Enlarge image

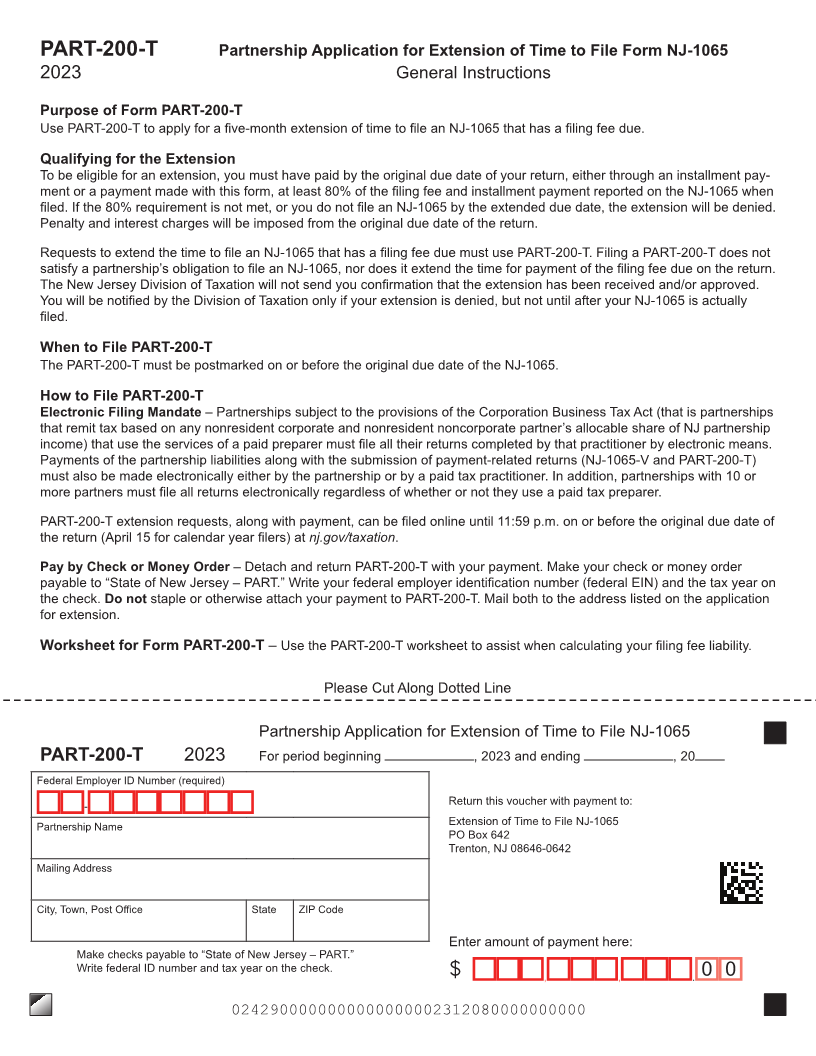

PART-200-T Partnership Application for Extension of Time to File Form NJ-1065

2023 General Instructions

Purpose of Form PART-200-T

Use PART-200-T to apply for a five-month extension of time to file an NJ-1065 that has a filing fee due.

Qualifying for the Extension

To be eligible for an extension, you must have paid by the original due date of your return, either through an installment pay-

ment or a payment made with this form, at least 80% of the filing fee and installment payment reported on the NJ-1065 when

filed. If the 80% requirement is not met, or you do not file an NJ-1065 by the extended due date, the extension will be denied.

Penalty and interest charges will be imposed from the original due date of the return.

Requests to extend the time to file an NJ-1065 that has a filing fee due must use PART-200-T. Filing a PART-200-T does not

satisfy a partnership’s obligation to file an NJ-1065, nor does it extend the time for payment of the filing fee due on the return.

The New Jersey Division of Taxation will not send you confirmation that the extension has been received and/or approved.

You will be notified by the Division of Taxation only if your extension is denied, but not until after your NJ-1065 is actually

filed.

When to File PART-200-T

The PART-200-T must be postmarked on or before the original due date of the NJ-1065.

How to File PART-200-T

Electronic Filing Mandate – Partnerships subject to the provisions of the Corporation Business Tax Act (that is partnerships

that remit tax based on any nonresident corporate and nonresident noncorporate partner’s allocable share of NJ partnership

income) that use the services of a paid preparer must file all their returns completed by that practitioner by electronic means.

Payments of the partnership liabilities along with the submission of payment-related returns (NJ-1065-V and PART-200-T)

must also be made electronically either by the partnership or by a paid tax practitioner. In addition, partnerships with 10 or

more partners must file all returns electronically regardless of whether or not they use a paid tax preparer.

PART-200-T extension requests, along with payment, can be filed online until 11:59 p.m. on or before the original due date of

the return (April 15 for calendar year filers) at nj.gov/taxation.

Pay by Check or Money Order – Detach and return PART-200-T with your payment. Make your check or money order

payable to “State of New Jersey – PART.” Write your federal employer identification number (federal EIN) and the tax year on

the check. Do not staple or otherwise attach your payment to PART-200-T. Mail both to the address listed on the application

for extension.

Worksheet for Form PART-200-T – Use the PART-200-T worksheet to assist when calculating your filing fee liability.

Please Cut Along Dotted Line

Partnership Application for Extension of Time to File NJ-1065

PART-200-T 2023 For period beginning , 2023 and ending , 20

Federal Employer ID Number (required)

- Return this voucher with payment to:

Partnership Name Extension of Time to File NJ-1065

PO Box 642

Trenton, NJ 08646-0642

Mailing Address

City, Town, Post Office State ZIP Code

Enter amount of payment here:

Make checks payable to “State of New Jersey – PART.”

Write federal ID number and tax year on the check. $ , , . 0 0

0242900000000000000002312080000000000