Enlarge image

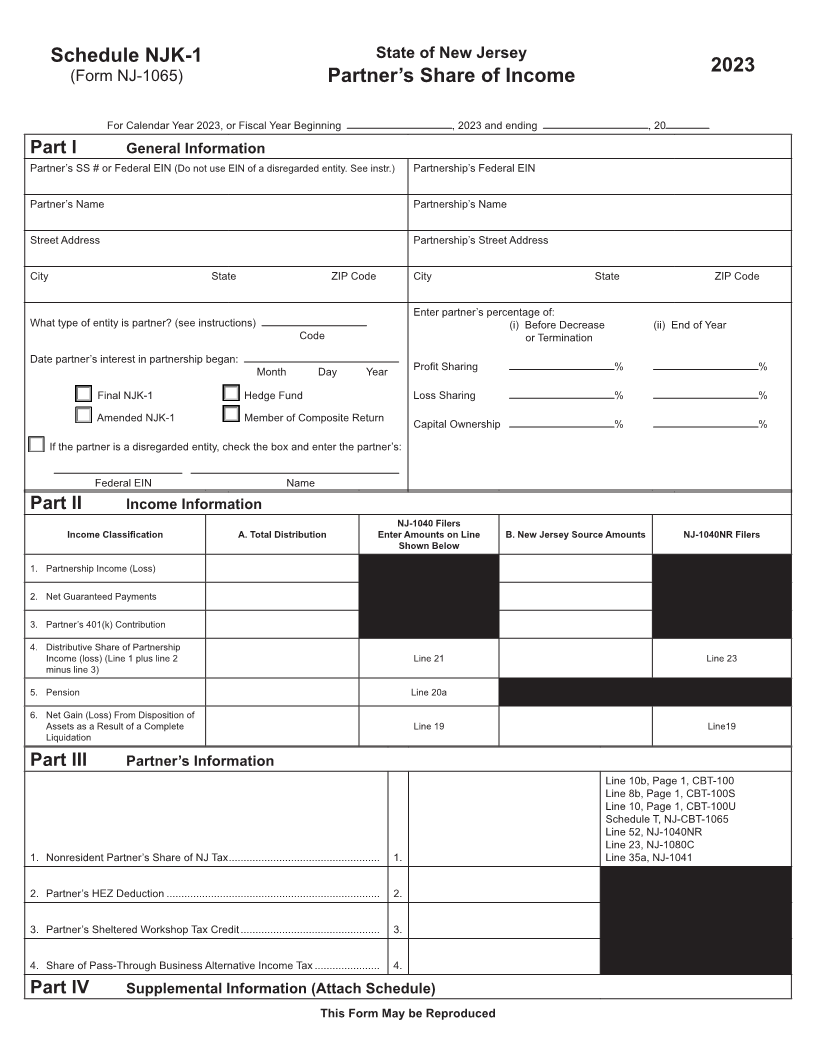

Schedule NJK-1 State of New Jersey

2023

(Form NJ-1065) Partner’s Share of Income

For Calendar Year 2023, or Fiscal Year Beginning , 2023 and ending , 20

Part I General Information

Partner’s SS # or Federal EIN (Do not use EIN of a disregarded entity. See instr.) Partnership’s Federal EIN

Partner’s Name Partnership’s Name

Street Address Partnership’s Street Address

City State ZIP Code City State ZIP Code

Enter partner’s percentage of:

What type of entity is partner? (see instructions) (i) Before Decrease (ii) End of Year

Code or Termination

Date partner’s interest in partnership began:

Month Day Year Profit Sharing % %

Final NJK-1 Hedge Fund Loss Sharing % %

Amended NJK-1 Member of Composite Return Capital Ownership % %

If the partner is a disregarded entity, check the box and enter the partner’s:

Federal EIN Name

Part II Income Information

NJ-1040 Filers

Income Classification A. Total Distribution Enter Amounts on Line B. New Jersey Source Amounts NJ-1040NR Filers

Shown Below

1. Partnership Income (Loss)

2. Net Guaranteed Payments

3. Partner’s 401(k) Contribution

4. Distributive Share of Partnership

Income (loss) (Line 1 plus line 2 Line 21 Line 23

minus line 3)

5. Pension Line 20a

6. Net Gain (Loss) From Disposition of

Assets as a Result of a Complete Line 19 Line19

Liquidation

Part III Partner’s Information

Line 10b, Page 1, CBT-100

Line 8b, Page 1, CBT-100S

Line 10, Page 1, CBT-100U

Schedule T, NJ-CBT-1065

Line 52, NJ-1040NR

Line 23, NJ-1080C

1. Nonresident Partner’s Share of NJ Tax ................................................... 1. Line 35a, NJ-1041

2. Partner’s HEZ Deduction ........................................................................ 2.

3. Partner’s Sheltered Workshop Tax Credit ............................................... 3.

4. Share of Pass-Through Business Alternative Income Tax ...................... 4.

Part IV Supplemental Information (Attach Schedule)

This Form May be Reproduced