Enlarge image

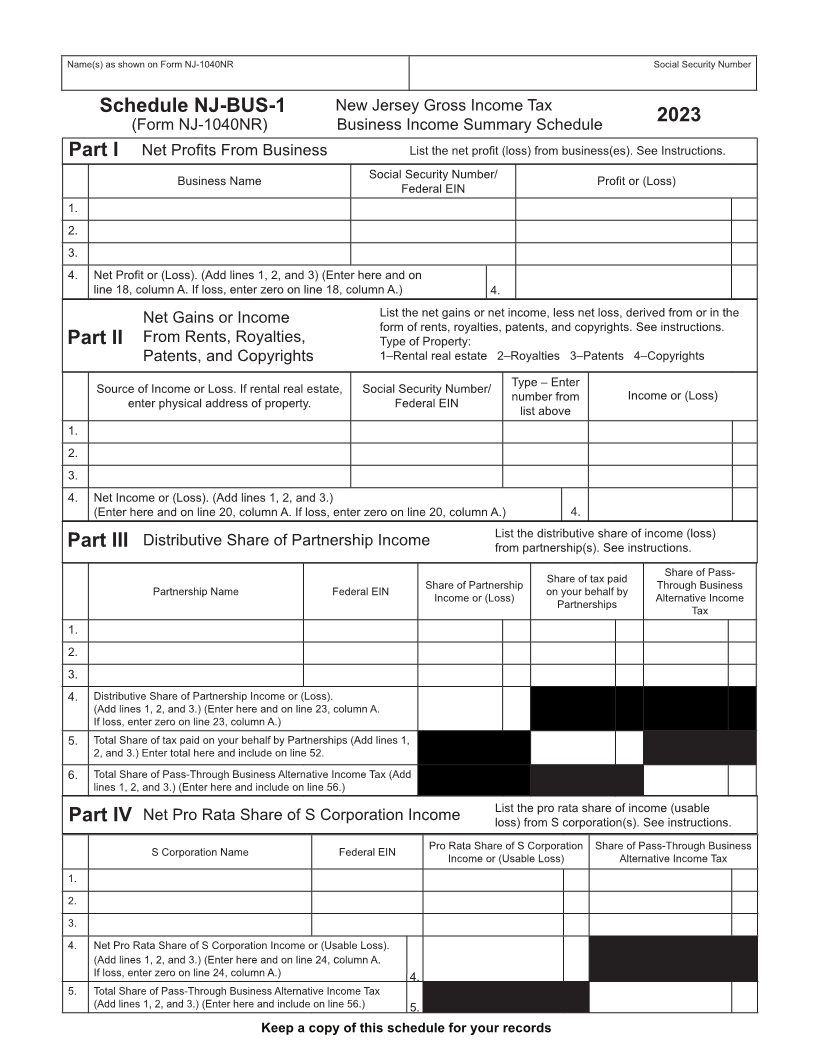

Name(s) as shown on Form NJ-1040NR Social Security Number

Schedule NJ-BUS-1 New Jersey Gross Income Tax

(Form NJ-1040NR) Business Income Summary Schedule 2023

Part I Net Profits From Business List the net profit (loss) from business(es). See Instructions.

Social Security Number/

Business Name Profit or (Loss)

Federal EIN

1.

2.

3.

4. Net Profit or (Loss). (Add lines 1, 2, and 3) (Enter here and on

line 18, column A. If loss, enter zero on line 18, column A.) 4.

List the net gains or net income, less net loss, derived from or in the

Net Gains or Income

form of rents, royalties, patents, and copyrights. See instructions.

Part II From Rents, Royalties, Type of Property:

Patents, and Copyrights 1–Rental real estate 2–Royalties 3–Patents 4–Copyrights

Type – Enter

Source of Income or Loss. If rental real estate, Social Security Number/ Income or (Loss)

number from

enter physical address of property. Federal EIN

list above

1.

2.

3.

4. Net Income or (Loss). (Add lines 1, 2, and 3.)

(Enter here and on line 20, column A. If loss, enter zero on line 20, column A.) 4.

List the distributive share of income (loss)

Part III Distributive Share of Partnership Income from partnership(s). See instructions.

Partnership Name Federal EIN Share of Partnership Share of tax paid Share of Pass-

Income or (Loss) on your behalf by Through Business

Partnerships Alternative Income

Tax

1.

2.

3.

4. Distributive Share of Partnership Income or (Loss).

(Add lines 1, 2, and 3.) (Enter here and on line 23, column A.

If loss, enter zero on line 23, column A.)

5. Total Share of tax paid on your behalf by Partnerships (Add lines 1,

2, and 3.) Enter total here and include on line 52.

6. Total Share of Pass-Through Business Alternative Income Tax (Add

lines 1, 2, and 3.) (Enter here and include on line 56.)

List the pro rata share of income (usable

Part IV Net Pro Rata Share of S Corporation Income loss) from S corporation(s). See instructions.

S Corporation Name Federal EIN Pro Rata Share of S Corporation Share of Pass-Through Business

Income or (Usable Loss) Alternative Income Tax

1.

2.

3.

4. Net Pro Rata Share of S Corporation Income or (Usable Loss).

(Add lines 1, 2, and 3.) (Enter here and on line 24, column A.

If loss, enter zero on line 24, column A.) 4.

5. Total Share of Pass-Through Business Alternative Income Tax

(Add lines 1, 2, and 3.) (Enter here and include on line 56.) 5.

Keep a copy of this schedule for your records