Enlarge image

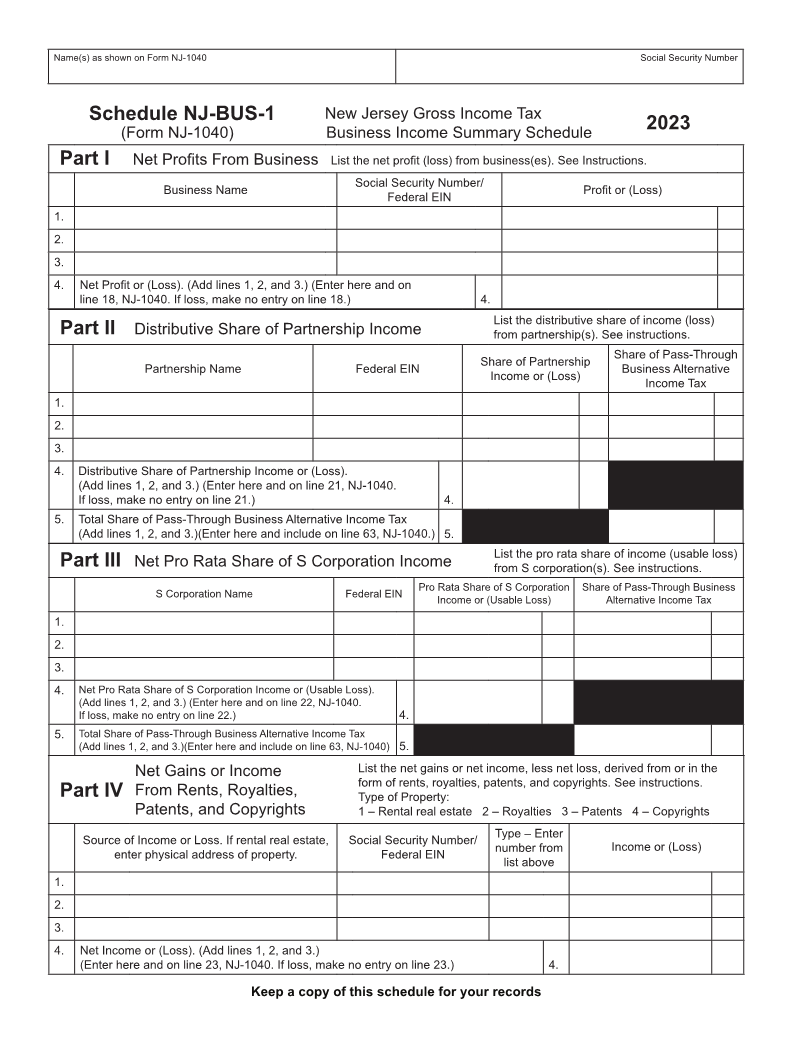

Name(s) as shown on Form NJ-1040 Social Security Number

Schedule NJ-BUS-1 New Jersey Gross Income Tax

(Form NJ-1040) Business Income Summary Schedule 2023

Part I Net Profits From Business List the net profit (loss) from business(es). See Instructions.

Social Security Number/

Business Name Profit or (Loss)

Federal EIN

1.

2.

3.

4. Net Profit or (Loss). (Add lines 1, 2, and 3.) (Enter here and on

line 18, NJ-1040. If loss, make no entry on line 18.) 4.

List the distributive share of income (loss)

Part II Distributive Share of Partnership Income from partnership(s). See instructions.

Share of Pass-Through

Share of Partnership

Partnership Name Federal EIN Business Alternative

Income or (Loss)

Income Tax

1.

2.

3.

4. Distributive Share of Partnership Income or (Loss).

(Add lines 1, 2, and 3.) (Enter here and on line 21, NJ-1040.

If loss, make no entry on line 21.) 4.

5. Total Share of Pass-Through Business Alternative Income Tax

(Add lines 1, 2, and 3.)(Enter here and include on line 63, NJ-1040.) 5.

List the pro rata share of income (usable loss)

Part III Net Pro Rata Share of S Corporation Income from S corporation(s). See instructions.

Pro Rata Share of S Corporation Share of Pass-Through Business

S Corporation Name Federal EIN Income or (Usable Loss) Alternative Income Tax

1.

2.

3.

4. Net Pro Rata Share of S Corporation Income or (Usable Loss).

(Add lines 1, 2, and 3.) (Enter here and on line 22, NJ-1040.

If loss, make no entry on line 22.) 4.

5. Total Share of Pass-Through Business Alternative Income Tax

(Add lines 1, 2, and 3.)(Enter here and include on line 63, NJ-1040) 5.

Net Gains or Income List the net gains or net income, less net loss, derived from or in the

form of rents, royalties, patents, and copyrights. See instructions.

Part IV From Rents, Royalties, Type of Property:

Patents, and Copyrights 1 – Rental real estate 2 – Royalties 3 – Patents 4 – Copyrights

Type – Enter

Source of Income or Loss. If rental real estate, Social Security Number/ Income or (Loss)

number from

enter physical address of property. Federal EIN

list above

1.

2.

3.

4. Net Income or (Loss). (Add lines 1, 2, and 3.)

(Enter here and on line 23, NJ-1040. If loss, make no entry on line 23.) 4.

Keep a copy of this schedule for your records