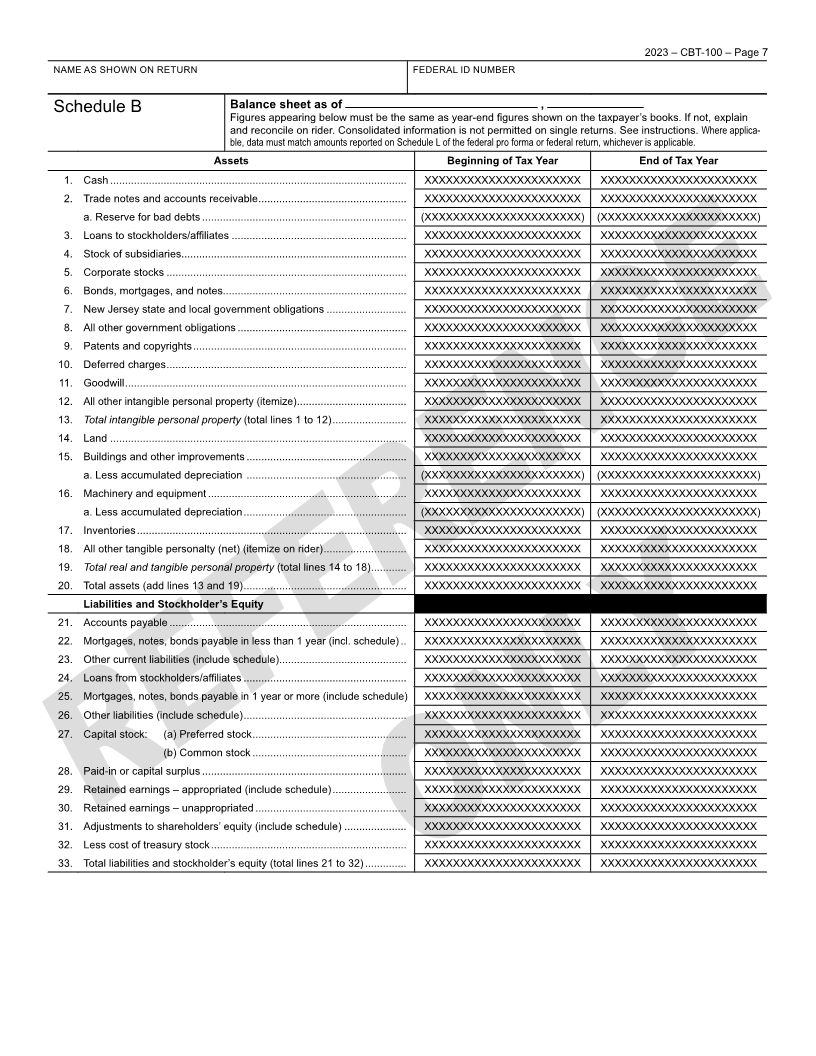

2023 – CBT-100 – Page 7

NAME AS SHOWN ON RETURN FEDERAL ID NUMBER

Schedule B Balance sheet as of ,

Figures appearing below must be the same as year-end figures shown on the taxpayer’s books. If not, explain

and reconcile on rider. Consolidated information is not permitted on single returns. See instructions. Where applica-

ble, data must match amounts reported on Schedule L of the federal pro forma or federal return, whichever is applicable.

Assets Beginning of Tax Year End of Tax Year

1. Cash .................................................................................................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

2. Trade notes and accounts receivable .................................................. XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

a. Reserve for bad debts ..................................................................... (XXXXXXXXXXXXXXXXXXXXXX) (XXXXXXXXXXXXXXXXXXXXXX)

3. Loans to stockholders/affiliates ........................................................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

4. Stock of subsidiaries............................................................................ XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

5. Corporate stocks ................................................................................. XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

6. Bonds, mortgages, and notes.............................................................. XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

7. New Jersey state and local government obligations ........................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

8. All other government obligations ......................................................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

9. Patents and copyrights ........................................................................ XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

10. Deferred charges ................................................................................. XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

11. Goodwill ............................................................................................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

12. All other intangible personal property (itemize) ..................................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

13. Total intangible personal property (total lines 1 to 12) ......................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

14. Land .................................................................................................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

15. Buildings and other improvements ...................................................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

a. Less accumulated depreciation ...................................................... (XXXXXXXXXXXXXXXXXXXXXX) (XXXXXXXXXXXXXXXXXXXXXX)

16. Machinery and equipment ................................................................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

a. Less accumulated depreciation ....................................................... (XXXXXXXXXXXXXXXXXXXXXX) (XXXXXXXXXXXXXXXXXXXXXX)

17. Inventories ........................................................................................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

18. All other tangible personalty (net) (itemize on rider) ............................ XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

19. Total real and tangible personal property (total lines 14 to 18) ............ XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

20. Total assets (add lines 13 and 19) ....................................................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

Liabilities and Stockholder’s Equity

21. Accounts payable ................................................................................ XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

22. Mortgages, notes, bonds payable in less than 1 year (incl. schedule) .. XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

23. Other current liabilities (include schedule)........................................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

24. Loans from stockholders/affiliates ....................................................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

25. Mortgages, notes, bonds payable in 1 year or more (include schedule) XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

26. Other liabilities (include schedule) ....................................................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

27. Capital stock: (a) Preferred stock .................................................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

(b) Common stock .................................................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

28. Paid-in or capital surplus ..................................................................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

29. Retained earnings – appropriated (include schedule) ......................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

30. Retained earnings – unappropriated ................................................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

31. Adjustments to shareholders’ equity (include schedule) ..................... XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

32. Less cost of treasury stock .................................................................. XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

33. Total liabilities and stockholder’s equity (total lines 21 to 32) .............. XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX

|

Enlarge image |

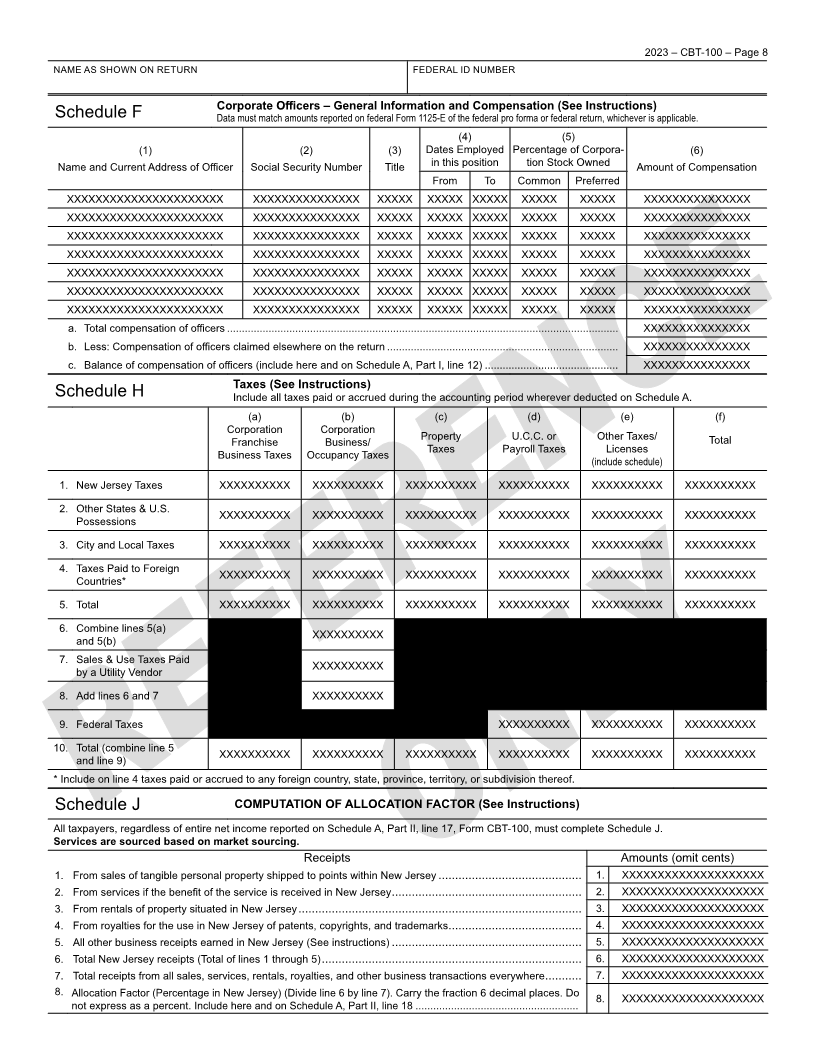

2023 – CBT-100 – Page 8

NAME AS SHOWN ON RETURN FEDERAL ID NUMBER

Corporate Officers – General Information and Compensation (See Instructions)

Schedule F Data must match amounts reported on federal Form 1125-E of the federal pro forma or federal return, whichever is applicable.

(4) (5)

(1) (2) (3) Dates Employed Percentage of Corpora- (6)

Name and Current Address of Officer Social Security Number Title in this position tion Stock Owned Amount of Compensation

From To Common Preferred

XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXX XXXXX XXXXX XXXXX XXXXX XXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXX XXXXX XXXXX XXXXX XXXXX XXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXX XXXXX XXXXX XXXXX XXXXX XXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXX XXXXX XXXXX XXXXX XXXXX XXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXX XXXXX XXXXX XXXXX XXXXX XXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXX XXXXX XXXXX XXXXX XXXXX XXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXX XXXXX XXXXX XXXXX XXXXX XXXXXXXXXXXXXXX

a. Total compensation of officers .................................................................................................................................... XXXXXXXXXXXXXXX

b. Less: Compensation of officers claimed elsewhere on the return .............................................................................. XXXXXXXXXXXXXXX

c. Balance of compensation of officers (include here and on Schedule A, Part I, line 12) ............................................. XXXXXXXXXXXXXXX

Taxes (See Instructions)

Schedule H Include all taxes paid or accrued during the accounting period wherever deducted on Schedule A.

(a) (b) (c) (d) (e) (f)

Corporation Corporation

Franchise Business/ Property U.C.C. or Other Taxes/ Total

Business Taxes Occupancy Taxes Taxes Payroll Taxes Licenses

(include schedule)

1. New Jersey Taxes XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX

2. Other States & U.S. XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX

Possessions

3. City and Local Taxes XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX

4. Taxes Paid to Foreign XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX

Countries*

5. Total XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX

6. Combine lines 5(a) XXXXXXXXXX

and 5(b)

7. Sales & Use Taxes Paid XXXXXXXXXX

by a Utility Vendor

8. Add lines 6 and 7 XXXXXXXXXX

9. Federal Taxes XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX

10. Total (combine line 5 XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX

and line 9)

* Include on line 4 taxes paid or accrued to any foreign country, state, province, territory, or subdivision thereof.

Schedule J COMPUTATION OF ALLOCATION FACTOR (See Instructions)

All taxpayers, regardless of entire net income reported on Schedule A, Part II, line 17, Form CBT-100, must complete Schedule J.

Services are sourced based on market sourcing.

Receipts Amounts (omit cents)

1. From sales of tangible personal property shipped to points within New Jersey ........................................... 1. XXXXXXXXXXXXXXXXXXXX

2. From services if the benefit of the service is received in New Jersey ......................................................... 2. XXXXXXXXXXXXXXXXXXXX

3. From rentals of property situated in New Jersey ..................................................................................... 3. XXXXXXXXXXXXXXXXXXXX

4. From royalties for the use in New Jersey of patents, copyrights, and trademarks ........................................ 4. XXXXXXXXXXXXXXXXXXXX

5. All other business receipts earned in New Jersey (See instructions) ......................................................... 5. XXXXXXXXXXXXXXXXXXXX

6. Total New Jersey receipts (Total of lines 1 through 5) .............................................................................. 6. XXXXXXXXXXXXXXXXXXXX

7. Total receipts from all sales, services, rentals, royalties, and other business transactions everywhere ........... 7. XXXXXXXXXXXXXXXXXXXX

8. Allocation Factor (Percentage in New Jersey) (Divide line 6 by line 7). Carry the fraction 6 decimal places. Do 8. XXXXXXXXXXXXXXXXXXXX

not express as a percent. Include here and on Schedule A, Part II, line 18 .......................................................

|

Enlarge image |

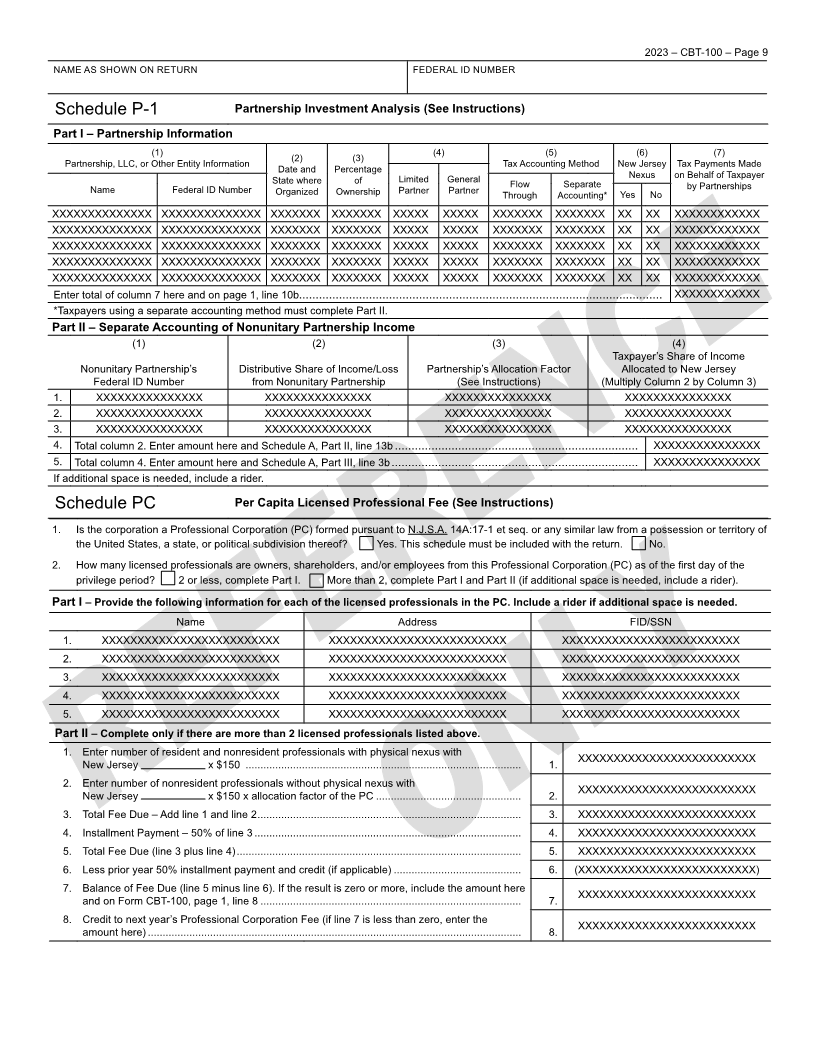

2023 – CBT-100 – Page 9

NAME AS SHOWN ON RETURN FEDERAL ID NUMBER

Schedule P-1 Partnership Investment Analysis (See Instructions)

Part I – Partnership Information

(1) (2) (3) (4) (5) (6) (7)

Partnership, LLC, or Other Entity Information Date and Percentage Tax Accounting Method New Jersey Tax Payments Made

State where of Limited General Flow Separate Nexus on Behalf of Taxpayer

Name Federal ID Number Organized Ownership Partner Partner Through Accounting* Yes No by Partnerships

XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXX XXXXXXX XXXXX XXXXX XXXXXXX XXXXXXX XX XX XXXXXXXXXXXX

XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXX XXXXXXX XXXXX XXXXX XXXXXXX XXXXXXX XX XX XXXXXXXXXXXX

XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXX XXXXXXX XXXXX XXXXX XXXXXXX XXXXXXX XX XX XXXXXXXXXXXX

XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXX XXXXXXX XXXXX XXXXX XXXXXXX XXXXXXX XX XX XXXXXXXXXXXX

XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXX XXXXXXX XXXXX XXXXX XXXXXXX XXXXXXX XX XX XXXXXXXXXXXX

Enter total of column 7 here and on page 1, line 10b............................................................................................................. XXXXXXXXXXXX

*Taxpayers using a separate accounting method must complete Part II.

Part II – Separate Accounting of Nonunitary Partnership Income

(1) (2) (3) (4)

Taxpayer’s Share of Income

Nonunitary Partnership’s Distributive Share of Income/Loss Partnership’s Allocation Factor Allocated to New Jersey

Federal ID Number from Nonunitary Partnership (See Instructions) (Multiply Column 2 by Column 3)

1. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

2. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

3. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

4. Total column 2. Enter amount here and Schedule A, Part II, line 13b ......................................................................... XXXXXXXXXXXXXXX

5. Total column 4. Enter amount here and Schedule A, Part III, line 3b .......................................................................... XXXXXXXXXXXXXXX

If additional space is needed, include a rider.

Schedule PC Per Capita Licensed Professional Fee (See Instructions)

1. Is the corporation a Professional Corporation (PC) formed pursuant to N.J.S.A. 14A:17-1 et seq. or any similar law from a possession or territory of

the United States, a state, or political subdivision thereof? Yes. This schedule must be included with the return. No.

2. How many licensed professionals are owners, shareholders, and/or employees from this Professional Corporation (PC) as of the first day of the

privilege period? 2 or less, complete Part I. More than 2, complete Part I and Part II (if additional space is needed, include a rider).

Part I – Provide the following information for each of the licensed professionals in the PC. Include a rider if additional space is needed.

Name Address FID/SSN

1. XXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXX

2. XXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXX

3. XXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXX

4. XXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXX

5. XXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXX

Part II – Complete only if there are more than 2 licensed professionals listed above.

1. Enter number of resident and nonresident professionals with physical nexus with XXXXXXXXXXXXXXXXXXXXXXXXX

New Jersey x $150 ............................................................................................. 1.

2. Enter number of nonresident professionals without physical nexus with XXXXXXXXXXXXXXXXXXXXXXXXX

New Jersey x $150 x allocation factor of the PC ................................................. 2.

3. Total Fee Due – Add line 1 and line 2 ......................................................................................... 3. XXXXXXXXXXXXXXXXXXXXXXXXX

4. Installment Payment – 50% of line 3 .......................................................................................... 4. XXXXXXXXXXXXXXXXXXXXXXXXX

5. Total Fee Due (line 3 plus line 4) ................................................................................................ 5. XXXXXXXXXXXXXXXXXXXXXXXXX

6. Less prior year 50% installment payment and credit (if applicable) ........................................... 6. (XXXXXXXXXXXXXXXXXXXXXXXXX)

7. Balance of Fee Due (line 5 minus line 6). If the result is zero or more, include the amount here XXXXXXXXXXXXXXXXXXXXXXXXX

and on Form CBT-100, page 1, line 8 ........................................................................................ 7.

8. Credit to next year’s Professional Corporation Fee (if line 7 is less than zero, enter the XXXXXXXXXXXXXXXXXXXXXXXXX

amount here) .............................................................................................................................. 8.

|

Enlarge image |

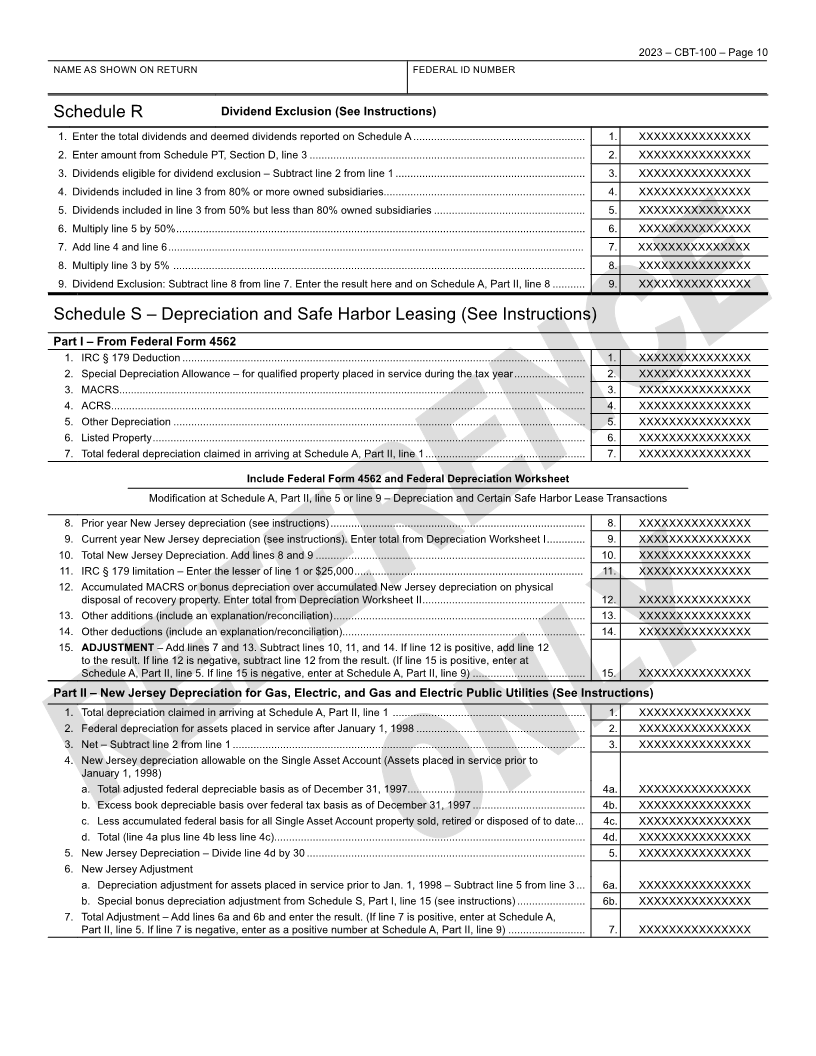

2023 – CBT-100 – Page 10

NAME AS SHOWN ON RETURN FEDERAL ID NUMBER

Schedule R Dividend Exclusion (See Instructions)

1. Enter the total dividends and deemed dividends reported on Schedule A .......................................................... 1. XXXXXXXXXXXXXXX

2. Enter amount from Schedule PT, Section D, line 3 ............................................................................................. 2. XXXXXXXXXXXXXXX

3. Dividends eligible for dividend exclusion – Subtract line 2 from line 1 ................................................................ 3. XXXXXXXXXXXXXXX

4. Dividends included in line 3 from 80% or more owned subsidiaries.................................................................... 4. XXXXXXXXXXXXXXX

5. Dividends included in line 3 from 50% but less than 80% owned subsidiaries ................................................... 5. XXXXXXXXXXXXXXX

6. Multiply line 5 by 50% .......................................................................................................................................... 6. XXXXXXXXXXXXXXX

7. Add line 4 and line 6 ............................................................................................................................................... 7. XXXXXXXXXXXXXXX

8. Multiply line 3 by 5% ........................................................................................................................................... 8. XXXXXXXXXXXXXXX

9. Dividend Exclusion: Subtract line 8 from line 7. Enter the result here and on Schedule A, Part II, line 8 ........... 9. XXXXXXXXXXXXXXX

Schedule S – Depreciation and Safe Harbor Leasing (See Instructions)

Part I – From Federal Form 4562

1. IRC § 179 Deduction ........................................................................................................................................ 1. XXXXXXXXXXXXXXX

2. Special Depreciation Allowance – for qualified property placed in service during the tax year ........................ 2. XXXXXXXXXXXXXXX

3. MACRS ................................................................................................................................................................ 3. XXXXXXXXXXXXXXX

4. ACRS................................................................................................................................................................ 4. XXXXXXXXXXXXXXX

5. Other Depreciation ........................................................................................................................................... 5. XXXXXXXXXXXXXXX

6. Listed Property .................................................................................................................................................. 6. XXXXXXXXXXXXXXX

7. Total federal depreciation claimed in arriving at Schedule A, Part II, line 1 ...................................................... 7. XXXXXXXXXXXXXXX

Include Federal Form 4562 and Federal Depreciation Worksheet

Modification at Schedule A, Part II, line 5 or line 9 – Depreciation and Certain Safe Harbor Lease Transactions

8. Prior year New Jersey depreciation (see instructions) ...................................................................................... 8. XXXXXXXXXXXXXXX

9. Current year New Jersey depreciation (see instructions). Enter total from Depreciation Worksheet I ............. 9. XXXXXXXXXXXXXXX

10. Total New Jersey Depreciation. Add lines 8 and 9 ........................................................................................... 10. XXXXXXXXXXXXXXX

11. IRC § 179 limitation – Enter the lesser of line 1 or $25,000 .............................................................................. 11. XXXXXXXXXXXXXXX

12. Accumulated MACRS or bonus depreciation over accumulated New Jersey depreciation on physical

disposal of recovery property. Enter total from Depreciation Worksheet II ....................................................... 12. XXXXXXXXXXXXXXX

13. Other additions (include an explanation/reconciliation) ..................................................................................... 13. XXXXXXXXXXXXXXX

14. Other deductions (include an explanation/reconciliation).................................................................................. 14. XXXXXXXXXXXXXXX

15. ADJUSTMENT – Add lines 7 and 13. Subtract lines 10, 11, and 14. If line 12 is positive, add line 12

to the result. If line 12 is negative, subtract line 12 from the result. (If line 15 is positive, enter at

Schedule A, Part II, line 5. If line 15 is negative, enter at Schedule A, Part II, line 9) ...................................... 15. XXXXXXXXXXXXXXX

Part II – New Jersey Depreciation for Gas, Electric, and Gas and Electric Public Utilities (See Instructions)

1. Total depreciation claimed in arriving at Schedule A, Part II, line 1 ................................................................. 1. XXXXXXXXXXXXXXX

2. Federal depreciation for assets placed in service after January 1, 1998 ......................................................... 2. XXXXXXXXXXXXXXX

3. Net – Subtract line 2 from line 1 ....................................................................................................................... 3. XXXXXXXXXXXXXXX

4. New Jersey depreciation allowable on the Single Asset Account (Assets placed in service prior to

January 1, 1998)

a. Total adjusted federal depreciable basis as of December 31, 1997............................................................ 4a. XXXXXXXXXXXXXXX

b. Excess book depreciable basis over federal tax basis as of December 31, 1997 ...................................... 4b. XXXXXXXXXXXXXXX

c. Less accumulated federal basis for all Single Asset Account property sold, retired or disposed of to date ... 4c. XXXXXXXXXXXXXXX

d. Total (line 4a plus line 4b less line 4c)......................................................................................................... 4d. XXXXXXXXXXXXXXX

5. New Jersey Depreciation – Divide line 4d by 30 .............................................................................................. 5. XXXXXXXXXXXXXXX

6. New Jersey Adjustment

a. Depreciation adjustment for assets placed in service prior to Jan. 1, 1998 – Subtract line 5 from line 3 ... 6a. XXXXXXXXXXXXXXX

b. Special bonus depreciation adjustment from Schedule S, Part I, line 15 (see instructions) ....................... 6b. XXXXXXXXXXXXXXX

7. Total Adjustment – Add lines 6a and 6b and enter the result. (If line 7 is positive, enter at Schedule A,

Part II, line 5. If line 7 is negative, enter as a positive number at Schedule A, Part II, line 9) .......................... 7. XXXXXXXXXXXXXXX

|

Enlarge image |

2023 – CBT-100 – Page 11

NAME AS SHOWN ON RETURN FEDERAL ID NUMBER

New Jersey Depreciation Worksheet I (See instructions)

(A) (B) (C) (D) (E) (F) (G)

Classification of Property Basis for Bonus Depreciation Convention Method Federal New Jersey

Depreciation (30% or 50%) Depreciation Depreciation

Deduction Deduction (See

Instructions)

1. 3-year property XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX

2. 5-year property XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX

3. 7-year property XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX

4. 10-year property XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX

5. 15-year property XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX

6. 20-year property XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX

7. 25-year property XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX

8. Residential rental property XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX

9. Nonesidential rental property XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX XXXXXXXXXXXXX

10. Total Column G (Enter amount on Schedule S, Part I, line 9) ................................................................................................................................. XXXXXXXXXXXXX

New Jersey Depreciation Worksheet II – Disposal of Recovery Property (See Instructions)

(A) (B) (C) (D) (E) (F)

Description of Property Date Acquired: Date Sold: Federal Depreciation New Jersey Excess/Deficiency

month, day, year month, day, year Depreciation

1. XXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX

2. XXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX

3. XXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX

4. XXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX

5. XXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX

6. XXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX

7. XXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX

8. XXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX

9. XXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX

10. XXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX

11. XXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX

12. XXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX

13. XXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX

14. XXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX

15. XXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX XXXXXXXXXXXXXX

16. Total Column F (Enter amount on Schedule S, line 12) ......................................................................................................................................... XXXXXXXXXXXXXX

|

Enlarge image |

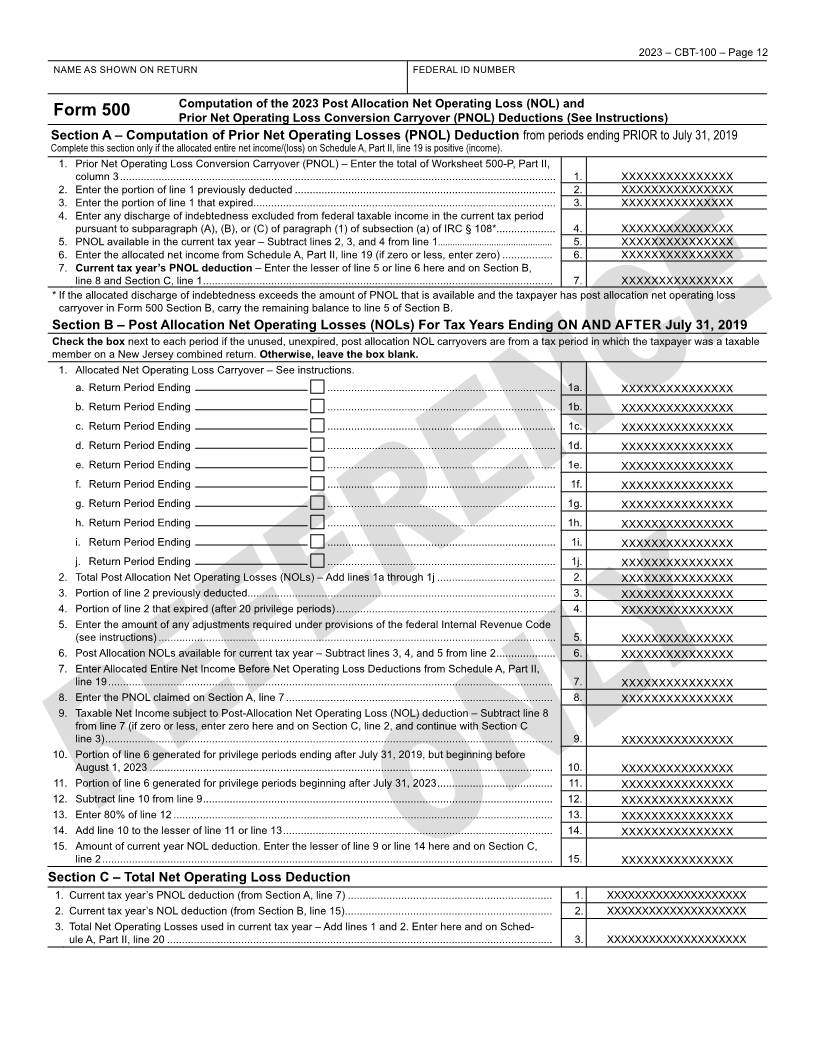

2023 – CBT-100 – Page 12

NAME AS SHOWN ON RETURN FEDERAL ID NUMBER

Computation of the 2023 Post Allocation Net Operating Loss (NOL) and

Form 500 Prior Net Operating Loss Conversion Carryover (PNOL) Deductions (See Instructions)

Section A – Computation of Prior Net Operating Losses (PNOL) Deduction from periods ending PRIOR to July 31, 2019

Complete this section only if the allocated entire net income/(loss) on Schedule A, Part II, line 19 is positive (income).

1. Prior Net Operating Loss Conversion Carryover (PNOL) – Enter the total of Worksheet 500-P, Part II,

column 3 ................................................................................................................................................... 1. XXXXXXXXXXXXXXX

2. Enter the portion of line 1 previously deducted ........................................................................................ 2. XXXXXXXXXXXXXXX

3. Enter the portion of line 1 that expired...................................................................................................... 3. XXXXXXXXXXXXXXX

4. Enter any discharge of indebtedness excluded from federal taxable income in the current tax period

pursuant to subparagraph (A), (B), or (C) of paragraph (1) of subsection (a) of IRC § 108*.................... 4. XXXXXXXXXXXXXXX

5. PNOL available in the current tax year – Subtract lines 2, 3, and 4 from line 1............................................... 5. XXXXXXXXXXXXXXX

6. Enter the allocated net income from Schedule A, Part II, line 19 (if zero or less, enter zero) ................. 6. XXXXXXXXXXXXXXX

7. Current tax year’s PNOL deduction – Enter the lesser of line 5 or line 6 here and on Section B,

line 8 and Section C, line 1 ...................................................................................................................... 7. XXXXXXXXXXXXXXX

* If the allocated discharge of indebtedness exceeds the amount of PNOL that is available and the taxpayer has post allocation net operating loss

carryover in Form 500 Section B, carry the remaining balance to line 5 of Section B.

Section B – Post Allocation Net Operating Losses (NOLs) For Tax Years Ending ON AND AFTER July 31, 2019

Check the box next to each period if the unused, unexpired, post allocation NOL carryovers are from a tax period in which the taxpayer was a taxable

member on a New Jersey combined return. Otherwise, leave the box blank.

1. Allocated Net Operating Loss Carryover – See instructions.

a. Return Period Ending ............................................................................. 1a. XXXXXXXXXXXXXXX

b. Return Period Ending ............................................................................. 1b. XXXXXXXXXXXXXXX

c. Return Period Ending ............................................................................. 1c. XXXXXXXXXXXXXXX

d. Return Period Ending ............................................................................. 1d. XXXXXXXXXXXXXXX

e. Return Period Ending ............................................................................. 1e. XXXXXXXXXXXXXXX

f. Return Period Ending ............................................................................. 1f. XXXXXXXXXXXXXXX

g. Return Period Ending ............................................................................. 1g. XXXXXXXXXXXXXXX

h. Return Period Ending ............................................................................. 1h. XXXXXXXXXXXXXXX

i. Return Period Ending ............................................................................. 1i. XXXXXXXXXXXXXXX

j. Return Period Ending ............................................................................. 1j. XXXXXXXXXXXXXXX

2. Total Post Allocation Net Operating Losses (NOLs) – Add lines 1a through 1j ........................................ 2. XXXXXXXXXXXXXXX

3. Portion of line 2 previously deducted........................................................................................................ 3. XXXXXXXXXXXXXXX

4. Portion of line 2 that expired (after 20 privilege periods) .......................................................................... 4. XXXXXXXXXXXXXXX

5. Enter the amount of any adjustments required under provisions of the federal Internal Revenue Code

(see instructions) ...................................................................................................................................... 5. XXXXXXXXXXXXXXX

6. Post Allocation NOLs available for current tax year – Subtract lines 3, 4, and 5 from line 2 .................... 6. XXXXXXXXXXXXXXX

7. Enter Allocated Entire Net Income Before Net Operating Loss Deductions from Schedule A, Part II,

line 19 ...................................................................................................................................................... 7. XXXXXXXXXXXXXXX

8. Enter the PNOL claimed on Section A, line 7 .......................................................................................... 8. XXXXXXXXXXXXXXX

9. Taxable Net Income subject to Post-Allocation Net Operating Loss (NOL) deduction – Subtract line 8

from line 7 (if zero or less, enter zero here and on Section C, line 2, and continue with Section C

line 3) ....................................................................................................................................................... 9. XXXXXXXXXXXXXXX

10. Portion of line 6 generated for privilege periods ending after July 31, 2019, but beginning before

August 1, 2023 ........................................................................................................................................ 10. XXXXXXXXXXXXXXX

11. Portion of line 6 generated for privilege periods beginning after July 31, 2023 ....................................... 11. XXXXXXXXXXXXXXX

12. Subtract line 10 from line 9 ...................................................................................................................... 12. XXXXXXXXXXXXXXX

13. Enter 80% of line 12 ................................................................................................................................ 13. XXXXXXXXXXXXXXX

14. Add line 10 to the lesser of line 11 or line 13 ........................................................................................... 14. XXXXXXXXXXXXXXX

15. Amount of current year NOL deduction. Enter the lesser of line 9 or line 14 here and on Section C,

line 2 ........................................................................................................................................................ 15. XXXXXXXXXXXXXXX

Section C – Total Net Operating Loss Deduction

1. Current tax year’s PNOL deduction (from Section A, line 7) ..................................................................... 1. XXXXXXXXXXXXXXXXXXXX

2. Current tax year’s NOL deduction (from Section B, line 15) ...................................................................... 2. XXXXXXXXXXXXXXXXXXXX

3. Total Net Operating Losses used in current tax year – Add lines 1 and 2. Enter here and on Sched-

ule A, Part II, line 20 .................................................................................................................................. 3. XXXXXXXXXXXXXXXXXXXX

|

Enlarge image |

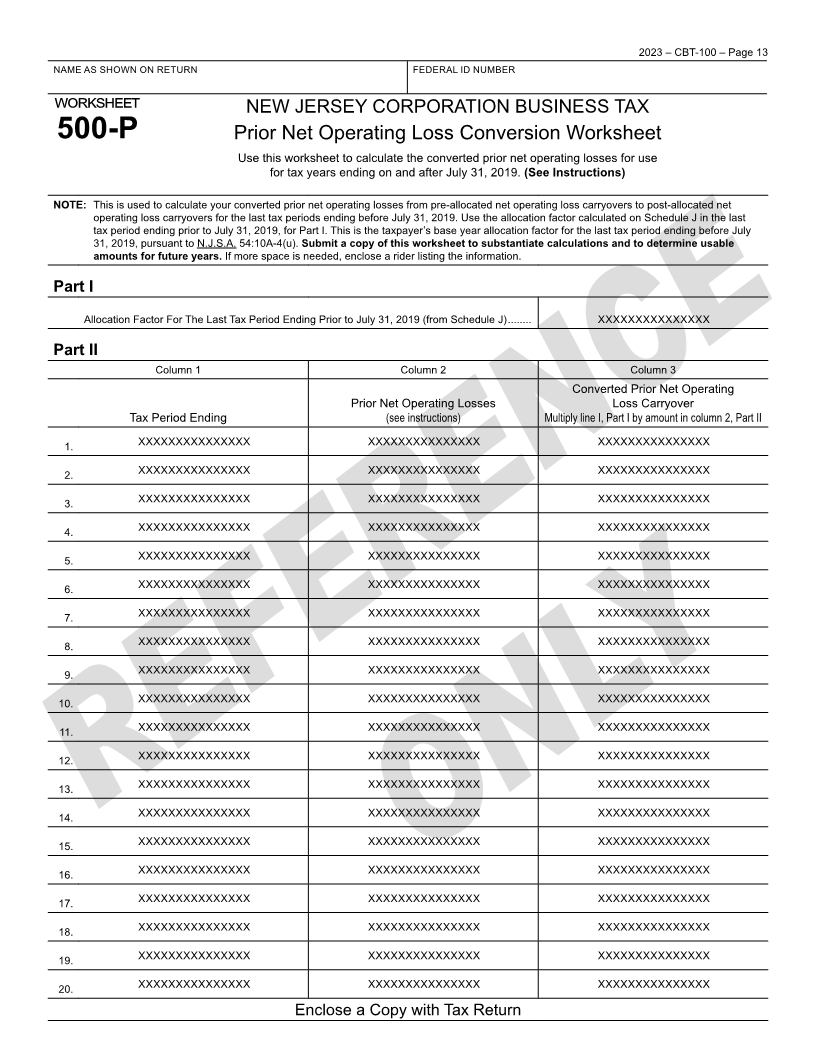

2023 – CBT-100 – Page 13

NAME AS SHOWN ON RETURN FEDERAL ID NUMBER

worksheet NEW JERSEY CORPORATION BUSINESS TAX

500-P Prior Net Operating Loss Conversion Worksheet

Use this worksheet to calculate the converted prior net operating losses for use

for tax years ending on and after July 31, 2019. (See Instructions)

NOTE: This is used to calculate your converted prior net operating losses from pre-allocated net operating loss carryovers to post-allocated net

operating loss carryovers for the last tax periods ending before July 31, 2019. Use the allocation factor calculated on Schedule J in the last

tax period ending prior to July 31, 2019, for Part I. This is the taxpayer’s base year allocation factor for the last tax period ending before July

31, 2019, pursuant to N.J.S.A. 54:10A-4(u). Submit a copy of this worksheet to substantiate calculations and to determine usable

amounts for future years. If more space is needed, enclose a rider listing the information.

Part I

Allocation Factor For The Last Tax Period Ending Prior to July 31, 2019 (from Schedule J) ........ XXXXXXXXXXXXXXX

Part II

Column 1 Column 2 Column 3

Converted Prior Net Operating

Prior Net Operating Losses Loss Carryover

Tax Period Ending (see instructions) Multiply line I, Part I by amount in column 2, Part II

1. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

2. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

3. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

4. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

5. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

6. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

7. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

8. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

9. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

10. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

11. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

12. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

13. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

14. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

15. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

16. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

17. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

18. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

19. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

20. XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX XXXXXXXXXXXXXXX

Enclose a Copy with Tax Return

|