- 15 -

Enlarge image

|

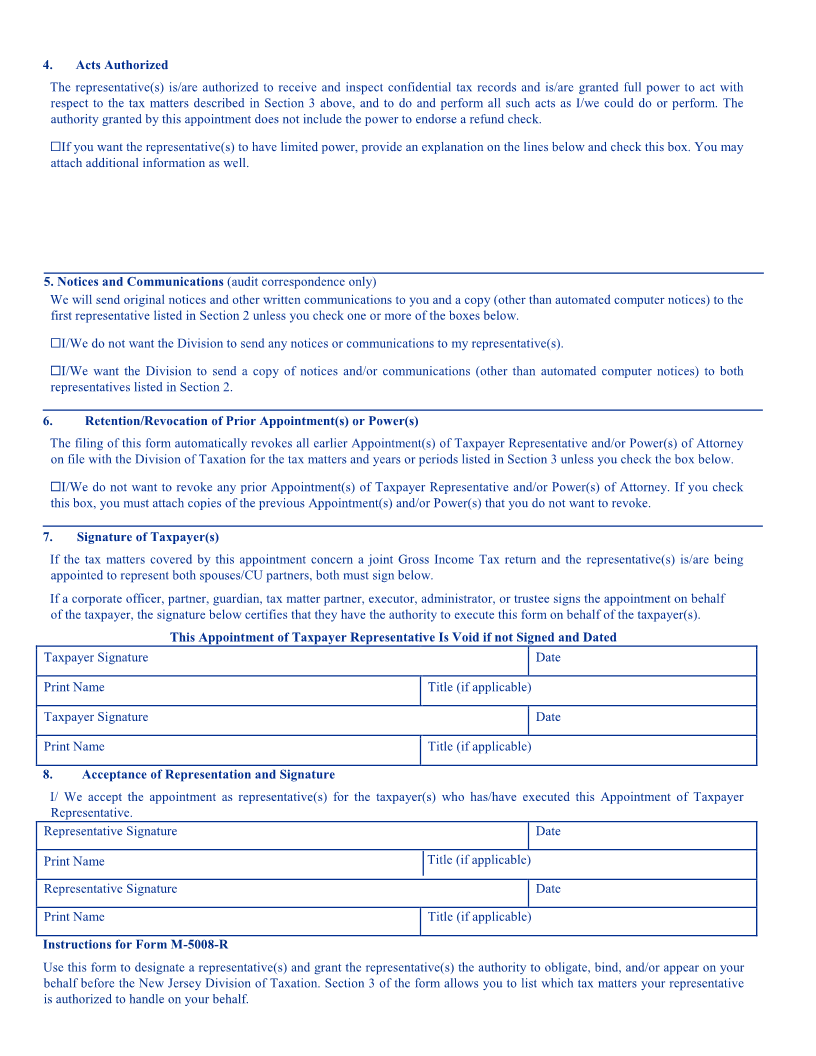

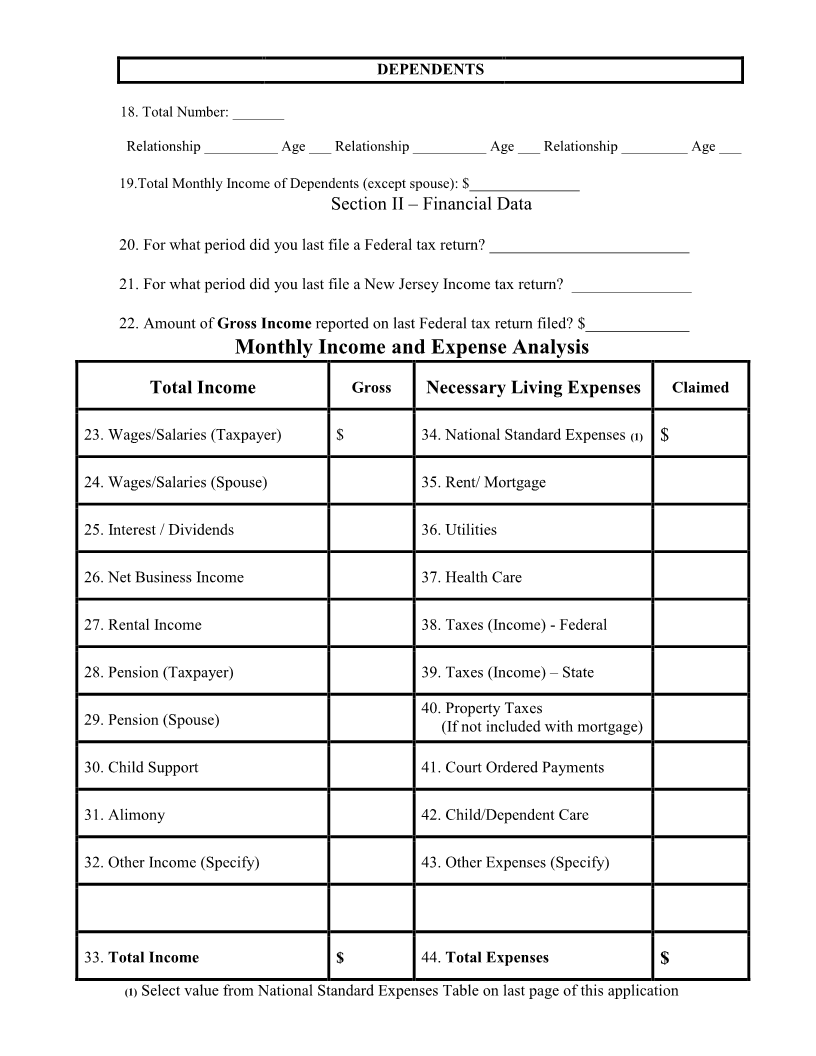

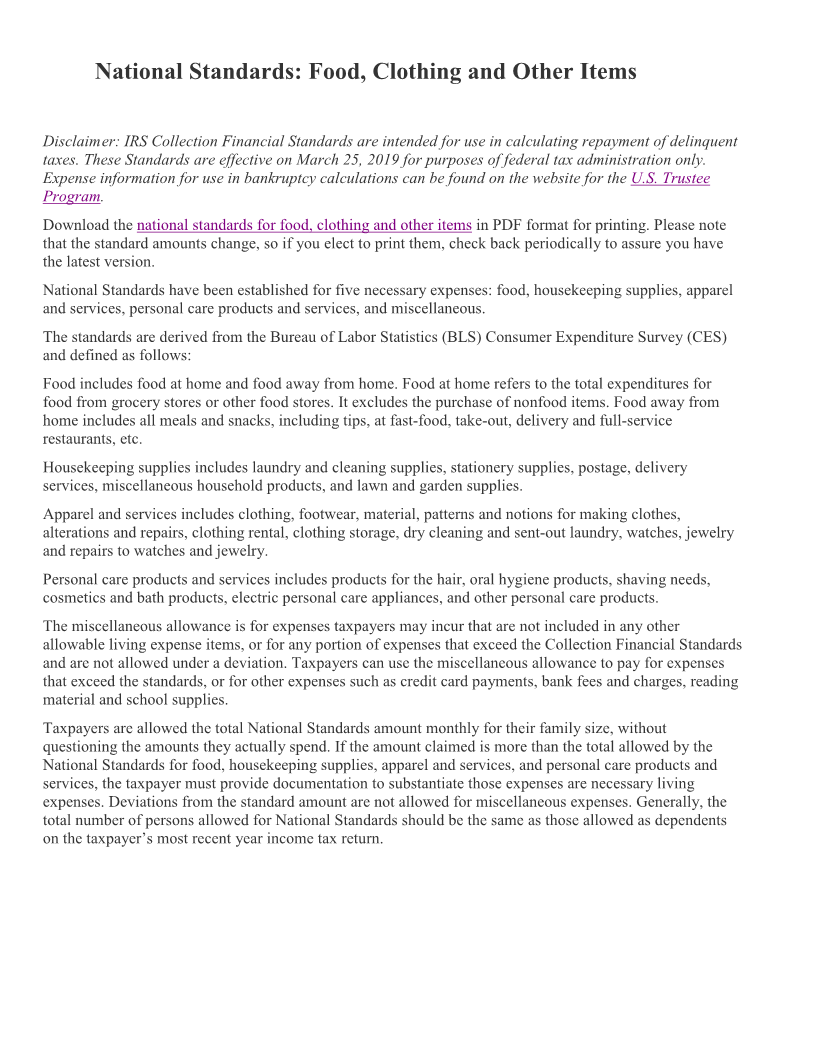

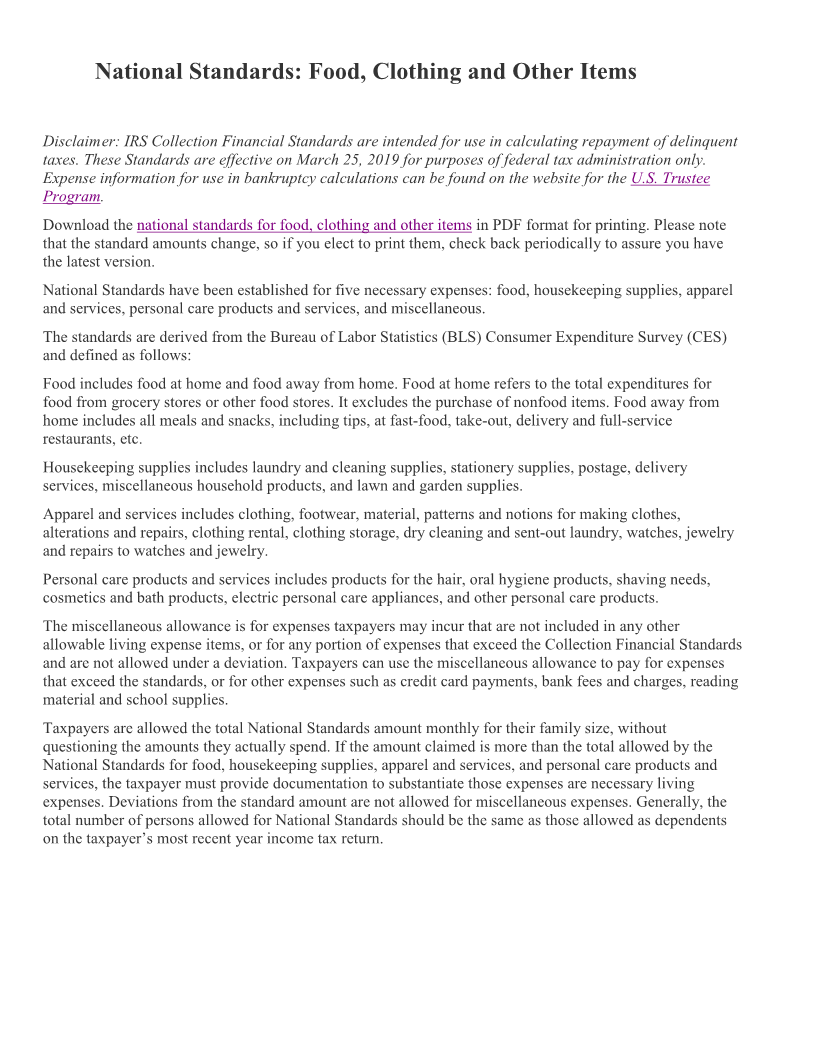

National Standards: Food, Clothing and Other Items

Disclaimer: IRS Collection Financial Standards are intended for use in calculating repayment of delinquent

taxes. These Standards are effective on March 25, 2019 for purposes of federal tax administration only.

Expense information for use in bankruptcy calculations can be found on the website for the U.S. Trustee

Program.

Download the national standards for food, clothing and other items in PDF format for printing. Please note

that the standard amounts change, so if you elect to print them, check back periodically to assure you have

the latest version.

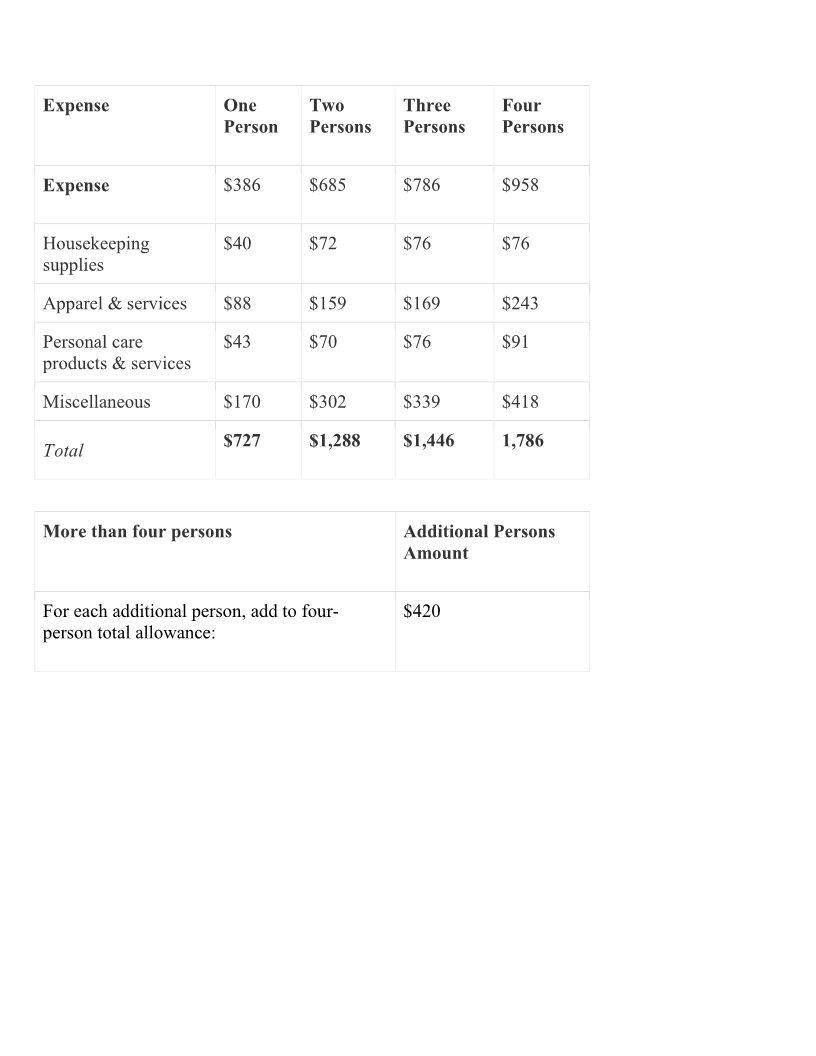

National Standards have been established for five necessary expenses: food, housekeeping supplies, apparel

and services, personal care products and services, and miscellaneous.

The standards are derived from the Bureau of Labor Statistics (BLS) Consumer Expenditure Survey (CES)

and defined as follows:

Food includes food at home and food away from home. Food at home refers to the total expenditures for

food from grocery stores or other food stores. It excludes the purchase of nonfood items. Food away from

home includes all meals and snacks, including tips, at fast-food, take-out, delivery and full-service

restaurants, etc.

Housekeeping supplies includes laundry and cleaning supplies, stationery supplies, postage, delivery

services, miscellaneous household products, and lawn and garden supplies.

Apparel and services includes clothing, footwear, material, patterns and notions for making clothes,

alterations and repairs, clothing rental, clothing storage, dry cleaning and sent-out laundry, watches, jewelry

and repairs to watches and jewelry.

Personal care products and services includes products for the hair, oral hygiene products, shaving needs,

cosmetics and bath products, electric personal care appliances, and other personal care products.

The miscellaneous allowance is for expenses taxpayers may incur that are not included in any other

allowable living expense items, or for any portion of expenses that exceed the Collection Financial Standards

and are not allowed under a deviation. Taxpayers can use the miscellaneous allowance to pay for expenses

that exceed the standards, or for other expenses such as credit card payments, bank fees and charges, reading

material and school supplies.

Taxpayers are allowed the total National Standards amount monthly for their family size, without

questioning the amounts they actually spend. If the amount claimed is more than the total allowed by the

National Standards for food, housekeeping supplies, apparel and services, and personal care products and

services, the taxpayer must provide documentation to substantiate those expenses are necessary living

expenses. Deviations from the standard amount are not allowed for miscellaneous expenses. Generally, the

total number of persons allowed for National Standards should be the same as those allowed as dependents

on the taxpayer’s most recent year income tax return.

|