Enlarge image

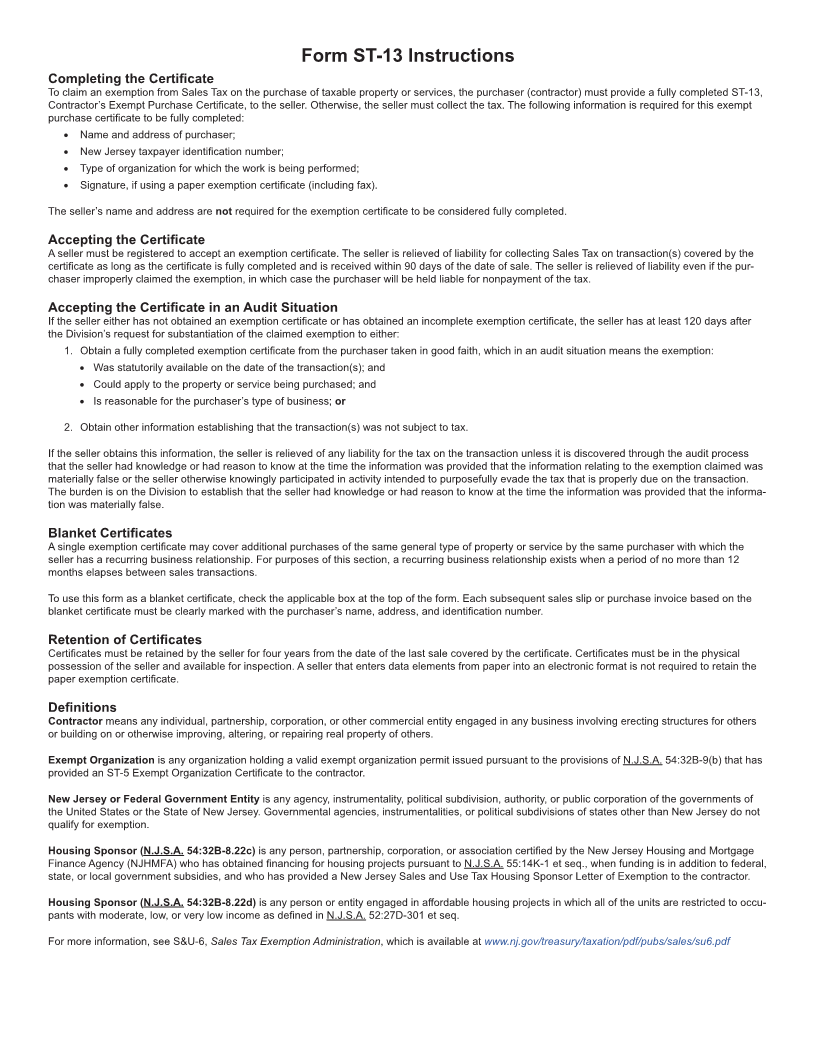

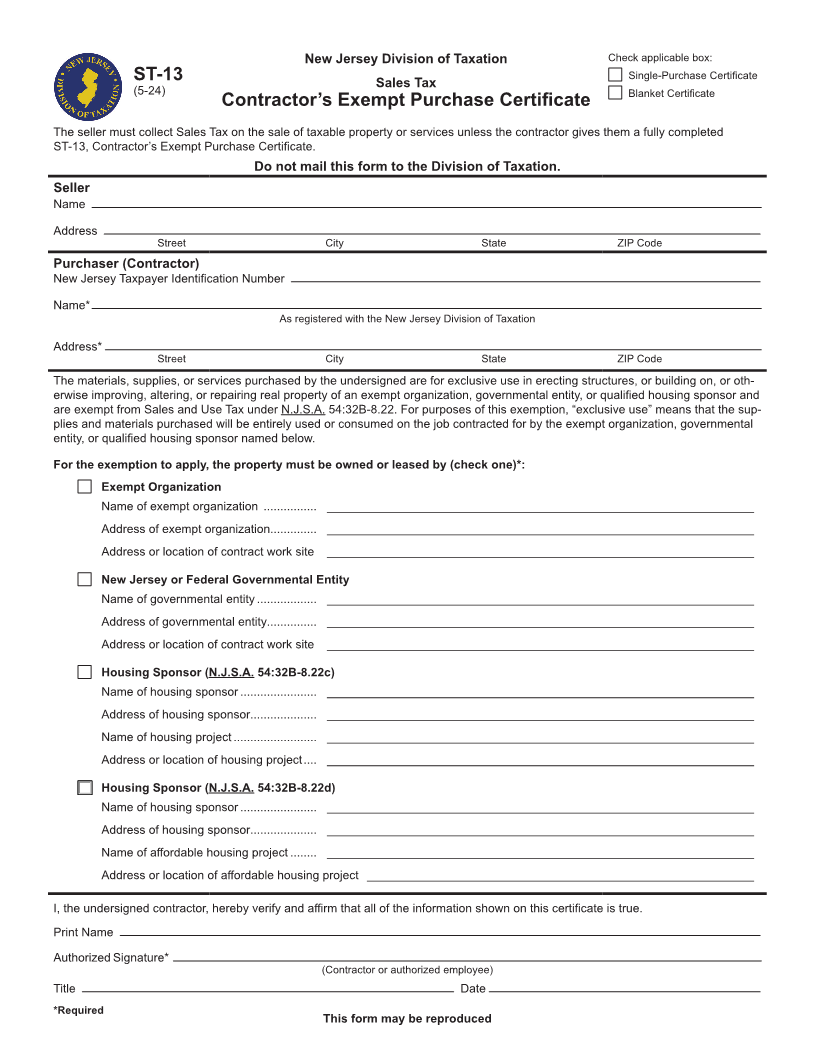

New Jersey Division of Taxation Check applicable box:

Single-Purchase Certificate

ST-13 Sales Tax

(5-24) Blanket Certificate

Contractor’s Exempt Purchase Certificate

The seller must collect Sales Tax on the sale of taxable property or services unless the contractor gives them a fully completed

ST-13, Contractor’s Exempt Purchase Certificate.

Do not mail this form to the Division of Taxation.

Seller

Name

Address

Street City State ZIP Code

Purchaser (Contractor)

New Jersey Taxpayer Identification Number

Name*

As registered with the New Jersey Division of Taxation

Address*

Street City State ZIP Code

The materials, supplies, or services purchased by the undersigned are for exclusive use in erecting structures, or building on, or oth-

erwise improving, altering, or repairing real property of an exempt organization, governmental entity, or qualified housing sponsor and

are exempt from Sales and Use Tax under N.J.S.A. 54:32B-8.22. For purposes of this exemption, “exclusive use” means that the sup-

plies and materials purchased will be entirely used or consumed on the job contracted for by the exempt organization, governmental

entity, or qualified housing sponsor named below.

For the exemption to apply, the property must be owned or leased by (check one)*:

Exempt Organization

Name of exempt organization ................ ________________________________________________________________

Address of exempt organization.............. ________________________________________________________________

Address or location of contract work site ________________________________________________________________

New Jersey or Federal Governmental Entity

Name of governmental entity .................. ________________________________________________________________

Address of governmental entity............... ________________________________________________________________

Address or location of contract work site ________________________________________________________________

Housing Sponsor (N.J.S.A. 54:32B-8.22c)

Name of housing sponsor ....................... ________________________________________________________________

Address of housing sponsor.................... ________________________________________________________________

Name of housing project ......................... ________________________________________________________________

Address or location of housing project .... ________________________________________________________________

Housing Sponsor (N.J.S.A. 54:32B-8.22d)

Name of housing sponsor ....................... ________________________________________________________________

Address of housing sponsor.................... ________________________________________________________________

Name of affordable housing project ........ ________________________________________________________________

Address or location of affordable housing project __________________________________________________________

I, the undersigned contractor, hereby verify and affirm that all of the information shown on this certificate is true.

Print Name

Authorized Signature*

(Contractor or authorized employee)

Title Date

*Required

This form may be reproduced