Enlarge image

New Jersey

Income Tax Withholding

Instructions

NJ-WT

This Guide Contains:

Mandatory Electronic Filing of 1099s

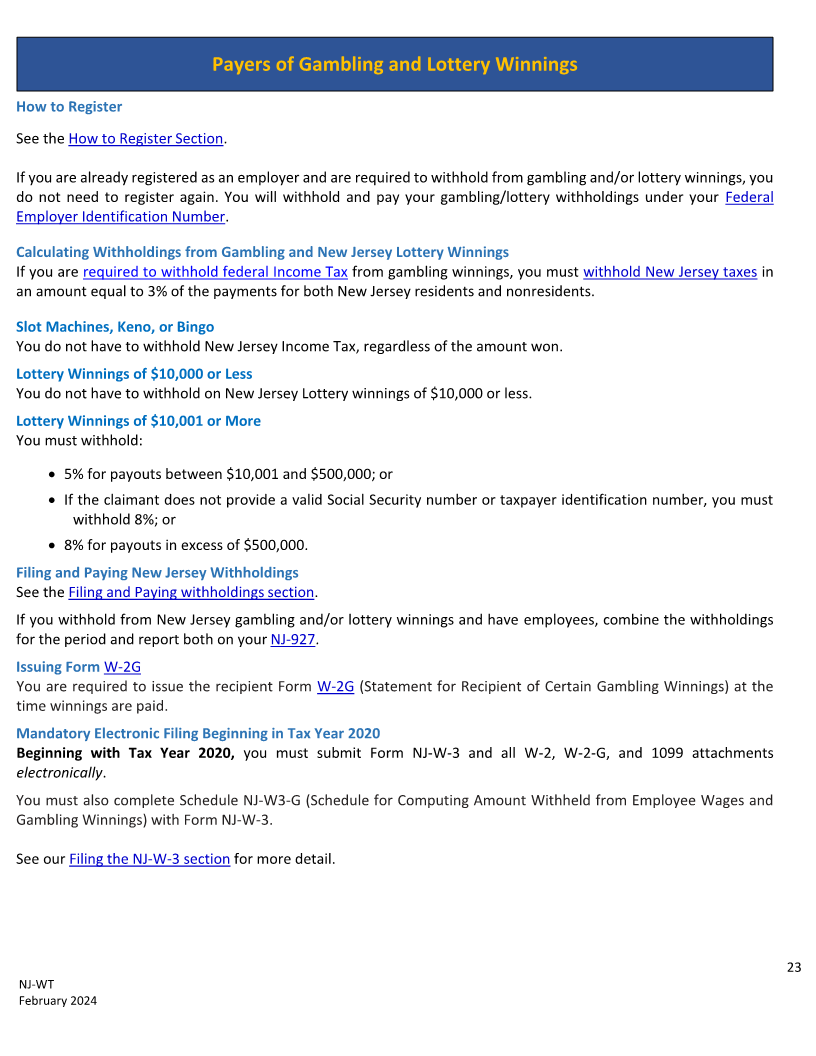

How to Calculate, Withhold, and Pay New Jersey Income Tax

“Customer quotes,

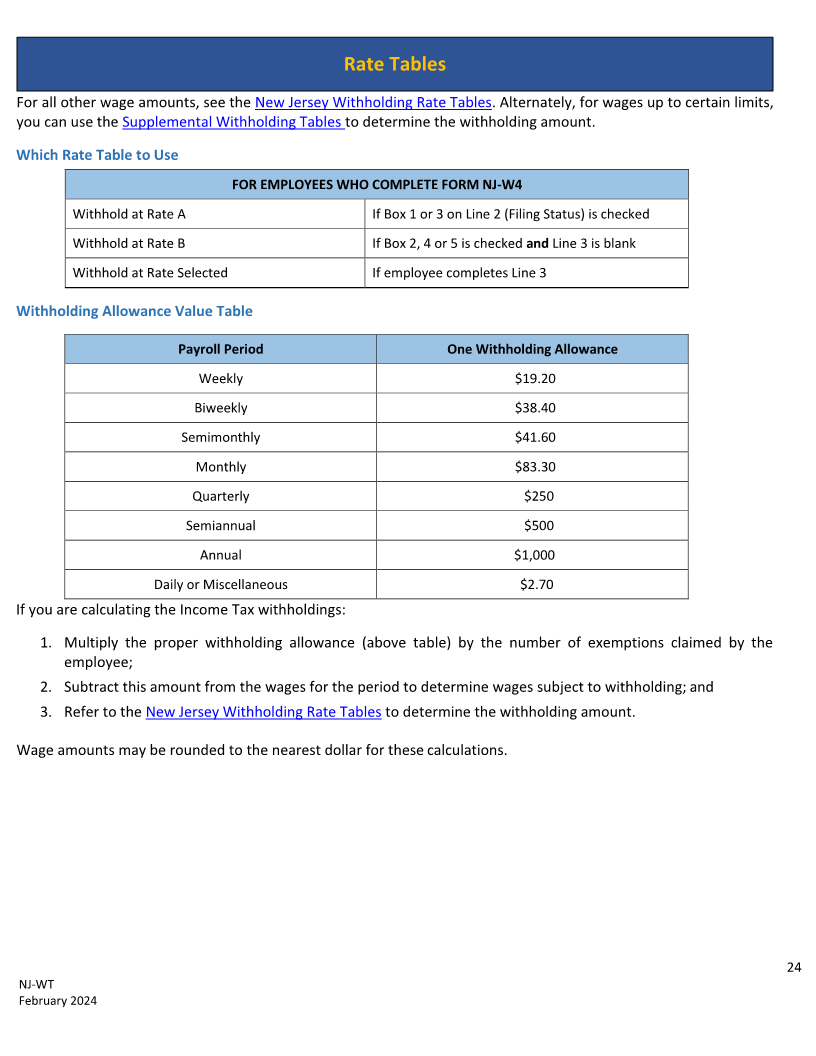

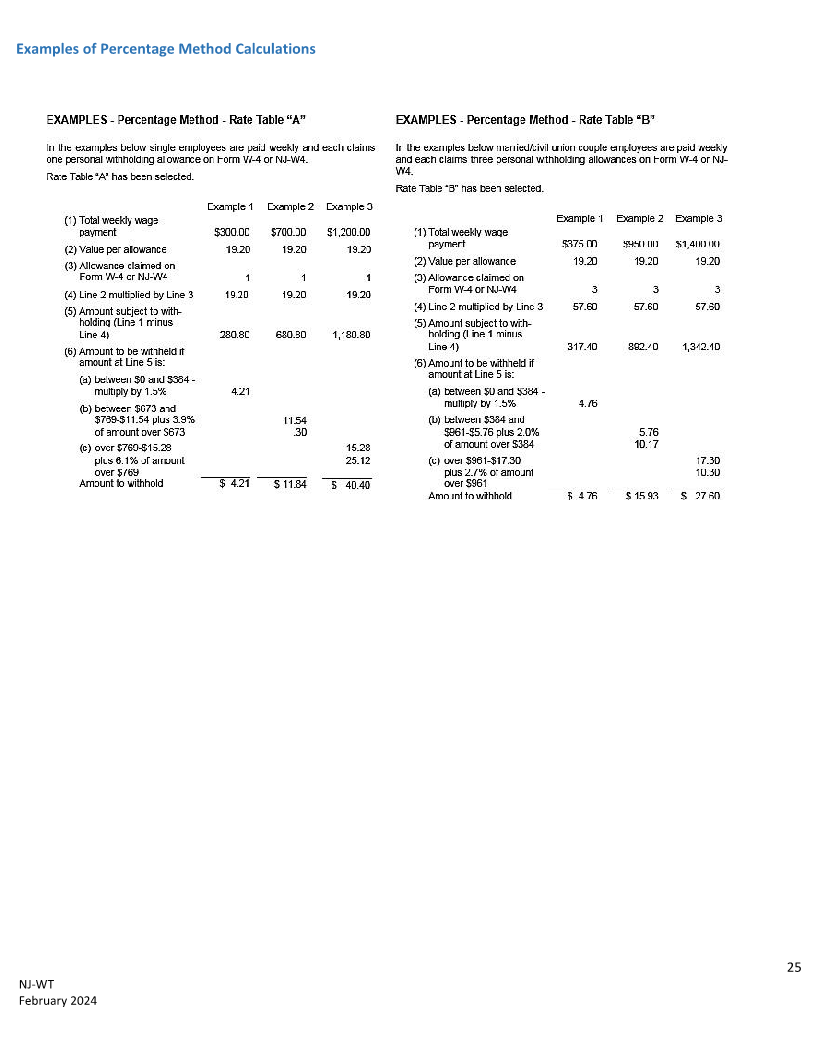

Withholding Rate Tables

called “pull quotes,” are

Instructions for the Employer’s Reports (Forms NJ-927 and

NJ-927-W) an excellent way to

Instructions for Domestic Employer’s Report (Form NJ-927-H) demonstrat your

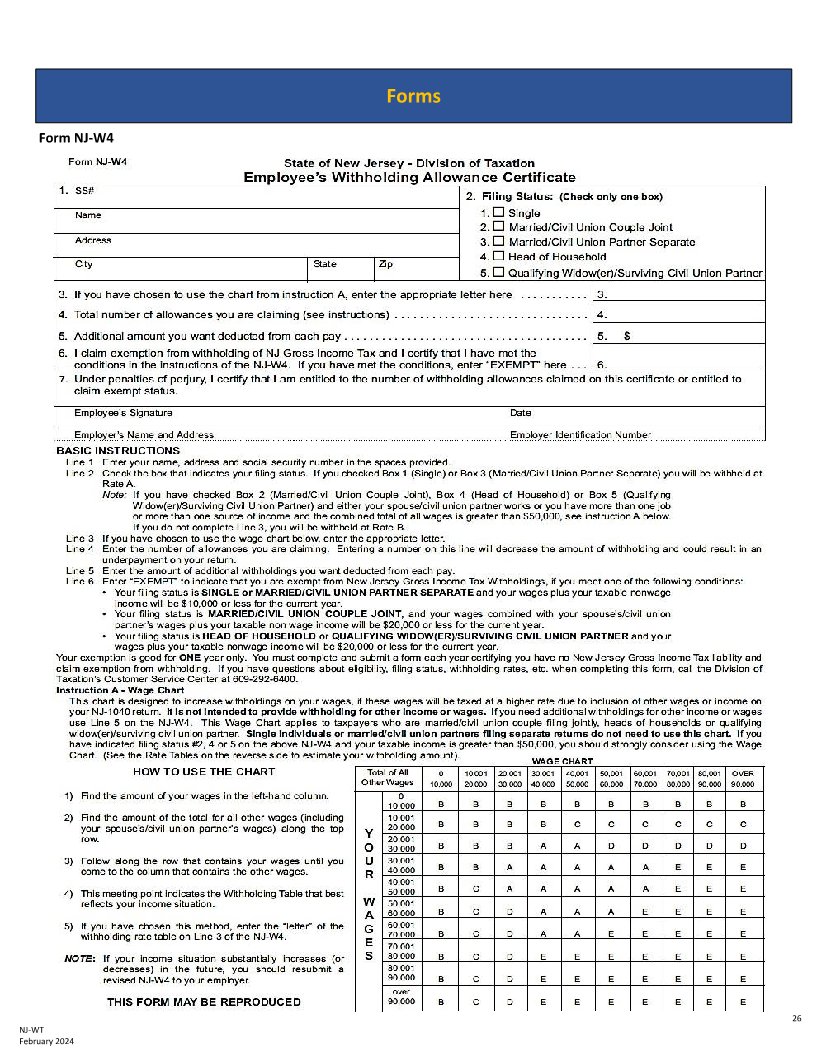

Form NJ-W4 (Employee’s Withholding Certificate) success and put

emphasis on your

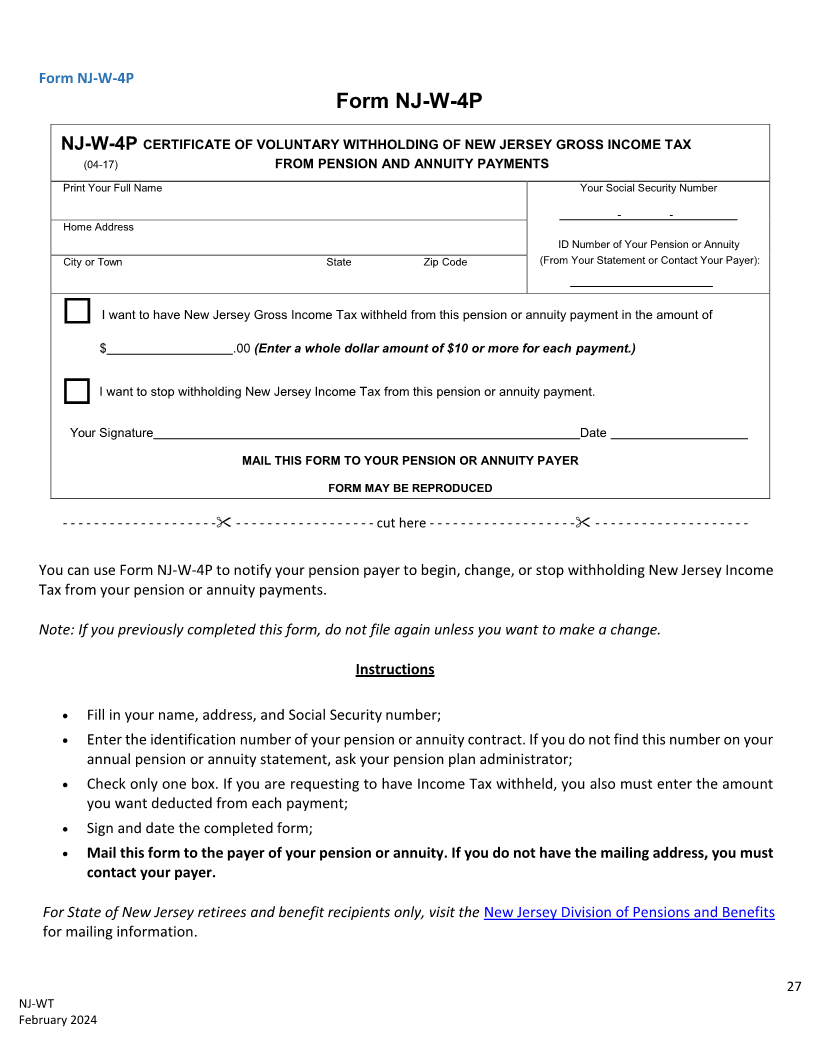

Form NJ-W-4P (Voluntary Withholding for Pension Income)

values. They also add

Sample Form W-2

visual interest to your

Withholding Requirements for Certain Construction

newsletter...”

Contractors

Contact information for the Department of Labor and - Kim Abercrombie

Workforce Development on Questions about New Jersey

Unemployment, Disability, and Family Leave Insurance

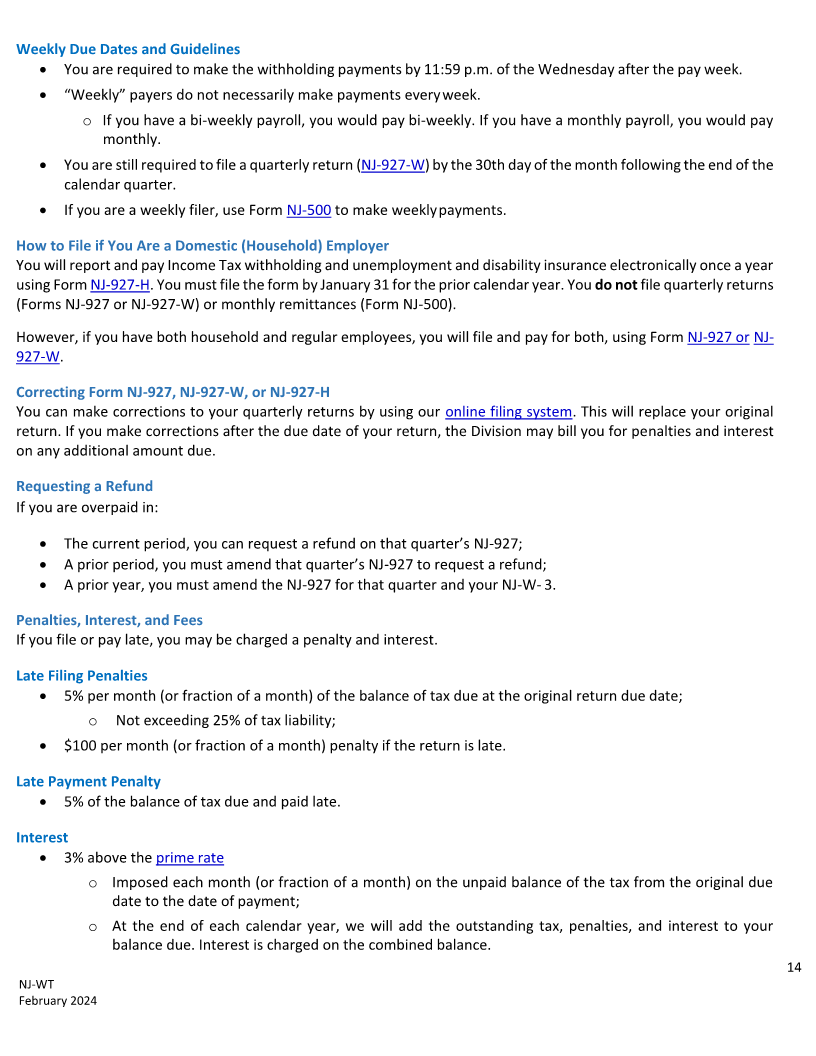

Penalty and Interest Guidelines and Rates

1