Enlarge image

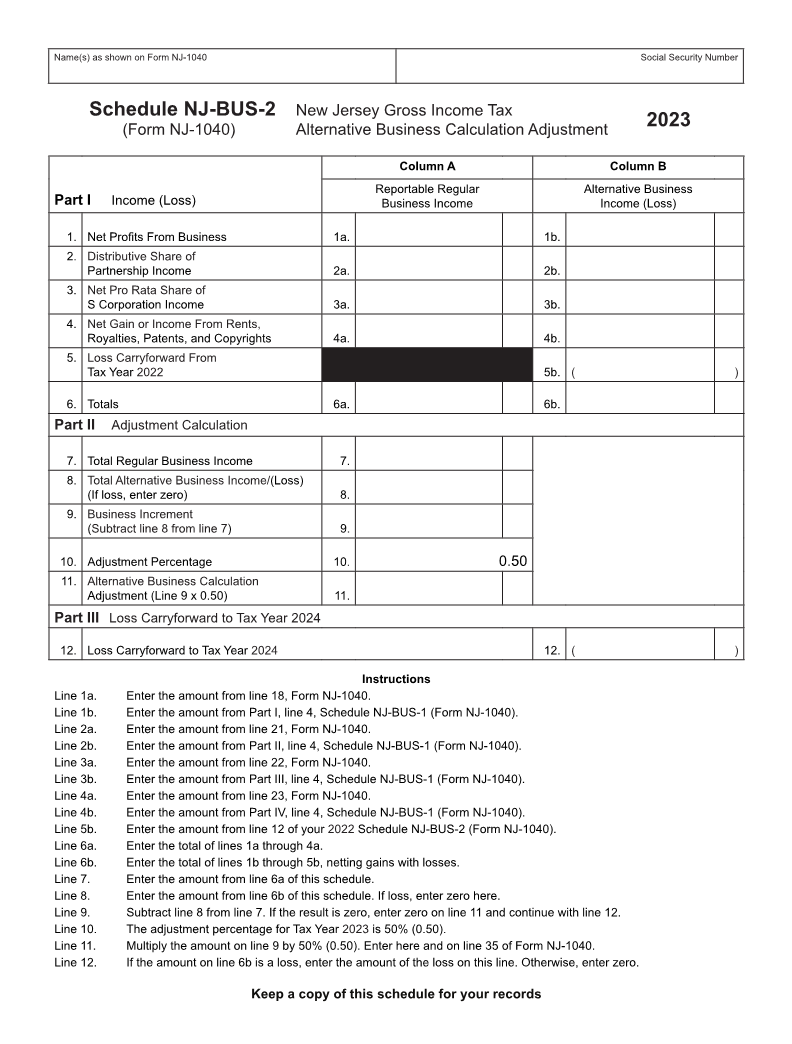

Name(s) as shown on Form NJ-1040 Social Security Number

Schedule NJ-BUS-2 New Jersey Gross Income Tax

(Form NJ-1040) Alternative Business Calculation Adjustment 2023

Column A Column B

Reportable Regular Alternative Business

Part I Income (Loss) Business Income Income (Loss)

1. Net Profits From Business 1a. 1b.

2. Distributive Share of

Partnership Income 2a. 2b.

3. Net Pro Rata Share of

S Corporation Income 3a. 3b.

4. Net Gain or Income From Rents,

Royalties, Patents, and Copyrights 4a. 4b.

5. Loss Carryforward From

Tax Year 2022 5b. ( )

6. Totals 6a. 6b.

Part II Adjustment Calculation

7. Total Regular Business Income 7.

8. Total Alternative Business Income/(Loss)

(If loss, enter zero) 8.

9. Business Increment

(Subtract line 8 from line 7) 9.

10. Adjustment Percentage 10. 0.50

11. Alternative Business Calculation

Adjustment (Line 9 x 0.50) 11.

Part III Loss Carryforward to Tax Year 2024

12. Loss Carryforward to Tax Year 2024 12. ( )

Instructions

Line 1a. Enter the amount from line 18, Form NJ-1040.

Line 1b. Enter the amount from Part I, line 4, Schedule NJ-BUS-1 (Form NJ-1040).

Line 2a. Enter the amount from line 21, Form NJ-1040.

Line 2b. Enter the amount from Part II, line 4, Schedule NJ-BUS-1 (Form NJ-1040).

Line 3a. Enter the amount from line 22, Form NJ-1040.

Line 3b. Enter the amount from Part III, line 4, Schedule NJ-BUS-1 (Form NJ-1040).

Line 4a. Enter the amount from line 23, Form NJ-1040.

Line 4b. Enter the amount from Part IV, line 4, Schedule NJ-BUS-1 (Form NJ-1040).

Line 5b. Enter the amount from line 12 of your 2022 Schedule NJ-BUS-2 (Form NJ-1040).

Line 6a. Enter the total of lines 1a through 4a.

Line 6b. Enter the total of lines 1b through 5b, netting gains with losses.

Line 7. Enter the amount from line 6a of this schedule.

Line 8. Enter the amount from line 6b of this schedule. If loss, enter zero here.

Line 9. Subtract line 8 from line 7. If the result is zero, enter zero on line 11 and continue with line 12.

Line 10. The adjustment percentage for Tax Year 2023 is 50% (0.50).

Line 11. Multiply the amount on line 9 by 50% (0.50). Enter here and on line 35 of Form NJ-1040.

Line 12. If the amount on line 6b is a loss, enter the amount of the loss on this line. Otherwise, enter zero.

Keep a copy of this schedule for your records