Enlarge image

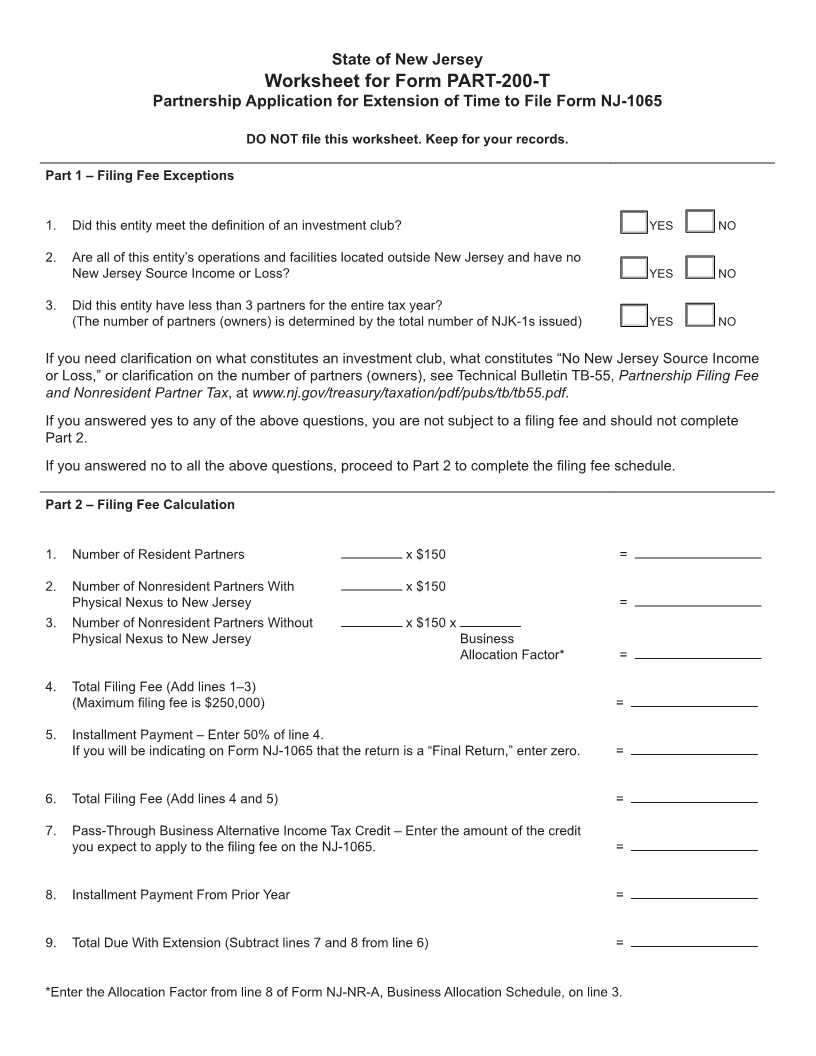

State of New Jersey

Worksheet for Form PART-200-T

Partnership Application for Extension of Time to File Form NJ-1065

DO NOT file this worksheet. Keep for your records.

Part 1 – Filing Fee Exceptions

1. Did this entity meet the definition of an investment club? YES NO

2. Are all of this entity’s operations and facilities located outside New Jersey and have no

New Jersey Source Income or Loss? YES NO

3. Did this entity have less than 3 partners for the entire tax year?

(The number of partners (owners) is determined by the total number of NJK-1s issued) YES NO

If you need clarification on what constitutes an investment club, what constitutes “No New Jersey Source Income

or Loss,” or clarification on the number of partners (owners), see Technical Bulletin TB-55, Partnership Filing Fee

and Nonresident Partner Tax, at www.nj.gov/treasury/taxation/pdf/pubs/tb/tb55.pdf.

If you answered yes to any of the above questions, you are not subject to a filing fee and should not complete

Part 2.

If you answered no to all the above questions, proceed to Part 2 to complete the filing fee schedule.

Part 2 – Filing Fee Calculation

1. Number of Resident Partners x $150 =

2. Number of Nonresident Partners With x $150

Physical Nexus to New Jersey =

3. Number of Nonresident Partners Without x $150 x

Physical Nexus to New Jersey Business

Allocation Factor* =

4. Total Filing Fee (Add lines 1–3)

(Maximum filing fee is $250,000) =

5. Installment Payment – Enter 50% of line 4.

If you will be indicating on Form NJ-1065 that the return is a “Final Return,” enter zero. =

6. Total Filing Fee (Add lines 4 and 5) =

7 . Pass-Through Business Alternative Income Tax Credit – Enter the amount of the credit

you expect to apply to the filing fee on the NJ-1065. =

8. Installment Payment From Prior Year =

9. Total Due With Extension (Subtract lines 7 and 8 from line 6) =

*Enter the Allocation Factor from line 8 of Form NJ-NR-A, Business Allocation Schedule, on line 3.