- 2 -

Enlarge image

|

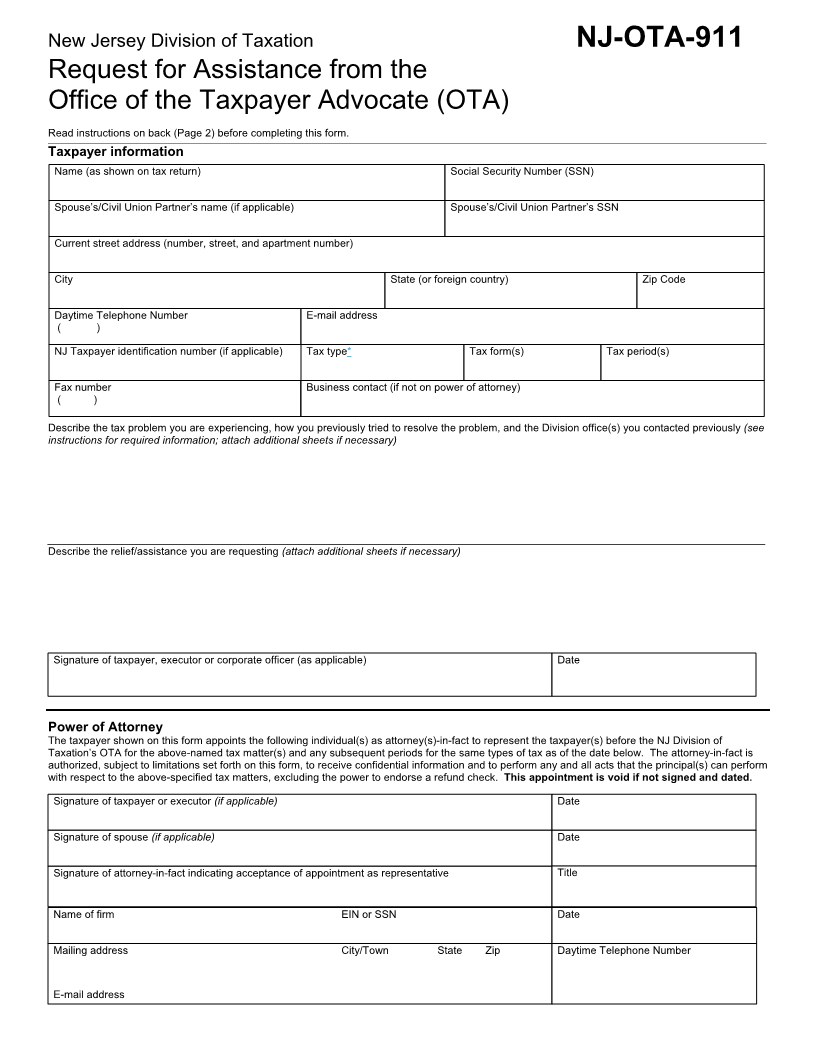

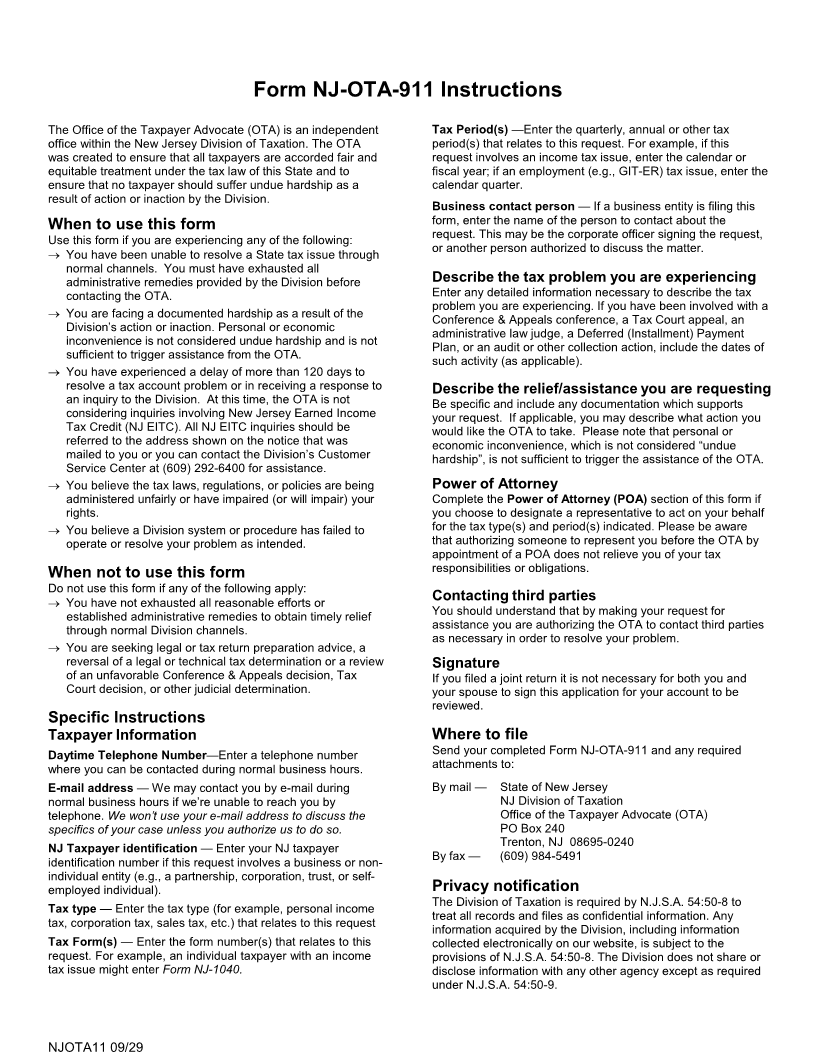

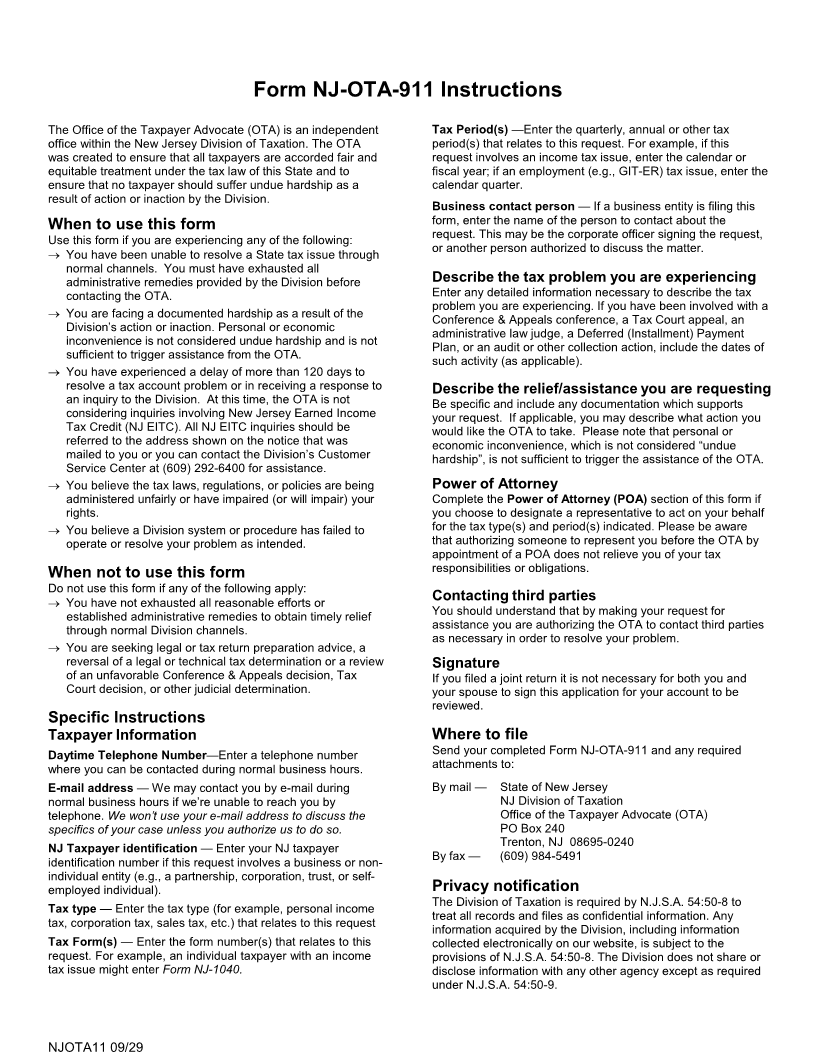

Form NJ-OTA-911 Instructions

The Office of the Taxpayer Advocate (OTA) is an independent Tax Period(s) —Enter the quarterly, annual or other tax

office within the New Jersey Division of Taxation. The OTA period(s) that relates to this request. For example, if this

was created to ensure that all taxpayers are accorded fair and request involves an income tax issue, enter the calendar or

equitable treatment under the tax law of this State and to fiscal year; if an employment (e.g., GIT-ER) tax issue, enter the

ensure that no taxpayer should suffer undue hardship as a calendar quarter.

result of action or inaction by the Division.

Business contact person — If a business entity is filing this

When to use this form form, enter the name of the person to contact about the

Use this form if you are experiencing any of the following: request. This may be the corporate officer signing the request,

or another person authorized to discuss the matter.

→ You have been unable to resolve a State tax issue through

normal channels. You must have exhausted all

administrative remedies provided by the Division before Describe the tax problem you are experiencing

contacting the OTA. Enter any detailed information necessary to describe the tax

problem you are experiencing. If you have been involved with a

→ You are facing a documented hardship as a result of the Conference & Appeals conference, a Tax Court appeal, an

Division’s action or inaction. Personal or economic administrative law judge, a Deferred (Installment) Payment

inconvenience is not considered undue hardship and is not Plan, or an audit or other collection action, include the dates of

sufficient to trigger assistance from the OTA. such activity (as applicable).

→ You have experienced a delay of more than 120 days to

resolve a tax account problem or in receiving a response to Describe the relief/assistance you are requesting

an inquiry to the Division. At this time, the OTA is not Be specific and include any documentation which supports

considering inquiries involving New Jersey Earned Income your request. If applicable, you may describe what action you

Tax Credit (NJ EITC). All NJ EITC inquiries should be would like the OTA to take. Please note that personal or

referred to the address shown on the notice that was economic inconvenience, which is not considered “undue

mailed to you or you can contact the Division’s Customer hardship”, is not sufficient to trigger the assistance of the OTA.

Service Center at (609) 292-6400 for assistance.

→ You believe the tax laws, regulations, or policies are being Power of Attorney

administered unfairly or have impaired (or will impair) your Complete the Power of Attorney (POA) section of this form if

rights. you choose to designate a representative to act on your behalf

→ You believe a Division system or procedure has failed to for the tax type(s) and period(s) indicated. Please be aware

operate or resolve your problem as intended. that authorizing someone to represent you before the OTA by

appointment of a POA does not relieve you of your tax

When not to use this form responsibilities or obligations.

Do not use this form if any of the following apply:

→ You have not exhausted all reasonable efforts or Contacting third parties

established administrative remedies to obtain timely relief You should understand that by making your request for

through normal Division channels. assistance you are authorizing the OTA to contact third parties

as necessary in order to resolve your problem.

→ You are seeking legal or tax return preparation advice, a

reversal of a legal or technical tax determination or a review Signature

of an unfavorable Conference & Appeals decision, Tax If you filed a joint return it is not necessary for both you and

Court decision, or other judicial determination. your spouse to sign this application for your account to be

reviewed.

Specific Instructions

Taxpayer Information Where to file

Daytime Telephone Number—Enter a telephone number Send your completed Form NJ-OTA-911 and any required

where you can be contacted during normal business hours. attachments to:

E-mail address — We may contact you by e-mail during By mail — State of New Jersey

normal business hours if we’re unable to reach you by NJ Division of Taxation

telephone. We won’t use your e-mail address to discuss the Office of the Taxpayer Advocate (OTA)

specifics of your case unless you authorize us to do so. PO Box 240

NJ Taxpayer identification — Enter your NJ taxpayer Trenton, NJ 08695-0240

identification number if this request involves a business or non- By fax — (609) 984-5491

individual entity (e.g., a partnership, corporation, trust, or self-

employed individual). Privacy notification

The Division of Taxation is required by N.J.S.A. 54:50-8 to

Tax type — Enter the tax type (for example, personal income

treat all records and files as confidential information. Any

tax, corporation tax, sales tax, etc.) that relates to this request

information acquired by the Division, including information

Tax Form(s) — Enter the form number(s) that relates to this collected electronically on our website, is subject to the

request. For example, an individual taxpayer with an income provisions of N.J.S.A. 54:50-8. The Division does not share or

tax issue might enter Form NJ-1040. disclose information with any other agency except as required

under N.J.S.A. 54:50-9.

NJOTA11 09/29

|