Enlarge image

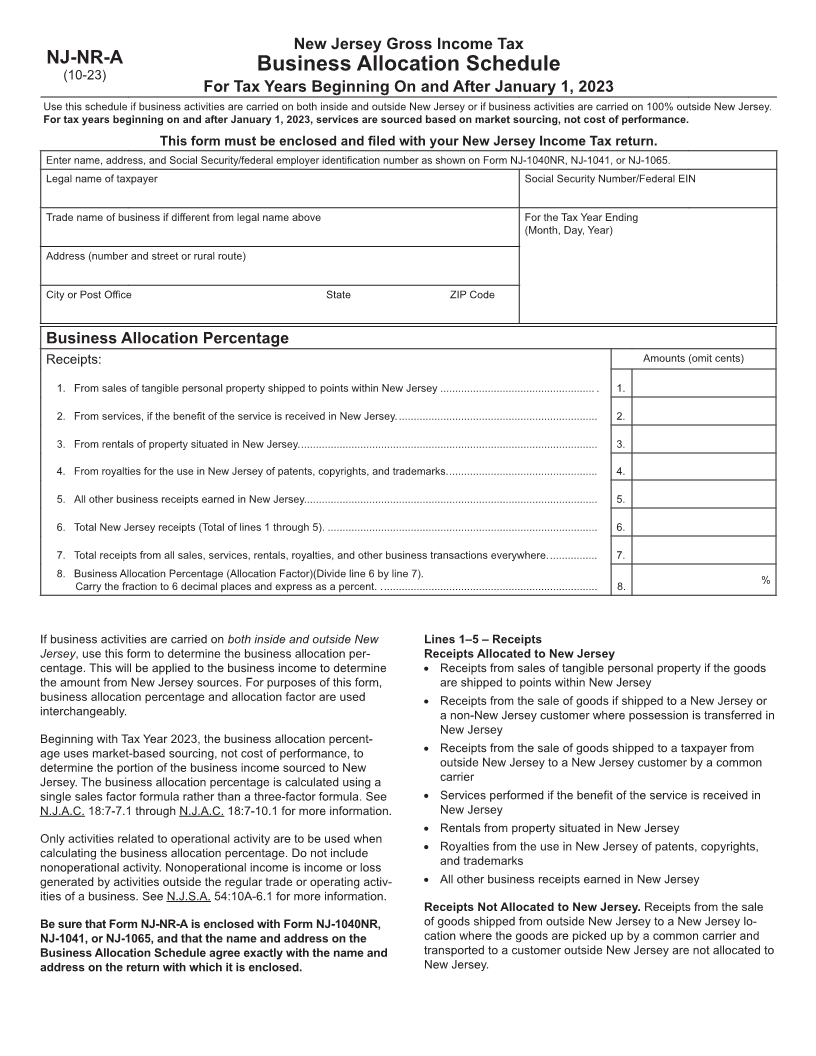

New Jersey Gross Income Tax

NJ-NR-A

(10-23) Business Allocation Schedule

For Tax Years Beginning On and After January 1, 2023

Use this schedule if business activities are carried on both inside and outside New Jersey or if business activities are carried on 100% outside New Jersey.

For tax years beginning on and after January 1, 2023, services are sourced based on market sourcing, not cost of performance.

This form must be enclosed and filed with your New Jersey Income Tax return.

Enter name, address, and Social Security/federal employer identification number as shown on Form NJ-1040NR, NJ-1041, or NJ-1065.

Legal name of taxpayer Social Security Number/Federal EIN

Trade name of business if different from legal name above For the Tax Year Ending

(Month, Day, Year)

Address (number and street or rural route)

City or Post Office State ZIP Code

Business Allocation Percentage

Receipts: Amounts (omit cents)

1. From sales of tangible personal property shipped to points within New Jersey .................................................... . 1.

2. From services, if the benefit of the service is received in New Jersey. ................................................................... 2.

3. From rentals of property situated in New Jersey. .................................................................................................... 3.

4. From royalties for the use in New Jersey of patents, copyrights, and trademarks. .................................................. 4.

5. All other business receipts earned in New Jersey................................................................................................... 5.

6. Total New Jersey receipts (Total of lines 1 through 5). ........................................................................................... 6.

7. Total receipts from all sales, services, rentals, royalties, and other business transactions everywhere. ................ 7.

8. Business Allocation Percentage (Allocation Factor)(Divide line 6 by line 7). %

Carry the fraction to 6 decimal places and express as a percent. . ........................................................................ 8.

If business activities are carried on both inside and outside New Lines 1–5 – Receipts

Jersey, use this form to determine the business allocation per- Receipts Allocated to New Jersey

centage. This will be applied to the business income to determine • Receipts from sales of tangible personal property if the goods

the amount from New Jersey sources. For purposes of this form, are shipped to points within New Jersey

business allocation percentage and allocation factor are used • Receipts from the sale of goods if shipped to a New Jersey or

interchangeably. a non-New Jersey customer where possession is transferred in

New Jersey

Beginning with Tax Year 2023, the business allocation percent-

age uses market-based sourcing, not cost of performance, to • Receipts from the sale of goods shipped to a taxpayer from

determine the portion of the business income sourced to New outside New Jersey to a New Jersey customer by a common

Jersey. The business allocation percentage is calculated using a carrier

single sales factor formula rather than a three-factor formula. See • Services performed if the benefit of the service is received in

N.J.A.C. 18:7-7.1 through N.J.A.C. 18:7-10.1 for more information. New Jersey

• Rentals from property situated in New Jersey

Only activities related to operational activity are to be used when • Royalties from the use in New Jersey of patents, copyrights,

calculating the business allocation percentage. Do not include

and trademarks

nonoperational activity. Nonoperational income is income or loss

generated by activities outside the regular trade or operating activ- • All other business receipts earned in New Jersey

ities of a business. See N.J.S.A. 54:10A-6.1 for more information.

Receipts Not Allocated to New Jersey. Receipts from the sale

Be sure that Form NJ-NR-A is enclosed with Form NJ-1040NR, of goods shipped from outside New Jersey to a New Jersey lo-

NJ-1041, or NJ-1065, and that the name and address on the cation where the goods are picked up by a common carrier and

Business Allocation Schedule agree exactly with the name and transported to a customer outside New Jersey are not allocated to

address on the return with which it is enclosed. New Jersey.